Mozambique E&P to Take $3bn/Yr: Report

Investors will spend an average $3bn/yr developing eight oil and gas fields in Mozambique between 2018 and 2020, according to a new report by GlobalData. Ultra-deepwater projects will be responsible for over two thirds of that; deepwater for another quarter; while onshore projects will soak up $0.6bn over the period.

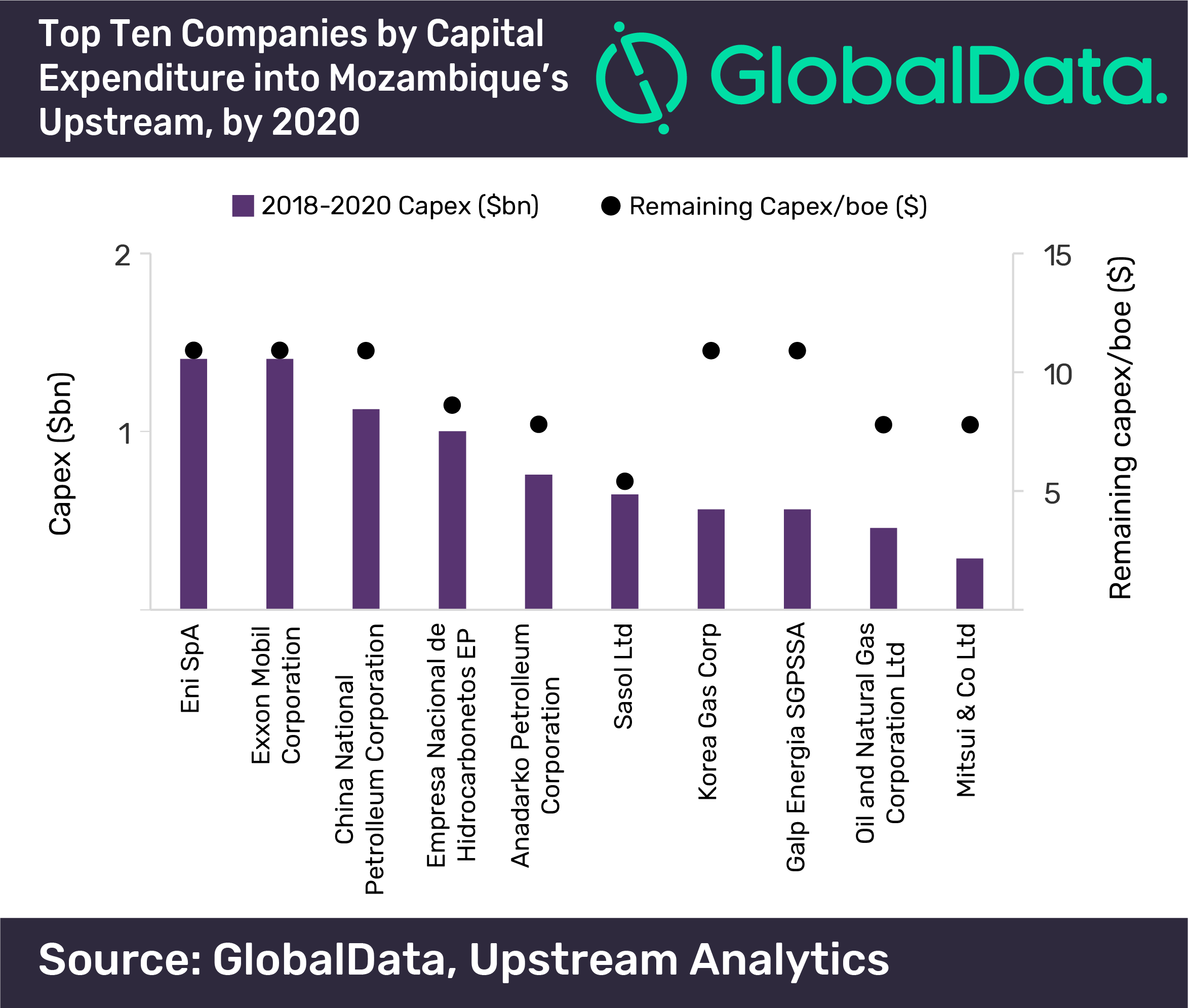

GlobalData expects Italy's Eni and US major ExxonMobil to each spend $1.4bn and that China National Petroleum Corporation will follow with $1.1bn, over the period.

Eni's Coral South, a planned ultra-deepwater conventional gas field, will lead capital investment with $4.3bn from all partners between 2018 and 2020. Next comes the US Anadarko operated Golfinho-Atum complex, a deepwater conventional gas field in the Rovuma Basin, with capex of $2.3bn.

GlobalData reports the average remaining capex/barrel of oil equivalent for Mozambique projects at $6.0. Deepwater projects have the highest remaining capex/boe at $6.8, followed by onshore and ultra–deepwater projects with $5.9 and $5.8, respectively.