LNG: more sellers than buyers [NGW Magazine]

Recent additions to global liquefaction capacity have lifted LNG supply significantly over recent months, leading to falls in gas prices outside North America, the lowest-priced market of all.

Price differences between east and west have narrowed, and LNG cargo arrivals in Europe are up sharply. With up to another 48mn metric tons (mt)/yr of liquefaction capacity coming onstream in 2019 and demand growth expected to be weak, prices are likely to remain under pressure.

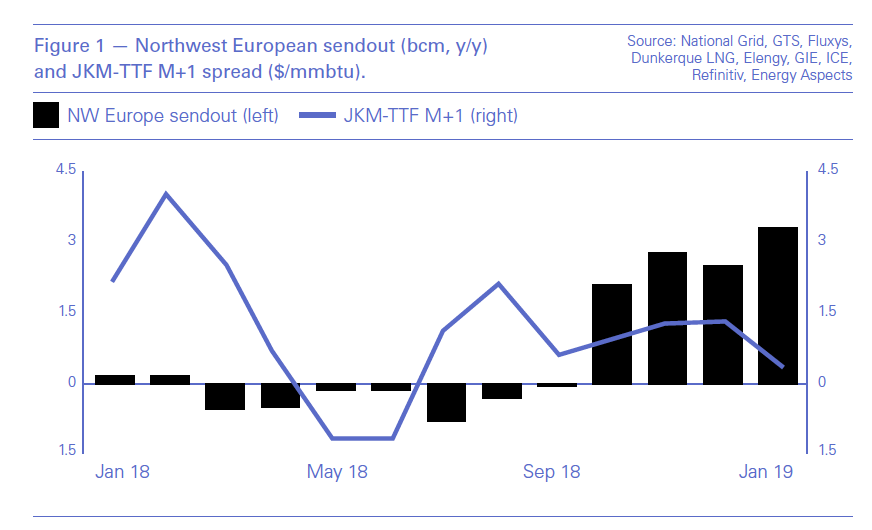

Liquefaction ramp-ups and a slowing rate of Chinese demand growth at last seem to have left the LNG market open to a long-anticipated period of global surplus. An ample flow of cargoes in Asia as new liquefaction capacity ramps up there, softened prices from the autumn onwards. This, combined with high freight rates, closed the Atlantic Basin–Asia arbitrage, restricting US, Russian and other Atlantic basin cargoes to regional destinations (primarily Europe).

Consequently, LNG deliveries to Europe have been running at near record levels since November – putting downward pressure on the UK National Balancing Point (NBP) and Dutch Title Transfer Facility (TTF) benchmarks. Weather has also been relatively mild so far this winter, and there has been little in the way of pipeline supply disruption.

The downward price pressure in Asia has to date out-paced that in Europe (in that prices have fallen from a greater height), despite the record European LNG imports This has left the spread between the TTF and the Japan Korea Marker – the SP Global forward-month spot assessment – at just $0.30/mn Btu at the end of January, down from $1.60/mn Btu in December, with JKM March deliveries at about $7/mn Btu, and the TTF March price at $6.70/mn Btu – well down on the same period last year.

A different season

In total, Europe received 5.6mn mt of LNG in December, and 5.8mn mt in January – which was 2.2mn mt higher than the first month of 2018. In the UK the contrast was even sharper, with almost 0.9mn mt arriving this January, compared with nothing in January 2018. The UK’s South Hook terminal received cargoes from a diversified range of liquefaction plants, including Yamal in Russia and the US over recent months – not just from the plant’s part-owner Qatar, as was the case last year.

The winter has so far seen US exports to Europe trump those to east Asia for the first time, with US flow to Europe at about 58bn ft³ in January – about 1bn ft³ more than went to east Asia. Deliveries were also higher in December. This suggests that as well as big Asian term deals, European traders and US exporters are becoming increasingly keen to secure outlets in countries including Spain, Germany and Poland.

Gail India has swapped or resold many of its Cove Point cargoes to European or other Atlantic basin buyers, and even some Japanese buyers have sold term deliveries to European markets. The arrivals capped cold-related price rises on the NBP and TTF exchanges through January. And in the first week of February, forecasts of milder weather sent prices sharply lower, with storage still relatively full and the additional LNG weighing heavily on the market.

