[NGW Magazine] Economist Tackles High UK Energy Prices

This article is featured in NGW Magazine Volume 2, Issue 21

Energy economist Dieter Helm has delivered his critique of the UK energy market, finding much wrong with it. But while publicly welcoming it, some industry bodies will try to thwart it.

UK’s Department of Business, Energy & Industrial Strategy (Beis) published October 25 its Cost of Energy Review that it commissioned UK energy economist Dieter Helm to write in August. Its intention is to set out a long-term energy road-map for the energy sector and relates to the government’s Industrial Strategy Green Paper.

Helm, a professor at Oxford University and the author of numerous books on energy economics and regulation, was an advisor to the Labour government between 2004 and 2007, meaning that he left that position before the Energy Act that introduced concepts he opposes, such as the feed-in tariff, was passed in 2008.

The review considers the whole electricity supply chain of generation, transmission, distribution and supply and outlined ways to reduce costs while not breaking national carbon emissions reduction commitments; or jeopardising security of supply. The review considers each element of the consumer’s bill and put forward proposals on how to reduce the cost of each.

Final cost components

Helm said his review came “at a time of considerable public debate and concern about the increases in energy bills to customers, and about the ability to pay and the impacts on industrial competitiveness. It also comes at a time of huge technological opportunities and change, on a scale not seen in electricity since the late-19th century, which offers considerable optimism about the speed of decarbonisation and about the process being less costly than many have feared.”

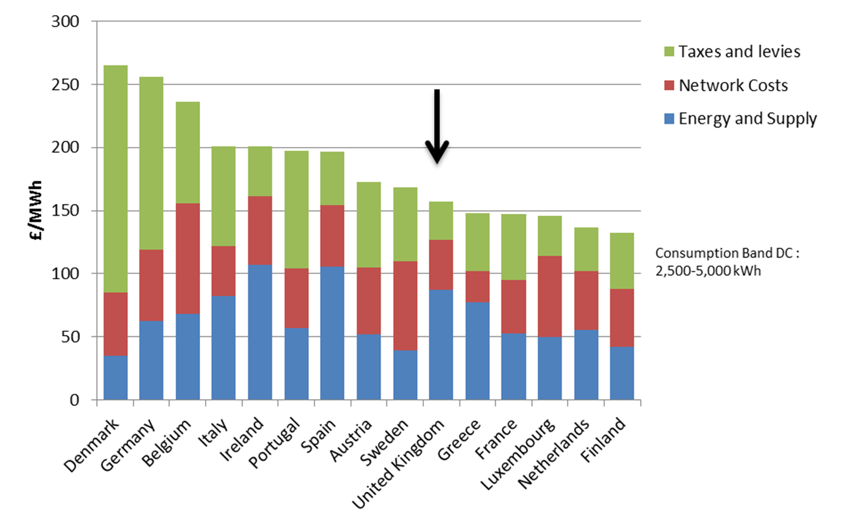

UK households are paying more for clean power than they should, he found; but official data shows UK bills are still below average compared with other EU member states (Figure 1).

