[NGW Magazine] Digitalisation in the energy sector

Digitalisation is accelerating, theoretically allowing great savings of time and hence energy in some areas but also creating demand in undreamt-of areas too.

Digitalisation is now widespread making huge inroads into world energy systems. The International Energy Agency (IEA) published November 6 its first comprehensive report on Digitalisation in Energy.

In his foreword the IEA CEO Fatih Birol said: “Digitalisation holds great promise to help improve the safety, productivity, efficiency and sustainability of energy systems worldwide. But it also raises questions of security, privacy and economic disruption.”

The IEA suggests that digital technologies will make the global energy system more connected, reliable and sustainable, and will have a profound and lasting impact on both energy demand and supply.

Digitalised energy systems in the future may be able to identify who needs energy and deliver it at the right time, in the right place and at the lowest cost. Ultimately all sectors along the global energy chain will be affected.

Digitalisation has already led to higher productivity and efficiency in operations throughout the energy supply chain, thanks to better analytics, the use of virtual facilities, the introduction of automation and artificial intelligence, and the use of quantum computing technologies.

Digitalisation is also changing markets, businesses and employment. New business models are emerging, while some century-old models may be on their way out. Key is how technology is used to transform business models, businesses and industry.

But it is not without its risks. The IEA warns that digitalisation is raising new security and privacy risks as it increases the range of energy targets for cyber attacks as they are becoming cheaper and easier to carry out.

A new era in energy

The IEA points out that the energy sector has been an early adopter of digital technologies. In the 1970s, power utilities were digital pioneers, using emerging technologies to facilitate grid management and operation. Oil and gas companies have long used digital technologies to model exploration and production assets and so reduce time and money spent on drilling.

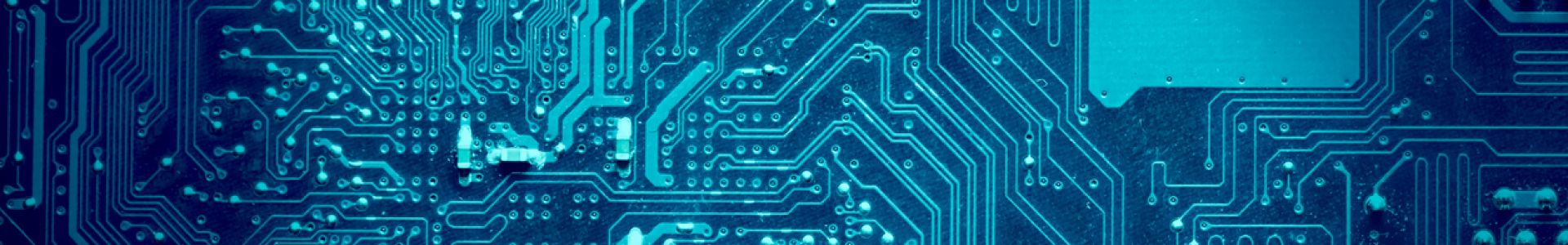

Massive amounts of data, widespread and increasing connectivity and rapid progress in artificial intelligence and machine learning are enabling new applications and business models across the energy system, from autonomous cars and shared mobility to 3D printing and connected appliances (Figure 1).

Figure 1: Global trends in connectivity

Key message: Connectivity is increasing rapidly, particularly in the developing world. Notes: * denotes estimate for 2017; “Internet access” is defined as households with internet access at home; developed/developing country classifications are based on the UN M49. Sources: ITU (2017), ICT Facts and Figures 2017; IEA (2017), Energy Access Outlook: From Poverty to Prosperity. (Credit: IEA)

The electricity sector and smart grids are at the centre of this transformation, but ultimately all sectors across energy supply and demand, households, transport and industry, will be affected. From the rise of connected devices at home, to automated industrial production processes and smart mobility, digital technologies are increasingly changing when energy is consumed.

