Natural gas in 2022: 12 themes [Gas in Transition]

Top questions in everybody’s mind, as we enter 2022, include when will the energy crisis come to an end and when will energy markets return back to normality. These and a host of other uncertainties frame 12 themes expected to shape the outlook, markets and prices for natural gas in 2022.

Key factors will be the state of the pandemic and the global economy, the EU’s green agenda, a decisive move towards clean energy combined with a sustained attack on the global oil and gas sector, energy finance, combating climate change and global geopolitical developments.

1. Covid-19 pandemic

Will 2022 be year when the pandemic will be tamed, or at least will the world come into terms with it? Suspicions are that it will be the latter, especially as new deaths have been falling substantially worldwide. The UK is already relaxing measures to contain Covid-19 and may actually remove all restrictions at some stage in 2022. Apparently, the government is “setting out a strategy on how the country is going to ‘live with Covid’ once Omicron has passed.”

But there is always a risk that inability to control Omicron, or the next variant, could lead to more lockdowns, slowing down economic recovery, with knock-on effects on oil and gas demand and prices.

However, as recovery from Covid-19 continues and as the world comes to terms with the pandemic, demand for all fossil fuels is expected to carry on increasing in 2022. But the question that arises is: will the investments needed to ensure the required supply materialize? Especially at a time when, following COP26, the world’s attention is turning decisively to energy transition and net-zero emissions.

2. Impact on IOCs

The international oil companies (IOCs) will continue capital discipline and consolidation in 2022, as they face policy uncertainty and the focus on renewable energy increases.

In addition to climate change pressure, the greatest challenges IOCs will face in 2022 are: shareholder pressure for a faster transition to low-carbon energy, increased court action, financial institution investment pressure and increasing uncertainty limiting their ability to invest in new long-term projects.

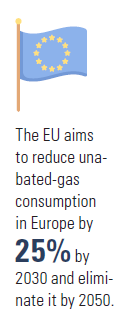

The signaling from the EU and the US is not helpful to the long-term future of oil and gas. Both are committing to and are driving rapid decarbonisation. The EU published mid-December its new gas legislation package that aims to “steer Europe away from fossil gas towards renewables and low-carbon hydrogen.” Despite the current energy crisis, it still aims to reduce unabated-gas consumption in Europe by 25% by 2030 and eliminate it by 2050.

It is likely that during this uncertain period, IOCs will want to wait and see. They will not rush into investing into long-term projects until they are certain the returns will be there. But pressure on the IOCs will only increase in 2022.

3. Financing oil and gas

2022 will be a year when financing oil and gas attracts more attention and becomes more challenging than ever before. Consultancy Wood Mackenzie has warned that the sector “heads into next year facing peak uncertainty with record cashflows tempered by increasing environmental scrutiny. Despite this, for many stakeholders and even some chief executives, the sector’s risks outweigh its upsides. This tension will define 2022.”

In fact BloombergNEF expects the growth of sustainable finance to accelerate in 2022 to as much as $2.5 trillion, overtaking investments in the oil and gas sector – a trend that started in 2021. The world is heading for a new phase of climate-aligned investing.

Financing oil and gas was getting harder before COP26, but pressure will increase in 2022. A major risk to oil and gas financing comes from the 450 institutions – including banks, stock exchanges, fund managers and insurers – that make up the ‘Glasgow Financial Alliance for Net-Zero’ (GFANZ), set-up during COP26. They control funds totaling over $130 trillion and pledged to play a bigger role in pushing companies to decarbonise, by financing the transition away from fossil-fuels in line with the goals of the Paris Agreement. In 2022 banks will come under increased pressure to expose their oil and gas financing to more scrutiny.

In addition, ESG pressure and new requirements for sustainability disclosures, introduced at COP26 with the formation of an ‘International Sustainability Standards Board’ (ISSB), will make it more difficult for oil and gas companies to raise funds for new, long-term, projects, leaving them facing higher costs for capital, with credit pressures increasing. Oil and gas project financing will get harder in 2022.

With low re-investment rates, Wood Mackenzie says that in 2022 the focus will be on “advantaged projects” with low-breakeven, low-carbon, robust project economics, short payback periods and low emissions.

But such project financing constraints may store trouble for the future. Without sufficient spending globally to ensure that the required oil and gas production capacity is maintained, may lead to fuel shortages and higher prices in the future. However, this is not likely to happen in 2022.

4. Strengthening climate pledges

Following COP26, The COP Presidency called on countries to strengthen their NDC pledges by COP27 that will take place in November in Cairo.

But the consequences of accelerating energy transition without ensuring the security of energy supplies first have been driven home by the energy crisis engulfing Europe and the world.

The European Central Bank (ECB) has already warned that the impact of policies to tackle climate change us likely to keep energy prices higher for longer. It has warned that without change - in response to the current energy crisis - Europe’s push for clean energy will drive inflation higher in 2022 and beyond.

