Market crashes as disease spreads [NGW Magazine]

The International Energy Agency (IEA) released its flagship Oil Market Report March 27, as the Covid-19 pandemic combined with weak demand to send prices crashing. Among its conclusions were:

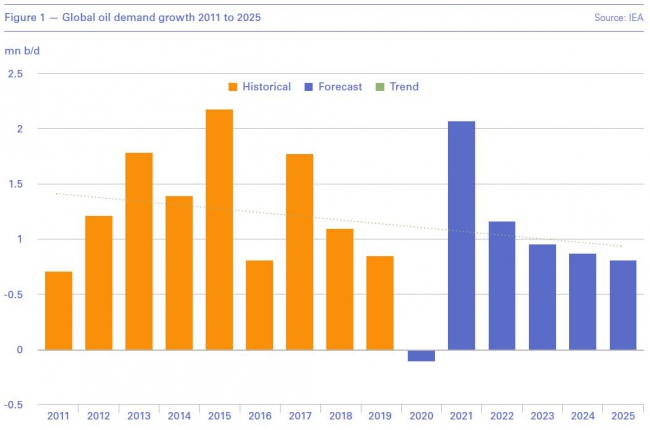

- The IEA has cut its 2020 base-case global oil demand forecast by 1.1mn b/day on average. For the first time since 2009, demand is expected to experience a net fall, by 90,000 b/day yr/yr, just under 1% less than in 2019 (Figure 1). But on some days oil demand could drop by as much as fifth; and other industry observers see a much greater average daily drop (see below).

- In 1Q 2020, China’s demand is expected to fall by 1.8mn b/d year on year, with global demand down 2.5mn b/d.

- Global oil supply fell by 580,000 b/day in February as production from Libya slowed to a trickle. At 100mn b/day, output was virtually flat on a year ago, with non-Opec gains of 2.4mn b/day offsetting declines from Opec.

- Robust non-Opec supply gains of 2.1mn b/day in 2020, and a contraction in demand, cut the call on Opec crude to 27.3mn b/d. In 1Q 2020, the call is 25mn b/d, 3.5mn b/d below the group’s assumed output for the period.

- OECD industry stocks rose by 27.8mn b to 2.930bn b in January as an increase in product inventories more than offset counter-seasonal draws in crude stocks. Total oil stocks stood 2.9mn b above the five-year average and covered 63 days of forward demand.

- As well as the negative impact on demand of Covid-19, the outcome of the Opec+ March meeting was seen by traders as a bearish signal. Travel restrictions and lower industrial and commercial activity as governments responded to the virus weighed on cracks for jet fuel, diesel and gasoil.

- The immediate outlook for the oil market will ultimately depend on how quickly governments move to contain the coronavirus outbreak and how successful they are. At this stage it is very uncertain. With this in mind, the IEA assumes that oil demand returns to close to normal in only in the second half of this year.

These developments have no equal in oil market history.

The IEA expects a strong rebound in 2021, following which the global oil demand should resume its downward trajectory (Figure 1), assuming the global energy transition regains its momentum.

The IEA provided a low-case estimate, assuming that Covid-19 spreads globally and recovers more slowly, with European demand remaining subdued in 3Q 2020, and demand in the US growing at a slower pace. In this pessimistic case, global oil demand could decline by an average of 730,000 b/day in 2020. However, with the way the virus is progressing, this could prove optimistic.

Oxford Institute of Energy Studies (OIES) is predicting that the 2020 average global oil demand will fall by up to 4mn b/d.

Opec+’s current production cuts of 2.1mn b/day are due to expire at the end of March. With Saudi Arabia planning to increase production by up to 13mn b/day and Russia promising to follow suit. the oil price dropped by 65%, rebounding to only about $24/b by end of March.

But despite the oil price war, the real problem is destruction of oil and gas demand owing to the economic impact of Covid-19. Reinstating oil production cuts alone will not work on their own if Covid-19 still impacts travel.

Where is it going?

The impact of Covid-19 on what was already a weak global economy and on oil and gas demand is expected to last into 2021.

