[NGW Magazine] BP shifts into gas

This article is featured in NGW Magazine Volume 2, Issue 16

By Mark Smedley

Most of BP's new output from its major projects will be gas, although CEO Bob Dudley did not say that this was intentional, or the result of a long look at the relative value of oil.

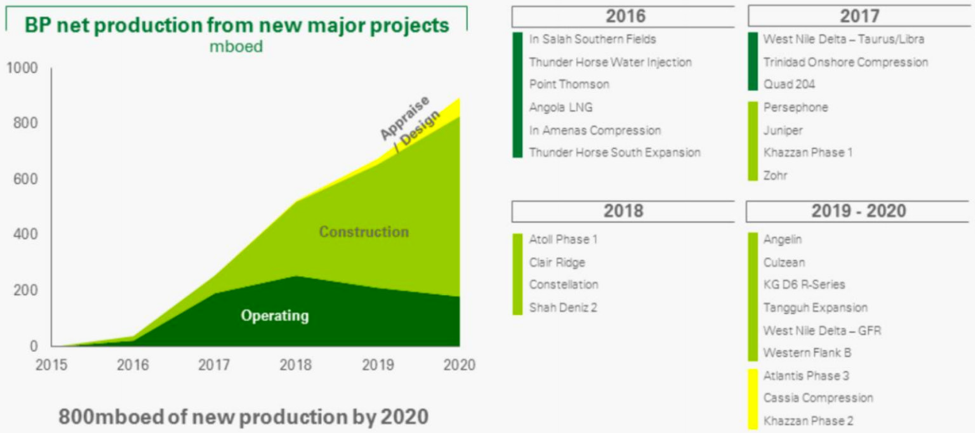

BP illustrated, at its August 1 results briefing, how major projects coming onstream in 2016-2020 will add an extra 800,000 barrels of oil equivalent/day to its output by 2020, relative to end-2015. Most of the projects are gas, and this did not escape the keen eye of Martijn Rats, Europe oil and gas analyst at Morgan Stanley, who essentially asked the two questions above.

“If you look at the projects that are oil, as far as I can see, they add up to about 85,000 b/d of that total, so a smidgeon above 10% – suggesting that the other 90% is gas,” said Rats, who went on to ask: “Is it really the strategic intent of BP to have the oil-to-gas mix shift so much towards gas over the next couple of years?”

“Good question,” replied BP CEO Bob Dudley: “There is a shift in the portfolio towards gas. It’s not a 90% shift.” Yet he did not volunteer a gas percentage figure of his own. “We do have the oil projects in there, if you look at the Thunderhorse expansion project, the Mad Dog project which is a significant oil project coming down the track, Clair Ridge next year in the UK and Quad 204 this past year. With a fair number of the gas projects, there are a lot of liquids and condensates with them. So, it isn’t 90%,” the BP chief continued.

From a glance at the 800,000 boe/d slide, it’s clear that most major BP projects out to 2020 are gas. Several have yet to produce, including BP-operated: Shah Deniz phase 2 in Azerbaijan which Dudley said is expected to start flowing gas in October 2018; Atoll phase 1 in Egypt; Khazzan tight gas in Oman (both phases); Jupiter and Angelin offshore Trinidad; and Tangguh LNG train 3 in Indonesia.

In others, such as the Eni-operated Egyptian mega-field Zohr (with phases rolling out from end-2017 to 2020), the Woodside-operated Persephone offshore Australia which came on line in end-July and the UK’s Maersk-operated Culzean project, BP has significant equity interests.

Dudley explained: “We look at these projects as ‘advantaged gas projects’. They are not like [US] Lower 48 type projects. They tend to be in markets that are short on gas where we have contractual gas pricing so that the economics are clear: the Egypt and Oman projects fit into that. So, there’s gas, and there’s gas. These are quite selective gas projects for us.”

Beyond 2020, so not shown on BP’s chart, is its farm-in to Kosmos’ discoveries off northwest Africa. “Mauritania/Senegal, which will have a significant amount of gas, also has a lot of oil prospectivity there as well,” said Dudley.

Kosmos CEO Andrew Inglis said, when BP completed its farm-in this February, that he expects first gas from a BP-operated Tortue floating LNG venture by 2021 – but admitted that schedule could be extended if both partners agree to develop any oil discoveries ahead of the LNG project.

Dudley concluded by telling Rats: “You’ve seen our strategic shift. Low-cost oil, advantaged oil will remain a very important part of the portfolio. But there will be a higher shift to gas.”

NGW followed up Rats’ question by asking, if it’s not 90%, whether BP can provide a gas split for the 800,000 boe/d from new projects onstream between 2016 and 2020.

“When looking at the split between pure oil and pure gas, Martijn is correct that there is a significant bias to gas, per our strategy,” replied BP spokesperson. “But as Bob indicated, our gas projects often include economic condensates/liquids. We don't provide a breakdown project by project, so I can't confirm the number.”