Energy supply sectors also stand to gain from greater productivity and efficiency, as well as improved safety for workers.

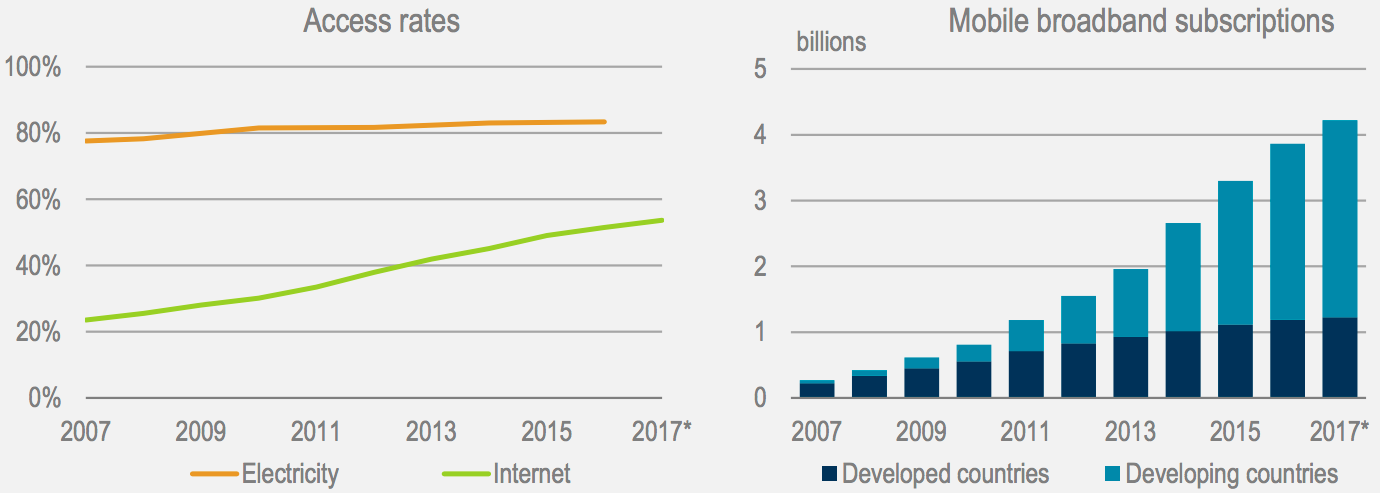

The IEA forecasts more than 1bn households and 11bn smart appliances, including smart meters, could be part of interconnected electricity systems by 2040 as costs fall (Figure 2). Among others, this would allow homes to alter when they draw electricity from the grid and in what volumes.

Figure 2: Unit costs of key emerging electricity technologies

Key message: Technology cost reduction is a key driver enhancing connectivity throughout the electricity sector. Sources: IEA analysis based on Bloomberg New Energy Finance (2017); Holdowsky et al. (2015); IEA (2017a; 2017b; 2017c); Navigant Research (2017). (Credit: IEA)

However, the report states that the greatest transformational potential for digitalisation is its ability to break down boundaries between energy sectors, increasing flexibility and enabling integration across entire systems.

