LNG: from hero to zero [NGW Magazine]

The Paris-based International Group of Liquefied Natural Gas Importers (GIIGNL) released its annual report in April. Introducing it, the president, Jean-Marie Dauger, said that “2019 marked an all-time record increase in annual LNG production, driven by new liquefaction trains and ramp-ups in the US, Russia and Australia.”

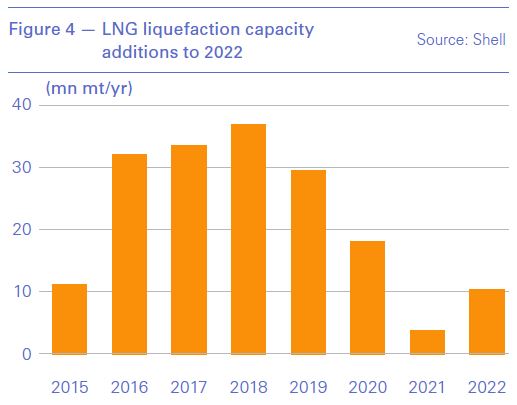

Over the last three years, the industry has added close to 100mn mt/yr of capacity, with significant volumes due to come online by 2025. 2019 was also a record year for new investment decisions - by the end of the year, these reached 71mn mt/yr worldwide.

LNG import demand growth in northeast Asia dipped in 2019 thanks to the economic slowdown, milder weather and competition from nuclear and coal-fired power generation – but also prompted in part by security of supply concerns, which led domestic energy sources to shift up the supply mix in some countries.

Low prices drove most of the additional LNG into Europe, which played a balancing role thanks to its abundant infrastructure and large and well-connected gas market.

The main highlights of the report are:

- The LNG import market grew 13% year on year, reaching 354.7mn mt – driven by low prices. This was the highest growth rate in a decade.

- Of that, 119mn mt – a third of the total – was imported on a spot or short-term basis. Most of it – 95mn mt – was imported as spot cargos.

- Total liquefaction capacity increased to 427mn mt/yr, with seven liquefaction facilities starting commercial operations.

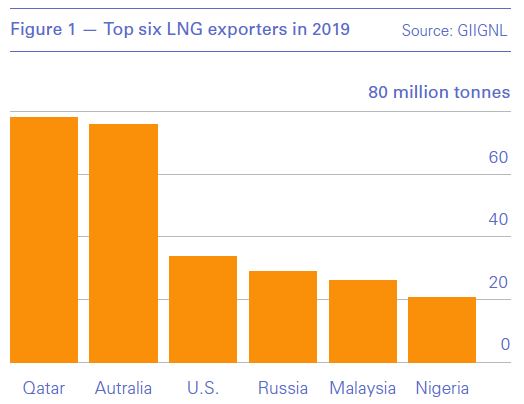

- Most of new LNG supply volumes were from the US (13.1mn mt/yr), Russia (11mn mt/yr) and Australia (8.7mn mt/yr).

- Total regasification capacity increased to 920mn mt/yr, with seven regasification terminals added.

- The number of importing and exporting countries remained unchanged (21 and 42).

- The Pacific Basin remained the largest source of LNG supplies to the global market with 146.7mn mt/yr (or 41.3%) of the total global market, followed by the Atlantic Basin (32.2%), and the Middle East (26.5%) (Figure 1).

- Most (38%) US LNG was delivered to Europe, followed by Asia (37%) and last the Americas (21%).

- Most Russian LNG was delivered to Europe (51%), followed by Asia (46%) and the Middle East (3%).

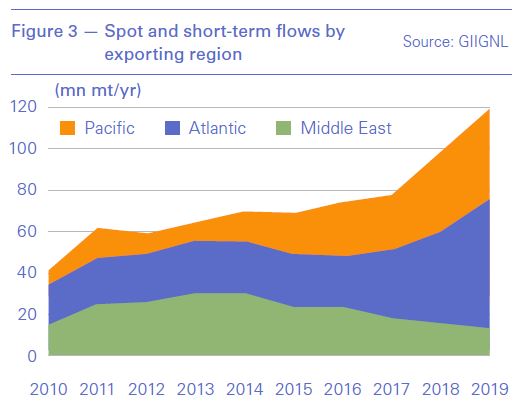

- Europe experienced a 75.6% growth in net LNG imports, reaching 85.9mn mt (Figure 2).

