Need for flex continues to drive Permian growth [Gas in Transition]

As explained back in 2020, the on-going M&A in the US Permian is linked to the desperate need for major companies to get hold of flexibility in an energy transition world, where the forecasts are more and more difficult to establish.

While concentration was the main focus in recent years with big oil understanding the value of the Permian, only Shell was against this trend and exited by selling its stake in 2021 to another big oil player, ConocoPhillips. BP, which does not disclose its Permian production (like privately-held Endeavor) has now decided to continue growing its North American arm bpx’s production by 30-40% to 2025, while its overall output should stay flat and then decline. In short, bpx production is going to account for around 19% of BP overall production in 2025.

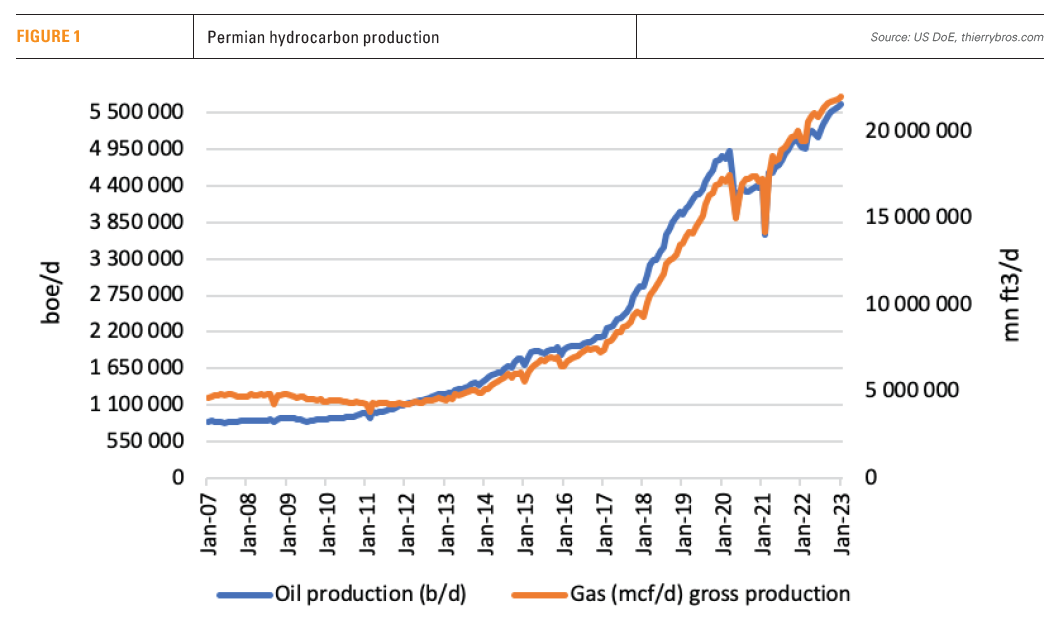

The Permian has again proven to be extremely flexible; in 2022, yearly hydrocarbon production grew by 13%.

