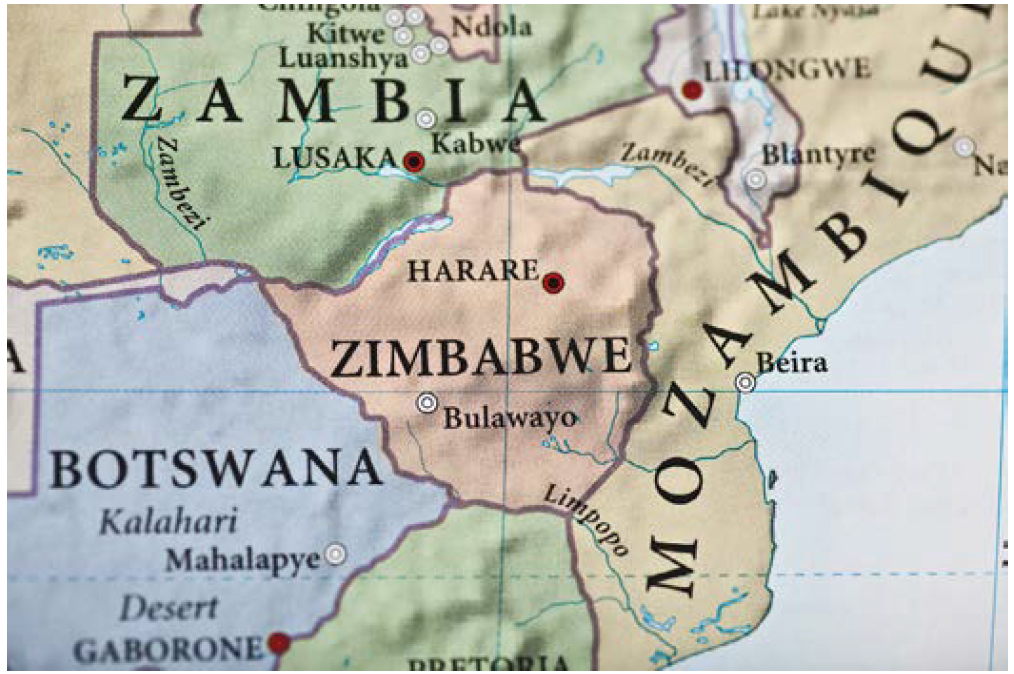

[NGW Magazine] Zimbabwe: how to power the future

Rid of its tyrannical leader, Zimbabwe now has an opportunity to put in place the conditions needed to attract investors into its upstream and perhaps stimulate industry with a new energy.

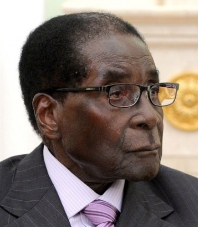

After ruling Zimbabwe with an iron fist for 37 years, Robert Mugabe resigned as president on November 21, giving in to a combination of mass protests, a parliamentary impeachment process and a military coup.

Robert Mugabe (Credit:-- CC BY 4.0/ Kremlin.ru)

Critics blame Mugabe, 93, for implementing policies that were inimical to foreign direct investment, among them the seizure of 14mn hectares of farmland from whites and a Zimbabweanisation drive forcing foreign-owned companies operating in the mining and farming sectors to set aside 51% of their shareholding to indigenous Zimbabweans – analogous to policies in many other countries.

His efforts to propose his wife, Grace, 52, as his successor infuriated a faction in his party who masterminded his ouster. The military whose commanders fought the 1970s liberation war with him put him under house arrest on November 15 as hundreds of thousands staged street protests in Harare, the capital.

He was forced to resign and was succeeded by his former deputy Emmerson Mnangagwa who was inaugurated on November 24. Mnangagwa, seen as a reformist despite his ominous soubriquet Crocodile, started his presidency with pledges to rebuild bridges with the international community and the local political opposition. His speech ignited hopes for renewed investment inflows in the economy as well as the country’s undeveloped natural gas market.

“Our system of economic organisation and management will incorporate elements of market economy in which enterprise is encouraged, protected and allowed just and merited rewards, while gainfully interacting with strategic public enterprises run professionally and profitably, all to yield a properly run national economy in which there is room and scope for everyone,” Mnangagwa told the 60,000 who filled a stadium in Harare.

