Navigating Spain's energy island [NGW Magazine]

In energy terms Spain and the wider Iberian peninsula is sill very much an island, cut off from the rest of Europe by the Pyrenees. A number of ambitious projects have been floated to boost gas connections, the most recent of which is the Step project to increase interconnection capacity between France and Spain. But that was dealt a blow last month when the two countries’ regulators said they could not support the project in its current form.

Much of the impetus for those connections is political – it's part of the EU's drive to build the infrastructure that makes its internal energy market a reality and also a desire by Madrid to become less dependent on imports from outside Europe.

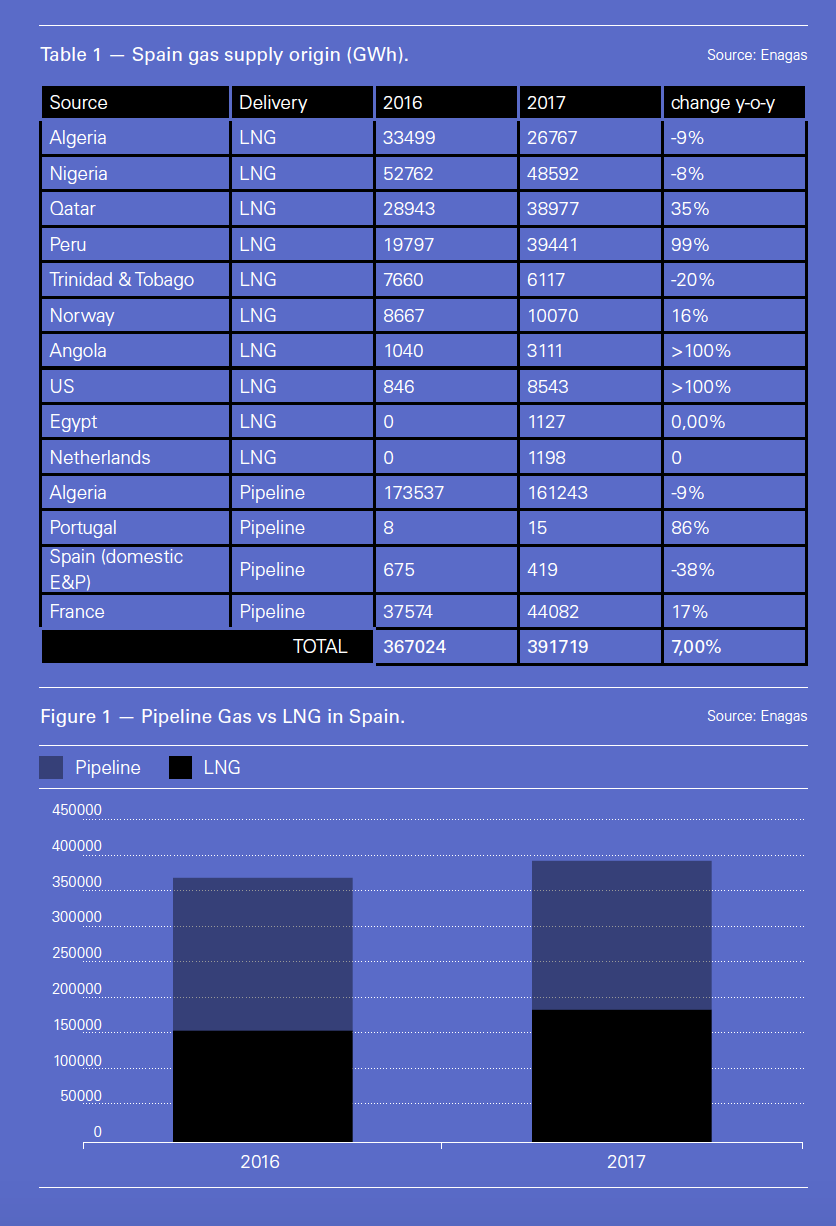

The lion's share of the country's gas is imported either by pipeline from Algeria or as LNG. In 2017, Spain sourced gas from 12 different countries, according to the latest available figures from gas transmission system operator (TSO) Enagas (see table 1).

Existing links to the rest of Europe, via France, are negligible, with exchange capacity of up to 7bn m3/yr in the pipelines between Larrau/Biriatou in France and Irun in Spain. According to European Commission analysis, this offers interconnection capacity of just 6% compared with the EU wide target of 15%.

North African Connections

But looking south, there is a very different picture, with over 20bn m3/year of pipeline capacity bringing gas from North Africa.

The first pipeline gas from Algeria arrived in 1996 via the 1,620-km Maghreb-Europe pipeline connecting Algeria to Spain and Portugal via Morocco. With an initial capacity of 8bn m3/year, this increased to 12.5bn m3//year in 2005. It is operated by EMPL, a joint venture between major Spanish energy utility Naturgy (78%) and Portuguese energy group Galp (22%).

