Japan: future uncertainty, but potential upside [LNG Condensed]

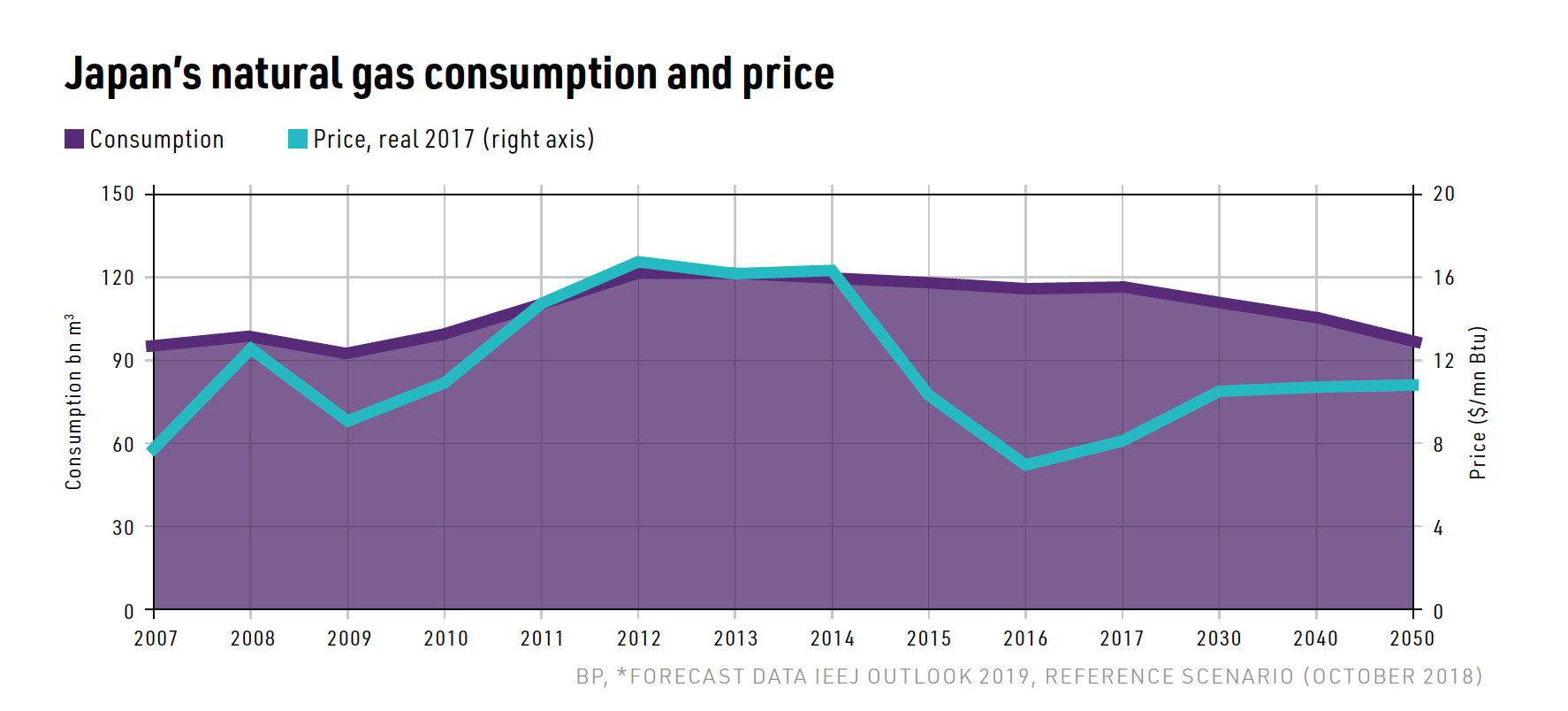

Japan is by far the world’s largest single LNG importer and has been the undisputed titan of the Asian LNG market for decades, its policies determining everything from industry investment models to contract terms and prices. So the projections in a recent study by the Institute for Energy Economics Japan (IEEJ) make for sober reading. Not only does the IEEJ Outlook 2019 project thatJapanese gas demand -- all supplied by LNG – will fall in absolute terms from 117 bn m3 in 2016 to 96 bn m3 in 2050, but Japan’s share of overall Asian gas demand will plummet from 18% to 5.5% over the same period.