In recent memory the world has experienced the following oil-price wars (Figure 2):

- 1985 lasting 13 months – the Brent crude price went down by about 68% and it took four years for oil prices and investments to recover.

- 1997 lasting 17 months – the Brent crude price went down by over 50% and it took three years for oil prices and investments to recover.

- 2014 lasting 22 months - the Brent crude price went down by about 65% and it took four years for oil prices and investments to recover.

IEA executive director Fatih Birol warned late March that oil demand may drop by up to 20% during 2020, adding that “demand recovery would neither be easy nor quick.” He said “global demand was in free-fall” as lockdowns – in response to Covid-19 – wreaking havoc on consumption while Opec and Russia pump more – as much as 3mn b/day more.

Birol added “Today 3bn people in the world are locked down. As a result of that, we may see demand fall” by as much as 20mn b/day, with the decline in demand likely to worsen in the second quarter from the previous three months. The effects of the glut will be felt for years to come. This is filling up inventories quickly, and oil storages may become full “very soon.”

Vitol Group CEO Russell Hardy was even more pessimistic. The trading giant said oil consumption has dropped by between 15mn and 20mn b/day and will be lower by at least 5mn b/day this year.

The low prices are starting to hit oil production in places where break-even costs are high, such as Canada, Brazil and shale oil in the US.

According to Birol, “With these prices, we will see a major decline in shale production in the US, no question about that.” He added that there will be “huge suffering” for the American oil industry.

But even without these developments, US shale oil production was expected to start slowing down next year owing to a lack of profitability and the high indebtedness of the shale producers.

Birol called on Saudi Arabia to ease up; so too did the White House, urging Saudi Arabia to abandon its plan to flood the crude market. There is even a suggestion that Texas could consider a 10% cut in production, possibly in co-operation with Opec.

OIES suggests that a one-off agreement between Opec+ and the world’s top oil producers specifically to deal with the oil price shock could speed up recovery and bring prices back to 2019 levels. “If on the other hand, such an agreement can’t be reached, this could turn out to be one of the sharpest downturn cycles in the history of oil markets – extending the period of pain currently being experienced by oil exporting countries and oil companies alike and weakening the energy sector’s resilience in very challenging times when the industry is not only facing the challenge of surviving this downturn, but also the long-term challenge of transitioning to a more sustainable low-carbon future,” it says.

But it is more likely that the oil price war, having started, will persist. Opec and Russia do not appear to be considering returning to the negotiating table at this stage. Both have enough resources and can maintain this price war long enough to inflict pain on US shale oil producers, whose average break-even oil price is in the range $40 to $50/b – bankruptcies are inevitable, especially when most hedges on production end in 2021. Most smaller shale companies will not be able to withstand a prolonged oil price war.

Impact on the majors

These unprecedented developments are having a huge impact on the oil and gas industry, with the majors announcing drastic cuts to their capital and operating expenditures – capex and opex - for the remainder of this year and probably beyond. Given low prices, they will also be prioritising low production-cost projects that result in immediate returns – but even then they will wait for market recovery.

According to MacKenzie, the large projects that had previously been expected to be given final investment decisions this year would have added about 1.8mn b/day of oil production and about 20bn ft³/day of gas production by the mid-2020s. Now project delays and cancellations mean about 90% of that production could be pushed back or may not happen at all, impacting future production levels.

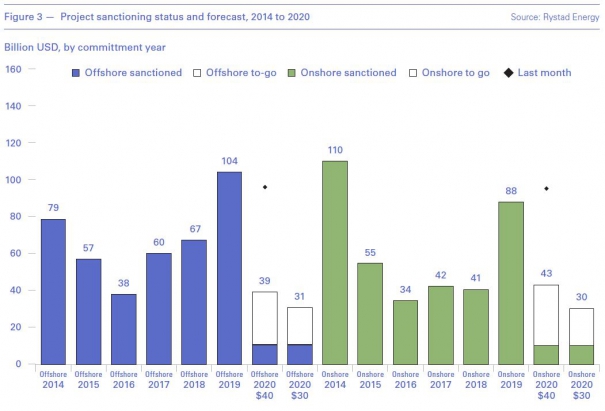

Rystad Energy estimates that if the Brent oil price remains below $30/b, 2020 exploration & production (E&P) spending may be slashed by close to 70% yr/yr and likely by more in 2021. There may be a repetition of what happened following the 2014 oil price war (Figure 3) – within two years spending was halved and it took another two years for spending and production to recover. It is also likely to be accompanied by extensive industry restructuring.

