Japan: nuclear policy to dent LNG demand [Gas in Transition]

The recovery of Japan’s nuclear power sector since the Fukushima accident on March 11, 2011 has been glacially slow and punctuated by setbacks.

17,128 MW of reactor capacity was written off in the aftermath of the accident, leaving 33 potentially operable reactors with 31,679 MW of capacity. The country also had two reactors under construction and a sizeable slate of planned plants. However, for about four years after the accident Japan had no operating reactors.

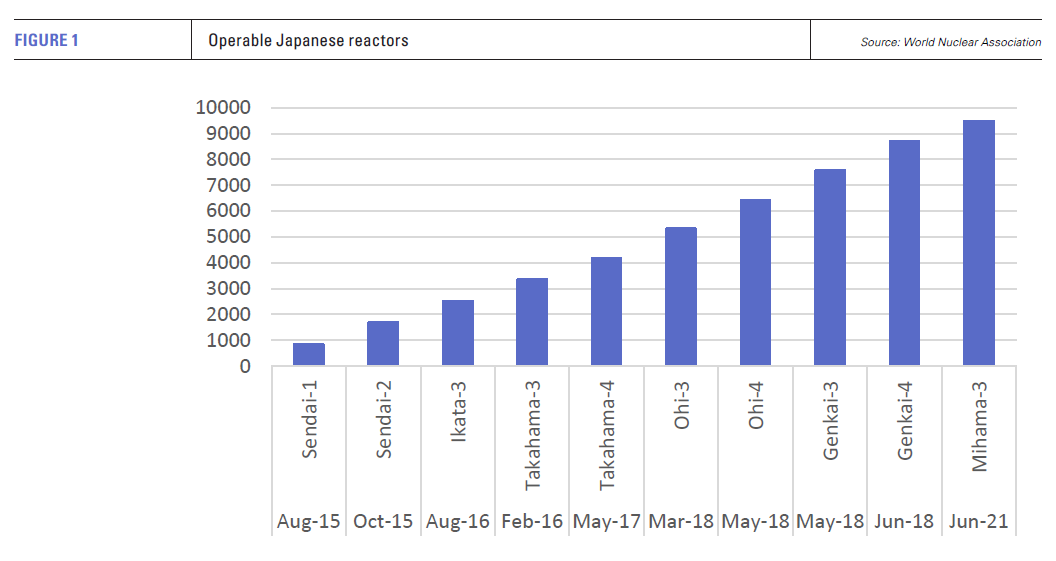

The first unit to resume operation after clearance from the Nuclear Regulation Authority (NRA) was Sendai-1 in August 2015. That was followed by Sendai-2 in October 2015, then two more in 2016, one in 2017 and four in 2018. There was then a gap until Mihama-3 restarted generation in July 2021.

These units, with total capacity of 9,486 MW, represent only 30% of the potentially operable capacity. The percentage of total electricity output produced by nuclear plants is just 6-7%, compared with almost a third at the time of the Fukushima accident.

While most of the remaining 23 potentially operable reactors have sought NRA approval to resume operation, progress has been extremely slow. The process has been hamstrung by protracted and increasingly complex regulatory requirements, as well as political and popular opposition at local level – where approval for restarts has to be secured.

Moreover, much of the operating and potentially operating capacity is relatively old, given that their licences cap reactors’ operating life at 60 years.

With the two plants under construction and those at the planning stage in limbo, Japan’s nuclear industry appeared to be in terminal decline. Indeed, at one stage, Tokyo aimed to phase out all nuclear generation by 2030.

Policy shift: nuclear returns to favour

However, without nuclear power, the country’s 2020 commitment to reduce greenhouse gas emissions and achieve carbon neutrality by 2050 is all the more challenging. In addition, concern over the security of fossil fuel imports has been heightened by the war in Ukraine and volatility in international energy markets.

