[NGW Magazine] Upstream Revisits EU Offshore Gas Pocket

This article is featured in NGW Magazine Volume 2, Issue 21

There has been a resurgence of upstream oil and gas activity in the Adriatic and Ionian Seas: close to market and free from serious territorial disputes, the reserves there look worth tackling.

The Adriatic and the Ionian are becoming a hotbed of exploration and production (E&P) activity, with Energean being the latest company to announce progress in its blocks offshore Montenegro.

The Adriatic and the Ionian have been prolific oil and gas producers for over 50 years. Italy, Albania, Croatia and Greece have been producing oil there for years and Montenegro is just about to enter the fray.

Figure 1: Adriatic and Ionian region

Source: eusair

All states in the region are parties to the United Nations Convention of the Law of the Seas (Unclos), which designates the region as a ‘semi-enclosed sea’, consisting primarily of territorial seas and exclusive economic zones involving two or more states. This often leads to disputes, in the absence of delimitation agreements of continental shelves. This is especially true between states of the former Yugoslavia, but also between other countries. Based on Unclos, solutions have to be found through bilateral negotiations. The status of national offshore policies and maritime border delimitations in the Adriatic and Ionian seas is well described in a comprehensive report by Association Internationale du Droit de la Mer.

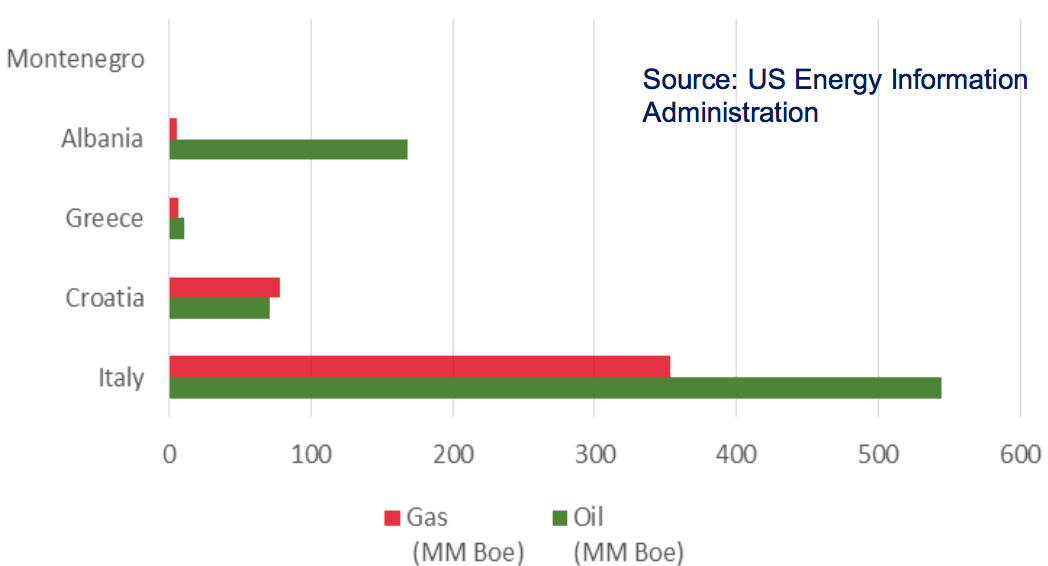

By the end of 2016 the proven oil and gas reserves of the region totaled 1.24bn barrels of oil equivalent (boe) – not impressive but still important in terms of regional perspectives (Figure 2).

Figure 2: Proven oil and gas reserves of the Adriatic/Ionian region

Source: INA/EIA

The prospect of collaboration between regional state hydrocarbon companies was raised by the CEO of Greek hydrocarbons management company Edey, Yiannis Bassias, at the Balkans Petroleum Summit in Athens October 3-4.

The summit brought together state hydrocarbon authorities, regulators and international oil company officials for a discussion on upstream projects, as well as an exchange of ideas on future hydrocarbon projects in the Balkans. Participants unanimously agreed that the EU hydrocarbon directive should be used as a guiding mechanism for a framework of common business practices and they agreed to meet annually.