Impact on power generation and supply

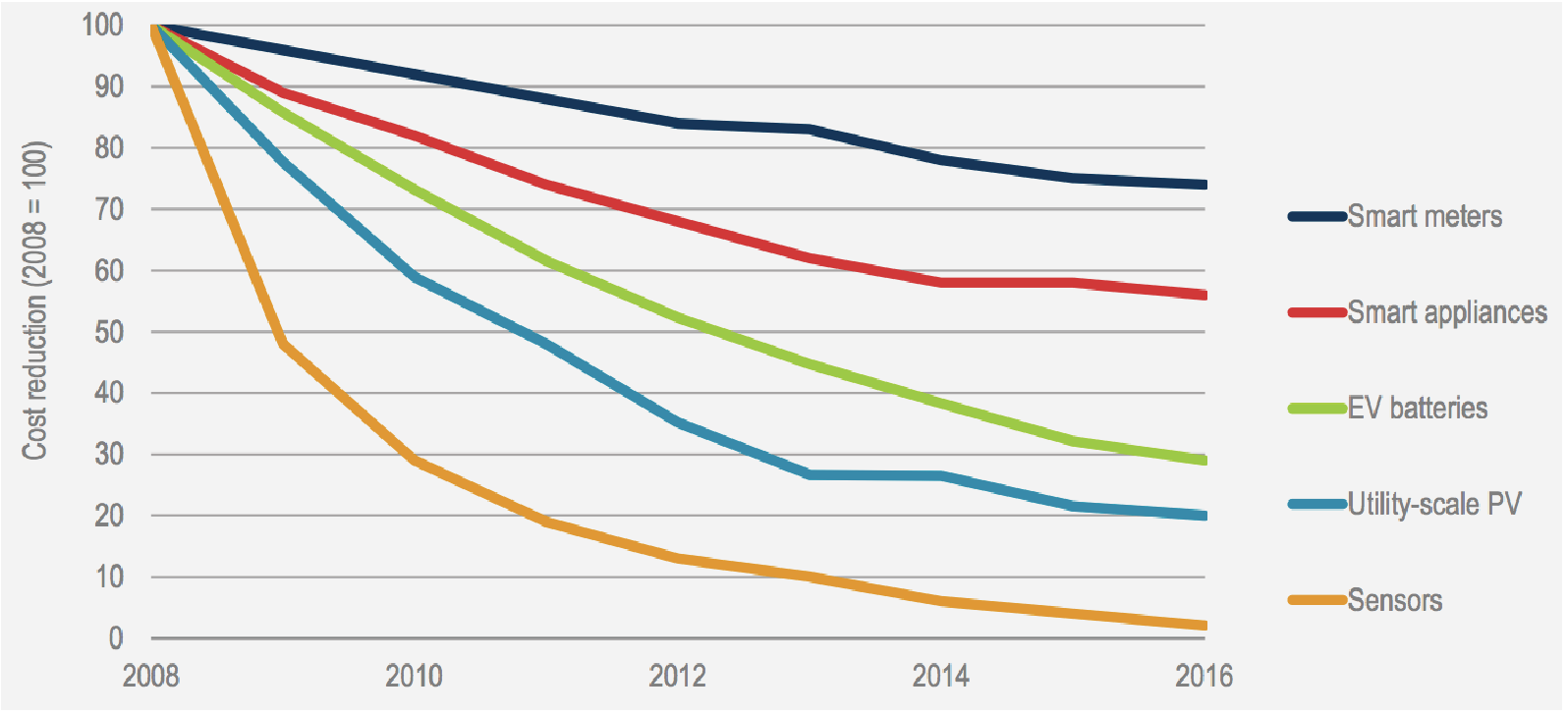

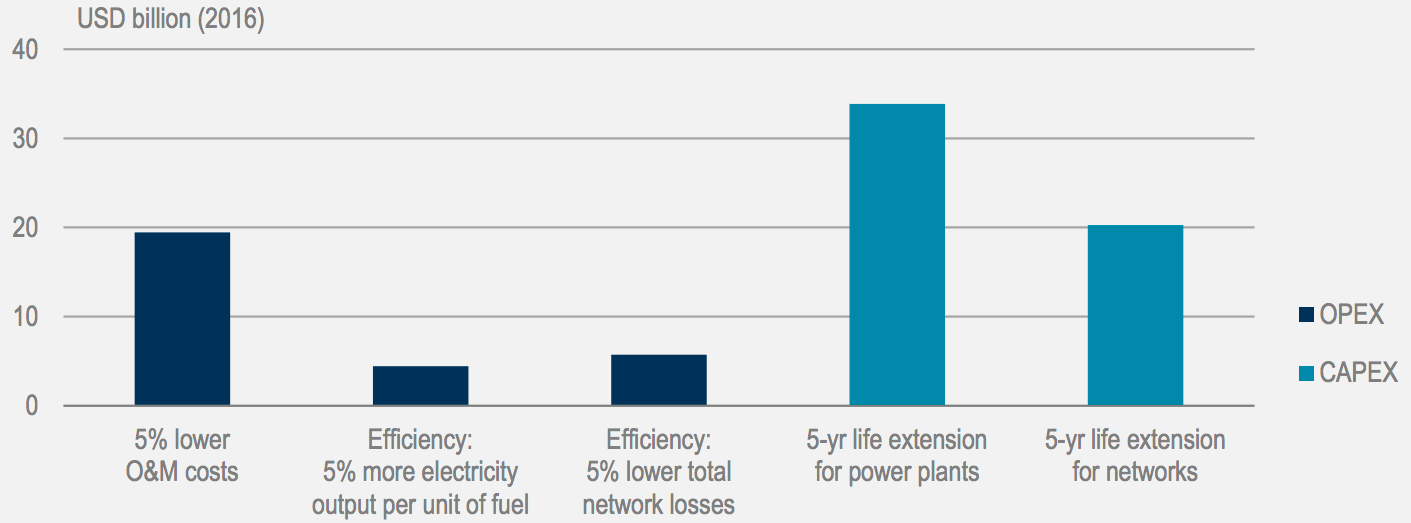

Digital data and analytics can reduce power system costs by reducing operations and maintenance costs, improving power plant and network efficiency, reducing unplanned outages and downtime and extending the operational lifetime of assets (Figure 3).

Figure 3: Impact of digitalisation in the power sector

Key message: Digitalization in the power sector has the potential to bring benefits to the ownersof power sector assets, the wider electricity system, consumers and the environment. Notes: green: financial benefits for asset owner; red: system benefits, consumer benefits; blue: global environmental benefits; CO2 = carbon dioxide. (Credit: IEA)

As a result, increased use of data and analytics in the energy sector could save power companies close to $270bn of investment in new electricity infrastructure.

Demand side response technologies in building, industry and transport could provide 185 GW of flexibility.

It adds that the overall savings from these digitally-enabled measures could be around $80bn/yr between now and 2040, or about 5% of total annual power generation costs based on the enhanced global deployment of available digital technologies to all power plants and network infrastructure.

The IEA states that digital data and analytics can reduce operating and maintenance (O&M) costs, enabling predictive maintenance, which can lower costs for the owners of plants and networks and ultimately the price of electricity for end-users. Over the period to 2040, a 5% reduction in O&M costs achieved through digitalisation could save companies, and ultimately consumers, an average of close to $20bn/yr (Figure 4).

Figure 4: Potential worldwide cost savings from enhanced digitalization in power plants and electricity networks over 2016 to 2040

Key message: Cumulative savings from the widespread use of digital data and analytics in power plants and electricity networks could average around USD 80 billion per year. Notes: Assumes the enhanced global deployment of existing digital technologies to all power plants and network infrastructure; CAPEX = capital expenditure; OPEX = operational expenditure; yr = year. (Credit: IEA)

The report states that in the long term, one of the most important potential benefits of digitalisation in the power sector is likely to be the possibility of extending the operational lifetime of power plants and network components, through improved maintenance and reduced physical stresses on the equipment. If the lifetime of all the power assets in the world were extended by five years, investment in power plants would be reduced by $34bn/yr and in networks by $20bn/yr.

The report also states that digitalisation can help integrate renewables by enabling grids to better match energy demand to times when the sun is shining and the wind is blowing.

In the EU alone, increased storage and digitally-enabled demand response could reduce curtailment of solar PV and wind power from 7% now to 1.6% in 2040, thus avoiding 30mn metric tons of carbon dioxide emissions in 2040.