Japan’s long-standing search for energy independence has consequently gained a new urgency and this has been reflected in the election of a number of pro-nuclear politicians and a more widespread renewal of support for nuclear power.

As a result, in July last year, Prime Minister Fumio Kishida announced a radical shift in policy. This stipulates that regulatory clearances for reactor restarts should be fast tracked, the operating life of reactors extended beyond 60 years, and about 20 existing reactors replaced with advanced nuclear plants on their decommissioning.

These changes will be implemented within the wider Green Transformation (GX) programme. Implementation of one of the main measures occurred in December 2022, when the NRA approved new rules allowing reactors to operate beyond 60 years, premised on a 30-year initial operating life, which can be extended through 10-year reviews. All the policy changes were approved by the cabinet in early February.

The new nuclear policies have come at a time when political and popular opposition to nuclear restarts continues to weaken. Opposition has declined in many localities because of sharply rising electricity prices, the threat of power shortages during the summer peak period in 2022, and concerns about national energy security.

Skills shortages a problem

Putting in place the mechanisms to implement the new nuclear policies has occurred at a relatively fast pace by Japanese standards. But it remains to be seen how quickly this translates into additional nuclear generation. The chairman of the NRA cautioned in September 2022 that it would be difficult to fast track all 23 of the remaining potentially operable reactors in one go.

It is now planned that seven reactors will enter commercial operation from summer 2023, according to the Japan Electric Power Information Centre’s 2023 Electric Power Industry Report. The seven reactors have 10,180 MW of capacity and were already at an advanced stage in the regulatory process in mid-2022.

These will be followed by another ten, so that the total number of operating reactors will amount to 27 in the financial year to March 2031 (FY30/31).

One of the main reasons for back-pedalling on a faster approach to the reactor restart programme is the lack of experienced staff. After more than a decade of constrained nuclear operations and very limited development activity, the skilled personnel needed to operate the reactors and undertake the regulatory and system activities underpinning the operation of the plants is in short supply.

The shortage of experienced staff - and in some cases of manufacturing facilities - equally applies to the production of some of the equipment needed to restart reactors mothballed for over a decade, as well as to the development of the new nuclear plants incorporating advanced technology that are intended eventually to replace existing capacity. The number of engineers with experience of manufacturing nuclear equipment has fallen by 45% since 2011, according to data from Japan’s Electrical Manufacturers' Association.

Nuclear renaissance prospects

There is very little likelihood that new reactors based on advanced technology will enter commercial operation in the current decade. But the picture is different for the restart of existing reactors.