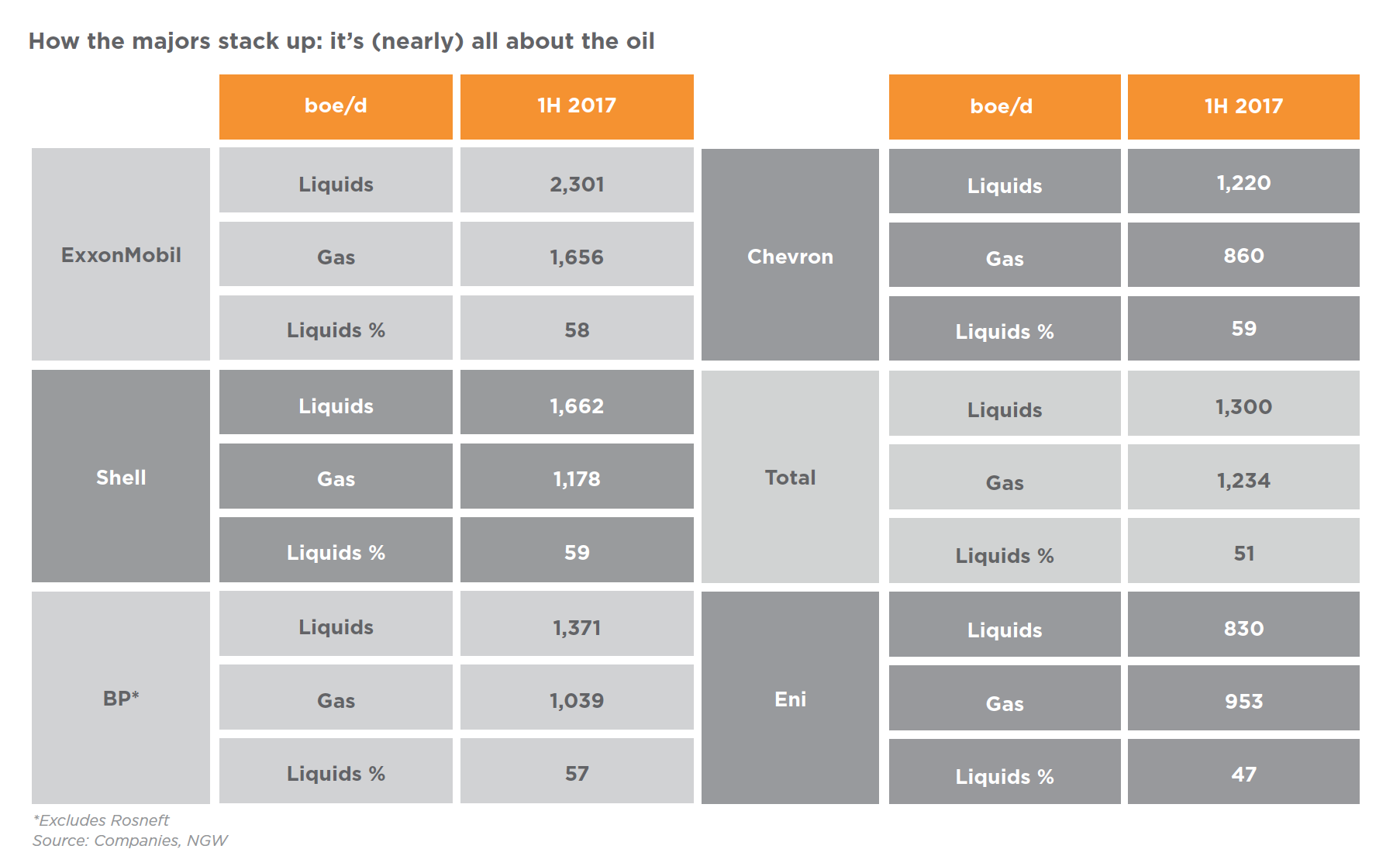

Some might be surprised at that over two-fifths of existing production in BP’s core business – so excluding its 19.75% equity stake in Russian state-run oil producer Rosneft – is already gas.

BP’s non-Rosneft production was 2.43mn boe/d in 2Q 2017, up 10% year on year (see table for comparison of majors' output).

Rosneft gets gassier

When its 1.2mn boe/d share of Rosneft (mainly oil) output is added, BP’s overall net output reaches 3.6mn boe/d and the liquids proportion rises correspondingly to about 64%. Rosneft’s total 1H 2017 production was 5.74mn boe/d, of which four fifths (4.59mn boe/d) was liquids. But the company means to grow the remaining gas share significantly by 2020.

Earlier this year Rosneft declared its aim to produce 100bn m³/yr (9.67bn ft³/d) of Russian equity gas by 2020, partly by flaring less associated gas. Gas production by Rosneft of 34.2bn m³ in 1H 2017, up 3% year on year, has just pulled ahead of independent producer Novatek’s 31bn m³ -- long Russia’s main non-Gazprom gas producer. Rosneft had a leg-up by its acquisition of Itera – Russia's first independent privately-held gas company.

Rosneft signalled its intent to challenge Gazprom’s piped gas export monopoly outside Russia: it signed June 2 a memo of understanding and strategic gas agreement with BP, whereby it and BP will market Rosneft-produced gas into Europe by 2019 subject, of course, to Kremlin consent (NGW Vol.2, Issue 12, pp17-19).

Rosneft is expanding beyond Europe too. Eni has sealed a deal to sell 10% of its Zohr project to BP for $375mn, with BP retaining an option to buy a further 5%. Then partner Rosneft agreed to buy 30%, also with an option for 5% more. If both options are exercised, Eni’s Zohr share will fall to 50%.

Zohr in Egypt has total potential gas in place of 850bn m³ (30 trillion ft³) at 100%. Moreover, Rosneft was reported by Reuters in July to be looking to set up an office in Mozambique, ostensibly to monitor its joint offshore exploration interests with the US major, Exxon. Given its past form in entering overseas gas projects, Rosneft may now conceivably be running a slide-rule over the giant Anadarko or less likely Exxon/Eni-run onshore LNG projects looking to start production there in the mid- to late 2020s – unless Qatar blows east Africa LNG project dreams out of the water – and asking if they need a partner.

BP is 100% offtaker of the 3.4mn mt/yr Coral South floating LNG project, on which operator Eni and partners announced final investment decision June 1 in Maputo, which should start exports in 2022.