Rolling out smart charging technologies for electric vehicles could help shift charging to periods when electricity demand is low and supply is abundant, according to the report. This, the report states, would provide further flexibility to the grid while saving between $100bn and $280bn, depending on the number of EVs deployed, in avoided investment in new electricity infrastructure between 2016 and 2040.

The IEA also believes that digitalisation can facilitate the development of distributed energy resources such as household solar PV panels and storage, by creating better incentives and making it easier for producers to store and sell surplus electricity to the grid. New tools such as blockchain could help to facilitate peer-to-peer electricity trade within local energy communities.

Impact on oil, gas and coal

Oil and gas drilling is already highly digitalised. However, the industry is constantly innovating, particularly as it tries to cut costs and adapt to an increasingly low price, uncertain and volatile market. Ultimately production processes could be optimised through enhanced connectivity and monitoring and digitally-connected remote operations, to help reduce both capital and operating costs.

In upstream oil and gas digital technologies include enhanced reservoir modeling, widespread use of sensors, and advanced processing of seismic data.

DNV believes that in the longer horizon offshore production and processing systems are going down to the seabed as a cost effective and safe alternative for platforms and floaters. By 2025 subsea solutions are expected to rely actively on remote monitoring and data analytics (Figure 5).

Figure 5: Remotely monitored subsea systems

Credit: Statoil

Being able to crunch and process massive volumes of seismic data can accelerate the lead times for new projects. Comparing geological data to well performances helps companies find where to drill and how to drill. New advanced analytics takes into account all of these variables and allows drillers to optimise each project, without having to resort to trial and error, which is how companies traditionally operated.

DNV goes further, stating that one of the most anticipated technologies, automated drilling, offshore and onshore, could reduce drilling times and costs by 30% to 35% in comparison with conventional drilling rigs.

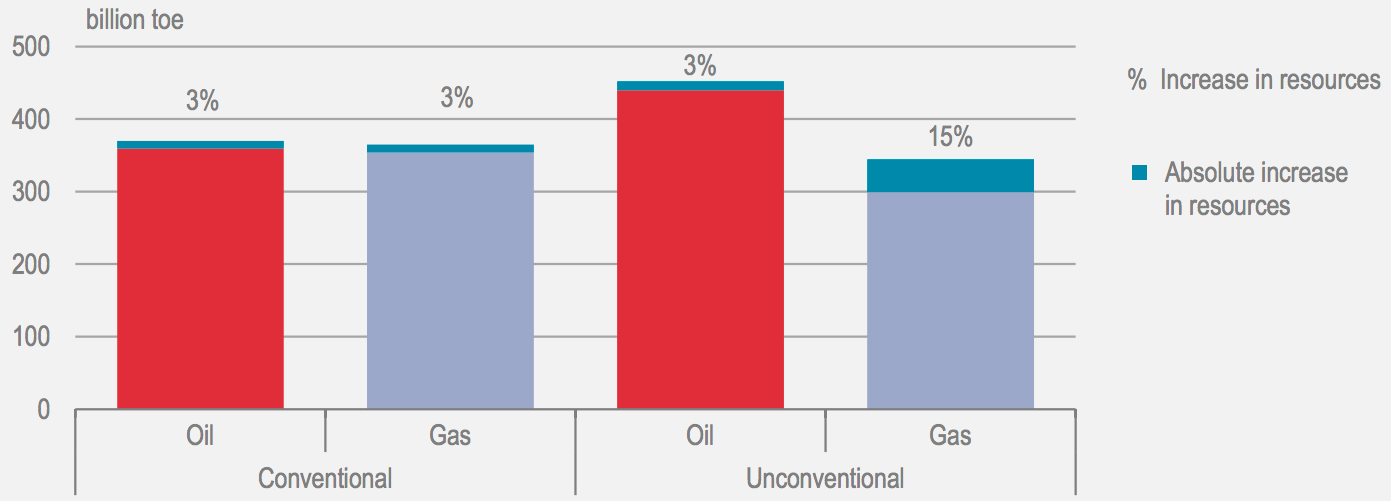

Technology could also boost technically recoverable oil and gas resources in the world by around 5%, with the largest gains projected in shale gas (Figure 6). The IEA estimates that across-the-board digitalisation could lower production costs by 10% to 20%.