A second connection came in 2011 with the 8bn m3/year Medgaz pipeline, which offers an alternative route with direct connection from Algeria's Hassi R'Mel fields to the coast of Almeria in southeast Spain. Medgaz is operated by a consortium of Algerian state-owned energy group Sonatrach (43%), Spanish oil and gas group Cepsa (42%) and Naturgy (15%).

The relationship between Spain's gas industry and Algeria has not always been easy – negotiations on pricing to extend Algeria's long-term supply contract with Spain concluded in June 2018. Algeria agreed to a shorter term of 12 years, instead of the 20-25-year terms typical in the past.

Naturgy agreed to payments totalling €30 ($34)bn. This included provisions for the supply of both pipeline gas and LNG up until 2030, accounting for over 40% of Naturgy's total gas procurement, or around 30% of total gas supply to Spain.

“There are still some concerns around Sonatrach, but our contract has now been extended to help resolve this,” Naturgy chairman and CEO Paco Reynes said at the company's annual results presentation on January 30. He stressed the company's push to diversify its gas sourcing in recent years through wider LNG procurement.

LNG growth

LNG has always been part of the natural gas landscape in Spain. The first LNG shipments to the country arrived in Barcelona from Libya in the 1960s, and it was not until the 1990s that the first pipeline gas arrived from Algeria via the Maghreb pipeline. In the ensuing years, Algeria emerged as the major supply source both of pipeline gas and LNG – accounting for around half of all gas in recent years.

But the role of other suppliers is growing, as is the relative role of LNG, whose share of overall gas supplies rose to 47% in 2017, from 42% a year earlier (see chart 1). Supplies have become more diversified with countries like Peru and Qatar accounting for a growing share of imported LNG, and, significantly, the first cargoes from the US arrived in 2017. Some in Spain hailed this development as a step towards the goal of becoming a major hub for US LNG imports into Europe.

Both prices and volumes of LNG rose in 2018 according to Naturgy. The company's LNG volumes rose 40% in 2018 compared with 2017, chief accountant Jon Ganuza told investors on January 30. Prices tracked oil prices higher throughout the year -- and lower since. But he said the impact of further price increases would continue to feed through in 2019.

“This scenario already helped boost results in 2018, but some of our sales were agreed before high prices kicked in so there is still some impact to come”.

Naturgy said volatility in LNG prices meant that it was hard to predict what would happen – especially as doubts remain about whether an “LNG club” could emerge to seek to influence gas prices in the way that Opec influences oil prices. Naturgy has already secured 70% of the LNG it needs for 2019 in an effort to hedge against price volatility – though with LNG prices tracking oil lower, there could now be some upside to sourcing on the spot market.

“We don't have a better crystal ball than anyone else,” Ganuza said. “We can't foretell what will happen to prices or whether an LNG club will be created [to shore them up]. We haven't fully benefited yet from the lower spot price but we need to insulate ourselves [from volatility] as much as we can,” he said.

