[NGW Magazine] Greek Energy in the Spotlight

This article is featured in NGW Magazine Volume 2, Issue 19

By Charles Ellinas

The privatisation saga of Greece’s natural gas transmission system operator, Desfa, is entering the home straight, albeit with a very brief shortlist. Other developments upstream give grounds for hope.

Greece’s Hellenic Republic Asset Development Fund (HRADF) formally announced the shortlist of bidders to acquire 66% of it September 23, after about three months’ deliberations.

Of the original six bidders only two have been shortlisted, although all were transmission system operators (TSOs):

- Snam (Italy) / Enagas Internacional (Spain) / Fluxys (Belgium) / Gasunie (NL)

- Regasificadora del Noroeste (Spain)

It should be noted that Snam, Enagas and Fluxys are also members of the Trans-Adriatic Pipeline (TAP) going through Greece.

The consortium of Romania’s Transgaz and French GRTgaz was disqualified because even though the two companies are certified European gas system operators, they are not fully independent, as required by the call for proposals, based on the European Directive for the Third European Energy Package (TEP) and Law 4001/201: Transgaz is a subsidiary of GRTgaz.

In addition, another condition for participation is that the competition is confined exclusively to certified TSOs in EU member states, who are members of the European Network of Transmission System Operators for Gas (Entso-g). Participation of non-Entso-g members in a consortium led by a TSO is permitted, but only with a minority stake.

As a result, Qatar’s Powerglobe, US-based Integrated Utility Services and Macquarie Infrastructure and Real Assets were also disqualified for not complying with the terms of reference.

However, there is a risk that unsuccessful bidders may appeal against their disqualifications, with inevitable adverse effects on the smooth development of the competition and the timetable.

The Greek government, keen to achieve the highest possible price for Desfa, is concerned with this outcome. It needs to realise €2.2bn income from its privatisation programme this year – and Desfa is a crucial component of this. The fewer players going into the final stage, the more competition may be limited, with the risk that prices will be lower than expected. There is an additional concern that the contest will eventually become a one-horse race: the Snam/ Enagas/ Fluxys/ Gasunie consortium. The €400mn that Socar offered in the earlier, cancelled, competition has become an informal ‘bottom line target’. None of the Desfa shareholders wants to even consider the possibility of having to accept bids below this target.

Barring any delays, the two successful bidders will be invited to submit their final and binding offers in October. However, unsuccessful bidders as well as others now have the opportunity to seek alliances with the successful bidders, something allowed for in the bidding process.

An ambitious timetable has been agreed between the government and the successful bidders, with the binding offers expected by December 2017, aiming to select the preferred investor in January 2018.

In an interview Snam’s CEO Marco Alvera emphasised that Greece is becoming an important hub, helping make European energy integration a reality. He confirmed that Snam’s interest in Desfa is strong and the main objective of the company is to speed up the process of market integration so that Italy has a key role in the European gas market.

Snam was part of an Italian industry delegation, which included Eni, Enel and Edison, that met their Greek counterparts in Corfu September 14 to discuss mutual interests in energy and gas markets. The delegation was headed by Italy’s prime minister, Paolo Gentiloni.

HRADF had asked Greece’s energy regulatory authority (RAE) to respond to requests by the bidders for clarifications, which they consider vital in finalising their offers. The bidders asked for a disclosure of the new network usage tariffs for the four years 2019-2022, which Desfa is planning to announce early 2018. They also requested a precise timetable and a determination of the interest rate for the recovery of the €320mn that Desfa will have to receive as uncollected revenue from past years.

The proposed reduction in the Desfa tariffs in 2018 will range between 8% and 9%, with the €320mn to be recovered over an 18-year period. The bidders earlier requested that the recovery period be limited to 10 years. These still need to be accepted by RAE. The danger is that if the bidders are not satisfied with the responses they get, they may lower their offers. Urgent resolution of these issues, preferably by October, is critical if selection of the successful bidder is not to be delayed beyond the January 2018 deadline.

In a separate development, RAE is proceeding with a complete revision leading to a substantial reduction of the tariffs charged at Desfa’s Revythousa LNG import terminal. The immediate result will be to increase competitiveness considerably and it is hoped, improve the utilisation of the terminal.

In what may be good news for Desfa and the preferred investor, an agreement between TAP and Desfa for the operation and maintenance of the TAP pipeline is reaching its final stages.

Macron shows paternal interest in GRTgaz, Total

The French president Emmanuel Macron of France, who visited Greece September 7, confirmed French interest in Desfa’s privatisation, but to no avail as GRTgaz did not qualify.

Total CEO Patrick Pouyanne, who accompanied Macron during this visit, met the president of Hellenic Petroleum, Stathis Tsotsoros, and discussed the joint participation with ExxonMobil in the new bidding round for offshore blocks south and southwest of Crete, expected to be announced formally soon.

