[NGW Magazine] Energean eyes IPO to fund Israel plans

Israel has achieved its aim of making its gas market competitive, with newcomer Energean looking at producing gas from two minor fields in 2020. To do so though it needs to raise cash, perhaps through an IPO.

Greek upstream minnow Energean confirmed to NGW in mid-November that it is “in the process of developing the Karish and Tanin offshore gas fields in Israel” and “engaged in a range of contracting and financing discussions to achieve this.” It added it was “examining all options of funding the project’s requirements.”

According to Reuters this includes the option of an initial public offering (IPO). Specifically Reuters reported that ‘Greek energy firm Energean is considering listing on the London stock exchange to raise cash for a $1.5bn development of gas fields off Israel’s coast,’ adding that investment banks Morgan Stanley and Citi are advising the firm on the IPO process.

Energean acquired the Tanin and Karish gas-fields from Delek Group in 2016 for close to $148mn. The combined 2C contingent resources of the two fields are 67bn m³ of natural gas and up to 33mn barrels of oil equivalent (boe) of light hydrocarbon liquids.

One of the preconditions of the gas regulatory framework agreement between the Israeli government and Delek Group and Noble Energy in 2016 was that they should sell off the two gas-fields with the aim of increasing gas supply competition in Israel.

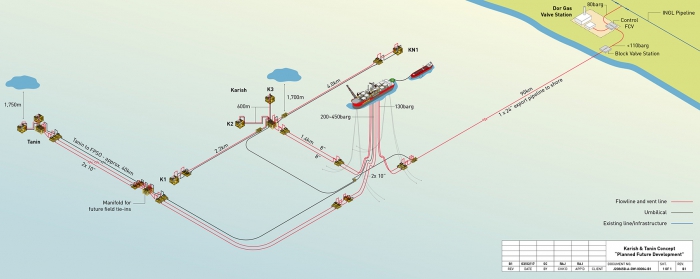

Energean took the government at its word. It submitted a field development plan (FDP), which was approved by the Israeli government in August. This is based on the development of the two fields using a floating production, storage and offtake vessel and a 90-km pipeline to connect it to the Israeli natural gas transmission system, developed by the front-end engineering and design contractor ,Technip. The FDP envisages drilling three wells totalling 4bn m³/yr capacity.

The final investment decision (FID) is expected before the end of 2017, with first gas production in 2020. Energean has appointed Morgan Stanley as project finance advisor for the estimated $1.3-1.5 bn investment.

Energean signed three gas sales and purchase agreements (GSPA) November 2 for a period of about 14 years (Figure 2), one with Dorad Energy for 6.75 bn m³ and two more with Edeltech Group’s subsidiaries Ramat Negev Energy and Ashdod Energy for a total 2.65 bn m³. Turkey’s Zorlu Energy is a major shareholder in all three companies. The average price of these deals is estimated to be close to $4/mn Btu, about a fifth lower than a deal signed by these companies and the Leviathan partners and 30% lower than the price that Israel Electric Corporation pays for its gas.

Figure 1: Tanin and Karish field development concept

In addition, in May this year Energean signed two GSPAs with Dalia and Or Power Energies for a total of 23bn m³ gas.

Energean’s CEO, Mathios Rigas, said: “We are delighted to have made such rapid progress in securing these agreements. Israel’s private sector is taking advantage of the competitive prices offered by Energean. Companies that agree to receive natural gas from the Karish and Tanin fields strengthen their position in the local market and secure cheaper energy for the future.”

He added: “Energean has signed with Dalia, Dorad and Edeltech GSPAs for a total of up to 33bn m³ in volume so far. The company has secured revenues of approximately $3bn, underpinned by take-or-pay arrangements and firm floor prices once all conditions are satisfied. We are delivering the contracts we have promised as planned and we are working steadily towards achieving all the milestones on the project required to reach FID.”

Energean had more good news. A reserves survey carried out in June by Netherland, Sewell & Associates showed that Tanin and Karish could hold another 69bn m³ of 2C prospective resources and 71mn boe of light hydrocarbon liquids. If this is confirmed, it will enable more sales to the domestic market, further increasing competition and piling more pressure on the development of Leviathan.

Energean’s interests in Israel may even expand further. Israel closed its first offshore bidding round November 15, announcing that it has received proposals from Energean and a consortium of Indian oil companies led by ONGC.

These will be evaluated over the next few weeks. Confirming this, the energy minister Yuval Steinitz, added that Israel plans to hold another bidding round in 2018.

Energean is a leading independent E&P company focused on the eastern Mediterranean region, where it holds nine licences, encompassing offshore Israel, Greece, the Adriatic and onshore North Africa. Tanin and Karish are being developed by Energean Israel in a 50/50 JV with Kerogen Capital.

Charles Ellinas