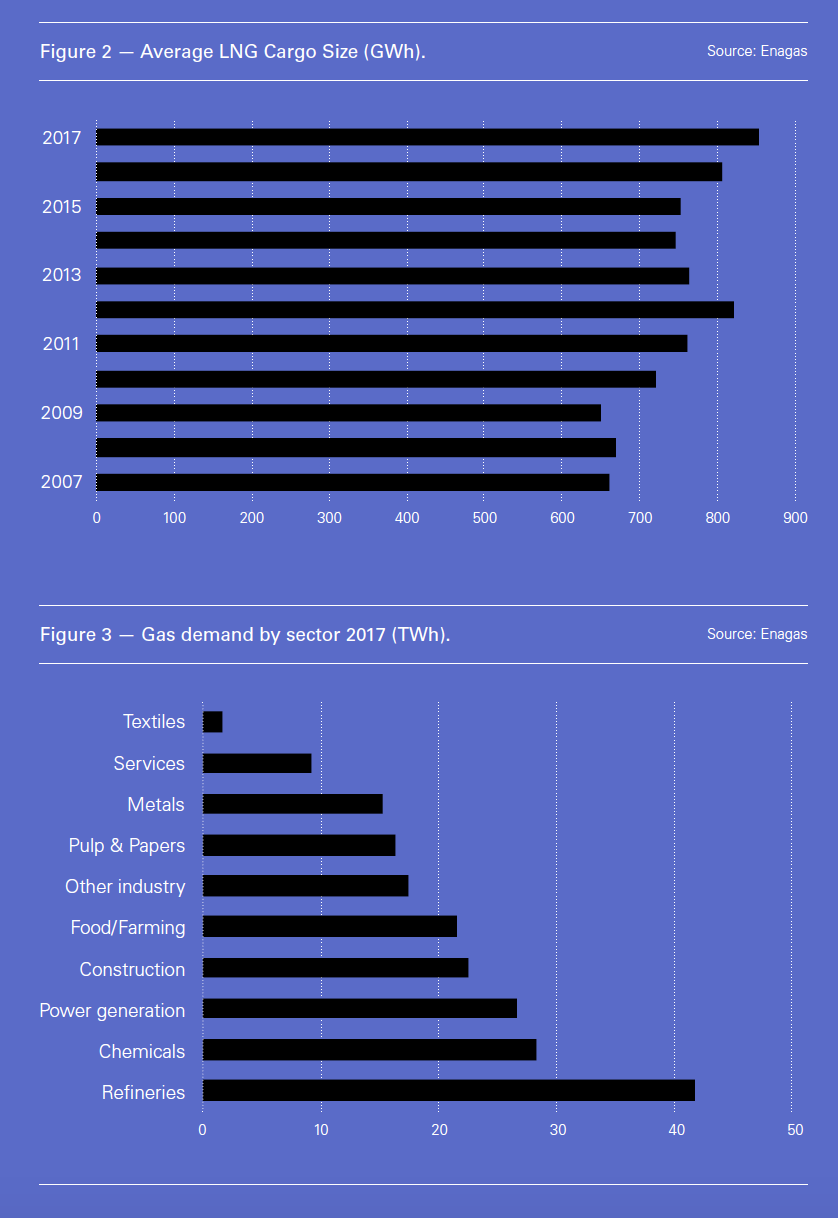

As well as overall volumes rising, the average size of vessels has grown over the last decade. In 2017, 216 tankers were unloaded at Spain's six LNG terminals, 14% more than in 2016 according to TSO Enagas. But the average volume of gas unloaded was also up almost 6% year-on-year to 852 GWh, and this compares to an average cargo size of just 660 GWh a decade earlier (see figure 1).

Demand flat as power generation stalls

According to provisional figures from Enagas, power generator demand reached 350 TWh (32.5bn m3) in 2018 – virtually unchanged on 2017. But this figure disguises the fact that demand rose for all sectors outside power generation.

Demand from power generators stood at 61.94 TWh by year end, lower than the year before largely owing to higher hydroelectric production which had been subdued because of especially dry weather in 2017.

The future of gas in power generation is likely to be one of decline. The current left-of-centre coalition government led by Pedro Sanchez has pledged to completely decarbonise electricity generation by 2050 and reversed some of the taxes on renewable energy imposed by the former conservative government. According to data from power TSO REE, renewable energy accounted for 40% of power produced in 2018, up 6% from 2017. But a big factor in the increase was an 85% jump in hydropower output from very low levels in 2017's drought.

Spain still needs gas to plug the gaps when weather conditions are not right for hydro, wind and solar, and will continue to do so until other technologies like mass storage become more viable.

And demand from other sectors continues to rise. Excluding power generation, demand rose 4.4% to 287.32 TWh in 2018. Much of the increase came from increased demand from industry – which accounts for 60% of the total. This is in turn owing to increased economic activity, Enagas said. This continues a longer-term trend, with demand rising 9% in 2017. Major industrial consumers include refineries, chemicals and pulp and paper (see figure 2).

For residential and small business consumers demand rose 7% with new record monthly demand for these customers set on eight occasions in 2018.

And into 2019, Spanish gas demand reached a 13-month high of 1.54 TWh on January 16, owing to higher demand from both residential and business consumers as well as increased use in power generation during cold weather.

A growing proportion of gas is also now being traded on wholesale markets. The volume of gas traded at the virtual balancing point was 250.8 TWh in 2017, equivalent to 71.5% of total gas demand, and up 41% year-on-year, according to figures from competition watchdog CNMC. OTC volumes in 2017 accounted for 94.7% of total volumes on both organized (Mibgas) and bilateral market places.

Since then, the Mibgas derivatives market launched in April 2018, offering futures clearing through a central counterparty.

Overall, there is a mixed picture, with a lower role for power generation on the demand side and a growing role for LNG from more diverse sources on the supply side.

Paradoxically, that growth in LNG – and potentially falling LNG prices on the back of lower oil prices and a better supplied market – means the price signals to build better infrastructure to France are no longer there on the Spanish side of the Pyrenees.

The EU's original motivation to build better links to Iberia's energy island may be shifting as it looks to cut growing European dependence on Russian gas – new proposals to modify the Gas Directive could adversely affect the economics of the Nord Stream 2 pipeline from Russia, for example. In that context Spain's six LNG terminals could provide a useful gateway for LNG imports from the US, but there are plenty of other European LNG terminals that have much better connections to major centres of demand.

Spain may remain an energy island for some time, but islands look to the sea. And in gas terms, that means LNG.