Pouyanne confirmed Total’s interest in investing in blocks in the Ionian Sea and offshore Crete, adding that the Greek economy now has many opportunities for recovery and the opportunity to achieve good growth rates.

But he added that the greatest obstacle being faced in hydrocarbon development is bureaucracy and delays. He was referring to block 2 close to Corfu, the license for which Total has been awaiting approval since May.

This intervention by Macron and Pouyanne had the desired effect. Within a week of the visit Greece’s Court of Auditors approved the delayed license audit. The government will now submit the license application to parliament for final approval, expected within 2017.

In the meantime, the Greek Hydrocarbon Management Company (EDEY) approved on 28 September the transfer of 60% of the onshore Ioannina block from Energean to Repsol, that now takes over as the operator.

Greek energy developments

Energy problems were also centre stage during the visit to Athens of technical teams from Greece’s lenders in late September. Top of the agenda is the further privatisation of energy resources, especially lignite production, and restructuring of the gas market, which includes increasing competition through the loosening of Depa’s almost complete control of the market.

The International Energy Agency (IEA) has just started its 5-year in-depth-review (IDR) of Greek energy. This will include the study of all of Greece’s energy policies and efforts to reduce the energy footprint of the energy sector. It will focus specifically on renewable energy and energy efficiency. This is timely in terms of contributing to the preparation of Greece’s future energy plans.

Energy minister Giorgos Stathakis announced earlier in September the preparation of an energy plan for the period to 2030. This will deal with Greece’s major energy issues, including implementation of climate change commitments and the Paris climate accord and related EU agreements, the profound changes in the energy market within the country, energy sources and security, the liberalisation of the electricity and gas markets and the emergence of institutions that will guarantee the smooth operation of the energy market.

During the launch Stathakis said “We are at a critical juncture in Greece’s transformation into an energy centre. The TAP pipeline is close to completion; there are many other investment plans for our interconnection with the Balkans and the energy market in the country is changing radically.” He was referring to the Alexandroupolis FSRU and the Interconnector Greece-Bulgaria (IGB) pipeline.

The EC Energy Union Commissioner Maros Sefcovic confirmed that the IGB implementation plan was signed-off September 28. Calls for tenders for management and supply contacts will be issued in October and November 2017. Construction is planned to begin in June 2018, with first gas expected end of 2022.

In the meanwhile, on September 28 Snam received approval from the Italian ministry of the environment to connect TAP to its gas pipeline network in Italy.

Stathakis’ reference to interconnection also included the EastMed pipeline, to carry gas from Israel through Cyprus and Greece to Italy and Europe, which was the subject of a meeting in Rome between Greece, Israel, Cyprus and Italy September 12.

During the meeting the four countries signed a memorandum of co-operation as a precursor to an Intergovernmental Agreement to promote the pipeline to be signed at a summit between the four countries, to be held in Cyprus before the end of 2017. This is considered to be a decisive step for the investment realisation of the project. However, despite the strong political support, low gas prices in Europe make such a project commercially very challenging.

Desfa’s input to Entso-g

The natural gas managers of the southern EU sub-sector (Southern Corridor Region), which include Desfa, published last week of September the third edition of their regional investment plan, SC Grip 2017.

The preparation was conducted under Desfa’s co-ordination, with the aim to support the ten-year development program (TYNDP). The publication provides an insight into the developments of these regional markets and provides information on projects infrastructures within the Region, including Greece.

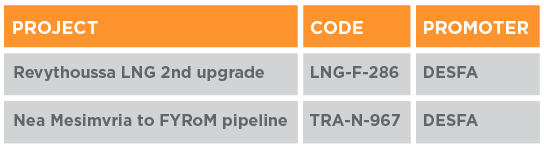

Greek gas projects in progress/planning

Credit: Entso-g

Dimitris Kardomateas, a member of the general assembly of Entso-g and a director of Desfa’s strategy and development, said: “The current version of SC Grip comes at a time when the first major projects are expected to breathe life into the southern corridor, having entered the construction phase, while at the same time we see the first positive results of the Central and Southeast Europe Gas Connectivity (the European Commission’s Cesec initiative), regarding the reverse flow of its interconnections area, but also the development of the vertical corridor.

“Since the last edition of Grip, recent developments include the transfer of Black Sea and eastern Mediterranean gas to European markets, the importance of the Polish-Slovak interconnection linking the region with the Baltic and the options for new routes of Russian gas.”s

Gazprom’s gas supplies to Greece reached 2.68bn m³ in 2016, a 35% increase on 2015. This upward trend is persisting in 2017, with a 17.7% increase so far this year. The new Grip includes forecasts for supply and demand for gas supplies and flows at interconnection points. It also includes analysis of the adequacy of supply in times of crisis.