[NGW Magazine] Indonesia's prosperity needs gas

This article is featured in NGW Magazine Volume 2, Issue 21

Indonesia sees a gas supply deficit looming in the east, especially Java, as hotels and malls join the industry and transport sectors as growing energy consumers.

The oil and gas sector of former Opec member Indonesia has seen better days. From being one of the largest LNG

.png)

exporters in the world, accounting for more than a third of global LNG exports in the 1990s, the country’s share of the global LNG market was less than 7% in 2015. Now, industry officials within the country are preparing for a rise in LNG imports to help it to meet its power generation needs.

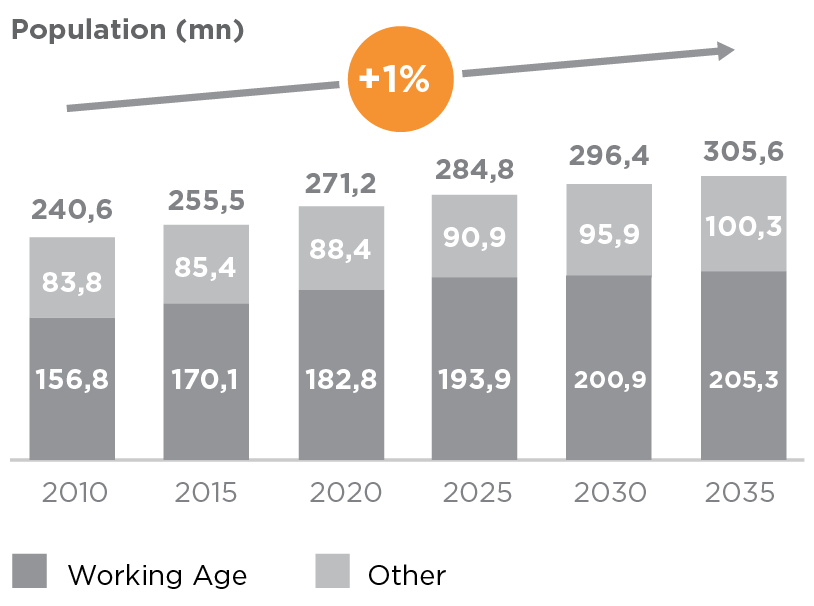

On October 25, the general manager of LNG sales for state-owned energy firm Pertamina Irma Surya said that Indonesia will become a net gas importer by 2020 as the population grows. The deficit will reach 4bn ft³/day by 2030, she added.

One of the biggest challenges comes from Java, Indonesia’s most populous island with some 135mn people, including

.png)

Jakarta – the country’s capital. About 55% of Indonesia’s gas demand comes from Java, while the province’s gas use is projected to increase five-fold from 2015 to 2030, Surya said. “Since the eastern part of Indonesia has a gas surplus, while the west and south have deficits, to cope with the large amount of gas demand in western Indonesia, an adequate gas infrastructure within the region is needed,” she said, saying that the country will become a net LNG importer for the first time in 2020.

Indonesia, an archipelago of more than 18,000 islands, is southeast Asia’s largest economy and its most populous, with nearly 265mn people, according to UN estimates. Indonesia is also the most fourth populous country in the world after China, India and the US.

Though Indonesia held 101.2 trillion ft³ of proved natural gas reserves at the end of 2016, the 13th largest in the worldand second in the Asia-Pacific region after China, according to the BP Statistical Review of World Energy 2017, its oil and gas sector woes have been mounting for years.

The country struggles to attract sufficient investment to meet its growing domestic energy demand as there is a lack of adequate infrastructure; further, the complex regulatory environment often drives international oil companies (IOCs) away to less complex and faster-moving countries. Moreover, Indonesia’s natural gas production fails to meet domestic demand, creating a gas shortage for the country’s industries.