Figure 6: Impact of digitalisation on global technically recoverable oil and gas resources

Key message: Widespread digitalization could boost global technically recoverable oil and gas resources by around 5%. Note: It is assumed that both existing and emerging digital technologies are deployed across the entire world oil and gas resource base. (Credit: IEA)

The shale revolution has enabled the US to increase oil and gas production by almost half as much again over the last five years. Large contributors to this have been sensors and massive computing power, which have enabled implementation of new drilling technologies such as seismic imaging, horizontal drilling, digital oil fields and measurement while drilling. Big data will became a regular fixture in the oil and gas industry in the future, contributing to significant reductions in costs, thus enabling fossil fuels to compete in a world of increasingly abundant, cheap, energy supplies.

Other technologies will also become more abundant over time that will dramatically change the oil and gas industry. Miniaturised sensors and fibre-optic sensors will help increase the volume of oil and gas that can be recovered from a reservoir. Automated drilling rigs, subsea robots, and drones will take on a greater role going forward.

Many of these technologies are already making inroads in the industry increasing efficiency and cutting cost. A year ago, GE unveiled a new helicopter drone that could detect methane leaking from a drilling site in the Fayetteville Shale in Arkansas. The drone could replace a worker that has to manually walk around the site using an infrared camera to detect any methane leakage. In theory, the use of a drone will make inspection safer, faster, and cheaper.

Another example is the increasing use of “smart pigs” – robots that travel through pipelines to inspect them and detect corrosion. Smart pigs are becoming increasingly adept at finding problems, and crucially, advancements in data analysts are allowing for the interpretation of the massive volumes of data the pigs produce when passing through a pipeline.

In the past, the results would take months to analyse, but that time has now been drastically reduced. Moreover, predictive analytics would allow a company to use that data to discover problems or to anticipate them before the situation got out of control.

Put it all together and the changes could be considerable. Oil producers will see enormous benefits from digitalisation, while at the same time steady innovation in the transportation sector could reduce consumer fuel demand. For example, airlines are using data analytics to optimise travel routes and allow pilots to make decisions during flights that save fuel. The same is true in the maritime industry, making global trade more efficient.

Road transport will see the most revolutionary changes from digitalisation, the IEA argues, which could fundamentally transform how people and goods are moved. New technologies will allow passenger vehicles to be ‘automated, connected, electric, and shared’ (Aces). The ramifications for future crude oil demand are highly uncertain, and depend very much on the rate of innovation, policy intervention, and consumer behavior. The most bullish long-term forecast for Aces technology adoption could cut energy consumption in the transportation sector by half.

However, the conservative management culture of the oil and gas companies may pose challenges to digitalisation. Though the industry has adopted digital strategies at various points along the value chain, it has not yet really digitalised, but it is on the way. For example, Statoil plans to invest up to $240mn in digitalisation efforts by 2020, establishing a centre to coordinate and manage data analytics, machine learning, and artificial intelligence.

But the oil and gas industry is accustomed to pushing the boundaries of technology, with oilfield service companies and vendors having already taken the lead to develop digital technologies and expand digital services on offer with increasing effectiveness. The IEA says that investment in digital infrastructure has increased by 20% each year over the past couple of years and all indications are that it will carry on.

Coal

Digital technologies are being used throughout the coal supply chain to reduce production and maintenance costs and enhance workers’ safety. These are set to grow, which will lead to significant changes in many operations in the coal sector. These include geological modeling, process modelling, automation and predictive maintenance.