Even though the region is still highly unexplored, with resurgence in upstream activity in Greece and Montenegro, this is about to change.

Montenegro

Not yet an oil or gas producer, Montenegro announced its first offshore licensing round in 2013. But it was not until last year that it signed its first contracts jointly with Italy’s Eni and Russia’s largest independent gas producer Novatek for four offshore blocks.

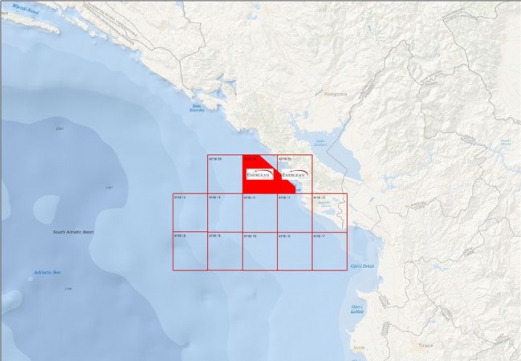

A further two blocks were awarded to Energean in March this year covering 338 km² in shallow waters, between 50 metres and 100 metres deep. Energean’s concession agreements are for 30 years and cover blocks 4218-30 and 4219-26 (Figure 3).

Figure 3: Energean’s blocks offshore Montenegro

On October 19, Energean announced its first competent person’s report (CPR) regarding the potential of its two fully-owned blocks, prepared by Netherland Sewell & Associates. The CPR shows that the combined net unrisked prospective recoverable resources (P50) for the two blocks are 1.8 trillion ft³ natural gas and 144mn barrels liquids, equivalent to a total of 438mn boe.

The CPR is part of the first three-year exploration phase, which includes 3-D seismic surveys to take place in 2018, and geophysical and geological studies. It will conclude with drilling one well. Energean estimates the total cost of the initial exploration phase to be $5mn, expected to rise to $19mn over the three years.

Energean believes the geology to be similar to that in western Greece, where it has been exploring onshore in Ioannina since 2014; it also has a field development plan in progress at West Katakolon, offshore Peloponnese. Through this exploration experience, Energean has developed a detailed understanding of the area’s geology, uniquely positioning it to maximise the development possibilities and unlock the region’s hydrocarbon potential.

Energean said that the CPR is an important step in scoping the potential of the under-explored area offshore Montenegro. Previous operators found oil and gas discoveries late last century but they were never developed commercially.

Its CEO Mathios Rigas said the CPR “further suggests that Montenegro sits in the ‘sweet spot’ of untapped potential in the eastern Adriatic. The area remains substantially underexplored, despite having what appears to be working petroleum system with extensive sandstone and carbonate reservoir development.”

Energean has a strong track record of operating in environmentally sensitive areas. It has been successfully operating the Prinos oil field in northeastern Greece, producing oil since 1981. It is Greece’s only oil producer with an average output of 3,500 b/d. It is also the operator of the Karish and Tanin gas-fields offshore Israel, which are at the development phase, with FID expected next year. This successful experience is ideal for the company to drive through this project for the benefit of Montenegro, which, initial data indicate, could have enough resources to at least cover its own needs.

Greece

Herodotus writing in 425 BC that tarry oil existed in Greece’s Zakynthos island in open pools. But it took the Greeks another 2,500 years to start realising this potential.

Energean is also active in the Ionian Sea, where it is working on one field, the West Katakolon oilfield. It was discovered in 1981 by a Greek state-owned oil company, but the project was abandoned owing to complexities and low oil prices at that time. The West Katakolon block is estimated to contain between 10mn and 12mn barrels of recoverable oil equivalent, with the West Katakolon oilfield containing contingent resources of 3.7mn barrels.

This is now being operated by Energean under a 25-year licence. Following new seismic surveys, Energean plans to use extended reach drilling (ERD) to drill in 2018 from onshore to the offshore reservoirs, to avoid any impact on the regional tourism industry.

