[NGW Magazine] Iran faces gas shortage

While Iran’s gas output is going up, its exports are going up faster and imports are now off the menu. So even though diesel reserves are building, its gas supplies will be tight this winter.

Iran added 25bn m³ to its gross gas production last year to March 20, bringing the total to 285bn m³. This was achieved by relying almost completely on developing new phases of the giant South Pars gas field. However, no new phase has been inaugurated this year, posing a threat to the country’s security of gas supply.

New statistics, released by South Pars Oil and gas Company (POGC), indicate a 15% growth in gas production during the seven months of the year: gross production was 94bn m³ and refined gas production 75bn m³. However, all the growth relies on South Pars phases 17-21, which became operational mostly in the second half of last year.

South Pars supplied 70% of the gas that went into the grid this year, which is about 6% more than the same period last year. Iran injected 204.77bn m³ of processed gas into the grid last year.

The giant field, shared between Iran and Qatar, is the world’s biggest dry gas reservoir. Iran holds a third of it with 14 trillion m³ natural gas, which it has divided into 24 phases, of which 1-10, 12 and 15-21 are active and the rest under development. Iran plans to complete 23 phases with a total production capacity of 245bn m³/yr in the next two years; and a further 18bn m³/yr will come from phase 11 by early 2021. A Total-led consortium is preparing to develop this phase.

Winter preparations

As winter was looming, Iran stopped exporting diesel September 23 in order to start storing it for fuelling power plants. An oil ministry official told NGW that he was preparing for gas supplies to be very tight this year.

Iran’s power generation sector is already using more diesel and fuel oil although gas use has also increased in this sector.

According to the energy ministry’s latest weekly statistics, the country used 1.479bn litres of diesel (up 31.6% year-on-year), 1.71bn litres of fuel oil (up 8.7%) and 47.945bn m³ gas (up 7.3%) in the first 230 days of this year. Iran added 1 GW to power generation capacity and generated 212 TWh electricity during this period.

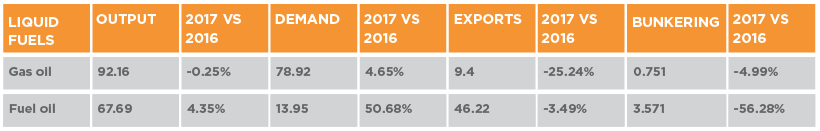

Iran’s Fuel Oil and Gas Oil statistics for 6 months of fiscal year, March 21-September 22, 2017 (millions of litres/day)

Source: Oil ministry

According to an official document, seen by NGW, the country’s diesel and fuel oil exports declined year on year (March 21-Sept 22).

Regarding inventories, the statistics, mentioned on document shows huge plunge for diesel, but fuel oil inventories rose slightly at the end of sixth month.

The official said that all of South Pars gas processing plants have been overhauled until early November and ready for winter. “The South Pars refinery No13 is also preparing to be launched and the jacket of phase 13 was installed earlier. However, the gas shortage is unavoidable in winter, regarding connecting tens of new cities and villages to grid during the year.

Iran has planned to connect 900,000 households to gas grid in the current fiscal year. As of March, about 98% of urban and 70% of rural households (21.25mn households in all) were connected to grid. Iran plans to bring gas to all its villages and cities in two years.

Turkmenistan has stopped gas flow to Iran since January 2016 owing to delayed payments of $1.8bn for past deliveries. Iran had been buying 9bn m³/yr from its northern neighbour. Further making things worse, Iran increased gas export to Turkey by 27% between January and August, reaching 6.415bn m³, according to the Turkish energy regulator’s statistics; while Iran began exporting gas to Iraq at 7mn m³/d on June 22.

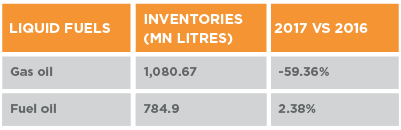

Iran Inventories, at September 22 2017

Iran oil ministry’s official report, seen by NGW

This volume rose to 10-12mn m³ in early October, and kept going despite the deadly earthquake near the two countries’ border in mid-November.

Regarding the lack of gas production growth since March 20, higher annual demand and the cut in flows from Turkmenistan, and higher exports, mean that Iran faces a gas shortage this winter.

The housing sector, which uses about 48% of the total annual sweet gas production, consumes three times as much gas in the winter months on average, taking about 80%-85% of the total output of processed gas. This leaves very little for the power generation and industrial sectors.

For instance, last year, Iran‘s power sector used about 10.5bn litres of diesel and fuel oil, of which about 78% was consumed during autumn and winter. It used more of those refined products in the power sector in the first 230 days of this year, so the gas shortage is already apparent despite the warm start to this winter.

The deputy head of Iranian gas transmission company Majid Mosaddeghi said November 8 that about 2bn m³ of gas were also stored at the Shourijeh and Serajeh underground facilities, which are near the capital Tehran and are ready to pump 15mn m³/d gas into the grid in winter.

Iran re-injects about 25-27bn m³/yr into oil fields to maintain production, including 7bn m³ of dry gas. Mosaddeghi said the dry gas injection has fallen by 10.7% to 3.811bn m³ in six months of this year, compared to the same period in last year, in order to compensate partly for the shortage in the power sector.

Dalga Khatinoglu