Most oil companies will probably wait for the spread of Covid-19 to slow down and for the market to start to recover before they commit to new projects – especially those with high break-even costs.

ExxonMobil

ExxonMobil is looking at reducing its 2020 spending significantly, notifying its contractors and vendors accordingly. At its lowest, its share value dropped by about 55% this year.

The company is already slowing down its US shale-oil production. It is also likely to delay its $30bn Rovuma LNG project in Mozambique as part of its spending cuts, the poor outlook worsened by the impact of Covid-19 on demand and the expectation that LNG supplies are likely to rise sharply by 2025.

Similar arguments apply to the expansion of Qatar LNG, where ExxonMobil is partnering Qatar Petroleum.

Shell

Shell also announced major cuts and the suspension of its share buyback programme, prioritising financial resilience. At its lowest, its share value dropped by about 60% this year.

It will be reducing its opex over the next 12 months by $3bn to $4bn in comparison to 2019. It is also cutting 2020 capex from $25bn to $20bn, while embarking on material reductions in its working capital. It is still committed to its divestment programme of more than $10bn of assets in 2019 to 2020 but timing depends on market conditions.

Shell is placing priority on maintaining financial stability during Covid-19. The company said it needs to be “well positioned for the eventual economic recovery.” In that light, its decision to leave the US LNG export project in Lake Charles to Energy Transfer Partners came as no big surprise.

BP

At its lowest, BP’s share value dropped by about 54% this year. The company said it planned to reduce capex and opex from about $15bn last year. CFO Brian Gilvary said that spending could be cut by as much as 20% this year, with offshore and some US operations likely to get less investment.

He said: “Oil prices I think could go lower than where we are today... The key for a company of our size and scale is to make sure we have the flexibility to manage that volatility.”

But he still expects BP to achieve its $15bn asset-sale target by the middle of next year. CEO Bernard Looney said that he will still press ahead with his plans to transform BP into a greener energy company.

Eni

Eni has cancelled its share buyback and is cutting its 2020 investments sharply in line with new prices. It experienced a 55% drop in its share price this year.

In the meanwhile, it announced that it is reviewing its planned activities in 2020 and 2021, as well as all its energy projects in the Middle East, with a plan to reduce 2020 capex by 25%, or $2.2bn, and opex by $446mn. It also expects to cut capex by around $2.8bn in 2021. Eni also said that it is postponing the start-up of new projects.

Total

Total has announced a 20% cut in its planned 2020 spending and has suspended its share buyback programme. At its lowest, its share value dropped by about 55% this year.

Total has announced capex cuts of over $3.3bn and $800mn reductions in opex costs in comparison to 2019.

But if oil prices remain below $30/b, Total may face a cash gap of $9bn compared with the situation it would have been in with oil at $60/b. CEO Patrick Pouyanne said that, if required, the company could easily borrow $4bn, while still keeping its debt gearing at an acceptable level.

Chevron

Chevron experienced a 55% drop in its share value this year. The company said it aims to reduce spending and lower oil and gas production in the near term. It will reduce its 2020 capex and exploratory drilling guidance by 20%, to $16bn and opex by more than $1bn. It is also considering making a change to its near-term operating plan.

Capital and exploratory expenses are planned to be $3.3bn lower, at $10.5bn, in 2020. The company is also suspending its share buy-back programme.

CEO Michael Wirth said: “Given the decline in commodity prices, we are taking actions expected to preserve cash, support our balance sheet strength, lower short-term production, and preserve long-term value.”

ConocoPhillips

At its lowest, ConocoPhillips share value dropped by about 65% this year. The company said it will cut its 2020 capital spending budget and share-buyback plan owing to the recent drop in oil prices.