- Japan remained the top LNG importer, with 76.9mn mt/yr – 6.8% down. China was second, with 61.7mn mt/yr and up 14%; but a lot less than the 38% increase in 2018.

After a record growth year in 2019, which was tailing off in terms of prices at the end, this year has been catastrophic for sellers. Demand is declining, supply is growing, and this will continue for some time.

Growing spot and short-term LNG market

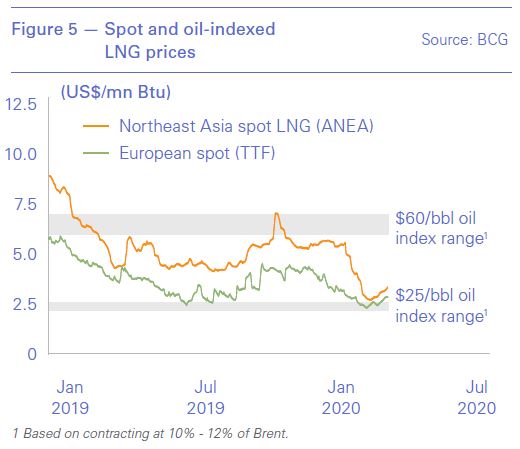

LNG continued to commoditise in 2019, with the share of spot and short-term volumes increasing to 119mn mt/yr, 34% of global LNG imports (Figure 3)

GIIGNL says the growth was mainly supported by the expansion of flexible volumes from the US, the largest contributor with a fifth of the market and Australia, with a sixth, but also from the rise of LNG volumes handled by traders and portfolio players.

Spot volumes – defined as those delivered within three months of the transaction date – reached 27% of total imports in 2019 or 95mn mt, compared with 25% of total imports in 2018. This is making the market more accessible to more traders as the bigger companies seek to “optimise their portfolios and to manage volume risk by purchasing and selling LNG under more flexible conditions.”

This continuous change prompted Dauger to say “for LNG sellers and buyers, business models and contractual arrangements are becoming increasingly diversified. Traders continue to take advantage of seasonal and local supply tensions and integrated portfolio players are displaying impressive growth, aiming to bridge the disconnect between LNG seller and buyer interests. We see competing interests, a world in which sellers require long-term commitments to support their investments, whereas buyers need shorter contract durations, diversified pricing structures, increased destination flexibility and greater volume flexibility in order to manage demand uncertainty.”

LNG prices

GIIGNL sees opportunities in low LNG prices, allowing gas to penetrate new markets.

There was already a glut of LNG in the global markets before Covid-19 struck. Given that new projects are now under construction and that final investment decisions have been made for yet more, the problem will deepen. According to Shell’s LNG Outlook 2020, since the big expansion in 2016, over 130mn mt/yr new liquefaction capacity has been added (Figure 4). This will increase by about 24mn mt/yr between 2020 and 2022 based on projects already under construction, with more to follow – such as Total’s 12.9 mn mt/yr Mozambique LNG expected to start operations in 2024.

It is still unclear what the overall impact of Covid-19 will be on global LNG demand this year and next, but forecasts already estimate this to fall significantly in comparison to pre-Covid-19 forecasts.

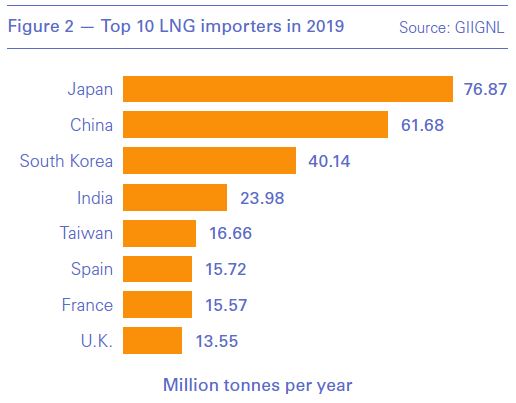

Even before Covid-19, the Oxford Institute of Energy Studies (OIES) was forecasting that LNG glut will persist well into this decade, keeping prices lower for longer. “In the absence of shocks to the market… there seems little reason for a material rise in prices.”