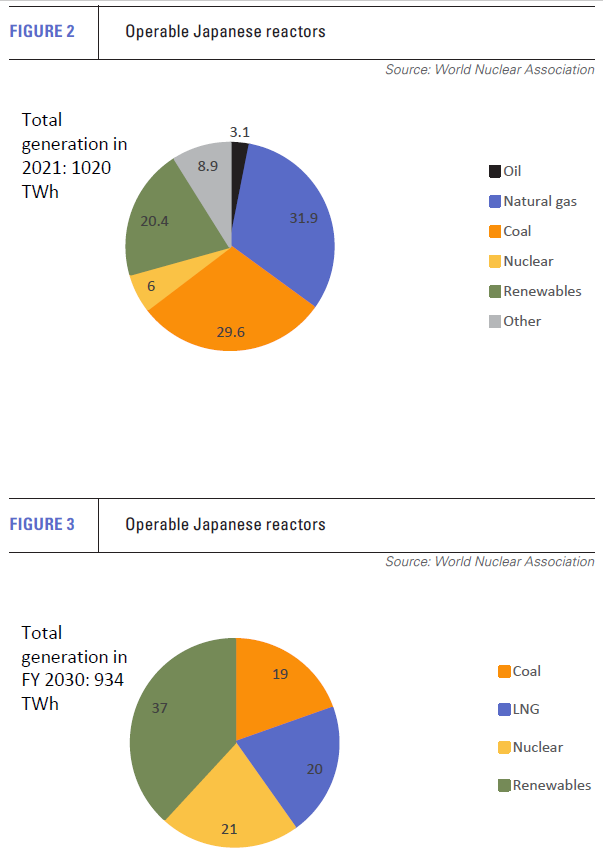

It is feasible that most of the potentially operable reactors could be in service by the end of the decade, if the industry’s personnel and manufacturing issues are resolved, and if the new regulatory rules and reduced local opposition are maintained. If 27 reactors are operational by FY30/31, the government’s target of generating 20-22% of electricity from nuclear plants in that year could well be achieved.

The 20-22% target is included in Japan’s Sixth Strategic Energy Plan, which was released in 2021. The plan envisages that energy conservation measures will result in a continued downward trend in electricity generation, which fell from 1,104 TWh in 2011 to 1,020 TWh in 2021. Total output is projected to fall to 934 TWh in FY30/31, implying nuclear generation of 187-205 TWh – quite feasible if 27 reactors are then operating.

Impact on LNG demand

This would necessarily have an impact on gas and thus LNG demand as almost all of Japan’s gas is imported as LNG. The electricity sector accounts for about 65% of Japanese gas use, according to the Japan Gas Association. Conversely, gas was the largest single contributor to Japanese electricity generation in 2021, producing about a third of the total.

.png) However, the Sixth Plan envisages that gas will account for only 20% of total generation in FY30/31, implying production of about 187 TWh – near half of the 355.2 TWh generated in 2021. Coal use is projected to fall by a similar amount, accounting for 19% of total output in FY30/31, compared with 29.6% in 2021.

However, the Sixth Plan envisages that gas will account for only 20% of total generation in FY30/31, implying production of about 187 TWh – near half of the 355.2 TWh generated in 2021. Coal use is projected to fall by a similar amount, accounting for 19% of total output in FY30/31, compared with 29.6% in 2021.

The big winner, unsurprisingly, is expected to be renewables, which are forecast to account for up to 38% of total electricity output in FY30/31, compared with just over 20% in 2021.

The clear implication is that LNG use in power generation will fall significantly by the end of the current decade. The impact on LNG consumption may be compounded by the fact that more of the output will be produced from highly-efficient plants. This could include the 6,000 MW of new gas-fired generation that in late 2022 was proposed by Tokyo for construction with government support by FY30/31.

Data on LNG use by Japanese generators is somewhat opaque, but it is estimated that the sector used about 72bn m3 of gas in 2020 to generate 355.2 TWh of electricity. So the amount of gas needed in FY30/31 to produce just over half that amount would, after efficiency gains, be in the region of 35bn m3.

Even allowing for some growth in city gas use, total Japanese gas use would thus be about 75bn m3 in FY30/31, compared with just under 100bn m3 (72 million mt) in 2022.

Forecast uncertainties

While the outlook for LNG demand may appear bleak, it should be borne in mind that the projections are just that - projections. For instance, coal is the most logical fossil fuel to be displaced by new nuclear output, both in terms of its higher greenhouse gas emissions per unit of output and its use primarily for baseload generation. If the relative price of LNG and coal narrows, the latter’s use may be overestimated compared with LNG, especially as the GX proposals include the eventual introduction of carbon pricing.

Achieving the nuclear target of 20-22% of the 934 TWh total in FY30/31 is also far from guaranteed. It could fall well short as a result of a change in government, and especially if public sentiment changes as a result of even a minor nuclear incident.

Japan has already witnessed a significant fall in LNG imports – deliveries decreased from 121.8bn m3 in 2014 to under 100bn m3 in 2022. Nonetheless, even if the implied further fall in gas demand out to FY30/31 does occur, it will remain a large market for LNG. Moreover, while nuclear power may be back in the ascendant at the moment, if the industry experiences renewed problems then gas and LNG demand could well bounce back.