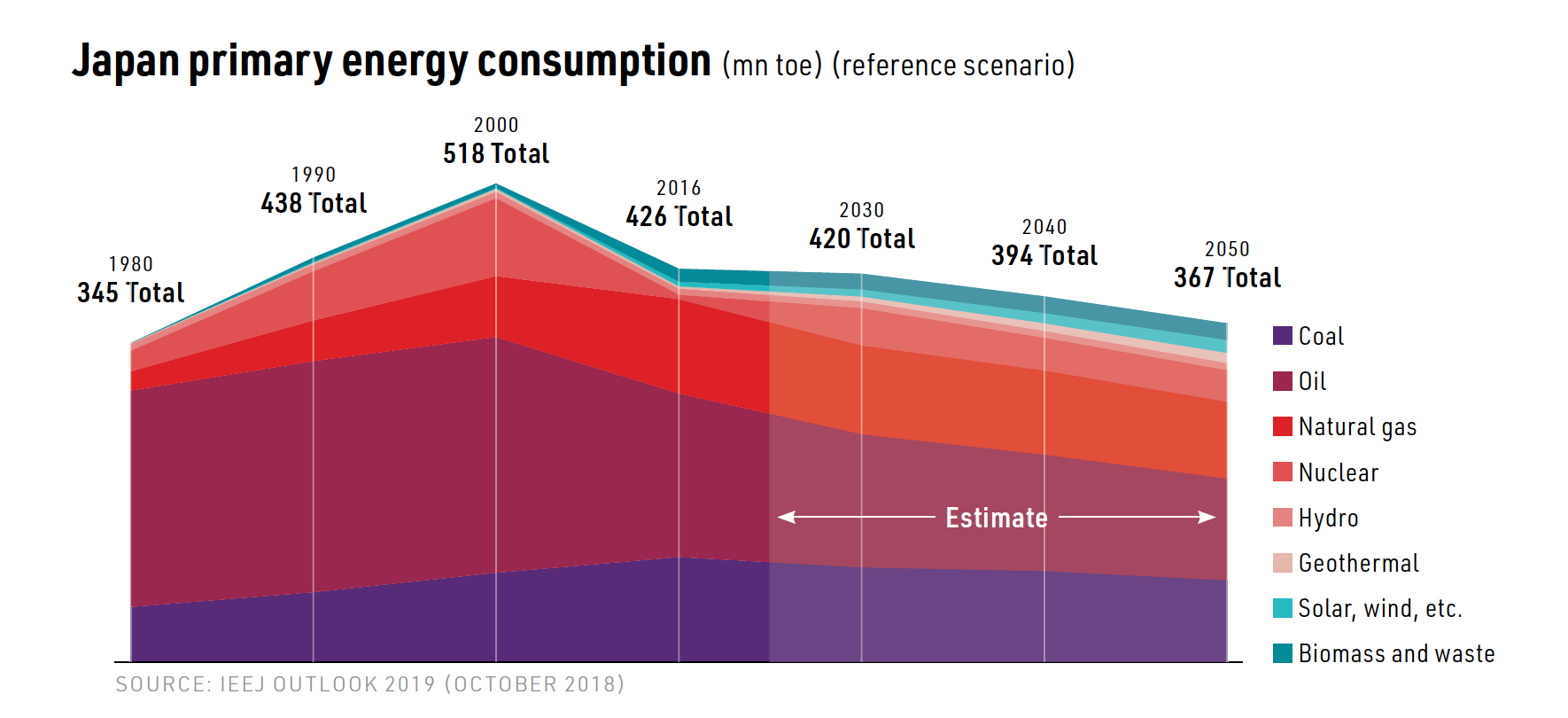

The base year for the projections is 2016, when almost all Japanese nuclear reactors were out of action, following the 2011 Fukushima nuclear disaster. Gas-fired power generation was thus atypically high. But this accounts for only part of the projected fall in LNG demand. Other factors include the expectation of muted economic growth, the government’s emphasis on energy efficiency and supply diversification, and the impact of coal, renewables and nuclear generation on gas-fired electricity output.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The IEEJ’s projections concur with most other analyses as well as government policy. The latest version of the Strategic Energy Plan, prepared by the Ministry of Economy, Trade and Industry (Meti) and approved by the cabinet in July 2018, envisages gas and other fossil fuel use in 2030 being squeezed by stringent energy efficiency measures combined with minimum shares of 22-24% for renewable and 20-22% for nuclear electricity generation.

Moreover, the projections chime with the fall in gas demand and LNG imports in recent years as several nuclear reactors resumed operation. The latest BP Statistical Review of World Energy indicates Japanese gas consumption fell from a peak of 122.4bn m3 in 2012 to 117.1bn m3 in 2017. The trend continued in 2018 when LNG imports fell to 82.85mn metric tons (112.7bn m3), according to Ministry of Finance data.