“The fabulous natural resources we have as a country must now be exploited for national good through mutually gainful partnerships with international investors whose presence in our midst must be valued and secured. In this global world, no nation is, can or need be an island, one unto itself. Isolation has never been splendid or viable; solidarity and partnership are and will always be the way. We are ready to embrace each and all, on principles of mutual respect and common humanity. We will take definite steps to re-engage those nations who have had issues with us in the past,” he said.

Although Zimbabwe is endowed with various minerals including the world’s second largest platinum reserves and arguably some of Africa’s biggest on-shore coal bed methane (CBM) reserves, it has failed to attract much foreign direct investment since 2000 as the international community had misgivings over Mugabe’s policies and oppressive rule.

As there has been low upstream activity, little is known about the quantity and quality of the resource but a report published by a local petroleum geologist, Norman Mukwakwami in 2013 says that gas reserves in western Zimbabwe alone are 800mn m³.

Tlou Energy is exploring for CBM across the border in Botswana, from western Zimbabe, with power projects being the proposed market for the gas.

A former CEO of Zimbabwe Electricity Supply Authority, Ben Rafemoyo, said Mnangagwa’s inauguration speech and the international goodwill that greeted his rise to the presidency could stimulate investment into CBM exploration and development. “It is possible we will soon be a darling of the world once more,” he told NGW. “He said he will re-engage the international community to attract investment, lobby for [Western] sanctions to be removed and come up with policies to speed up economic recovery and growth. If that recovery and growth occurs, it is obvious that we will need more electricity beyond what we are producing now. That is where the country’s CBM potential comes in.”

Stability is key

Rafemoyo said since gas-to-power investment is typically long term and capital intensive, any investor would expect predictability and a general understanding of how the political climate is likely to be in 20 or so years. “Our policy framework must be stable, our politics less confrontational. I have no doubt he [Mnangagwa] will be up to it,” he said.

About five companies are licensed to explore and develop CBM in western Zimbabwe but none of them has attracted enough foreign funding to monetise their reserves. In August 2017, one of them, Shangani Energy Exploration had their grant extended by three years while another company, Zambezi Gas lacks money to fund upstream activities.

Zimbabwe does not have a specific law or policy to encourage investment into natural gas but an authoritative South African publication, Inside Mining expects the new government to put in place an investor-friendly policy and legal framework. “The downfall of Robert Mugabe offers Zimbabwe a once-in-a-generation opportunity to recalibrate the country’s mining industry,” said the publication.

“The country’s mining industry, has already proven its capacity to attract investment – provided that global commodity prices recover as expected, however, that will depend upon cleaning up Zimbabwe’s toxic political environment and confused policy-making, both of which increase costs for investors.

“The new president of the country, Emmerson Mnangagwa, will have to unlock investment in the mining industry by clarifying so-called indigenisation laws that force companies to sell or transfer 51% stakes to black Zimbabweans and re-establish international credit lines. The greatest potential for Zimbabwe to attract foreign investment probably lies in its rich mineral endowment.”

Johnstone Chikwanda, chair of consultancy Energy Forum Zambia, said Mnangagwa’s government is encouraged to ensure that there is a robust energy policy to inform, guide and mentor an energy mix which will support the drive towards the attainment of the UN goal for universal access to clean, affordable and sustainable energy for all.

“In addition,” Chikwanda told NGW, “the leadership is encouraged to seize the investor goodwill as investors will be looking for security, policy consistency and enabling environment as part of content in the post-Mugabe new era. Business is very sensitive to market perception. Therefore, the new era is faced with great opportunity to assure the investor community regarding the safety of their assets in the post-Mugabe era which posed some challenges for investors in some spheres. The key is policy development which will make certain assurances, predictability and incentives.”

Britain, Zimbabwe’s former colonial master, welcomed the end of Mugabe’s rule as its prime minister Theresa May dispatching her Africa Minister, Rory Stewart to witness Mnangagwa’s inauguration. May told BBC on Tuesday November 21: “In recent days we have seen the desire of the Zimbabwean people for free and fair elections and the opportunity to rebuild the country’s economy under a legitimate government.

“As Zimbabwe’s oldest friend, we will do all we can to support this, working with our international and regional partners to help the country achieve the brighter future it so deserves.”

Thulani Mpofu