Figure 1: EU household energy prices

Source: Eurostat

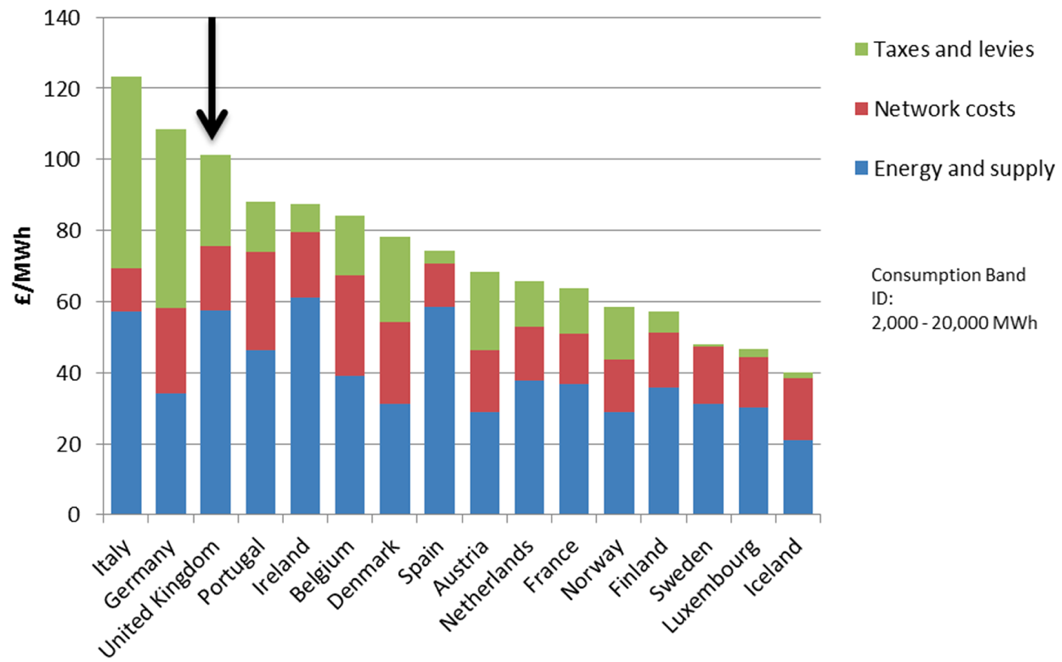

However, this is not the case for medium industrial and commercial customers. UK businesses pay well above the average in this sector (Figure 2). Only Germany and Denmark are more expensive. UK is in fact the most expensive EU country for very large industrial consumers – hence the Beis decision to investigate.

Figure 2: EU medium industrial consumer energy prices

Source: Eurostat

A key conclusion from this work is that the cost of energy in the UK is too high and is higher than necessary to meet the country’s climate change targets.

This is based on the facts that:

- The prices of oil, natural gas and coal have fallen substantially since 2014

- The price of renewables has been falling fast

- New technologies should mean lower costs and greater energy efficiency

- Margins should be falling as competition rises.

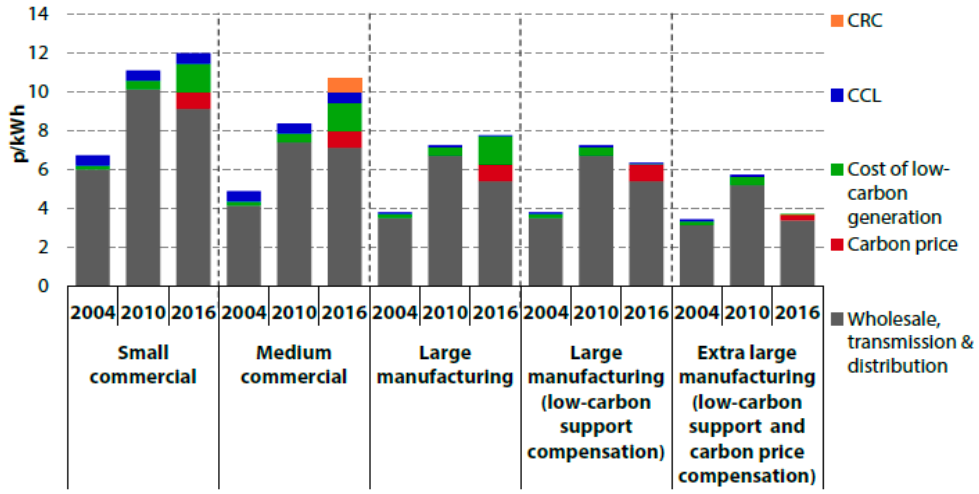

Despite these factors, “in this period, households and industry have seen limited benefits from these cost reductions. Prices have gone up, not down, for many customers,” with energy bills doubling over the past 10-years (Figure 3). He adds: “Prices should be falling, and they should go on falling into the medium and longer terms.” However, customers are not benefiting because of carbon pricing policies, regulation and the "exercise of market power," - ie the lack of effective competition.

