Legal Issues on Shale Gas in Spain

Hydrocarbons Regime

The Spanish Energy Ministry, through the General Directorate of Energy and Mines, is granting exploration permits in various autonomous regions, mainly in the north of Spain, where there has been an increase in recent discoveries of shale gas deposits, and the appetite for this industry is growing.

The exploration and development of unconventional gas by means of hydraulic fracking is subject to the national hydrocarbon legislation, the national and regional and town planning regulation, and the national and regional environmental regulations.

Shale gas operations are regulated by the Hydrocarbon Act 34/1998. This Act regulates various types of authorizations, such as exploration, research and the activities relating to operation and extraction of gas, including shale gas.

- Exploration Authorizations, (“Permiso de Exploración”). Includes geophysical exploration works. Exploration authorizations are granted by the Autonomous Communities where the development is located, unless exploration works are carried out within the territory of several Autonomous Communities in which case, the Ministry of Industry is the competent Authority to grant the authorization for exploration works in free blocks (where there is no prior authorization granted).

The companies awarded exploration authorizations shall previously submit to the authorities the exploration work program including the technology to be used and the environmental protection actions that are going to be implemented.

- Exploration and Appraisal Permits (“Permiso de Investigación”). These are also granted by the Autonomous Communities where the development is located, except when their activities also affect the territory of several Autonomous Communities in which case the Ministry of Industry is the competent authority. The resolution granting the permit shall be adopted by means of a Royal Decree (statutory instrument legislation) that needs to be approved by the Council of Ministers. These permits allow the awardee to investigate the existence of underground gas on an exclusive basis, and therefore allow their holders the carry out of the drilling and hydraulic stimulation fracture and the performance of test on wells so as to establish the potential commercial production.

Such permit requires a detailed work program. This program must describe the activities andtechniques to be used, investment and the measures of environmental protection and policies that are going to implement during the duration of the permit.

- Production Concessions (“Concesiones de explotación”). These concessions are also granted by the Autonomous Communities where the development activity will be carried out, except when operations affect to the territory of several Autonomous Communities in which case the Ministry of Industry is the competent authority. These exploitation concessions enable their holder companies to carry out the extraction of hydrocarbons. These concessions should include a general plan of operation and dismantling containing also an environmental plan covenant.

The above authorizations and permits are standard in most of the petroleum industry around the world, and the Spanish hydrocarbon legislation does not differ substantially from others. However, the activities of extraction of shale gas are also subject to other environmental standards and local town planning issues.

Introduction: Existing Shale Gas activity in Spain, the setting up of an industry

Spain is almost totally dependent on imports for its crude oil and natural gas requirements, other than for some gas production mostly in the Gulf of Cadiz (Poseidon field) and minor quantities on shore on the Guadalquivir valley, representing in total some 0.17% of the country requirements, and some crude oil production offshore in the Mediterranean (Casablanca and Boquerón fields) and also minor quantities onshore in Spain´s first oil field discovery (Ayoluengo field), covering in total about 0.14% of the country requirements.

Since that first commercial discovery in 1964 several other hydrocarbon prospects were identified some of which were put in production, such as the Serrablo and Gaviota gas fields (in the Pyrenees and offshore the Basque country respectively) now used as underground gas storage, and the Amposta oil field, offshore Tarragona, which has also been converted to gas storage and should come on stream in the very near future.

Recently there has been a marked increase in interest in oil and gas exploration in Spain, for conventional and unconventional hydrocarbon resources, as shown by the almost doubling of exploration licenses in the last 3 years. The areas subject of these recent licenses (see Annex I below) are the Asturias/Cantabria/Basque Country area, both offshore and onshore; north of the area of the first commercial discovery mentioned above; on the southern Pyrenees are; offshore the Ebro Delta area; on the Gulf of Valencia and on shore in nearby Castellon province; offshore Malaga and onshore near Tariff. A large part of these licenses appear to aim at the shale gas potential of the Iberian micro plate. However, the area offshore Fuerteventura and Lanzarote in the Canary Islands, also subject of recently approved licensing, is reported to have a potential an order of magnitude greater than the prospects in peninsular Spain.