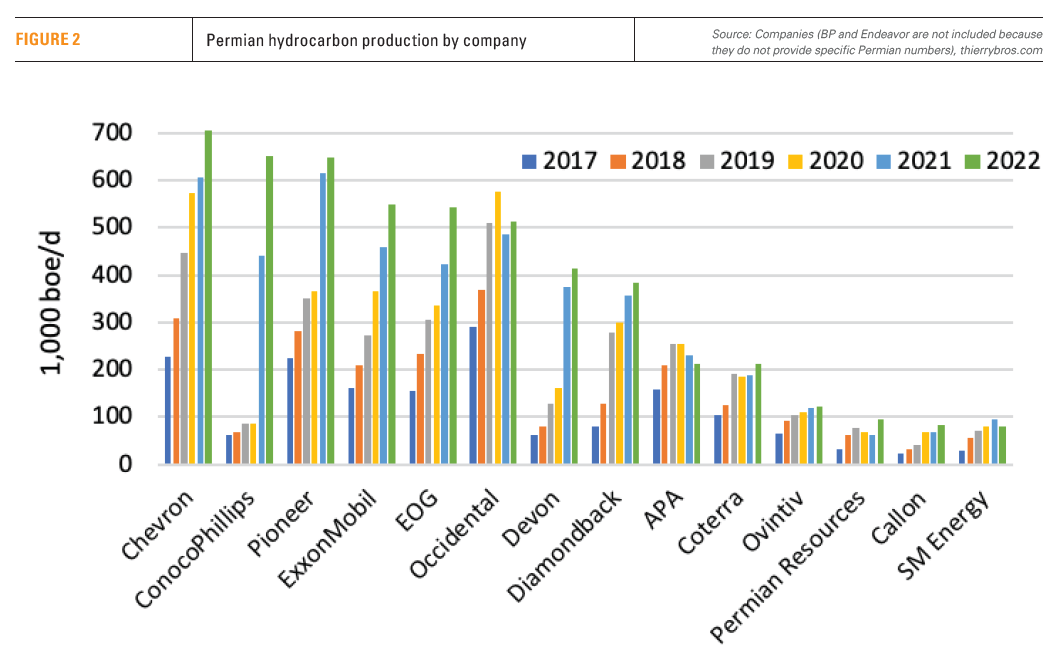

Chevron’s global hydrocarbon production (+4% in 2022) was driven by a strong Permian growth (+16%). This led to Chevron becoming the biggest Permian producer by overtaking Pioneer. Chevron is expecting flat total production in 2023 versus 2022 with a slightly lower production in the Permian in 2023 versus the 16% witnessed in 2022. This proves that, as expected, it is easier and safer for major US companies to concentrate on US unconventional versus conventional output outside the US for both security and flexibility.

ConocoPhillips completed its acquisition in January 2021 of Concho Resources and began to integrate the Shell Permian position from December 2021. As the accounting close date used for reporting purposes of the Shell transaction was December 31, 2021, ConocoPhillips recorded another high growth in 2022 (+47%), allowing it to move up to #2 by overtaking Pioneer and ExxonMobil.

By only growing its Permian production by the expected 5% in 2022 versus 2021, Pioneer Natural Resources lost its #1 position and is now ranked 3rd. Pioneer’s guidance for growth of its 2023 production growth is between 3 and 8%.

ExxonMobil growth has been extremely high and resilient in the past few years, with another 20% increase in 2022 versus 2021. This clearly shows that ExxonMobil is valuing this asset more than any other worldwide and explains the divesting of less strategic assets. ExxonMobil is still forecasting that its Permian production will reach about 1mn barrels of oil equivalent/day by 2027. ExxonMobil added about 90,000 boe/d of production both in 2021 and in 2022. Keeping this trend will allow ExxonMobil to reach its 2027 target.

After a strong 28% growth in 2022, EOG expects only a 6% growth in 2023 as its “game plan is to be focused on shareholder value.”

The $38bn mega Occidental-Anadarko deal, which kick-started this consolidation phase back in 2019, allowed Occidental to grow its Permian hydrocarbon production until 2020. But since then, for financial discipline, Occidental growth has been below its peers and the company has moved down from its leading position to #6. Occidental is guiding for a double-digit growth back in 2023.

Devon Permian production grew by 11% in 2022, representing 68% of total output. In 2023, the Delaware Basin will be the top funded asset in the company’s portfolio, representing 60% of total company-wide capital spending (between $3.6-3.8bn) with total production to grow only between 5% and 9%. 2023 capital requirements are estimated to be self-funded at pricing levels as low as $40/b WTI oil price. This is another indication that Permian producers will focus more on profitability versus growth. And less growth could push prices higher.

After the 2022 FireBird acquisition, Diamondback production grew in 2022 versus 2021 by 8% and growth should continue in 2023 (13% expected) following the closing of the acquisition of Lario Oil & Gas company (25,000 boe/d) on January 31, 2023.

APA data is indicative, as the company reports only full US output but operates primarily in the Permian Basin in West Texas and New Mexico. APA also has operations located in the Eagle Ford shale and Austin Chalk areas of Southeast Texas, offshore in the Gulf of Mexico, and along the Gulf Coast in South Texas and Louisiana.

In May 2022, Centennial announced its merger with privately held Colgate and in September 2022 Permian Resources announced the completion of this merger. This explains the high 57% growth and the fact that the new group moves up the ranking. 2023 should again see strong growth as this would be the first financial year of the new group (guidance between 60 and 75%).

In May 2022, Centennial announced its merger with privately held Colgate and in September 2022 Permian Resources announced the completion of this merger. This explains the high 57% growth and the fact that the new group moves up the ranking. 2023 should again see strong growth as this would be the first financial year of the new group (guidance between 60 and 75%).

In October 2021, Coterra announced the successful completion of the combination of Cabot Oil & Gas and Cimarex Energy. This explains 2022 growth but in its 2023 production guidance is relatively flat year/year.

Callon is overtaking SM Energy as the latter witnessed a growth in production (+24%) while the former showed a decline (-14%). Both expect their respective 2023 production volumes to remain flat to low single digit growth versus 2022.

Companies need to have access to flexibility on the up- and down-sides to be able to cope with whatever happens in the medium term. Outside OPEC+ spare capacity, the Permian alone seems to be able to provide this in a fast and affordable way; hence the financial consolidation and the production growth should continue. Going forward, the global players with a strong foothold in the Permian will be able to produce baseload, as usual, from their conventional assets and to match any unexpected /unforecastable swing in demand thanks to shale oil. Permian will be used going forward to cover the many energy transitions hiccups. As we can expect a lot of hiccups, the value of Permian will continue to increase.

The Ukraine war should push the EU to revisit its failed energy policy by increasing its diversification of energy supply. The US Permian could benefit from this new landscape as it is safer to get oil and LNG from a trusted ally than from a non-democratic regime.