LNG Condensed January 2020 Now Available

In this issue:

Editorial: US-China Trade - A Win for Whom?

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

China and the US in January signed their Phase 1 trade deal, but it is far from a major victory for anyone. First, a high level of tariffs, covering about $360bn worth of Chinese imports to the US and more than $100bn of goods fl owing in the other direction, remain in place, not least a 25% tariff on Chinese purchases of US LNG._f600x769_1580286418.jpg)

Europe will sustain its appetite for LNG in 2020

Europe saw its highest-ever level of LNG imports in 2019 with provisional data suggesting some 76mn metric tons (mt) reached its shores, just over a fi fth of global production and a huge jump from the 52.5mn mt imported in 2018. The main factors which have driven this upward leap remain prevalent, suggesting high levels of European imports can be sustained in 2020. Yet looming over this upturn is the prospect of long-in-construction gas pipeline projects fi nally coming to fruition.

Renewables: foe or friend for LNG?

The amount of wind and solar capacity installed in Asia has surged over the past decade. Capacity jumped from 387 GW in 2010 to more than 1,024 GW in 2018, rising from 31.6% to 43.5% of global renewable capacity. With much more to come, renewables are bound to affect LNG demand, but what the impact will be is far from certain.

Equatorial Guinea: “invest or move aside”

The government of Equatorial Guinea is pushing ahead with plans to develop a gas hub supplied from reserves across the Gulf of Guinea, mainly for LNG production. However, it has struggled to get investors to commit and has become frustrated by the slow pace of development. Further south, Angola too is looking at rejuvenating its gas sector and stimulating new investment.

Country Focus - Germany: Phasing LNG in

Germany, the fourth largest economy in the world, is girding itself to enter the LNG market. Plans to close down all of the country’s remaining nuclear plants by 2023 and to start phasing out coal from 2022 suggest a growing space in the energy mix for natural gas, despite competition from renewables. LNG is being supported by the desire to reduce Germany’s growing dependence on Russian gas imports.

Project Spotlight - Burrup Hub

Woodside’s Burrup Hub project is ambitious and simultaneously retrospective and forward-looking. It aims to make efficient use of existing LNG facilities and extend their life through the development of new off shore gas resources as far forward as 2070.

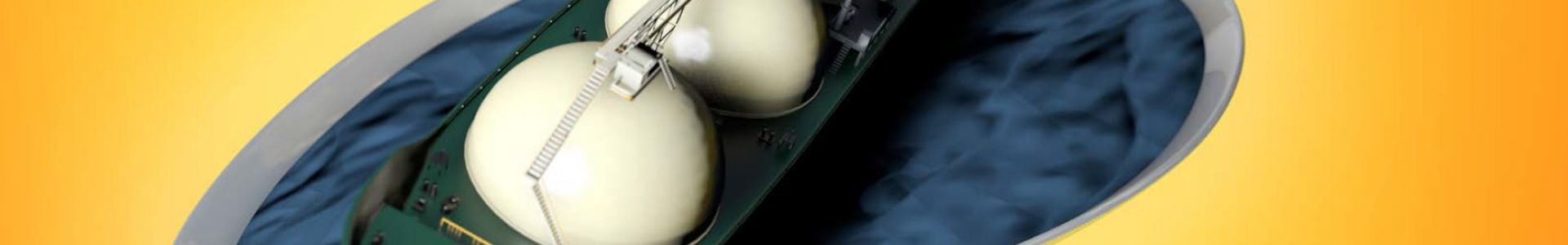

Technology - MEGI moves centre stage

M-type, electronically-controlled gas injection engines (MEGI) are becoming an increasingly popular option for LNG carriers, as commercial pressure to reduce transport costs intensifies.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future.