LNG project sanctioning in an uncertain environment [Gas in Transition]

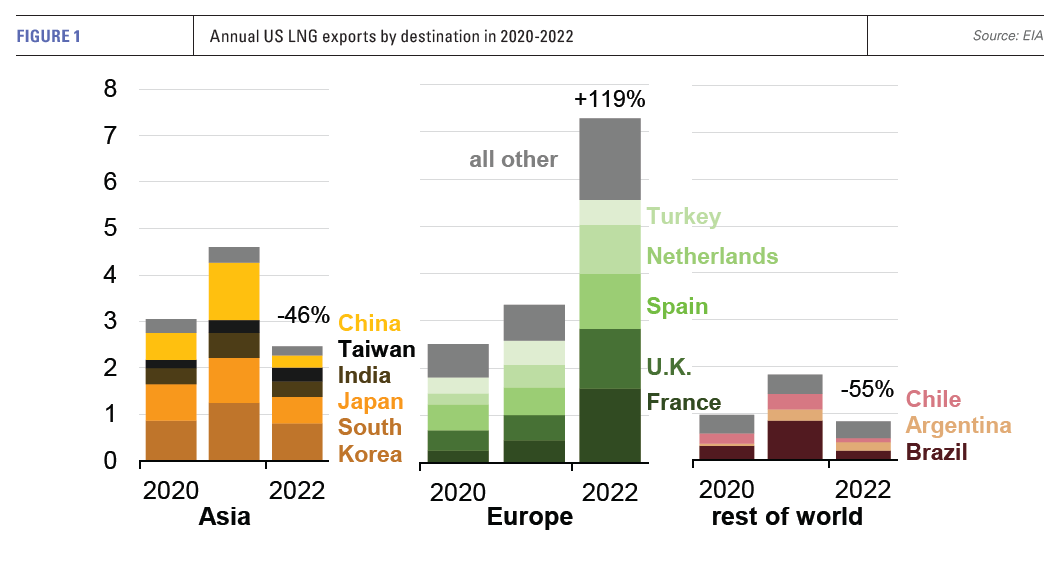

With Russia’s pipeline gas supplies to Europe expected to be down to 25bn m3 in 2023, global gas and LNG markets have undergone a huge change. US LNG exports to Europe increased massively, by about 120% in 2022, while exports to the rest of the world went down (see figure 1).

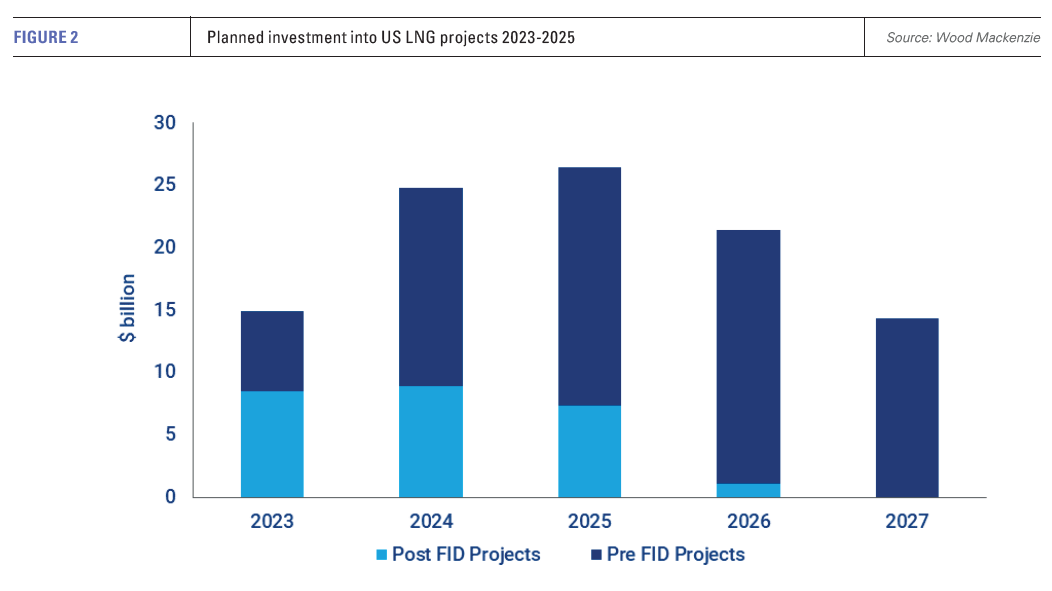

In total, the US exported 76.4mn metric tons of LNG in 2022, third behind Australia and Qatar. With a record 65mn m/tyr of long-term contracts signed in 2022, almost four-times more than the 18.5mn mt/yr of new contracts signed in 2021, and Freeport LNG back in operation, the US is poised to become the world’s largest exporter of LNG in 2023. And there is more to come (see figure 2).

However, the acceleration in energy transition, reduced demand, geopolitical risk, inflation and lenders' focus on ESG are contributing to a more uncertain environment to developing more LNG projects.