In almost all of the Autonomous Communities/ regions (Basque Country, Cantabria, Asturias, Castilla y León, Castilla La Mancha, La Rioja, Navarra, Catalonia, Valencia, Aragon and Andalusia) where companies have requested permits to explore for shale gas, these have been granted by the Authorities.

Recently Spain joined the train of unconventional gas revolution. In Q4 2011 the local oil industry publications reported the existence of a “world-class shale-gas play” in the Basque country, in northern Spain. The announcement of shale gas resources in the Basque Country placed Spain in the Shale Gas map. There is speculation that the potential of the shale gas play found in Alava province could meet the needs of the Basque Country for sixty years (hence some comments in the regional press about energy independence) or in terms of the whole country, the gas requirements of Spain for around five years. With the strong support from the regional government and some North American exploration companies, Spain unconventional gas exploration industry is looking to grow up.

At present, HEYCO Energy Group through its subsidiary Petrichor Euskadi is to drill two wells to evaluate the Valmaseda Formation in the Cantabrian basin. Along with True Oil LLC, HEYCO has a joint venture with the Basque National Oil Company “SHESA” who is the project operator. The consortium is planning to drill vertical wells to do core analysis, complete suite of petro physical logs and micro seismic monitoring. The first two wells will be drilled and fracked between 2012 and 2013 in order to evaluate the prospect feasibility. HEYCO’s final decision to enter the Spanish market was justified on several grounds such as the support from the Spanish government in the way of favorable permitting terms, a very efficient tax structure that makes financially attractive long term investments.

The Exploration permits awarded up to now by the Spanish Government are as follows:

- EBRO A; located in La Rioja, awarded to SHESA,

- CAMEROS; located in La Rioja awarded to SHESA,

- ENARA; located in Burgos and Alava awarded to SHESA

- CAMEROS 2, located in La Rioja, awarded to OIL & GAS SKILLS, SA,

- EBRO B, C, D AND E; located in Burgos, Alava, an La Rioja, awarded to OIL & GAS SKILLS, SA,

- ARQUETU; located in Cantabria, awarded to TROFAGAS, and

- URRACA; located in Alava and Burgos, awarded to TROFAGAS and recently transferred to BNK Sedano Hidrocarburos, S.L.U.

Annex I details the terms and conditions applying to these permits.

In addition to these Exploration Authorizations, (“Permiso de Exploración”) and Exploration and Appraisal Permits (“Permiso de Investigación”) already granted, applications lodged by several companies for new exploration authorizations all over the Spanish territory are in place, but limited to one Autonomous Region, therefore granted by the Regional Government and thus not included in Annex, namely:

- MONTERO ENERGY CORPORATION SL. It isa subsidiary company to the Canadian company R2 ENERGY. It has applied for two hydrocarbon exploration and appraisal permits (“Permisos de Investigación”) to the Catalonian Government. The projects LEONARDO and DARWIN, cover an area of around 166,324Hectares that affects a territory of more than 90 towns in Lerida province. The Catalonia Regional Government has started a two months period in which interested companies in being awarded such permits can submit their proposals to the General Directorate of Energy and Mines of the Catalonian Government, following which the Catalonian Government will award the research permit to the best proposal. On November 24th 2012 an environmental organization “Ecologistas en Acción de Cataluña” submitted its allegations against the hydrocarbon exploration and appraisal permits awarded to Montero Energy Corporation. The arguments provided by Ecologistas en Acción were based mainly in environmental risks of the fracking techniques and the effects of the products used on the human health. Ecologistas en Acción requested the nullity to the application process due to the lack of information, and also requested the denial of the permits awarded and the extension for the prohibition of the fracking techniques to all the Catalonian territory.

- MONTERO ENERGY CORPORATION S.L. has also applied to the Valencia Regional Government for three exploration and appraisal permits (“Permiso de Investigación”) for shale gas deposits in l´Alt Maestrat. The projects named ARISTOTELES, PITAGORAS and ARQUIMEDES, cover an area of 195,569.5 hectares more than 40 municipalities in Castellon and the Valencia provinces.

