[NGW Magazine] Gazprom and the eastern pivot

Gazprom is shortening Power of Siberia and pushing back the completion date but its other non-EU activities show a wide range of projects, with new markets and third-party gas transport plans.

Virtual gallons of digital ink have been spent on Nord Stream II and Gazprom-EU relations.

This is understandable, as gas pipeline deliveries to Europe make up the vast majority of Gazprom’s export business, excepting LNG concerns, Turkey – which Gazprom includes in ‘Europe’ statistics – and a few other income streams.

Given this reliance, and the ongoing legal hiccups in Nord Stream II, it is no surprise that Gazprom is attempting to develop other business.

Recent moves include resumed (though likely temporary) exports to Azerbaijan, a new interest in the Iran-Pakistan-India gas pipeline, and a strengthened relationship with Turkey.

Of course, a hugely significant project is the Power of Siberia pipeline, the landmark deal that will allow Gazprom to supply the hungry Chinese market. This project is proceeding, with some modifications.

According to Gazprom’s investment programme, published November 1, the final completion date of the Power of Siberia pipeline has been pushed back two years, from 2022 (as reported in Gazprom’s 2016 Investment Programme) to 2024.

The length of the pipeline has also been reduced, from 3,246.80 km to 2,154.52 km, although the number of compressor stations remains the same (eight). This is consistent with a recent Gazprom press release, which stated that 50.7% (1,095 km) of the pipeline had been laid.

The reduction in length is due to Gazprom’s cancellation of plans to extend the Power of Siberia to Vladivostok, where it would have supplied gas to the now-abandoned Vladivostok LNG export terminal. This is despite the announcement of Gazprom’s final investment decision to build it.

Despite the shorter pipeline and the longer timeframe, Gazprom is intensifying work on the project. Gazprom’s 2016 investment in the project was roubles 76bn (€1.1bn/$1.26bn), and that figure rose to roubles 210bn in 2017.[1]

Gazprom to resume gas exports to Azerbaijan

Gazprom Export announced November 22 that it had signed an agreement to resume exports of Russian gas to Azerbaijan. Gazprom signed a contract with the Azeri state-owned Socar in October 2009, to buy Azeri gas, receiving a total of 5.4bn m³ between 2010 and 2015 (Figure 1). That ended a period of Russian exports to Azerbaijan, from 2000-09.

Figure 1: Gas pipelines connecting Russia and Azerbaijan

Credit: Gazprom

The 2009 contract was signed at a time of declining Azeri gas consumption – from 9.2bn m³ in 2008 to 7.4bn m³ in 2010 – and rising domestic production – from 14.8bn m³ in 2008 to 15.1bn m³ in 2010.

Since then, production has stabilised at 17.5-17.9bn m³/yr in 2014-2016, while demand has risen back to 9.4bn m³ in 2014 and 10.4-10.6bn m³ in 2015-16. The latest Gazprom-Socar contract foresees the delivery of 1.6bn m³ of Russian gas to Azerbaijan, and Socar told NGW that would all arrive by November 2018.

Azerbaijan exports about 6.5bn m³/yr year to Turkey, and 800mn m³/yr to Georgia, via the South Caucasus Pipeline, which connects the three countries.

Azerbaijan’s gas exports to the west are set to increase with the expansion of the Shah Deniz project, which produces natural gas in the Azeri portion of the Caspian Sea. Socar holds 10% in that project, along with BP (28.8%), and five other shareholders, which each hold shares of between 6.7% and 19.0%.

According to BP, the first part of the Shah Deniz project (Shah Deniz 1), has a current annual production capacity of 10.9bn m³/yr and has been in operation since 2006.

The second phase of the project (Shah Deniz 2) is under development, and the first gas production is expected in 2018. When Shah Deniz 2 reaches full capacity, it will produce 16bn m³/yr.

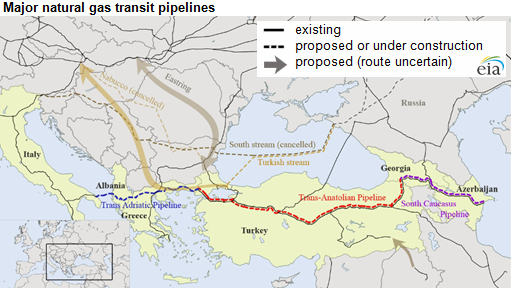

Of that, 6bn m³/yr are earmarked for export to Turkey, and the remaining 10bn m³/yr for export to Europe via the expansion of the South Caucasus Pipeline, the Trans-Anatolian Pipeline (Tanap) across Turkey, and the Trans-Adriatic Pipeline (TAP) between Greece and Italy (Figure 2).