The IEA states that increased availability of low-cost sensors and computer-aided simulations will bring new opportunities for coal operations. For example, sensors can provide the exact status of various components of the essential equipment in real time and analytics can compare the actual configuration with the ‘optimal’ situation as designed so that the process can be optimised.

Digital technologies, data analytics and automation will be increasingly adopted to improve productivity while enhancing safety and environmental performance through multiple applications.

Challenges associated with coal include concerns about air quality and climate change and the need to deploy carbon capture and storage (CCS) to mitigate the level of carbon emissions.

However, increasing digitalisation and automation can make coal production even cheaper and make it even more competitive against other fuels. This is especially so in China and India, where coal is likely to remain an important resource for the longer term.

Cyber-security

In addition to the benefits, the IEA warns that digitalisation is raising new security and privacy risks, as well as disrupting markets, businesses and employment. While the growth of the ‘Internet of Things’ (IoT) could herald significant benefits in terms of energy efficiency to households and industries, it also increases the range of energy targets for cyber-attacks.

The report calls for digital energy security to be built around resilience in withstanding shocks, cyber hygiene precautions, with security by design as its core.

The IEA says building system-wide resilience depends on all actors and stakeholders first being aware of the risks. Digital resilience also needs to be included in technology research and development efforts as well as built into policy and market frameworks.

The report adds that international efforts can also help governments, companies and others to build up digital resilience capabilities. A variety of organisations are involved, each contributing its comparative strengths, including to share best practices and policies as well as to help mainstream digital resilience in energy policy making.

Another concern about the rapid pace of digitalization in the energy sector is privacy. The tension between innovation and efficiency on the one hand and privacy on the other will define the rapid changes that will take place in the digitalisation space. Overall, the benefits could be profound, but policymakers and industry will have to resolve the array of new challenges that come with the digitalisation of the energy industry.

Policy implications

Policy makers, business executives and other stakeholders increasingly face new and complex decisions, often with incomplete or imperfect information. With digital technologies changing so rapidly, there are many unknowns about how technology, behaviour and policy will evolve over time and how these dynamics will impact energy systems into the future.

The IEA also warns that as digitalisation transforms the energy market, in addition to opportunities it also creates challenges. Top of the list are cyber-security, privacy and economic disruption.

Identification of digital risks and appropriate resilience measures need to be core to technology policy development and the design of various regulatory frameworks for energy markets. Governments and energy system operators need to work together proactively to manage the increasing complexity of risks and threats.

The IEA recommends that sector-specific and cross-sectoral policies are needed to maximise benefits made possible by digital technologies and to address such challenges, including job losses. The impact of digitalisation can be particularly strong in terms of jobs and skills.

Opportunities include blockchain applications. Both start-up companies and utilities see potential for blockchain to help solve key energy sector challenges, including automated trading to enable flexibility. Many focus on customer markets and enabling micro-trading among solar power prosumers. For example, peer-to-peer trading and settlement in wholesale power and natural gas markets is being trialed in Europe.

A consortium involving Shell, BP, and Statoil is working on the development of a blockchain-based energy commodity trading platform, along with three large commodity traders, Gunvor, Koch Supply & Trading and Mercuria.

The IEA says that the upstream oil and gas sector still has room to grow when it comes to digitalisation, through data, analytics and connectivity. The vision of automated oil and gas fields working maintenance-free over decades may one day be realised. In its first attempt to examine the impact of digitalisation in energy, the IEA concludes that energy systems are on the cusp of a new digital era. Digitalisation is becoming the cornerstone of the future energy system.

But there is still no way to predict with certainty how particular digital technologies will interact with specific energy system applications. As a result, further opportunities and challenges will certainly emerge.