Modest growth

There is little question Japanese economic growth and thus energy demand will grow modestly by regional standards. The IEEJ projects GDP per capita will grow by 1.3%/yr from 2016 to 2050. But with the country’s population projected to fall from 127 to 108 million over the period that translates into GDP growth of only 0.8%/yr, resulting in a 0.4%/yr decline in primary energy consumption.

Based on the projections of slow economic growth and population decline, and with most energy-intensive industry now located offshore, the IEEJ’s projection that gas use in final energy consumption will grow by only 0.8%/yr from 2016 to 2030 and decline thereafter seems reasonable.

More uncertain are the projections regarding power generation. The IEEJ forecasts that the sector will use little more gas in 2050 than pre-Fukushima. This is based on overall electricity generation growth of only 0.2%/yr from 2016 to 2050, which is low given GDP growth is projected at 0.8%/yr. It also assumes fuels other than gas will contribute the lion’s share of generation.

Coal

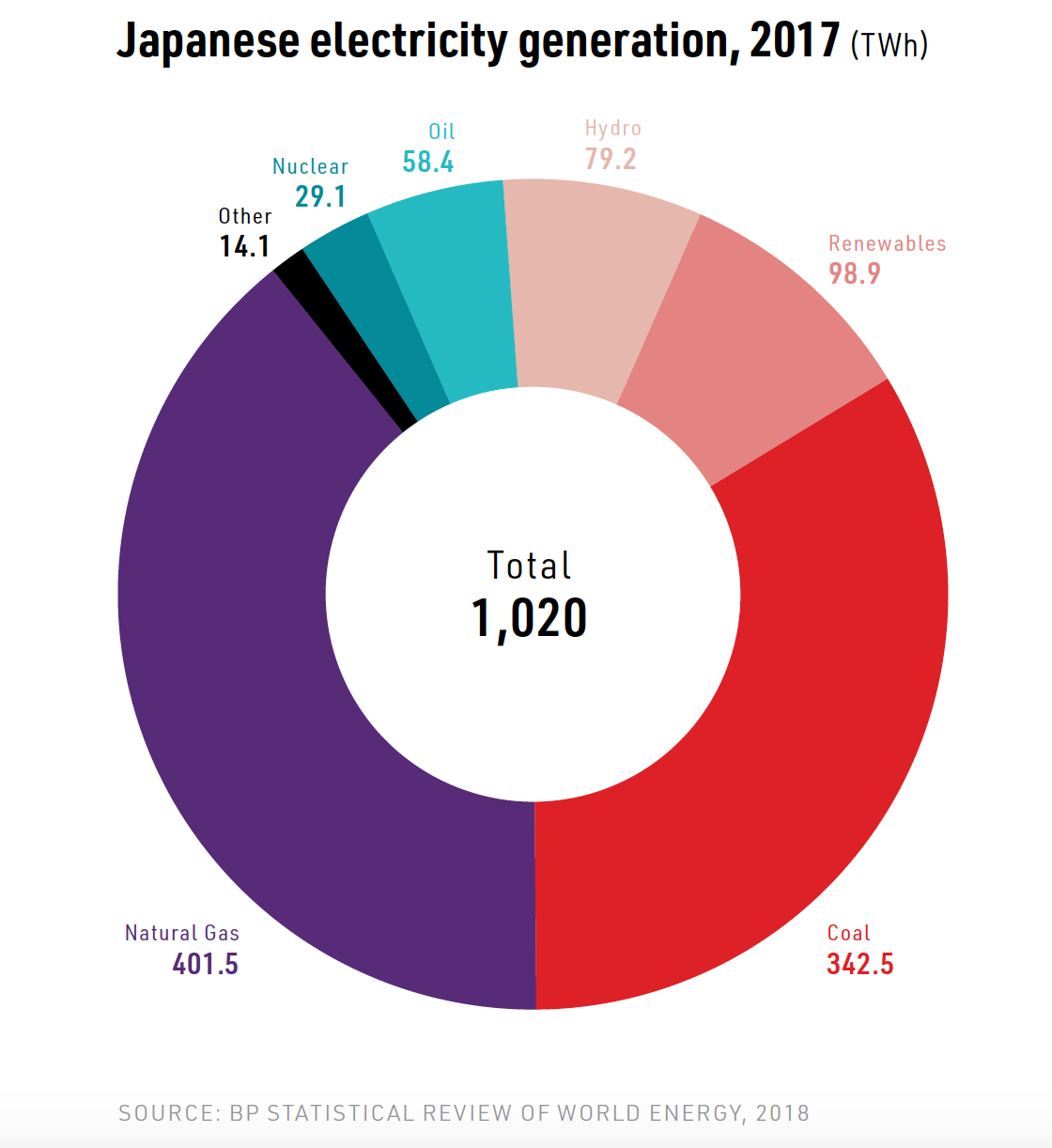

Coal forms a key part of Japan’s power mix. Driven by cost and diversification concerns, the fuel’s share of total Japanese generation rose from 14% in 1990 to 27% in 2010. The 2011 nuclear disaster led to a further rise, with coal accounting for a third of all generation by 2017.