Even though, until recently, high demand and high prices spurred interest in new LNG, this is unlikely to continue at the same pace, especially beyond the next three years. At least some of the projects at pre-FID stage may find it difficult to move to the next stage. European utilities’ reluctance to enter into long-term LNG purchase contracts is making things even more difficult.

Overall gas use in the EU dropped by 17.7% from August to March, compared with the five-year average for the same period, according to Eurostat, and it is expected to drop by 30% by 2030. This is the target in RePowerEU, which also expects gas demand in Europe to carry on declining in line with EU’s net-zero target by 2050. In addition, the EU has made a commitment to ban long-term LNG contracts after 2049. These developments contribute to the uncertain long-term environment and are having a destabilising effect on markets.

And so is geopolitical risk. The energy crisis and Russia’s invasion of Ukraine are changing the rationale for LNG projects. The war in Ukraine has increased geopolitical risk. Focus has now shifted to energy security and long-term contracts.

An accelerated energy transition

The drive to accelerate energy transition, brought about by the impact of Russia’s invasion of Ukraine on global energy markets, is making the longer-term future of LNG projects more uncertain.

While an LNG project's construction phase may last five or so years, most companies building LNG plants now look for project lifespans of at least 30 years. That would take such a project beyond the 2050 net-zero horizon, with decarbonisation becoming increasingly critical. Doubts about the longer-term future of such projects will start increasing as we approach 2030.

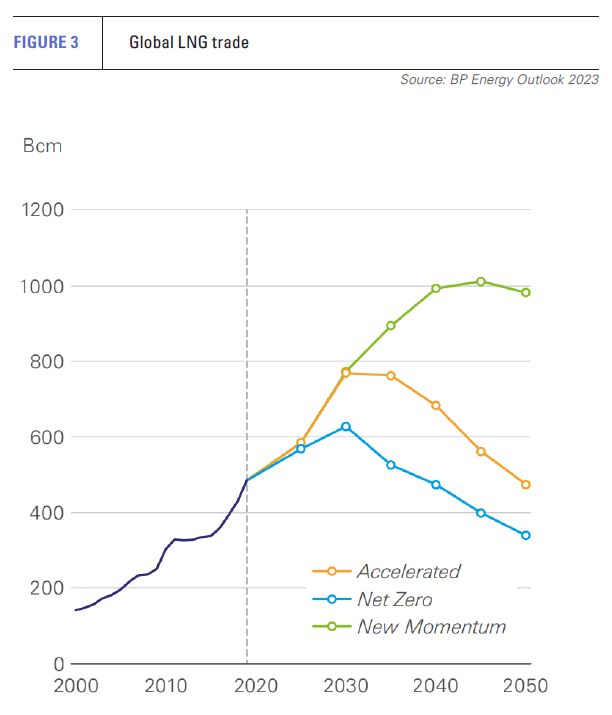

In fact, BP’s Net-zero scenario in its 2023 Energy Outlook shows LNG trade peaking by 2030 and then declining by almost 50% by 2050 (see figure 3). Even though scenarios are not predictions of what is likely to happen, they explore possible outcomes. As such, BP’s net-zero scenario is adding to the uncertainties surrounding new LNG projects.

In fact, BP’s Net-zero scenario in its 2023 Energy Outlook shows LNG trade peaking by 2030 and then declining by almost 50% by 2050 (see figure 3). Even though scenarios are not predictions of what is likely to happen, they explore possible outcomes. As such, BP’s net-zero scenario is adding to the uncertainties surrounding new LNG projects.

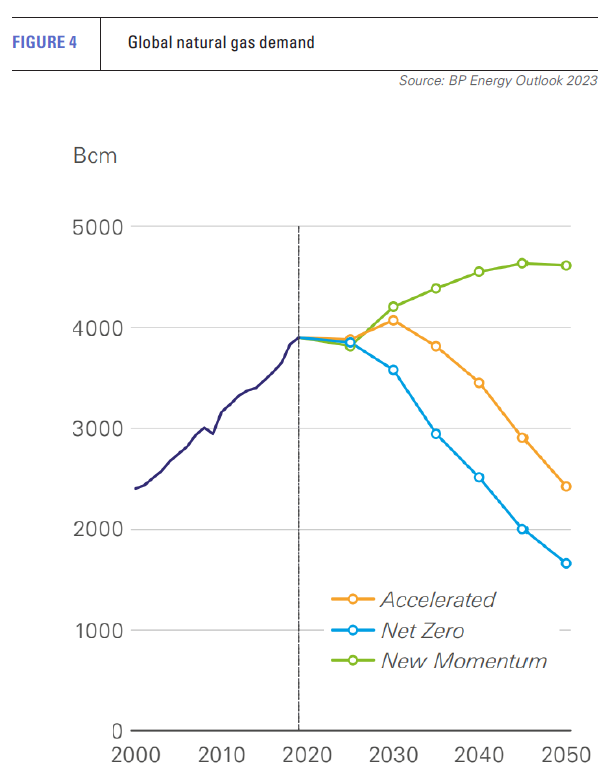

And then there is low-carbon hydrogen coming to replace gas. BP’s Energy Outlook states that its “pace of growth accelerates in the 2030s and 2040s as falling costs of production and tightening carbon emissions policies allow low-carbon hydrogen to compete against incumbent fuels in hard-to-abate processes and activities.” According to BP’s net-zero scenario, global natural gas demand will decline by 60% by 2050 (see figure 4). It is already happening in Europe.

