[NGW Magazine] Total Becomes Danish Champion

This article is featured in NGW Magazine Volume 2, Issue 16

By Mark Smedley

Total’s surprise agreement to buy Denmark’s Maersk Oil for $7.45bn in a share and debt deal defies any notion that the French business world shuts down for the summer.

In what has already been a busy year for Europe-based upstream mergers and acquisitions worth $1bn or more, the French firm's late August purchase has increased the total value of such announcements in 2017 by over 60% at a stroke to some $20bn. And unlike earlier 2017 deals in which private equity firms were generally the buyers, this latest involves an international oil and gas company buying up an independent en bloc.

Until late last year, Danish state-owned Dong’s upstream business had been expected to merge with Maersk Oil, creating an enlarged Danish national upstream champion. But heavy debt at Maersk’s parent company AP Moller-Maersk and Maersk’s ongoing capex commitments quashed such an approach.

Instead Denmark has now welcomed Total’s entry as the country’s most significant producer – thanks to commitments provided about the strategic future of the Danish offshore gas sector and the jobs that go with it.

Analysts were fulsome in congratulating both firms for achieving their strategic objectives, and Danish energy minister Lars Christian Lilleholt described Total as "a really strong buyer." He expressed his “great confidence that Total will continue to ensure that Denmark receives large revenues from North Sea activities." Prospects for UK jobs however look less certain.

Total will take over all Maersk's obligations, according to the Danish energy ministry, including the full reconstruction of Tyra gas hub redevelopment -- referred to by Total as the ‘Tyra Future’ project. However, a final investment decision (FID) on this vital Danish project has slipped from late 2017 into early 2018, perhaps as a consequence of the takeover talks.

The lure

AP Moller-Maersk will receive $4.95bn in the form of Total shares, representing 3.75% of the French company, while Total will assume $2.5bn of Maersk Oil’s debt. Its CEO Soren Skou said the Danish family-controlled group will become the third largest shareholder in Total, but it has yet to decide on the offer of a seat on Total’s board. There is no lock-up on the shares it will own in Total. The deal is already approved by both boards and expected to close in 1Q 2018, but with an effective date of July 1 2017.

Total said it expects to generate operational, commercial and financial synergies of more than $400mn/yr, in particular by the combination of North Sea assets at both firms. CEO Patrick Pouyanne said: “Total will become a 3mn boe/d major by 2019 to the benefit of all Total shareholders.”

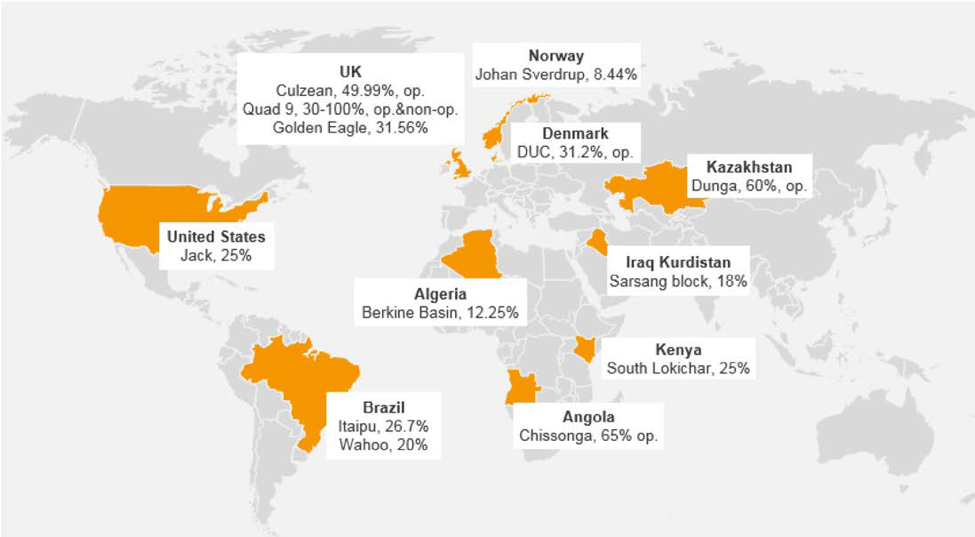

Maersk Oil assets going to Total (Map credit: Total)

North Sea-centred asset base

The deal will add around 1bn barrels of oil equivalent 2P/2C reserves to Total, 85% of which are in OECD countries (80% in the North Sea). It also means the addition of 160,000 boe/d production in 2018, acquired at an average price of $46,000/boe/d, offering high margins with an estimated free cash flow break-even of less than $30/b and growing to more than 200,000 boe/d by the early 2020s.

Maersk Oil’s expected 2018 production is made up of 70% liquids and 30% gas, said Pouyanne.

But that gas ratio could rise into 2019, when the Maersk Oil-operated Culzean gas field development offshore the UK (49.99% Maersk) comes onstream, close to the Total-operated Elgin-Franklin hub. By 2020-21 the high-pressure, high-temperature Culzean field will meet 5% of UK gas demand and “will help us create a new hub there,” said the Total CEO.

Maersk Oil also operates, with 31.2% ownership, the DUC producing assets in Denmark – accounting for some 60,000 boe/d gas and oil production net to Maersk in 2018, much of it gas handled by the Tyra offshore hub.

Total will also get Maersk’s 8.44% stake in the giant Johan Sverdrup oil development offshore Norway and become the second largest independent in Algeria through Maersk interests in Anadarko-operated oilfields there. AP Moller–Maersk finance chief Jakob Stausholm said August 21 that development of Culzean and Sverdrup would have meant a lot of negative free cash flow in the near-term for the Danish group, costs that it can now pass to Total.

