[NGW Magazine] Total Targets 5% of World LNG Trade by 2025

This article is featured in NGW Magazine Volume 2, Issue 19

By Mark Smedley

Total has been keeping a close watch on its spending upstream as it recognises that not all the world's oil and gas reserves will make it to market, but it sees gas as the main money-spinner in the coming years and is confident for LNG.

Total is targeting a 5% market share of world LNG trade by 2025. The goal, and several more for its gas business, were outlined at Total’s Investors Day strategy briefing September 25, its first since it announced its planned $7.45bn takeover of Denmark’s Maersk Oil August 21 (NGW Vol.2 Issue 16).

A 5% global LNG market share would equate to 20mn mt/yr in 2025, from current levels closer to 12mn mt/yr, said group CEO Patrick Pouyanne.

Total said it intends to grow its equity production, including gas, by 5%/year in the five-year period to 2022; to increase by 10%/year its business to business and business to customer gas sales volume, and to double the size of its traded gas and LNG portfolio between now and then.

Total said at the briefing that it had already completed its $10bn asset divestment programme for 2015-17, announced late 2014. But, following the Maersk acquisition, Pouyanne said Total intends to sell “at least $1bn/yr” worth of the “high breakeven” upstream assets from its expanded portfolio.

Low-cost projects to maximise gas cashflow

The group also said it means to deliver more than $2bn of free cash flow from its Integrated Gas business between now and 2022 – in other words, more than half its E&P free cash will come from gas.

Demand for LNG year on year has been growing rapidly, noted Pouyanne: “You have more and more countries, because of economic development, that are opening to LNG and gas supply, particularly in Asia.” Not just the traditional top three – Japan, South Korea and China – but Indonesia, Pakistan, Myanmar and Vietnam are now opening to gas. Floating regas (FSRUs) have reduced the cost of entry to LNG for new markets to $300mn, from $0.8bn- $1bn for an onshore terminal, he said.

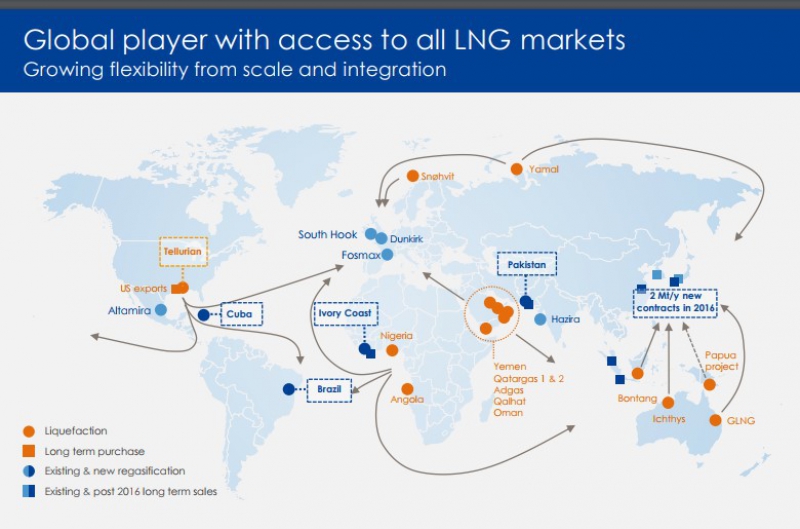

One slide showed markets, such as Cote d'Ivoire, where Total is already co-developing such an FSRU project, but also Cuba where no such project is yet known to be close to development by anyone.

Nonetheless “there is a bright future for gas. Gas has to enhance its position against coal. But this gives opportunities for growth along the gas value chain, and that is one of the drivers for an oil and gas company,” said Pouyanne, adding that Total wants also to develop low-carbon businesses.

To enhance cash flows, it was important to add low-cost assets, in giant fields such as South Pars gas in Iran and the al Shaheen oilfield in Qatar, he added. The other focus had been the US “because we have, and we want to, benefit the unconventional revolution which delivers cheap feedstock, cheap gas, cheap energy – the US is a place where an integrated major like Total has to develop its business as well.” Pouyanne cited three such activities in the US in the past 15 months: acquiring unconventional production in the Barnett Shale, participating in a planned Tellurian-led LNG project, and investing in petrochemicals fed by gas.

A separate briefing by Philippe Sauquet, head of gas, renewables and power, showed Total’s potential merit order for post-2020 LNG projects, with the lowest-cost options – at less than $6/mn Btu to produce – being in Qatar and onshore Papua New Guinea. In Qatar, Total is among several international oil companies seeking a role to fulfil Qatar Petroleum's ambition of expanding LNG export capacity by 30% to 100mn mt/yr. Next ranked in the $6-$8/mn Btu range are a seventh train at the Nigeria LNG (NLNG) joint venture, and the US LNG export project with Tellurian.

This must be the first time that NLNG has figured in a Total investor briefing for some while – and perhaps is an indication that investor confidence in Nigeria is slowly returning. NLNG’s status as a brownfield project may mean a lower risk of cost escalation.

In addition, Total has 13 projects looking to take FID by the end of 2018, which for gas include the South Pars phase 11 project in Iran and the Danish ‘Tyra Future’ gas hub redevelopment in which Maersk’s 31.2% operated stake will transfer to Total. Three of the 13 have taken FID already: Absheron 1 offshore Azerbaijan; Vaca Muerta the shale play in Argentina, and Halfaya-3 oil project in Iraq.

Together these 13 could add a further 350,000 boe/d net to Total. However, Pouyanne said Total has an internal threshold for these FIDs pending whereby they must yield an internal rate of return of about 15% at $50/b oil. He said about a fifth of the FIDs pending could achieve a 20% rate of return at that price.