The European Bank of Reconstruction and Development is supporting project funding. Energean’s development plan was approved by the state end of August, with the company granted production license.

Another active license in the Ionian is the West Patraikos Gulf block, awarded to Hellenic Petroleum (Helpe) and Edison following an open door international tender by the Greek government in October 2014. Following geological studies and 3D seismic surveys, Helpe is now assessing potential drilling targets.

Following earlier assessments, Patraikos Gulf is estimated to hold up to 100mn barrels of oil. The company is committed to a second exploration round starting April 2018, following by drilling at least one well, but probably more, during 2019 to 2020.

More recently, the Greek government concluded evaluation of tenders from its second offshore bid round in 2015, awarding in 2016 block 2 to a consortium of Total, Edison and Helpe and block 10 to Helpe (Figure 4).

Figure 4: Greek offshore blocks in the Ionian and off Crete

Source: IENE

The key development for Greece is the final signature of the contract for block 2 west of Corfu October 31 this year, almost three years after the start of bidding for the second round! It is an area for which there are high expectations for hydrocarbon discoveries. It has similarities with the geological zone in the Italian EEZ, where significant quantities of oil have been identified.

The consortium plans to commence geological studies and 3D surveys immediately, with the expectation that it will carry out the first drilling in three or four years, during the 2020-2021 period. Preliminary estimates based on existing seismic records are that block 2 holds about 2bn barrels of oil.

A tender for offshore blocks southwest and west of Crete will be published in the Official Journal of the European Union in November. This follows an announcement by the Greek government on August 17 of its intention to release a tender for the granting of the right to explore and exploit for hydrocarbons off Crete, as well as in the Ionian Sea. According to the invitation, tenders must be submitted within 90 days of the date of the official publication, so no later than February 2018.

This tender is the outcome of a joint request by ExxonMobil, Total and Helpe in May this year, expressing interest in acquiring blocks off Crete. It is understood that more recently Eni also expressed interest for such blocks, with Energean showing interest for blocks in the Ionian.

Italy

The biggest offshore producer in the Adriatic/Ionian region is Italy with about 8% of total EU gas production and just under 1% of oil.

But in response to concerns as a result of the Deepwater Horizon disaster in the Gulf of Mexico, the government enacted Legislative Decree 128/2010, modified in 2012 and 2013, which imposed a ban on exploration or exploitation of oil and gas in coastal and marine areas within 12 nautical miles of the entire national coastal perimeter.

However, in accordance with Italy’s Stability Law, operating oilfields within 12 nautical miles from the coast may have their concessions extended until all the commercial reserves have been extracted. Not surprisingly, these developments led to a decline of offshore activities.

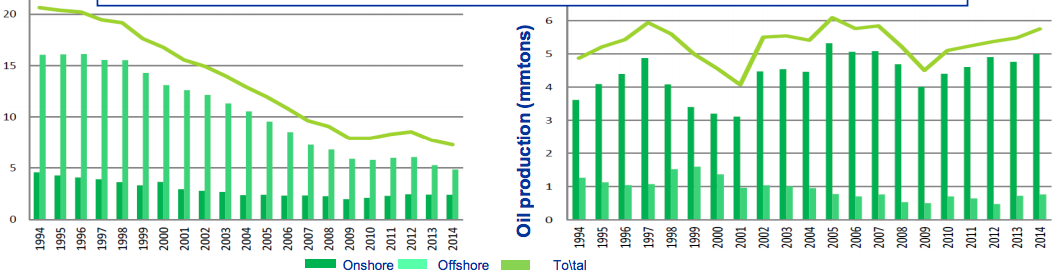

These and other legislative developments slowed down exploration and since late 1990s production dropped by close to half (Figure 6). This is despite an estimated potential to cover up to 20% of Italian hydrocarbons demand for 20 years.

Figure 6: Hydrocarbons production in Italy

In 2013 the Italian government decided to take action through the National Energy Strategy (SEN), covering the period to 2020, to improve domestic hydrocarbon production, both onshore and offshore, in order to enhance its energy security, reduce its dependence on imports, and boost economic growth.