Figure 3: Changes in electricity prices

Source: Committee on Climate Change

The review criticises government renewable energy support policies and recommends that so-called feed-in tariffs and low-carbon contracts for differences should be gradually phased out as they have contributed to rising energy prices. Helm says they should be charged separately and explicitly on customer bills. Industrial customers should be exempt. Once taken out of the market, the underlying prices should then fall.

In future, greater use of auctions can bear down on excessive costs, but there is a long way to go and existing energy policy is not fit for these new purposes.

He said the government has been getting its sums ‘spectacularly’ wrong on the energy market, locking customers into excessive prices for years to come; and this point has been made before: the government models of energy costs in the first half of the current decade wrongly predicted surging fossil fuel prices to justify investment in alternatives. Then the oil price crashed.

Another identified challenge is that the UK faces a "cliff-edge in capacity in the period through to 2025" as coal-fired power stations close, and so does most of the existing nuclear capacity. The review says there are “very real risks to security of supply, and a risk to the climate change agenda if, as a result, emergency measures are required to keep the coal stations available."

The review finds complexity is a major cause of rising costs and tinkering with policies and regulations is only going to raise them further: “Indeed, each successive intervention layers on new costs and unintended consequences. It should be a central aim of government to radically simplify the interventions, and to get government back out of many of its current detailed roles."

The way forward

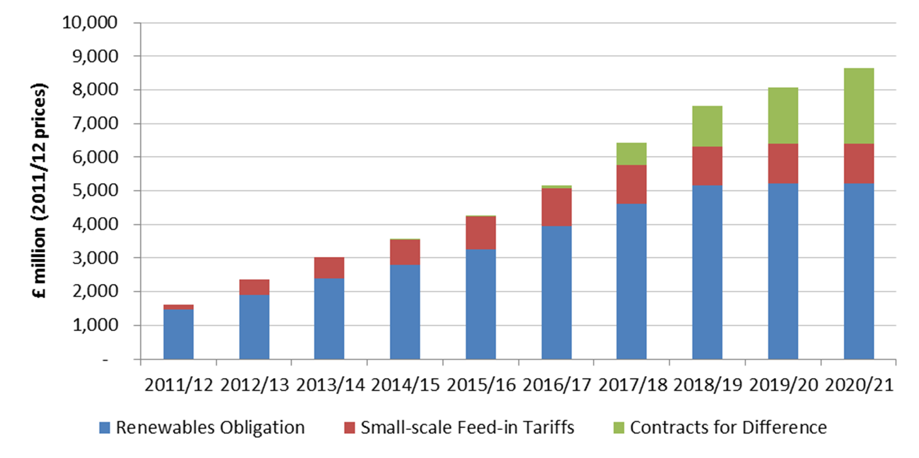

The review proposes 67 separate ways to reduce costs in the electricity chain, from generation to supply. Levies aimed at decarbonisation and social policies make up to 20% of bills, and are still increasing and may exceed 40% by 2020, (Figure 4).

Figure 4: Levy control framework and projections

Source: Beis

Helm blames government intervention for these cost inconsistencies that trigger unintended consequences. He says the scale of government involvement in the electricity market has become so extensive that few people, if any, could list all the measures it has taken.

More important, it concludes that energy policy, regulation and market design are not fit for the purposes of the emerging low carbon energy market, as it undergoes profound technical change. In effect the government has moved from mainly market-determined investments into the business of ‘picking winners’.

Helm recommends greater use of ‘equivalent firm power’ (EFP) capacity auctions and a higher, universal, carbon price across the economy, with the phasing out of legacy costs from renewables obligation certificates (ROCs), feed-in-tariffs (FITs) and contracts for differences. Through such auctions, those who cause the costs arising from intermittency will be the ones who pay for them, creating a “major incentive for the intermittent generators to contract with, and invest, in the demand side, storage and back-up plants.”

The review proposes setting an economy-wide carbon price as "the most efficient way to meet the Climate Change Act target and carbon budget", as well as a border carbon price on imports "to address the consequences of the UK adopting a unilateral carbon production target."

