[NGW Magazine] Russian gas demand grows again

Russian gas demand has risen for the same reason as elsewhere: it is cheaper than its alternatives, owing to government interventions cutting coal in China and higher fuel oil prices globally.

Russian natural gas production rose by 13.3% in the first nine months of 2017 compared with the same period last year, totalling 438bn m³ (Russian cubic metres have about 8% less energy than standard).

In addition, associated petroleum gas production rose by 1.7% up to 63.7bn m³ during the same period. Imports from central Asia stood at a similar level than last year, just about 6bn m³ according to official customs data.

This additional supply has been partly triggered by Gazprom’s record-breaking exports flows to Europe (including the Baltics states) and Turkey rising by over 18bn m³ year-on-year in the first three quarters of 2017, up to 147bn m³. Gas exports to CIS countries stayed flat (23.9bn m³) and LNG exports rose by an estimated 0.8bn m³.

While the story of rising Russian gas exports has been well-documented in the energy media, there has been less analysis of the dynamics behind recovering domestic demand, which fell between 2011 and 2015 by an average of 1.6%/yr, from 473bn m³ in 2011 to just over 444bn m³ in 2015.

This trend was reversed in 2016 with gas demand growing by 2.8% to 456bn m³. In November of this year, Gazprom’s CEO Alexei Miller stated that Russian gas demand had risen 7.6% during the first ten months of the year compared with the same period of 2016.

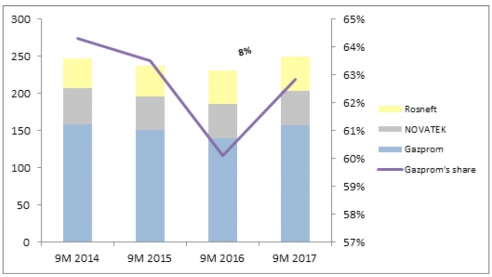

Initial estimates, based on data from Russia’s “Big Three” gas suppliers – Gazprom, Novatek and Rosneft – suggest a similar story.

Gas deliveries to domestic consumers rose by around 20bn m³ from 231 in 2016 to 251bn m³ in 2017 in Q1-Q3 or 8.4% year-on-year. What have been the main driving forces behind this recent increase in Russian gas demand?

The power sector

Natural gas plays a dominant role in the Russian power sector, accounting for above 70% of the fuel supply of thermal plants and some 40% of the total power output. In total, the power and heating sectors account for 36-38% of Russian gas demand. China’s decision in April 2016 to reduce the number of statutory working days for its coal miners to 276/yr from 330/yr had major implications for thermal coal supply, prices and consequently on coal trade flows.

Coal prices rose from less than $50/metric ton in April to over $100/mt by November 2016, when China’s National Development and Reform Commission decided to relax the working days restrictions.

Nevertheless, thermal coal prices remained high across 2017, with Newcastle coal prices hitting $103mt in September thanks to particularly strong Asian demand.

Russia played a key role in meeting buoyant Chinese coal demand, increasing exports to China by 18% to 18.93mn mt in 2016 from 15.78mn mt in 2015. This trend continued over 2017, with Russian coal exports to China increasing by over 50% in H1 up to 13.14mn mt.

As a consequence, coal supplies declined to the domestic market and especially to the power sector, by 5.9% in 2016 and by 1.8% in H1 2017 according to the Russian energy ministry.

However, two very distinct stories emerged in terms of fuel dynamics in the Russian power sector in 2016 and 2017. In 2016, most of the coal has been replaced by fuel oil and oil products, increasing supplies into the power sector from 1.28mn mt to 3.2mn mt. This can be explained by the fall of 34.3% of fuel oil prices through the year. Hence, gas to power rose by a mere 1.4% to 163.5bn m³ in 2016.

But through H1 2017, oil product prices more than doubled and consequently their supply into the power sector plummeted to 0.7mn mt from 2.7mn mt in H1 2016.

The combined impact of redirecting thermal coal into the more lucrative export markets and rising oil product prices led to an increase of 11.2% of gas-into-power in H1 2017 up to 89.54bn m³ from 80.441bn m³.

There is no more recent data provided on Russian fuel-to-power dynamics by the energy ministry. However, rising oil prices through Q3 -strongly correlated with oil prices- suggests that the trend is set to continue.

Industrial growth

Industrial gas demand (including feedstock) accounts for about one-fifth of Russian gas demand. The key consumer segments being the chemical industry (above 35%), the metallurgy (~23%) and the non-metallic minerals (~12%) contributing to approximately 70% of the total industrial gas consumption.

Russian industrial growth has started to recover in 2016 with the chemical industry, recording a growth rate above 6%, which increased gas demand by almost 2 bcm. Metallurgical gas demand rose by 0.4 last year, probably due to the ongoing coal-to-gas switching.

Russian gas output Q3 2017

Note: excludes gas from other, smaller gas producers, most of which is not injected into Gazprom’s GTS.

Gazprom’s sales, Jan-Sept

*net taxes, customs | Ruble=$0.01711 (Source: Gazprom, NGW)

This year the chemical sector continued to rise by 5.6% on average during January-September and the non-metallic mineral sectors shows some signs of revival as well (over 2% growth). Metallurgical production continued to decline, but further fuel switching in favour of gas continued this year.

Cold winters

Russian gas demand is extremely well-correlated with temperature changes. The extremely cold Q4 2016 and the prolonged winter temperatures in Q1 2017 have certainly contributed to the rising demand.

According to Gazprom’s CEO, Alexei Miller, only during the first two months of 2017, 4.7 bcm of additional gas has been delivered to Russian consumers amidst the cold snaps in January and February.

The winter ahead will be another key element in determining how much Russian gas consumption will rise this year.

Gergely Molnar