Figure 2. Route of Southern Gas Corridor

Credit: Energy information Administration (EIA)

In this context, the short-term purchase of 1.6bn m³ from Gazprom will allow Socar to ensure its existing gas supply commitments, as it awaits the launch of production at Shah Deniz 2. Socar’s focus on developing gas exports to the west is also consistent with the desire of the foreign investors in the Shah Deniz 2 project to deliver that gas to lucrative western markets rather than Russia.

Finally, during the 2010-2015 contract, Gazprom experienced the launch of substantial new gas production at Yamal (in 2012), and a decline in total gas sales by volume (from 551bn m³ in 2008 to 442bn m³ in 2014, followed by increases to 446bn m³ in 2015.

The growth in production and decline in sales by volume meant that Gazprom no longer needed to import gas from Azerbaijan, and so the contract was not extended.

Iran-Pakistan-India line

At the beginning of November, the Russian president, Vladimir Putin, visited Tehran. During that visit, Gazprom and the Iranian Oil Company (NIOC) signed a Memorandum of Understanding (MoU) on the construction the Iran-Pakistan-India (IPI) gas pipeline.

The Gazprom-NIOC MoU was based on an MoU signed earlier by the Russian energy ministry and the Iranian petroleum ministry, which signalled state support for the project. On the basis of their MoU, Gazprom and NIOC will conduct a feasibility study of the design, construction, and operation of the pipeline.

The route of the pipeline is yet to be determined, although statements by the Russian energy minister, Alexander Novak, suggest a Russian preference for a pipeline that runs through the Pakistani port of Gwadar – a port previously proposed as the site of a new Pakistani LNG import terminal.

Given the longstanding negotiations over the construction of either the IPI – or its competitor, the proposed Turkmenistan-Afghanistan-Pakistan-India pipeline – we should not assume that the IPI will definitely be built, but it is noteworthy to see Gazprom expressing interest in potential pipeline projects that do not involve its own gas supplies.

Turkey ‘needs’ TurkStream

Putin met with his Turkish counterpart, Recep Tayyip Erdogan, at the Russian Black Sea resort of Sochi November 13.

According to the Russian media outlet Tass, Putin told him: “Our relations may be considered as fully restored”, while Erdogan added: “Since the normalisation of relations between our countries began, frequent meetings [between leaders] have been giving impetus to bilateral ties”.

One of the most important ongoing projects in that bilateral relationship is the TurkStream pipeline.

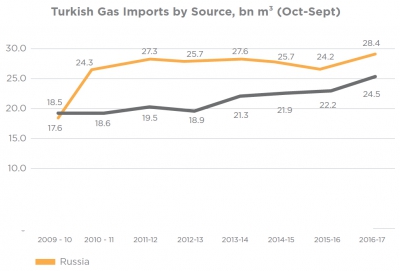

Following the Putin-Erdogan meeting, the Gazprom CEO, Alexei Miller, announced that between January 1 and November 13, Gazprom supplied 24.8bn m³ to Turkey – an increase of 4.4bn m³ (21.7%) compared with the same period in 2016, and equal to the amount that Gazprom supplied to Turkey in the whole of 2016.

According to Miller, “This is a very good result and one more graphic confirmation of the demand for TurkStream, the construction of which is in full swing.”

A map of the Turkish Stream pipeline is given in Figure 3, while a graph of Turkish gas imports by source (i.e. Russian and non-Russian) is given in Figure 4.

Figure 3: TurkStream pipeline

Credit: Gazprom

Figure 4: Russian gas exports to Turkey

Source: Table by author. Data from IEA Gas Trade Flows in Europe

Ben McPherson

[1] Fluctuations in currency exchange rates make it difficult to estimate, but in November 2017 the exchange rates were approximately 1 GBP=80 Roubles; 1 Euro=70 Roubles; 1 USD = 60 Roubles