Vaca Muerta has a ‘short cycle’ opportunity such that, if oil prices tumbled, the project could be scaled back or partly deferred, said Pouyanne. Total has a 41% operating interest in a 100,000 boe/d project under development there..png)

Upstream chief Arnaud Breuillac noted that Iran South Pars 11 technical costs are less than $4/barrel of oil equivalent. Total’s operating share of the 370,000 boe/d gas/condensate development is 50.1%.

Through direct negotiations, “in the new, hot area offshore Mauritania and Senegal, by having direct negotiation, [Total] had managed to capture some very interesting acreage for future wells,” said Pouyanne, neglecting to mention that the acreage off Senegal is still claimed by a smaller independent, African Petroleum.

East Mediterranean [gas exploration] is also an area of focus, with Egypt, Cyprus and Greece, the CEO said. Exploration chief Kevin McLachlan also cited Total’s “interest in Lebanon and south of Crete” acreage. However so far, its exploration work off Cyprus with Eni has disappointed. He also pointed to offshore South Africa and Namibia where Total and partners have near-term drilling plans, with follow on potential.

In terms of downstream, the CEO flagged plans to enter the French residential energy market, and secure more than 3mn customers: “We shall have to invest to get that customer base, but we can do it particularly in France by building on our strong brand.” He also signalled a willingness by Total to grow its downstream renewables business, citing Total’s recent acquisition of Eren, with an ambition of creating $500mn of free cash flow from renewables between now and 2022.

Ichthys LNG Start Deferred by 18 Months

He thanked the team at the UK West of Shetland Edradour/Glenlivet fields for bringing that gas development onstream two months ahead of schedule and under budget. But he admitted to delegates at the September 25 Investors Day that some of Total’s ‘super giant projects’ – ones that take more than 5 years to develop – have provided headaches

Ichthys LNG – originally due onstream late 2016 – was now looking “something like an April or May 2018 start-up”, albeit with first condensates produced in January 2018. Total holds a 30% interest in the US$34bn Australian development, operated by Japan’s Inpex (62.245%) that will produce 8.9mn mt/yr LNG, 1.6mn mt/yr of LPG, and over 100,000 b/d condensate at peak.

The Martin Linge oil/gas development project offshore Norway has also been delayed, following a fatal accident at the Samsung yard in South Korea where the production ship is being built, with the Norwegian project now deferred by one year.

Those two projects somewhat took the shine off the ‘Discipline, Growth and Cash’ takeaway message of Pouyanne’s presentation.

Yamal LNG on time and budget

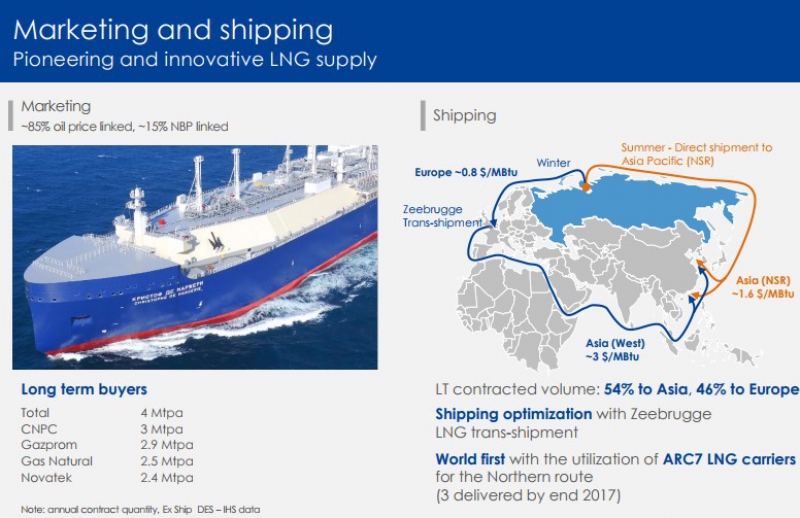

In contrast, a Yamal LNG presentation by Total’s senior vice president for Europe and Central Asia, Michael Borrell, describing how that project is being delivered “on time and within budget”, was very much on-message.

Total is a 20% partner, in this project led by Russian independent Novatek (50.1% equity) to develop three 5.5mn mt/yr LNG trains -- so totaling 16.5mn mt/yr -- alongside Chinese partners CNPC (20%) and Silk Road Fund (9.9%), using gas from the South Tambey gas-condensate field, the licence for which extends to 2045. Overall project cost is around $27bn. Total also owns 18% stake in Novatek.

The first gas pipeline into the liquefaction complex is operational, said Borrell, noting it would feed Trains 1 and 2, with the second gas pipe due to follow this December.

Train 1 began accepting gas September 10, with commissioning now underway, and the first LNG cargo still on schedule for shipment by end-2017, he said. For YLNG Trains 2 & 3 “all modules are on site, with hook up and commissioning in progress.”

Of upstream operations, 93 of the 208 expected wells on South Tambey have already been drilled (enough for the first two LNG trains), with the remaining 115 to be drilled between now and 1H 2020 – in schedule for T2 commissioning in 1H 2018 and its first cargo 2H 2018, with T3 following a similar pattern in 2019.

Borrell said the overall project will be “cash breakeven at $45/b in 2020-30, $30/b thereafter” and said that overall volumes are contracted “85% oil price linked, 15% [UK] NBP linked.” But more than 15% of the output is likely to end up in Europe, the only accessible market for LNG tankers during winter months. Contracts, allocated earlier this decade when the project got underway, are: Total 4mn mt/yr, CNPC 3mn mt/yr, Gazprom 2.9mn mt/yr, Spanish and South American marketer Gas Natural 2.5mn mt/yr and Novatek itself 2.4mn mt/yr.