The shock has now happened, the Covid-19 pandemic, not quite what was expected, but devastating in the depth and extent of its impact. It led to a massive reduction in oil demand, which saw West Texas Intermediate fall almost to zero at the close on April 20.

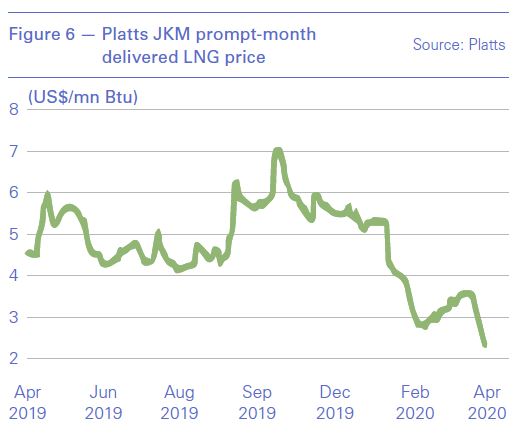

Oil price indexation means that LNG prices in term contracts are now down to similar levels as spot prices (Figure 5). And as GIIGNL points out, the convergence of European and Asian prices wipes out the free lunch of a location spread. Prices are at record lows to the extent that US LNG is now selling at a loss.

GIIGNL concludes that “to allow natural gas to penetrate new markets, prices need to remain at levels that make gas competitive with alternative fuels in downstream power and gas markets but, at the same time, support the significant investments needed in production, liquefaction, transportation, transmission and downstream infrastructure.” It suggests that “a balance will have to be found, and in the end, the scale of new developments will depend on the industry’s competitiveness, as well as on its ability to demonstrate its environmental benefits, in particular by increasing efforts to detect, measure and reduce methane emissions.”

Developing situation

GIIGNL states that “in the near term, the disruptive impact of the Covid-19 outbreak on the economies of importing countries will exert downward pressure on LNG demand in an already oversupplied market.” But with about 24mn mt/yr new supply coming by 2022, and with approved FIDs likely to add another 150mn mt/yr by 2025-2026, at a time when the global economy will still be struggling to return to normality, oversupply problems are likely to continue.

Global LNG demand has tumbled and with it prices (Figure 6). And on top of this, after a mild winter, storage levels are almost full putting more pressure on prices.

Even buyers in Italy and Spain are reportedly considering declaring force majeure. LNG supply cuts are becoming inevitable, with increasing signs of potential shut-ins at US LNG plants over the next few months – that could ease some of the supply pressure.

Taking advantage of the LNG oversupply, Singapore’s biggest LNG buyer is asking sellers to “quantify greenhouse gas emissions associated with each LNG cargo produced, transported and imported into Singapore. It’s also encouraging bidders to offer carbon offsets as part of sales deals.” This “marks the first time that environmental criteria were included in what’s otherwise a standard bidding process in the LNG industry,” reflecting increasing pressure on the industry to become greener.

Another hopeful sign is that natural gas in east Asia now costs about the same as coal, something which – combined with the drive for clean air – could accelerate coal substitution. But for this to succeed, natural gas prices need to remain consistently competitive with coal, as happened in the US.

The warnings, though, continue to be ominous. LNG prices in 2021 and 2022 have been revised downwards on the expectation that the LNG oversupply will continue and demand will still be facing headwinds. With oil prices forecast to remain lower, oil-indexed term contract prices are also being revised downwards (Figure 6).

However, there is also a likelihood that with low prices, and persistent oversupply, new project sanctioning may delayed, causing a shortage in 2024-2025 and a hike in prices.

But with no clear idea as to when Covid-19 will recede, there is considerable uncertainty how 2020 will turn-out, let alone 2021 and beyond. But given that demand is softening and oversupply problems continue, the impact of Covid-19 can only but worsen it. Global gas prices will stay low this year and are likely to remain weak for the next few years.