[NGW Magazine] Tellurian's new LNG model

US company Tellurian claims that it can deliver LNG to Japan at $6/mn Btu and is looking for equity partners to spread risk. This could make inroads in a crowded market where low prices can call the shots.

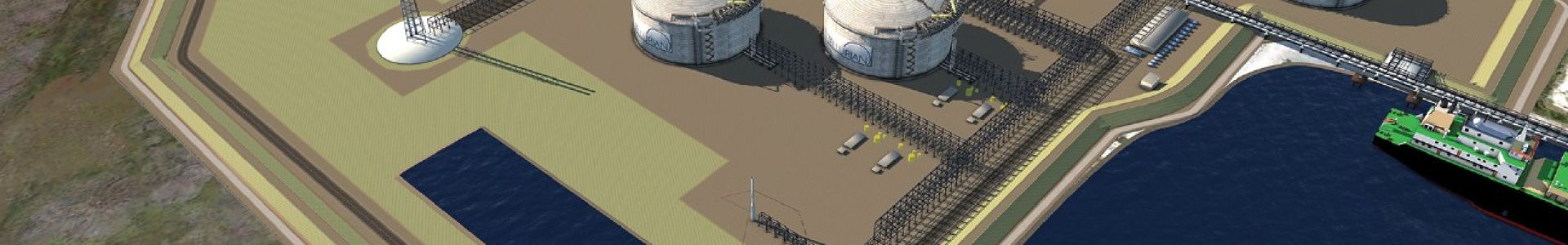

A perceived global glut in LNG is forcing suppliers to devise new models and build smaller, smarter and cheaper liquefaction plants. As demand carries on increasing at a rate of about 5% per year, most of the next ‘LNG wave’, post-2024, may be coming from such plants in North America (Figure 1).