The SEN set very ambitious targets for national oil and gas production to 2020 and opened up initiatives to unlock Italy’s hydrocarbons potential. It defined binding deadlines to obtain the required approvals by local stakeholders and simplified and reduced the authorization processes. Permitting and governance were improved, as well as co-ordination with EU regulations.

Taxation was also reduced and simplified in 2015, including provision of incentives for geophysical studies and the development of secondary fields. These measures led to an increase in exploration activities.

However, a political fight began in December 2015 after Italy’s government extended all existing 30-year concessions until their resources were exhausted, while at the same time banning all future exploration and drilling in territorial waters. By April 2016, Italians were called to vote on a referendum on the duration of existing oil and gas exploitation and drilling concessions in territorial waters.

This added to uncertainty and concerns with regards to how future domestic oil and gas production policies might evolve in the face of environmentalist pressures. The threat of any future restrictions on exploration and drilling activities impacted investments by oil companies.

However, the Italian government is making progress in the development and implementation of energy policy with emphasis on security of energy supply and support of its upstream.

The forecast is that even though a decline is expected from onshore regions, offshore should see growth in the longer-term as deeper waters in the Adriatic and the Ionian are exploited. The biggest offshore operators in Italy are Eni, Edison, Shell and Total.

By the end of 2016 there were 22 exploration licenses and 69 production licenses offshore Italy. According to the ministry of economic development, Italy has 362 offshore producing wells.

The offshore Adriatic Basin holds more than half its gas reserves, with a number of large and giant-size gasfields and medium to large oilfields discovered in the basin during the past 60 years.

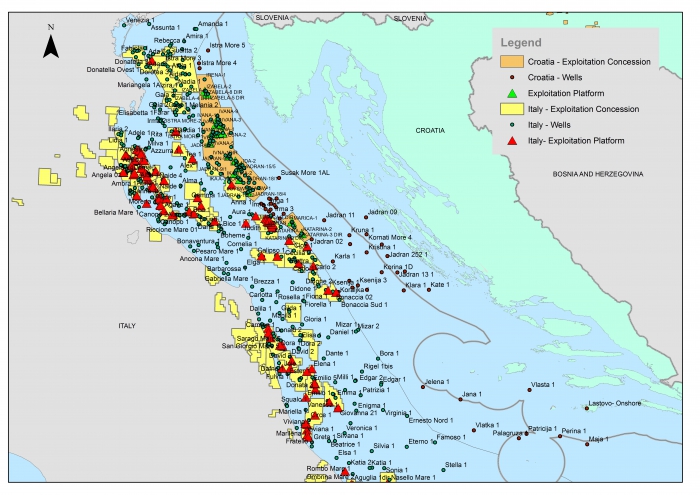

Eni is the biggest Italian operator in the Adriatic and Ionian seas (Figure 7). Its fields in the region accounted for 52% of Eni’s domestic production in 2016, about 70,000 boe/day, mainly gas.

Figure 7: Italian and Croatian E&P in the Adriatic

Main operated fields are Barbara, Cervia/Arianna, Morenna, Clara NW, Annamaria, Luna, Angela-Angelina, Hera Lacinia, Bonaccia and Porto Garibaldi. Production is operated by means of 72 fixed platforms installed on the main fields, to which satellite fields are linked by underwater infrastructures.

Edison has 60 concessions and permits in Italy, and operates two offshore oilfields in the Adriatic, Rospo and Sarago. The Giove and Cygnus prospects in southern Adriatic are being explored by Northern Petroleum and are estimated to jointly hold about 470mn barrels of oil.

There is still strong gas and oil potential in Italy, and successive governments have been quite keen on developing indigenous resources. However, despite this strong commitment, it is not expected to be a game changer, but future E&P should continue making an important contribution to Italy’s energy needs.

Croatia

Environmental concerns have also been affecting Croatia’s offshore E&P.

Supervision over all aspects of exploration and exploitation of hydrocarbons in Croatia is the responsibility of the Croatian Hydrocarbon Agency (CHA).