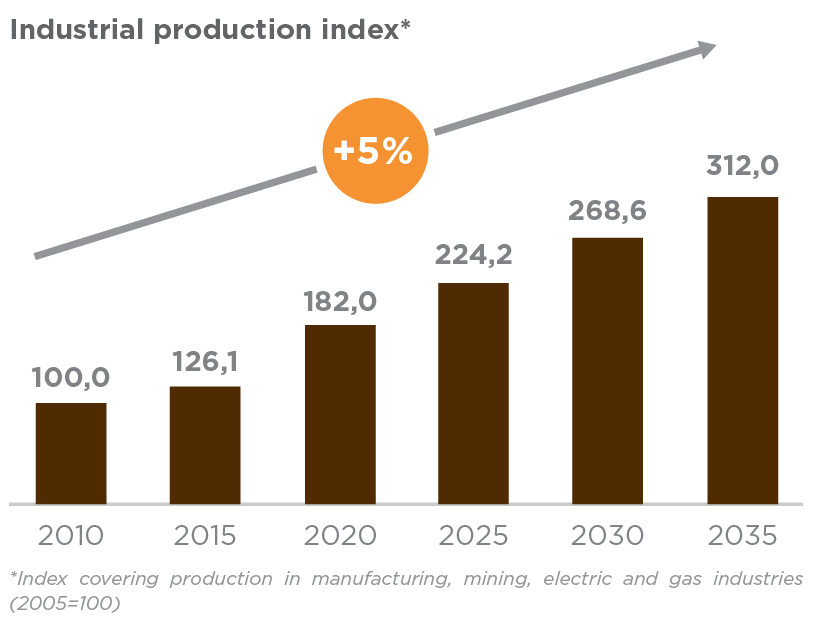

Indonesia’s power sector is expected to consume more natural gas as the government plans to add 13 GW of gas- firedcapacity by 2020 to replace relatively expensive diesel-fired power generation. BMI Research recently estimated that Indonesia’s gas demand will grow at an average annual rate of 4% over the next decade, with the greatest demand coming from the power sector, but transport and industry also featuring.

firedcapacity by 2020 to replace relatively expensive diesel-fired power generation. BMI Research recently estimated that Indonesia’s gas demand will grow at an average annual rate of 4% over the next decade, with the greatest demand coming from the power sector, but transport and industry also featuring.

According to a recent Invest Indonesia report, the country’s energy sector problems have also hampered GDP growth. However, the country did post a 5% GDP growth rate for the first quarter the year, mostly owing to a rise in commodity prices, according to Indonesia’s statistics bureau.

Massive infrastructure build needed

Indonesia’s gas and power sector problems bring it full circle to Surya’s LNG import forecast and the need for more gas infrastructure.

Beni Suryadi, a Jakarta-based programme officer at the Association of Southeast Asian Nations (Asean) Centre for Energy, and an oil and gas analyst, told NGW that a government initiative, the Medium Term National Development Plan, calls for seven floating storage and regasification units (FSRU) and more than 18,000 km of gas pipeline. He added that the Indonesia government should conduct a feasibility study to determine the hub area for linking supply and demand areas.

“This hub area will be the central point for co-ordinating LNG shipments from east to west and south,” he said. “On the demand side, pipeline infrastructure is also needed to distribute gas to the consumer. All of this infrastructure indeed requires huge capital investment and human resources, such as constructing GTL [Gas-to-Liquids] facilities and thousands of kilometres of gas pipelines.”

According to the US Energy Information Administration’s (EIA) most recent analysis of Indonesia’s energy sector, the country’s largest gas fields are in the Aceh region of South Sumatra and East Kalimantan. The Mahakam block, offshore East Kalimantan and operated by French oil major Total since 1967, accounts for roughly a quarter of Indonesia’s dry natural gas production and is a key supplier to the Bontang LNG plant, the EIA adds.Moreover, bringing gas supply from eastern Indonesia to population centres in other parts of the country is not only capital intensive: it will also take time, making Surya’s 2020 LNG import date even more pressing.

“Building all the planned infrastructure is expected to take more than two years from the beginning of construction,” Suryadi said. “It will be very challenging and more government effort is needed to implement all the construction in supporting the east-to-west gas connection.”

A July report in The Jakarta Post commented on this quandary facing the Indonesian government. It said that even though Indonesia is blessed with abundant gas supply, “that sheer supply may turn into a curse as lack of infrastructure to support gas distribution means some of it remains untouched.”

Inking LNG supply deals

As Indonesia grapples with trying to put in place the necessary infrastructure to transport its gas reserves to more populated demand centers, it will have to sign more LNG deals as that plan develops.

Likely candidates to sign more deals with the country include Australia, the US and Qatar, which recently pledged to ramp up production to 100mn metric tons/yr within the next five years. However, given the distance from the US to Indonesia as well as loss attributed to boil-off and pricing considerations, Australia and Qatar could have an advantage over US-sourced LNG going forward.

US-based Cheniere Energy signed an SPA in December 2013 to supply 0.8mn mt/yr of LNG to Pertamina for 20 years priced at 115% Henry Hub plus $3.50/mn Btu on a free on board basis. Shipments are scheduled to start next year. Earlier this year, Pertamina signed an agreement with the UAE’s Emirates National Oil Company to directly purchase LNG on a spot basis.

Tim Daiss