Nevertheless, the attractiveness of the European market (relative to Asia) is expected to be maintained for Atlantic basin cargoes, as more supply comes onstream in the Pacific basin this spring and heating demand peters out. The situation means the risk of any European price spikes during the summer associated with outages or extended pipeline maintenance will also be much lower.

Another potential supply gap for LNG, resulting from the full closure of Groningen following recent legal action related to on-going earthquakes, appears to have closed. The Dutch High Court dismissed the claim at the end of January. “Summer is all about supply side shenanigans so at least that’s one that we don’t have to contend with,” said one UK trader. Groningen has a permit to produce just under 20bn m³ in the current (October-September) Gas Year, ahead of further cuts in the mid-2020s and a permanent shutdown by 2030.

Lower gas prices are now also putting downward pressure on power prices, as well as making gas more competitive relative to coal. This is good for lower CO2 emissions, which had been rising with higher coal use in parts of Europe, including the UK, as gas prices firmed at the end of last summer. It may be no coincidence that it was the first week of February that EDF chose to begin winding down its 2-GW Cottam coal-fired power plant in the UK.

Weaker gas is also likely to put downward pressure on ETS carbon prices, as fewer credits will be needed if gas-burn displaces coal. Renewables will keep growing in any case.

Basin-focused trading

As well as commodity price weakness in both basins, the cost of LNG shipping is likely to stay high as it has been over recent months, which should maintain a narrow spread. New vessels are only expected to enter the market gradually – so a similar squeeze on long distance routes as seen in 2018 could transpire, combining with narrower spreads to extend the more basin-focused trading pattern.

That could be even more the case if China repeats 2018’s pattern of aggressive forward buying of fourth quarter-delivery cargoes in the summer to be sure of ample supply overwinter – which occupied many vessels, pushing rates up. That is less likely to happen again, however, after China left itself overcommitted this winter. At one point 13 vessels were backed up, unable to offload because there was no storage to hold the contents.

In addition, policy measures in China aimed at stimulating domestic gas output are also expected to halve LNG demand growth this year.

China still managed to increase imports by 1.2mn mt more year-on-year in December, and Asia generally added another 0.3mn mt on top of that, but it was not enough to absorb the 32.2mn mt of LNG dispatched globally in December – which was up by 4.4mn t, or almost 16%, from the same month in 2017.

Bearish outlook

Incremental demand this year looks unlikely to absorb the 48mn mt/yr of additional nameplate capacity expected onstream – although other estimates put the actual supply added lower at 34mn mt, a 9% rise from 2018. Either way, this significant rise could see the current amply-supplied market soften further. In the US alone, peak LNG export capacity is set to more than double from 3.4bn ft³/d to over 7.5bn ft³/d by the end of 2019, provided there is demand with a positive netback for US exporters.

Chinese demand for LNG will still grow at around 20% in 2019, down from 40-45% in 2017/2018. This is still by far the largest source of LNG demand growth in the global market, according to Wood Mackenzie – partly owing to lower demand growth, and partly owing to higher domestic output and the ramp-up of Power of Siberia, the pipeline from Russia due to start at the end of this year.

A key question is whether the lower LNG prices could stimulate fresh demand in price-sensitive markets such as India, which has had trouble affording LNG over recent years. Demand could also come from Bangladesh and Pakistan. The IEA is forecasting a "slight increase" in Indian demand but cautions that it is dependent on the competitiveness of gas to oil. Lately, fundamentals in the oil market look firmer than in LNG, which would favour more gas use.

Despite the rise in LNG, European supply remains dominated by Norway and especially Russia with over 200bn m³ last year. However, if the pipeline suppliers want to maintain market share, they must compete on price with LNG – so LNG and coal (plus carbon) prices lead the market. And looking a little further ahead, if either Nord Stream 2 or Ukrainian transit negotiations fail to work out as planned, there could be a fall in Russian exports and a potentially bigger supply gap for LNG.