Charles Ellinas

Mining the bitcoin

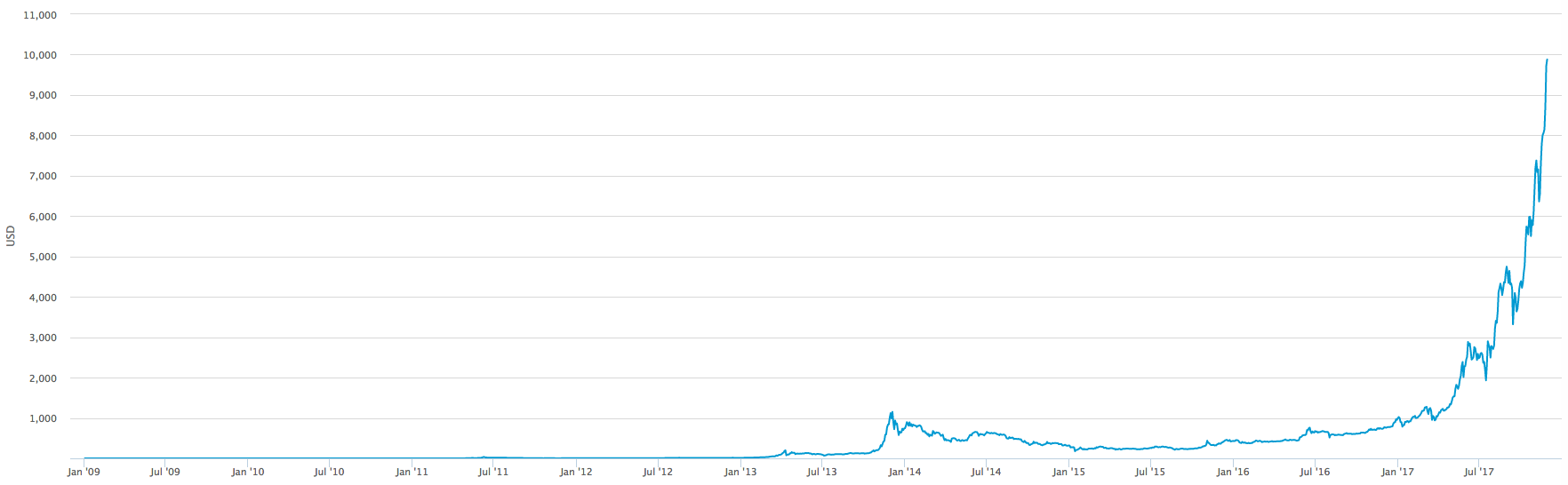

One challenge few experts had forecast is the growth of the bitcoin, the best-known of the crypto-currencies, which exists only in cyberspace. It is produced by a very energy-intensive process owing to the computing power needed to mine it.

The bitcoin enables safe peer-to-peer trading as the records of transactions are said to be unalterable. While states can exist without their own currency, it is not known yet how a currency can exist without a state, and yet it is gaining acceptance and its value is rising, despite the lack of a centralised repository or bank to manage it.

A few years ago bitcoins had a relatively low value, but this has shot up over the past year along with the cost of computer processing power (see graph). According to business consultancy Accounts & Legal, the mining industry now accounts for 0.13% of the entire world’s electricity demand every year, consuming 28.8 TWh/yr and growing. A large part of bitcoin’s value is the energy that computers need to produce one – which in the process gives off a lot of heat.

Value of Bitcoin

Credit: Blockchain Luxembourg S.A.

A&L says that one of the most advanced pieces of mining hardware available is the Antminer S9, an Asic mining rig that makes 14 trillion attempts at solving the value of a block of data each second. That amount of power means an Antminer S9 can earn around 0.11 bitcoins a month, or £800 based on today’s valuation.

The energy consumed in mining bitcoin is the equivalent of 13,500,000 barrels of oil, which at current rates, is over £576mn of oil for 52,560 bitcoins, or nearly £11,000/bitcoin in energy alone, says A&L. Most therefore are produced in China, where energy is heavily subsidised; but A&L warns of reputational risk of operating there. Miners are moving to colder climes such as Iceland where there is less political risk and the ambient temperature is lower, requiring less cooling for the computers.

William Powell