In 2022 the fallacy that renewables alone will power Europe and the rest of the world in the future will become clearer. The unintended consequences of single-mindedly driving energy transition without properly dealing with intermittency and its cost implications must be addressed. There is increasing realization that this endangers reliability, affordability and security of energy supplies.

5. Methane and Scope 3 emissions

In 2022 there will be increasing pressure for companies to commit to significant cuts in methane emissions, as well as track and disclose Scope 3 emissions.

The agreement by more than 100 countries at COP26 to cut methane emissions by 30% by 2030, and eventually eliminate them altogether, will impact the oil and gas sector massively. This is bound to become the centre of attention at COP27 in November.

And so will tracking and disclosure of Scope 3 emissions. Pressure to focus on transparency of disclosures and reduction of Scope 3 emissions will increase in 2022. Expect new commitments by COP27.

6. Fit-for-55/Taxonomy

EU energy debate in 2022 will be dominated by negotiations around the Fit-for-55 package.

But progress in these negotiations is not guaranteed. There are still major differences between EU member states, but also the European Parliament, exacerbated by the ongoing energy crisis and its impact on member state consumers, industries and economies. The last two European Council summits have shown a divided Europe on many key energy-related issues. Finding a balance to satisfy all will be the challenge in 2022.

The Taxonomy is crucial to the future of sustainable finance. The inclusion of natural gas and nuclear will be agreed and confirmed early in 2022, albeit under some quite strict conditions. This has been aided by the energy crisis – a recognition that at least during energy transition they are needed to back-up to intermittent renewables.

With the EU planning to publish its ‘Corporate Sustainability Reporting Directive’ by mid-2022, finalisation of which for inclusion in its Taxonomy during the first half of 2022 will be imperative.

In addition, ISSB aims to announce a basic sustainability disclosure framework for regulators worldwide before the end of 2022. Undoubtedly, EU’s Taxonomy will play a crucial role in this.

In the EU new investments in natural gas are unlikely to be approved unless proponents can demonstrate that they are compatible with the Taxonomy and Fit-for-55. The aim will be to facilitate transition from more polluting fuels to clean energy without locking-in technologies that may hinder the wider development of cleaner alternatives.

7. 2022 will be the year when the role of natural gas in the future energy mix becomes clearer

Not only gas will be included in EU’s Taxonomy in 2022, but it will regain a role in Europe and remain an important part of the global energy mix for the longer term.

But given the new package of gas legislation announced on December 15, the EU is determined to steer Europe away from unabated natural gas towards more sustainable energy sources, like renewable and low-carbon hydrogen, starting in 2022.

Even though the EU is about to include natural gas in its Taxonomy, this could be a temporary reprieve. It still aims to reduce consumption of unabated natural gas and eliminate it altogether by 2050. That’s why it has now banned long-term gas supply contracts beyond 2049.

But that will not be the case in Asia, where natural gas and LNG will continue playing an important role in 2022, not only replacing coal in power generation but also in satisfying Asia’s increasing energy demand as economies come out of the pandemic.

8. Natural gas price

By early 2022 the TTF natural gas price in Europe dropped below 50% from the peak experienced in October 2021, and while the downward trend persists, it is still exhibiting substantial volatility. The expectation is that it will return nearer to normal levels by mid-2022, as more supply becomes available to catch up with demand, and to pre-pandemic levels by 2023.

This assumes no pandemic flare-ups, Russia-NATO keeping the lid on further tension, particularly with regards to Ukraine and progress on Nord Stream 2. Indications so far in 2022 show that this is likely to be the case for all.