TROFAGÁS HIDROCARBUROS S.L. a subsidiary of BNK PETROLEUM Inc. and MACQUARIE CAPITAL MARKETS CANADA LTD. has applied for another exploration and appraisal permit (“Permiso de Investigación”) for a project named ROJAS in the Burgos region, covering an area of 94,896 hectares.

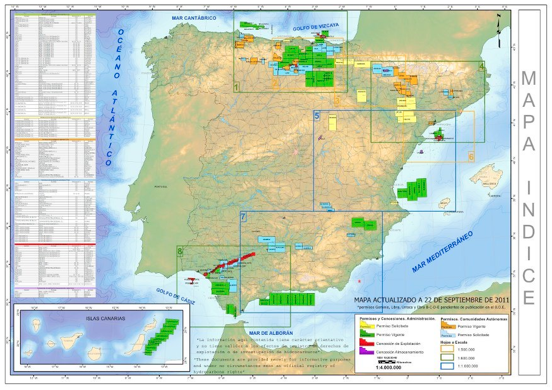

Map of the Exploration Authorizations, (“Permiso de Exploración”), Exploration and Appraisal Permits (“Permiso de Investigación”) and the Production Concessions awarded

The Town Planning Regime

The facilities for the operation of natural gas (both, conventional and/or non-conventional gas) must also comply with Town Plan Regulations.

In this respect, Section 5.3 of Hydrocarbon Act 34/1998 provides that: "The restrictions provided in the town planning or infrastructure planning affecting any exploration activities, research and extraction of hydrocarbons must be motivated". This means that those activities (exploration, appraisal, development and production of shale gas) are regulated in the instruments of urban, environmental and land planning, and if operations are restricted, such restriction shall be specifically justified.

Planning instruments affect the granting of exploration permits (“Permisos de Investigación”) and exploration authorizations as the land where operations are to be carried out, shall comply with planning legislation. The Hydrocarbons legislation is cross referred to the town planning legislation in the sense that it grants protection to applicants of permits and authorizations since any rejection of any such permit and authorization based on Planning Instruments shall be motivated.

The Environmental Impact Assessment Regime

Regarding the environmental assessment impact required for the valid granting of exploration and appraisal permits or production concession, the Law on Environmental Impact Assessment establishes on Group 2 letter d) of Annex I that the carrying out of environmental impact assessment is mandatory for operations with production estimation higher than 500.000 m3/ day of gas.

Moreover, Group 3 of Annex II on "extractive industry" (projects that are subject to Environmental Impact Assessment depending on the criteria of the environmental authority), includes deep-drilling projects, projects for the extraction of gas by means of surface industrial facilities, and shale gas extraction projects. Another characteristic that determines the need for an environmental impact assessment to be carried out is whether the operations require the existence of rafts with hazardous waste, or whether the facility requires the installation of gas pipes over 800 ml of diameter and more than 10 miles long, in which case it would fall within the aforementioned Annex I.

In any case, the Autonomous Communities may introduce different specification on their own Environmental Impact Legislation, including additional requirements and the obligation to submit an environmental impact assessment for the projects relating to activities with hydraulic fracking.

Spanish legislation addresses the environmental assessment on land occupation, water consumption, potential risk for the contamination of the land and groundwater by considering the impact and the preventive measures to be applied.

Existing regulation addresses potential risks that may arise during shale gas operations under the principle of environmental legislation "polluter pays".

Environmental Responsibility

Environmental responsibility is covered by Act 26/2007. The guiding principle of the Act is "polluter pays". This Act includes different Environmental damages: damage to water, soil damage, damage to the seashore and rivers and damage to flora and fauna. However, it excludes air damage and damage to people that is covered by other legislation.

The Act distinguishes two types of Environmental Responsibilities: Strict liability and Subjective liability.