Since the 1960s, INA (Industrija Nafte) has had a leading role in Croatia’s oil business and a strong position in the upstream there.

Croatia is considered to have a great offshore hydrocarbons potential, with seismic surveys in 2013 estimating 3bn barrels of oil reserves.

INA is producing from three offshore fields in north Adriatic: two in a joint venture with Eni and one in a joint venture with Edison. Croatia’s proven reserves in the Adriatic amount to about 70mn barrels of oil and 80mn boe of natural gas.

Croatia’s first offshore bid round took place during 2014/2015. Two blocks were awarded to Croatia’s INA (25 and 26), and one block to Eni, but production sharing agreements (PSAs) have not yet been signed by CHA, even though the offshore tender was never officially suspended.

The reason was strong public opposition to offshore exploration because of concerns it might harm the country’s lucrative tourist industry. For the time being the government states that there are no plans for oil exploration in the Adriatic.

However, the Croatian government is in the process of preparing a new Hydrocarbon Act, which should make future tender rules clearer and provide more clarity with regards to licensing procedures. This is much awaited by the oil and gas industry and should include clarification of the status of previously tendered blocks.

Albania

Albania’s oil also has its roots in history. It was established as a hydrocarbon-bearing province as early as Roman times, when heavy oil and asphalts fromthe Selenica mine were used as fuel for lamps.

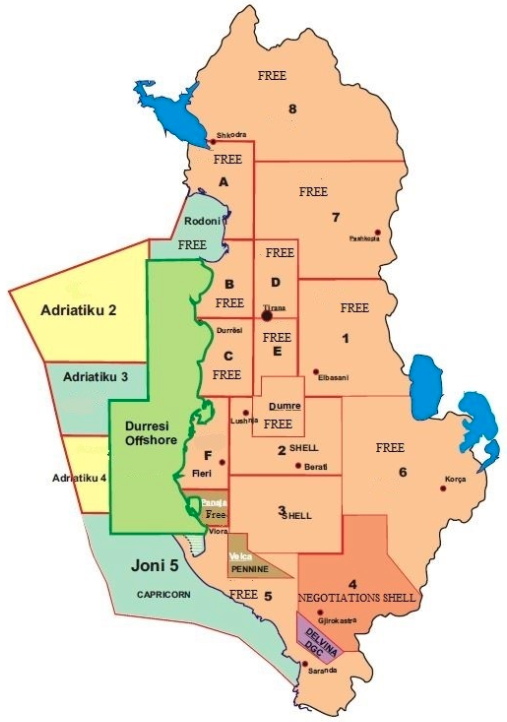

The development, monitoring and use of natural resources, including hydrocarbons, are the responsibility of the National Agency of Natural Resources (AKBN). Albpetrol is the state-owned petroleum production and marketing company. In 2014 AlbPetrol estimated that Albania had 314mn barrels offshore oil reserves.

Albania’s EEZ was divided into six blocks. The operator for the Durresi block is San Leon Energy; Emmanuelle Energy has blocks 2, 3 and 4; and Capricorn Albania has Joni 5, while block Rodoni is free.

The heading of an article in WorldOil in December 2016 was ‘Don’t overlook Albania’.

The country lies within a tectonically active and structurally complex geologic region, associated with thrust faulting along the Adriatico-Apuilian plate boundary, which has been shown to be prolific with a number of onshore oil-fields, including Europe’s largest onshore oil and gas field, the Patos-Marinza operated by Bankers Petroleum since 2004.

Encouraged by this, the Albanian government has been taking steps to help attract investments by international E&P companies.

More recent seismic and gravity data suggests that Montenegro and north-west Albania share the same Mesozoic platform plays. This is based on extensive geological and geophysical data gathered during mid-1990’s and early 2000. This data indicates the possible presence of another hydrocarbon province yet to be found in this region, consisting of Mesozoic thick-skin traps of low exploration risk. Albania hopes that this will spur upstream interest to replicate onshore hydrocarbon successes offshore.

Charles Ellinas