Figure 1: Global LNG demand/supply capacity balance

Source: Bloomberg NEF

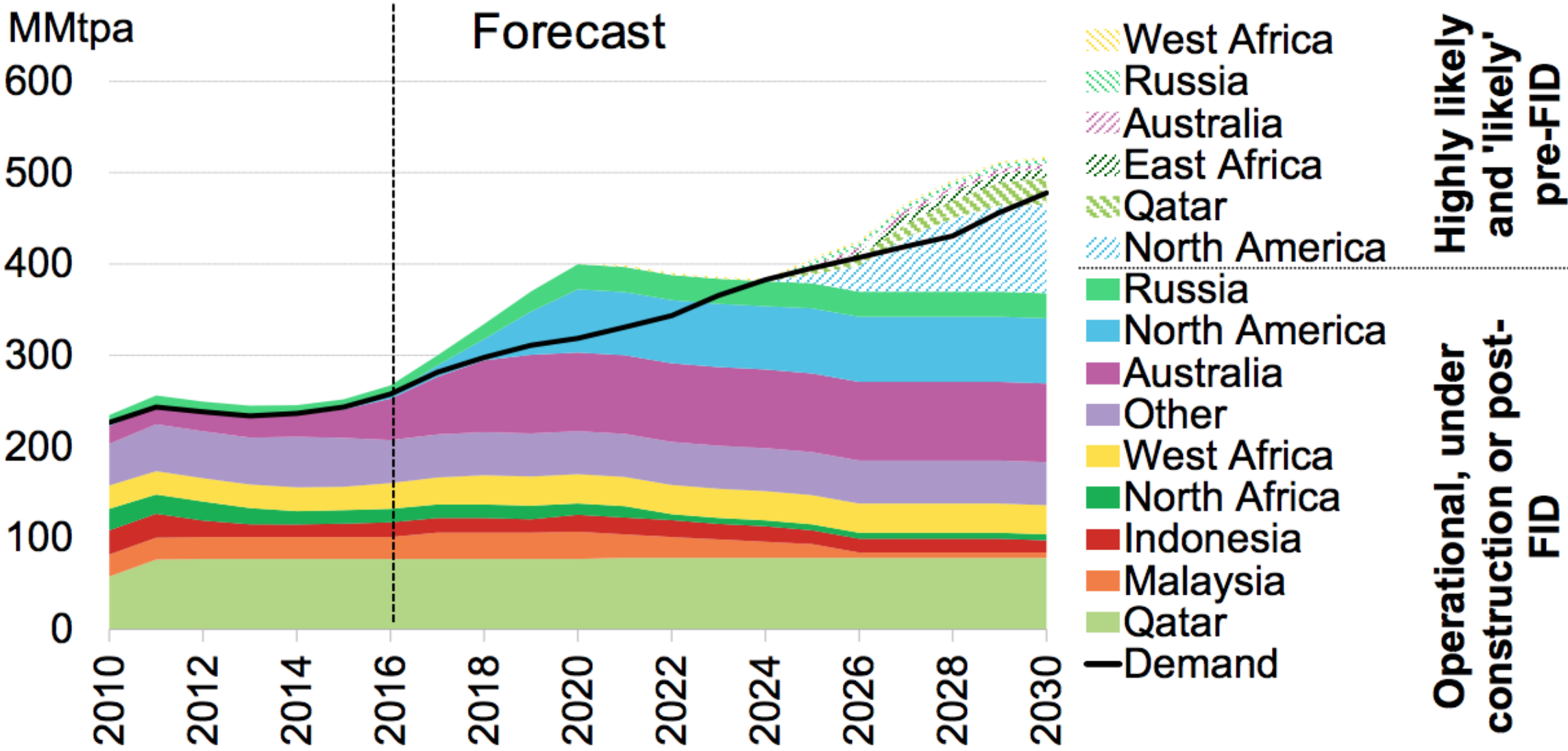

One such project is Tellurian’s Driftwood LNG export facility near Lake Charles, Louisiana (Figure 2), which will have about 27.6mn metric tons/yr capacity and will cost about $16bn, excluding a 96-mile pipeline connecting the facility to interstate pipelines which may cost another $2bn.

Figure 2: Location of Driftwood LNG

Source: American Press

The facility will consist of 5 LNG plants with a total of 20, small-scale, trains of 1.38mn mt/yr each, using new technology, requiring up to 4bn ft³/day of feed gas.

Front-end engineering and design was completed by Bechtel in August and it has already submitted a lump-sum engineering, procurement and construction proposal. Construction is planned to start in 2018, with first LNG scheduled 2022.

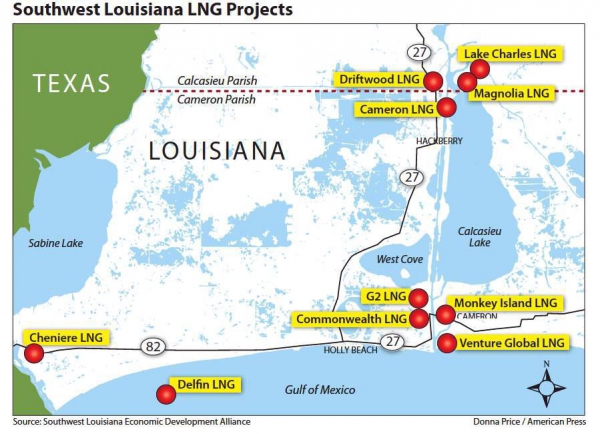

Co-founder Martin Houston, Tellurian’s vice chairman and the architect of BG’s pioneering merchant LNG strategy, said that the company has agreed a very low capex cost for the LNG terminal of between $560 and $580/metric ton/year. If achieved, this will make it the cheapest greenfield LNG project so far (Figure 3).

Figure 3: LNG Project Costs, in US$ per metric ton installed capacity

Source: Tellurian, Wood MacKenzie

On this basis, Tellurian expects to sign LNG sales and purchase deals in the first half of 2018, with regulatory authorisation and final investment decision expected mid-2018.

What is novel is that the project proposes to give customers equity stake and offtake volume: 1mn mt/yr LNG for $1.5bn payable over a four-year period. Tellurian is planning to retain 7 to 11mn mt/yr itself and act as the manager and operator of the facility. This would leave customers with ownership of 61% to 74% and Tellurian with the remaining 26% to 39%. In addition, it is offering customers different contract durations based on different pricing mechanisms, including fixed prices.

Tellurian is also aiming to capture the entire value chain from investing upstream, with an acquisition in Haynesville shale in September, down to spot trading. The company sees acquisition of natural gas producing assets as integral to its plans.

