[NGW Magazine] Korea's Gas Policy

This article is featured in NGW Magazine Volume 2, Issue 19

By Tim Daiss

South Korea continues to push energy policy renaissance, phasing out coal and limiting nuclear energy and bringing in more gas and renewables. Given the state of the LNG market, this could be a good time.

South Korea is continuing to revamp its energy sector in an effort to offset air pollution from coal-fired power generation and replacing it with renewables and natural gas. In its latest move, the government said on September 26 it would spend won 7.2 trillion ($6.3 bn) to reduce fine dust emissions by 30% by 2022, compared with today’s level.

South Korea’s president, Moon Jae-in, initially made the 30% reduction pledge during his campaign earlier this year in an ambitious energy renewal program. After his inauguration he launched a special task force to devise comprehensive energy plans. The government also said it would shut down seven coal-fired power plants that have operated for more than 30 years. A report in Korea Times said a temporary shutdown will also continue every year at five coal-fired power plants between March and June until 2022. From then on, they will be permanently off-line.

Moon has also earmarked the country’s nuclear power generation sector, pledging to end reliance on it owing to growing concern among the populace of a Fukushima-type nuclear disaster. These fears were exacerbated in September 2016 when two strong earthquakes – including the largest quake ever recorded in the country – hit near the city of Gyeongju, 171 miles southeast of Seoul.

South Korea maintains 59 coal-fired power plants and derives 40% of its electrical power from thermal coal and 30% from nuclear power. The country generated more than 528 terawatt-hours (TWh) of gross electricity in 2015, while its power generation has increased by an average of 4%/yr since 2005, according to the Korea Energy Economics Institute (KEEI).

The government also said in its September 26 disclosure that four coal-fired power plants that are in the early stages of construction will be converted to run on regasified LNG. In August, the country’s trade and energy ministry said it would no longer licence the construction or operation of coal plants.

A draft policy paper recently released by Korea’s energy ministry said that it hopes to meet rising energy demand in the country by adding 5-10 GW to its installed capacity base, around 4.7%-9.5% of current capacity – mostly from LNG and renewables. The ministry draft is the first step in a plan to flesh out a new energy policy by the end of October and finalise it by the end of the year, according to a Reuters report.

Questions to answer

There are several questions arising from South Korea’s plan to shift to renewables and gas. One of the questions that many analysts are asking is, could this be too ambitious?

Though the country is on the verge of a major energy transformation, policy-makers and experts are claiming that strong public support and a feasible supply plan are still needed to achieve the government’s goals, South Korea’s Yonhap News Agency recently reported. Moreover, entrenched nuclear industry interests in the country may not give up so easily.

Moon’s shift away from nuclear power is in stark contrast to previous presidential administrations that continued to earmark an increase in the fuel source in the long-term since the country has few domestic hydrocarbon resources. Nuclear power has also been a way to offset historically high imported oil prices.Nuclear power generated 31% of South Korea’s electrical power in 2015; fossil fuels generated about 64%, while 5% came from renewable sources, including hydroelectricity, according to the US Energy Information Administration (EIA).

The dramatic energy policy about-face highlights a struggle between the public, which is increasingly opposed to nuclear power, and an energy industry that wants a continued role for nuclear, Yonhap added.

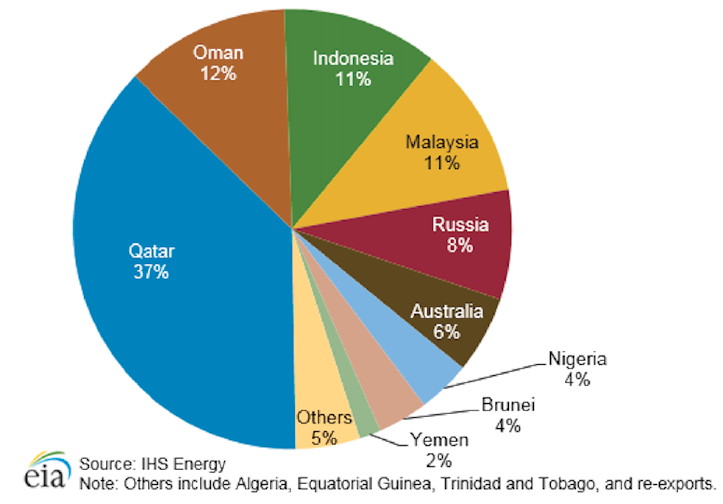

South Korea imports by source, 2015

Another question arising from Moon’s energy policy shift is its impact on LNG markets in the Asia-Pacific region, which already accounts for around two-thirds of global LNG demand, as well as its effect on South Korea’s LNG procurement going forward. With South Korea turning to gas as an increasing part of its energy mix, rising demand will bode well for LNG producers, all the way from Asia to the Middle East to the US. Since Moon’s election, some analysts have projected that South Korea’s LNG imports could increase as much as 50% by 2030 if his new

Tim Daiss