Capex will be cut by $700mn, down 10% from earlier guidance. This is expected to reduce 2020 production by about 1.5%. Overall, the combined cuts are expected to reduce 2020 spending by $2.2bn.

ConocoPhillips said it would slow development activity in the US, lower it in 48 states and defer drilling in Alaska.

ConocoPhillips CEO Ryan Lance said: "The rationale for consolidation in this sector only got stronger with this downturn." He noted that ConocoPhillips could become an interested buyer of distressed companies and assets once prices begin to stabilize.

Impact on natural gas

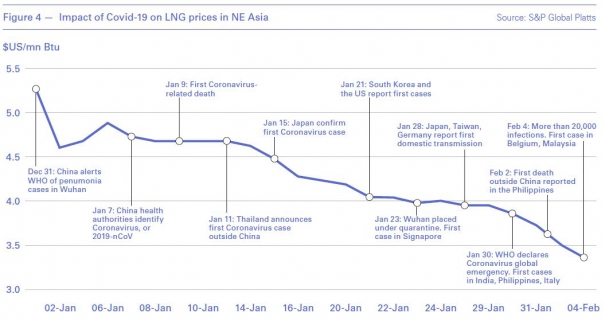

The oil price war is also re-shaping the global natural gas markets. Nationwide lockdowns in China earlier and in many European countries and India now have forced the delay or cancellation of LNG purchases.

The global LNG markets have been facing oversupply and demand challenges, and low prices, for some time. These were likely to continue into the longer-term, but now they are also being hit by Covid-19 (Figure 4). The expected 15% growth in US LNG supply capacity in 2020 from newly commissioned projects, with more to come next year, is not going to help.

In the short to medium-term, the impact of Covid-19 on the global economy is dramatic and will be escalating. LNG demand in Asia is declining and is likely to be further affected – with Europe about to follow – and with prices remaining rock-bottom. The pressure on suppliers is intensifying.

As the US Center for Strategic & International Studies points out: “For many producers, prices are trending near or below marginal costs, and the logic of continuing to produce in order to lose money will eventually give way to a more rational economic behaviour. In 2019, at least, there was a sense that this was a short-term shock to ride out. It no longer feels that way.”

By the last week in March, the Japan Korea Marker, the SP Global front-month assessment (May) was down to $3.30/mn Btu and the gas price at the Dutch trading hub TTF was $2.50/mn Btu. Depending on how low the oil price goes, oil-linked term-contract LNG prices may drop even further.

As Birol pointed out, many LNG exporters such as Australia, Qatar and Algeria, whose contracts are mainly linked to crude oil prices, will suffer.

A global oversupply, a declining demand and low LNG prices are challenging many of the US and Canada LNG projects at various stages of planning. Planned reductions in spending by most companies will invariably impact many new projects.

The huge impact of Covid-19 on the world economy has chilled investments in almost every country. It is not yet clear when the rebound will come. But when it comes, the cancellation of projects today risks causing a supply crunch down the line.

Such challenges, but also question-marks about LNG’s carbon footprint – especially US LNG, have the potential to reshape the global LNG market post-Covid-19

Implications

The economic downturn caused by Covid-19 and the oil price war are reshaping global energy markets.

Given past history, the oil companies may not resume exploration activities that quickly. But once they do, possibly in two or three years, their priorities will be the very big and low-cost projects. Recovery will be a slow process.

However, Middle East producers are likely to press on with most of their planned key oil and gas projects, especially those that break-even at $20 to $30/b. These will still be needed for many years to come in order to offset declines and meet the growing energy demand of the future.

The good news is that global lockdown and reduced economic activity have at least benefited the natural world.

The cut in emissions caused by Covid-19 serves as a reminder of just how strongly tied emissions remain to economic growth and how hard it will be to lower them.

However, on the negative side, Covid-19 has slowed down global efforts to fight climate change. And countries and companies may revert back to what they know works: shovel-ready coal projects.

Available and cheap oil and gas will enable a recovery so the price war may yet prove to be a blessing. In addition, the outcome of it may even be a more streamlined oil and gas industry, fitter for what post-Covid-19 will be a changed world.