9. Nord Stream 2

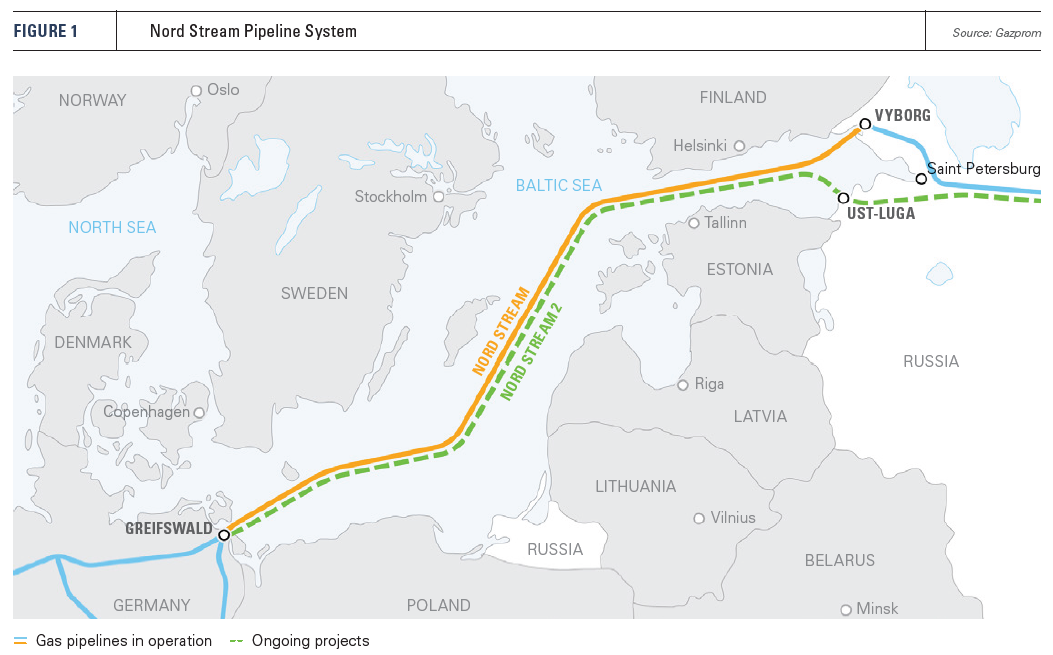

All eyes in 2022 will be on the fate of the delayed final certification of Nord Stream 2 (NS2).

The pipeline is already loaded with gas and ready to operate. To a large extent this is linked to the outcome of the Russia-NATO talks now in progress. The expectation though is that the pipeline will start operating mid-2022, leading to lower gas prices. The energy crisis and high gas prices this winter will see to that.

However, the risk is that if the Russia-Ukraine conflict intensifies, the pipeline could become the target of renewed US sanctions, impacting gas supplies to Europe and prices.

In the meanwhile, Gazprom will stick to delivering to its European customers the gas quantities that is contractually bound to deliver. New contracts early in 2022 with customers in Greece and Turkey confirm Gazprom’s determination to push for term-contracts, avoiding the spot market.

10. LNG market and price volatility

Global LNG demand and supply will carry on growing. The focus in 2022 will be on a stronger return to LNG term-deals, following a volatile year for the spot market in 2021. This is now favoured by Chinese and South Korean LNG buyers.

A factor in this is oil price and oil-price-indexation. Without further Covid-19 flare-ups, oil prices should stay within the $70-$80/barrel range in 2022. Similarly to natural gas prices, LNG price volatility will diminish by the summer.

A major factor in global LNG supply is what happens in the US, which in 2021 became the top LNG exporter in the world. President Joe Biden has made many pledges to tackle climate change. How is he going to respond to the new wave of LNG expansions expected from 2022?

At the same time, sustained and increasing demand in Asia – which is largely driving new LNG investment – is not a given. It could, at some stage weaken, increasing the risk for new LNG projects. With Europe determined to transit away from unabated natural gas and an increase in LNG exports later in the year, competition for LNG markets, especially in Asia, will only increase.

11. US-China relations

As the tension between US and China increases, so will the impact on global energy, from ensuring a timely energy transition, to availability of rare minerals to global clean energy markets, to LNG markets and trading, and global geopolitical polarisation affecting efforts to combat climate change.

This needs to be addressed in 2022, by building on the surprise announcement made at COP26 that the US and China have agreed to boost climate co-operation over the next decade, while acknowledging their differences elsewhere.

12. Uncertainties to dominate oil and gas markets in 2022

These include inability to control Omicron, or the next variant, leading to more lockdowns, and rising inflation, a cold snap this winter, escalation of the US-China, Russia-NATO and China-Taiwan confrontations, a weakened Biden, failure of the Iran nuclear talks leading to a crisis, a hotter summer and even more extreme climate events, another oil crisis, the ongoing energy transition, political turmoil in Europe, to name but a few risks to global economic recovery.

With spare global natural gas capacity remaining low, any disruptions could cause further market and price shocks.

Another factor that may influence energy developments in 2022 is rising solar and wind installation costs decelerating new capacity additions and slowing down energy transition. And this at a time of more coal and nuclear plant closures coming up in Europe. One more reason why natural gas is likely to have a longer-term role to play – Europe needs to ensure security of gas supplies.

But EU’s continuously negative narrative and ambiguity about the future role of natural gas in Europe introduces uncertainties that affect the planning of longer-term gas supply projects.

Will, as a result, Russia divert future gas supplies to China at the expense of Europe? Will polarisation impact global gas trade? Will carbon prices carry on rising in 2022 beyond €100/metric ton, making natural gas too expensive and impacting its future use?

Following the rebound in demand in 2021, the oil and gas industry and markets are entering 2022 with renewed uncertainties about prices, demand and the industry’s longer-term prospects, especially as – in the aftermath of COP26 – financial institutions and shareholders continue to apply pressure on IOCs to accelerate decarbonization. The questions surrounding the future role of oil and gas are in need of answers that, hopefully, 2022 will provide.