Beyond northwest Europe, Total said the takeover would: consolidate Total’s US Gulf of Mexico presence with the Maersk Oil 25% stake in the Jack development; strengthen Total’s Kazakh business via addition of operated production; benefit from potential upsides in Brazil and Angola; and pool Total and Maersk’s geological and operational expertise in the Middle East and north Africa.

Total also secures interests in oil exploration in Kenya. Pouyanne told analysts Total had looked at acquiring these before but judged them expensive. Now he thinks they could have synergies with Total’s existing Ugandan oil development and trans-Tanzania pipe interests operated by Tullow.

Pouyanne also said that Total might be in a better position to develop the deferred Chissongo oil field project offshore Angola operated by Maersk, than the latter by itself, especially given that Total “operates 40% of Angolan production” and has “a strong relationship with Sonangol.”

Asked if there were non-core Maersk assets that Total might divest, Pouyanne replied “there are pre-emption rights in Kurdistan and I won’t be sad if these are [individually] exercised.”

'Danish psychology'

In a briefing to analysts August 21 when the deal was announced, Pouyanne described how Total learned to appreciate Maersk during the period when both firms worked closely on the handover of a key Qatari oilfield concession, after Doha decided against extending Maersk’s 25-year tenure of it.

“Maersk has a reputation in the industry of being an excellent operator with strong technological skills, he said, adding: “We had the opportunity to appreciate this; we have just transitioned in Qatar from Maersk to Total taking over the al Shaheen operations from July 14 and during the last year we had the opportunity to appreciate the high-quality skills of the Maersk teams and their high professionalism. It was maybe a disappointment for Maersk to lose al Shaheen asset to Total, but it’s back in the company again” – a reference to the 3.75% stake that AP Moller-Maersk will hold in the French oil and gas major.

The Danish government’s enthusiasm for Total seems to be jobs and its commitment to investing in gas production. Pouyanne indeed thanked Total’s independent adviser on the deal, London-based Lambert Energy, for “the help they gave us to better understand the Danish psychology.”

Pouyanne told analysts: “We want to build on the Danish heritage, so the decision we have taken, in order to ensure that we will integrate and execute that transaction in the best possible way, we will move our North Sea base, which is today in London, to Copenhagen in order to be able to drive this integration. We will still have a strong operational base in Denmark, the one of Maersk, the other strong operational base in the North Sea will be in Aberdeen where obviously both companies are present.”

The Total CEO did not say how many jobs might be lost or moved from the UK but did cite Britain as having the largest overlap of Maersk and Total teams – roughly 700 staff in each, for a total of 1,400. Given stronger labour laws in Denmark, the welcome given by Lilleholt to Total, and Total’s failure to respond to NGW on the question of jobs, it looks likely that jobs will be shed in the UK, and maybe Norway and Netherlands too, as the French firm seeks to achieve $400mn/yr savings across North Sea operations through synergies.

‘Tyra Future’

Total said it is looking to sanction the big Tyra gas redevelopment offshore Denmark early 2018 – which is somewhat later than the end-2017 target indicated by Maersk itself as operator in March 2017.

Total said it is looking to sanction the big Tyra gas redevelopment offshore Denmark early 2018 – which is somewhat later than the end-2017 target indicated by Maersk itself as operator in March 2017.

The Tyra offshore hub handles 90% of Denmark’s roughly 4.5bn m³/yr gas production. In April 2016 Maersk had warned that, without an investment agreement, it would have to decommission the Tyra platforms and halt their production from October 2018 as they had been undermined by subsidence. A new fiscal agreement with the government in March promised to extend Denmark's gas production but remains subject to a final investment decision.

Pouyanne outlined his company's intentions with regard to Denmark and Tyra to analysts thus: “Denmark is also important. There will be no synergies in Denmark, as we are not present. But Maersk operates 90% of Danish oil and gas production. They have a big redevelopment project that they call ‘Tyra Future’ which we will carefully look at. The parliament of Denmark has enacted a law which gives some fiscal incentives to make some redevelopments in the Danish North Sea and also in marginal fields, so we will benefit from that. We are committed to this Tyra Future development and we think also that we have some competencies that could be applied to develop the oil potential. We have a long list of marginal fields and other additional resources that could be developed in Denmark.

“Tyra Future would be sanctioned in early 2018; we want to benefit from this low-cost development in order to secure the future growth of the company,” added Pouyanne, describing it as part "active decommissioning" and part creation of new platforms that would add some production. He was neither asked, nor divulged, details about Total's likely capital expenditure on Tyra Future.

“The Tyra Future redevelopment is an active decommissioning, where we will stop some production, then commission some [new] platforms – so creating the opportunity to add some production. It is fully taken into account by the valuation, and there are no surprises with that.”

Pouyanne said he expected to give more of an update on how Maersk assets would be integrated, and the roadmap for new developments like Tyra, in September 2017 and early 2018.

Asked about the $2.9bn decommissioning liabilities that Maersk said that Total will pick up, Pouyanne replied that, of those, $2.1bn would be in Denmark but would not be incurred until after the 2035-40 period. He said the $2.9bn was fully reflected in Total’s valuation of Maersk Oil.

The Maersk deal represents Total’s biggest transaction since its 2001 acquisitions of Elf and Belgian Petrofina, noted Pouyanne, while Wood Mackenzie pointed out it was the biggest North Sea deal since the 2006 merger of Statoil and Norsk Hydro. Its corporate services director Valentina Kretszchmar said the immediate 6% production increase and near-term growth – notably the Sverdrup and Culzean fields – was the most important element of the deal but there were many other factors too.

These include the shift towards less risky OECD regions; acquiring a specialist in unlocking complex reservoirs and boosting recovery factors through enhanced oil recovery techniques; and legacy oil production in Algeria to help support its existing gas-led growth strategy in the country.