Because of customer equity participation, small-scale trains and upstream ownership of the natural gas feeding the LNG terminal, Tellurian may be able to realise the low costs it claims. Another important factor is the experience the company management has in building LNG terminals

Tellurian was co-founded by Charif Souki who previously ran Cheniere, operator of the first major US export terminal – having salvaged the company when its plans to import LNG into the US foundered on high world LNG prices. So he has a good idea of what the market can bear, and what is needed to beat Sabine Pass.

In addition, Tellurian’s position was strengthened further when Total bought 23% of its shares in February, bringing strong financial clout and all-round LNG experience, including potentially buying LNG from the project. Souki is confident that, once completed, Tellurian’s model will revolutionise the industry. Total says it is the biggest LNG player after Shell, as far as the international oil companies are concerned: Total now will own Engie’s upstream LNG business as well, giving it capacity in Cameron LNG.

Houston said: “Our business model is a cost-plus model.” It will allow LNG to be loaded at $3/mn Btu variable cost that includes upstream, pipeline and liquefaction terminal expenses, as well as maintenance costs, which equates to landed cost in Japan of about $6/mn Btu.

Customers at Sabine Pass, by contrast, are paying typically about $3/mn Btu for liquefaction alone, with the Henry Hub gas price to be added on top of that, just to get LNG at the Gulf of Mexico. Cheniere may also make a profit from the Henry Hub price, if it can source it below the index.

Tellurian spokesperson Joi Lezcnar, said: “We are listening to what the customers want: smaller amounts of LNG and shorter contracts. However, we are open to all types of scenarios…Our model anticipates change in the LNG industry, and the winners will be those companies who are operationally low-cost and commercially flexible.”

This is what the market is expecting from the second wave of US LNG – technical, commercial and financial innovation to cut costs further. With greater volumes of LNG now becoming available, in order to increase demand it will require lower prices. This point was made forcefully by Yuji Kakimi, the head of Japan’s Jera, the world’s biggest buyer of LNG, who told the FT last month that LNG providers needed to offer “reasonable” prices and flexibility, or “the golden age of gas will never come”.

Having announced its business model early October, apparently this is already attracting considerable interest, with “a large number of ongoing discussions in some form or the other,” according to Tellurian. This includes large sovereign wealth funds and international portfolio players.

Asked his view on what are the new frontiers for global natural gas and LNG, Katan Hirachand, the managing director of energy project finance at Societe Generale told Gastech Insights earlier this month: “The past few years have demonstrated incredible ability to connect new markets, establish new uses of LNG and widen the footprint for natural gas. This is against the backdrop of a highly competitive market and the energy transition to cleaner fuels showing that gas has a base-load role to play in the global energy mix.” He added that the downstream markets have become more “bite-sized” which is forcing a squeeze on suppliers not only in terms of being competitive but also giving flexible supply terms.