Accelerating energy transition would increase such uncertainties. That is one of the main reasons European utilities are not keen to enter into long-term contracts without a change of policy by the EU recognising the longer-term need for gas.

Strong resistance by climate change activists to new LNG projects adds to the uncertainties. In a report released in April, Greenpeace accused US LNG exporters of profiting from Europe’s gas crisis. It said that Europe should move away from gas, focus on reducing demand and invest more in renewables and energy efficiency.

Of those who disagree, many do not see the need for new LNG to extend beyond the 2030s-2040s.

High inflation and interest rates

High inflation has led to higher interest rates increasing costs for borrowers. The IMF expects the US inflation rate to drop to 2% only by 2025 and remain at that level up to 2030.

This is impacting interest rates that are expected to average 5.25% in 2023, drop to 3.75% in 2024 and 3.25% in 2025, compared to about 1.5% pre-pandemic.

Rising interest rates are having an impact on project finance, affecting the cost of new LNG projects, forcing US producers and infrastructure companies to seek long-term LNG deals.

Wood MacKenzie says that its “benchmarking analysis indicates we have already seen inflation of over 20% on the US Gulf Coast, compared to projects which were built in the last five years.” In addition, while the number of new projects is increasing (see figure 2), developers are faced with services, work force and material price rise and cost challenges. Ultimately, these challenge new LNG project sanctioning.

The banking crisis has also added to these challenges.

Focus on ESG

In the US lenders’ focus on ESG is adding new environmental hurdles to new LNG projects, as is the enforcement of the Clean Air Act emissions regulations. The Inflation Reduction Act (IRA) has gone further. In addition to enforcing methane emission monitoring and mitigation, it has introduced a charge on methane emitted by oil and gas companies, including from the LNG value-chain, making methane emissions expensive. On top of this, the EU is planning to extend its new methane emission reduction regulations to imports of oil and gas, including LNG.

In the US, the Office of Fossil Energy and Carbon Management recently issued a new policy on LNG exports and greenhouse gas and methane emissions mitigation in April. It states that its “goal is to bring transparency and best practices to the US and global natural gas supply chains. This, in turn, will help American industry achieve among the lowest emissions profiles of any natural gas producer in the world, demonstrating that natural gas production, consumption and exports from the US can effectively align our energy security and climate goals.”

Reducing emissions is now becoming a ‘standard’ requirement for new projects, adding to costs.

A survey by McKinsey showed that “more than 50% of buyers already have targets in place to reduce their emissions from LNG and, furthermore, nearly 25% in total target emissions from the full value chain, such as upstream LNG.”

Increasing environmental compliance requirements are adding to the cost of new LNG projects in what is becoming a more competitive market.

In the US, ESG is also impacting regulator approval of new permits. These are taking longer and costing more. Poten & Partners reported that the cost of applying for permits alone has escalated to between $100mn to $150mn for a project.

With such a large choice of new US LNG projects, investors are becoming more demanding, choosing the cleanest and most profitable projects.

ESG is also impacting European LNG buyers. According to Bloomberg Intelligence, “most European utilities don’t want to touch gas-related projects with a barge pole as companies seek to improve their ESG metrics, improve valuation and avoid stranded asset risks.”

Impact on sanctioning new projects

These challenges have driven those US LNG developers that can afford it to seek more equity or balance-sheet financing to ensure sanctioning of their projects.

But even then, escalating costs impact project profitability. Wood MacKenzie says that “The combination of low fees and increasing costs mean we estimate unlevered internal rates of return (IRRs) as low as 5%-6% for some projects. Based on these returns, some projects are finding it challenging to secure finance, particularly via equity raises.”

The recent collapse in global LNG prices is adding to the problem. Increased inflation and interest rates mean that LNG project developers need to recover higher costs through higher liquefaction fees, reducing profitability even further, delaying project sanctioning.

In such an environment, projects that secure long-term LNG sale and purchase contracts have an advantage. Two such examples are Venture Global LNG and Sempra Energy LNG. Both secured about 90% of production capacity under long-term deals. This helped them win approvals and financing.

In addition to the uncertain economic environment impacting LNG project sanctioning, there is an increasing view that acceleration of energy transition means that the current LNG supply is enough to meet future energy demand. Nevertheless, despite the challenging environment, the outlook and interest in new LNG export projects in the US remains strong.