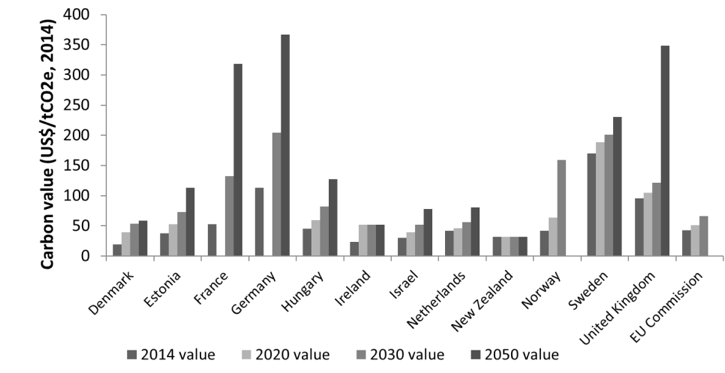

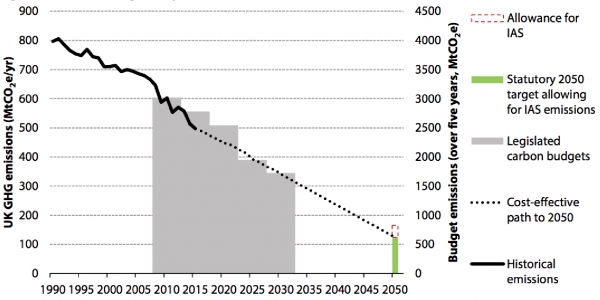

The review claims this is the most efficient way for the UK to meet the target set under the Climate Change Act for net carbon emissions to be at least 80% lower in 2050 than they were in 1990, (Figure 6). For reference, carbon prices from a number of countries are compared in Figure 5, based on a 2014 OECD review.

Figure 5: International carbon prices

Source: OECD Environment Working Papers

The review emphasises the importance of boosting energy efficiency, smart technologies and the role of carbon capture utilisation and storage (CCUS) – so far conspicuous by its absence.

It also recognises that the cost of renewable energy has fallen significantly and will continue to do so. The energy system is moving quickly towards one characterised by renewables, decentralisation, battery storage, demand-side response, a flexible grid and interconnection. The current policy and regulatory landscape will need to evolve quickly to support this transition. Helm goes as far as to describe renewables as the 'new conventionals'.

The review suggests that there should be no more periodic reviews in Ofgem’s current ‘RIIO framework’ (Revenue=Incentives+ Innovation+Outputs), as “technical change is so fast that predicting costs eight to ten years hence is impractical.”

Finding that the incremental approach being taken to adjust today’s market structures and regulations is not sufficient to meet the requirements of fast-paced change already impacting the sector, it recommends the establishment of national and regional system operators in the public sector to manage transmission and distribution, opening up competitive bidding in this area also for grid enhancements such as storage and demand side response. The role of Ofgem in network regulation should then be diminished significantly.

Figure 6: UK carbon budget and path to achieve it

Source: Committee on Climate Change

Helm says that if these recommendations are not implemented then the crises are likely to get worse, challenging the security of supply, undermining the transition to electric transport and weakening the delivery of the carbon budget. The high costs of the British energy system will remain high, perpetuating fuel poverty, poor industrial competitiveness and less public support for decarbonisation. He says: “We can and should do much better and open up a period of falling prices as households and industry benefit from great technological opportunities over the coming decades.”

Industry responds

The review has so far received a mixed reaction from energy industry experts and practitioners. For some, he is fighting the battles of the several years ago, especially where the networks and their regulation are concerned. They are adapting to change and to the new requirements for low carbon energy.

One industry source said the changes afoot in the operation of Britain's gas and power grids had been enabled by the regulator’s RIIO formula, although that does not mean that the price control periods do not need to be shortened.