“Strict liability”. Those who perform activities listed in Annex III, including: waste management (Annex III, paragraph 2); direct or indirect discharges to the groundwater or surface water which is subject to authorization (Annex III, paragraph 4); manufacture, use, storage, processing, release into the environment and transport "in situ" of hazardous substances as defined in Article 2.2 of RD 363/1995. (Annex III, paragraph 8.a) can be liable for strict liability. In strict environmental liability situations, the operator is subject to adopt preventive measures / avoidance / repair and communications. For environmental damage to occur and liability to arise, it is not necessary the concurrency of error, negligence, gross negligence or willful misconduct of the operator. Moreover, the compliance with the terms and conditions imposed by the authorization to operate or the production concession, does not exclude the liability of the holder of the authorization. In addition, operator environmental liability is not exempted even if the operator has taken the necessary preventive measures. However, if the damage is caused by a third party’s action or as a consequence of a mandatory instruction, the operator is entitled to recover the cost for repairing the environmental damage by means of claims to be filed either against such third party or to the Authority.

The other type of Environmental liability is the “Subjective Liability”. Operators that perform activities not included in Annex III of the Act, including damages to soil and water are subject to subjective liability. The concurrence of error, gross negligence or willful misconduct of the operator is required for subjective liability to apply. In addition, the operator shall also take prevention, avoidance and reparation actions. In the event that there is no error, gross negligence or willful misconduct on the operator, then he is not liable, however, prevention and avoidance measures are still imposed on him.

In any of the two cases, the Environmental responsibility can also be switched into administrative and/or criminal liability.

In addition, the permits or other authorizations or concessions for the development of shale gas projects require the establishment of different types of guarantees such as: financial guarantees to be posted by the operator, insurance policies or even placing security or technical reserves by means of the constitution of contingency funds. In addition, there is also a State fund devoted to cure damages suffered caused by shale gas operations.

Water Regime

Shale gas operation can cause environmental damages on water. Damages to water are regulated by Royal Decree 1/2001 approving the Water Act, and by Royal Decree 849/1986, which approves the Regulation of Public Water. The main features of the water legislation as to shale gas operations are as follows: (i) the exclusive use of public water for industrial consumption is subject to a payment fee (Articles 59, 60 and 112 of the Act “Canon del Agua”); (ii) a prior authorization is needed for both the transfer of water by truck to the operating facility and the building of an hydraulic work (i.e. water storage) (section 122 et seq.); (iii) as to the wastewater management, the underground injection is considered an indirect discharge (art. 245); (iv) for the treated water to be reused, it is necessary the construction and installation of a sewage treatment plant (art. 122 and following).

The penalties for noncompliance of the requirements established by this legislation can result in fines from € 10,000 to € 1,000,000.

Soil and Waste Regime

Shale gas operations can also cause damages to the soil. Spanish soil and waste legislation is as follows: (i) Act 22/2011, of 28 July, of Waste and Contaminated Land, and (ii) Royal Decree 9/2005, of 14 January, whereby potential soil polluting activities are regulated. The Spanish legislation establishes that if those substances (sodium borate, potassium) were considered hazardous waste its use should be authorized and it would require the submission of a communication to the environmental authority of the Autonomous Community before the beginning of the activity and the use of them.

Some of the soil and waste management obligations imposed by the above mentioned legislation are: (i) to produce waste treatment, or even to subcontract its management to a waste collection company (Section 17 of Law); to communicate to the environmental authorities any relevant information relating to the disappearance, loss or escape of hazardous waste in the operation. The Act also regulates the need of a risks minimization study (Section 17.6 of Act 22/2011), the subscription of financial guarantees or the hiring of insurance to cover the liability of any potential risk (Section 17.7 of the Act) and the obligation to keep waste stored in hygienic and safety conditions.

The extraction of natural gas is a potential contaminating activity as considered by Annex I of Royal Decree 9/2005). The holders of potential polluting activities must submit a report to the Autonomous Communities with a description of the situation of each of the soil where the activity is to be developed (Section 33 art.3 of Act 22/2011 and Royal Decree 9/2005). In the event of potential contamination of soil, the law contemplates some obligations as to the cleaning and recovery of the soil (Section.34 of Act 22/2011), the performance of decontamination operations (Section 36 of Act 22/2011); under certain circumstances resulting in the imposition of fines, the obligation to compensate damages and reparation obligations (Sections 47, 54 and 55 of the Act). The polluters are obliged to carry out the remedy activities.