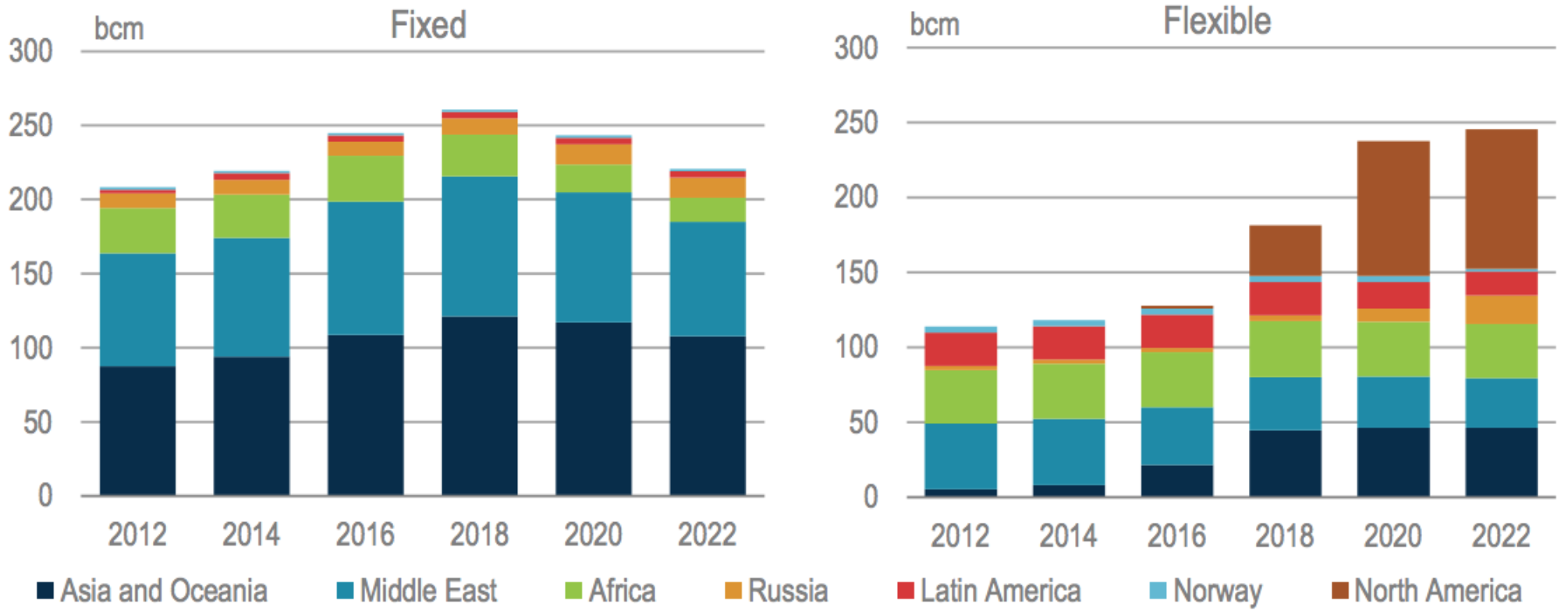

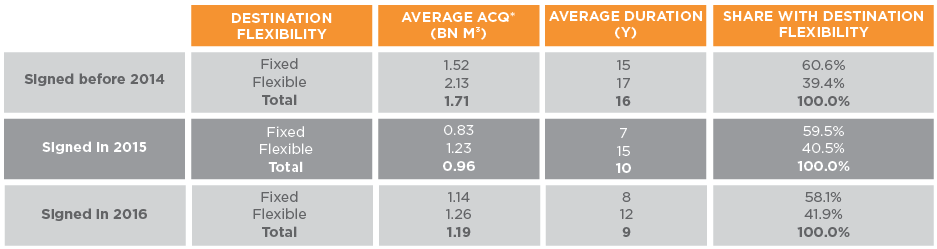

This is also one of the key findings of International Energy Agency’s new report on Global Gas Security Review, released last month. LNG contracts flexibility appears to be an important determinant of the resiliency of the global gas system - this is evidenced by the growing share of flexible destination contracts, (Figure 4), as well as by the decrease in duration (Table 1).

Figure 4: LNG export contract volumes by destination flexibility, 2012 to 2022

Source: IEA

The IEA concludes that the current well-supplied market is the driver behind this trend, providing opportunities to achieve more flexible market arrangements and new pricing systems that reflect regional supply and demand balance. This is where the emergence of new players, with different business models than traditional suppliers, and the development of US exports emerge as major sources of additional contractual flexibility.Market forces mean that the current pool of inflexible export contracts can be expected to shrink as contracts expire, with flexible, shorter-term, contracts, led by the US, having increasing impact. In answering the question “will anybody sign a contract longer than five years?” the Oxford Institute of Energy Studies’ expert Jonathan Stern said: “Probably not, unless the parties include a clause which resets the price at regular intervals, using criteria which they agree will represent a market level.

Table 1: Contract evolution by 2016

*ACQ = annual contracted volume (Source: IEA)

But sellers will need to be confident this level will remunerate the cost of developing new LNG projects. This is going to be a tough test for the future of LNG.” Tellurian claims to have the answers with its flexible approach. However, rivals are sceptical. Many of these new markets are changing the way LNG is bought, sold and traded and it is clear that risk is being shifted back to suppliers, or at least it is shared more equally between suppliers and buyers. This is what is driving new thinking in the LNG supply sector and, even though the jury is still out, this is where Tellurian’s new business model comes in.

Charles Ellinas