Ofgem warned that it would be getting tougher with networks to drive innovation, admitting it had been too soft on them as their performance had been at the upper end of expectations. But it says it has learned its lesson. And it said consumers have benefited from industry efficiency gains, and network costs have fallen 6% under RIIO since 2013, as well as improvements in reliability. "Ofgem has secured additional savings of over £4.5bn for consumers. We are reviewing the next set of price controls, including the length of the period, and have already signalled that the next set of price controls will be tougher."

The networks agree with their watchdog that a lot of progress has been made, under the 'innovation' heading, addressing precisely the concerns Helm raises as the UK looks to decarbonise its energy system to meet climate change targets.

“Many of the changes to networks referred to by Professor Helm are already taking place, as part of the government’s wider smart systems policy. Through the Open Networks Project, the functions of both local and national electricity networks are already being re-defined in close collaboration with industry and these changes will transform the way our electricity networks operate," the Energy Networks Association said.

It launched November 1 a draft Gas Network Innovation Strategy, to give stakeholders the chance to shape the future of energy innovation in the UK through a consultation process, with meetings and workshops planned for December. It said gas networks supported decarbonisation by balancing the intermittency of increasing penetration of renewable generation on the electricity network. Gas network companies, supported by RIIO, have introduced projects that can decarbonise heat supply while cutting the cost of gas supply

The Renewable Energy Association (REA) and the Solar Trade Association (STA) said they are broadly in agreement with the review’s request for major reform in the UK energy sector – suggesting even they have had enough of government interventions at the expense of market signals. They too want long-term certainty about how the sector will be structured.

Solar Trade Association hopes that the review will prompt an urgent rethink, without further prolonging uncertainty for the solar industry. Deputy CEO Jenny Hogan said the government’s own figures “show that the cheapest forms of new power generation are onshore wind and solar PV, with the costs of other technologies like offshore wind falling rapidly... We now look forward to working with government on achieving the goals set out in the Clean Growth Strategy, and with industry to ensure that the cost reductions happening across the sector can continue apace.”

Policy and communications director at Grantham Research Institute Bob Ward said: “It is right to highlight the need for a strong and uniform carbon price across the UK economy to confront fossil fuels with their real costs and to help correct the distortions in the electricity market.” He also added “…renewables with variable electricity generation output, such as wind and solar, do create further system costs. At present these costs are socialised and not directly borne by renewables generators. In future, it is possible that they could be reflected in the network charges faced by variable renewable generators. This would improve cost-effectiveness much more efficiently than requiring individual wind or solar farms to balance their output.”

Energy UK CEO, Lawrence Slade, suggests that at a time when “most agree that the sector needs to evolve,” Helm’s review should be seen as a helpful addition to much-needed new thinking around energy system reform.

The energy policy panel chair of the Institution of Engineering and Technology, Simon Harrison, said the review was "a rational economist’s perspective on what to do to lower consumer bills.... Implementing such changes in a single step would create massive opportunities for some and destroy substantial value for others. The question really is whether there is the political appetite to deliver major reforms over a period of time that deliver the reforms proposed cohesively. In a time of Brexit and minority government anxieties that seems unlikely. Some reforms would indeed need government action.”

Beis said it will shortly be seeking further views from industry, businesses, academics and consumer groups on the review. So there will be more feedback to follow before taking implementation decisions – and plenty of opportunities for the bolder ideas to be kicked into the long grass.

Challenges

In undertaking this review, Helm said it would be independent and “sort out the facts from the myths about the cost of energy, and make recommendations about how to more effectively achieve the overall objectives.”

But has he? Or are his recommendations too far-reaching and challenging? And will the government follow his recommendations? Judging from the responses so far, the way forward is not clear yet.

From the outset he was seen as a controversial choice to head the review. Some see him as being more favourable towards new gas capacity, than renewables and clean power subsidies, and as a man of grand theories passing over practicalities. Another criticism is that the government will cherry pick the bits it prefers.

Given that the review is broadly aligned with the UK Clean Growth Strategy [see separate feature] and the key questions it raises about the future of the UK energy system, it may well still play a key role in helping shape UK’s low carbon future. But with Brexit overshadowing everything, it might not receive the attention it deserves.

Charles Ellinas