Noise Regime

Likewise, shale gas operations may create noise levels above the authorized thresholds. In particular, shale gas operations shall also address the noise created by both trucks and drilling. Noise production is regulated by the following legislation Act 37/2007 of Noise, Royal Decree 1367/2007, of October 19 implementing Act 37/2007, Royal Decree 1513/2005, of 16 December, which implements Act 37/2003, of 17 November, of Noise, regarding the assessment and management of environmental noise and Royal Decree 212/2002, of 22 February, which regulates noise emissions to the environment due to outdoor machinery. There are also applicable regional and local regulations.

Act 37/2007, regulates the prevention of noise and the monitoring and reduction of noise pollution. As established by Act 37/2007, any new facility should take measures to avoid the transmission to the environment of noise levels exceeding the limits established (Art.24 of Royal Decree 1367/2007). In addition, the production of noise above the limit values is considered a very serious violation and will result in the imposition of fines from € 12,001 to € 300,000 and the possible revocation of the Environmental Impact Assessment.

Conclusion

From the analysis of the applicable legislation regulating the various potential impacts that may occur in shale gas operations, it is reasonable to argue that the possible environmental pollution that can be caused due to shale gas operations can be controlled and managed in a manner that respects the environment (soundproofing, waste management, order sealing operation and restoration of the land). In addition, since it is a fully regulated activity, Spanish legislation provides detailed legislation that regulates the prevention of potential impacts or accidents, and remedies and fines on damages caused due to shale gas operations.

About the Authors

Javier Lasa is a partner in Salans' Madrid office and co-head of the Global Energy and Natural Resources Group., Javier has over 20 years of experience advising energy and renewable energy companies in relation to "take or pay" contracts for the purchase and supply of natural gas and LNG, drafting energy conversion agreements, EPC contracts for gas infrastructures, in regulatory affairs: ATR matters - third-party access - (regulation, transport and storage) and access conflicts handled by the National Energy Commission. He has also advised numerous clients on matters relating to the natural gas distribution, tender procedures for the award of licenses, administrative and judicial proceedings in relation to authorizations for natural gas distribution and administrative and judicial proceedings in relation to the challenge of regulatory rules. Leading international directories such as The Legal 500 EMEA 2012 recommended Javier’s energy practice. The USA directory Best Lawyers 2013 recommends him as one of the leading banking and finance and administrative law lawyers in Spain. E: jlasa@salans.com T: +34 91 43 63 325 (Madrid) F: +34 91 43 63 329

Salans LLP, Fraser Milner Casgrain (FMC) LLP and SNR Denton are combining to create a new global law firm driven to give its clients a competitive edge in the world’s largest legal markets. The new firm will know as Salans FMC SNR Denton

José Ignacio García Bielsa, MSc Mining Engineer. MBA (IESE) is Gas Power Consulting (GPC) . José Ignacio has over 20 years of experience in the energy and industrial sector. He was General Manager for Spain and Portugal within the German power group RWE (RWE Trading GmbH and RWE Solutions AG) for 9 years, responsible for the development of their electricity and gas business in Spain and Portugal. He also supervised and negotiated acquisitions for RWE. José Ignacio held a membership position in the Technical Advisory Committee of SEDIGAS (Spanish Gas Association) and was founding member of ACIE (Independent Electricity Distribution Companies Association) E. jigbielsa@gaspowerconsulting.com

Gas Power Consulting (GPC) is an international consulting Firm in the energy field, particularly in matters of gas and electricity, and whose core mission is to deliver business as well as commercial and technical advisory services. GPC was established in 2011 by a group of professionals with extensive experience in the energy sector.As to the gas sector, GPC assists clients in the global overview of the Gas sector in any country all around the world, covering all related topics such as Regulation-Legislation, Liquefaction-Regasification facilities and assets, Transport, Distribution, Trading, Pricing, sale to end users, Gas-Gas arbitrage, Power-Gas arbitrage.