Almost 47 GW of coal-fired capacity was operational at end 2018, half of it commissioned after 1998, while there are plans to build a further 16 GW or so of capacity. The IEEJ thus projects that, while coal-fired generation will gradually decline, it will still account for 26.5% of total generation in 2050.

However, environmental opposition to coal power in Japan has increased in recent years, including a vociferous campaign to close all coal-fired plants by 2030. While this may not gain traction in the near term, the opposition to coal has led to backpedalling on many new projects. In January, a 1.1-GW coal-fired project in Chiba Prefecture was scrapped, while in February a 2-GW project at Sodegaura was dropped.

Even if the campaign to bring forward the closure of coal-fired capacity is unsuccessful, large tranches of plant are due to retire from the late 2030s. With few replacement projects making progress, that could necessitate a substantial increase in gas use at that stage.

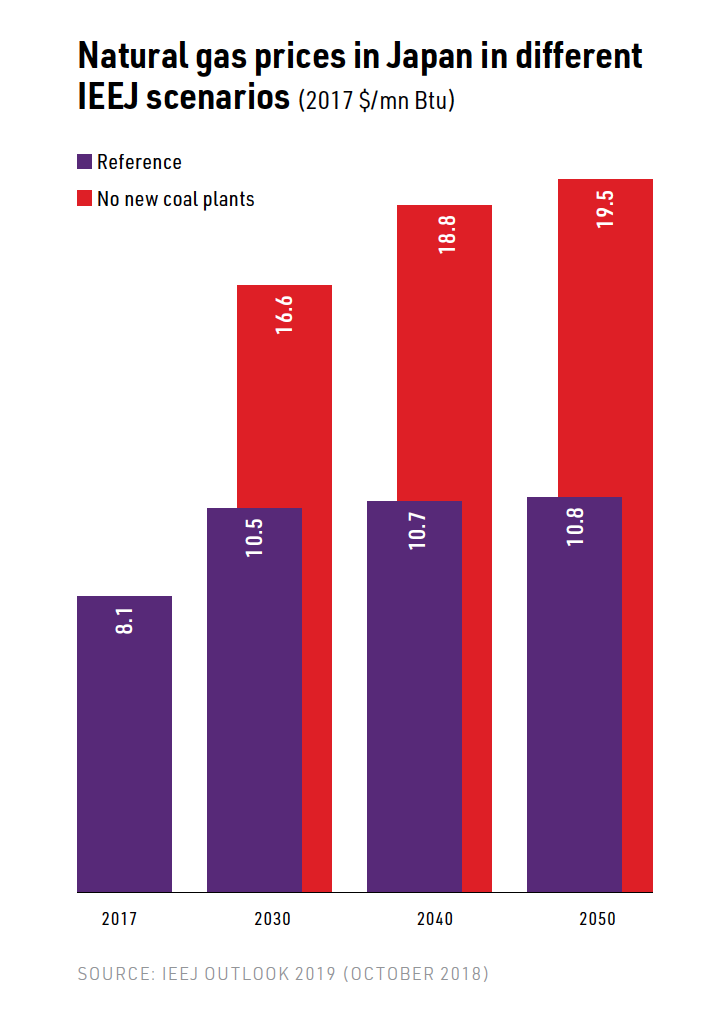

While this is some way off, the IEEJ flags up a nearer-term concern regarding wider opposition to new coal-fired plants. In the event that no new coal-fired plants are built worldwide, it projects that much more gas-fired generation would be needed, resulting in a sharp increase in traded gas demand and prices. The IEEJ’s “no new coal” scenario envisages the Japanese gas price could be two-thirds higher in 2030 than in the reference scenario.

Renewables

On top of the possibility that coal-fired plant may close earlier than planned, the substantial growth envisaged in solar photovoltaic and other renewable capacity is another major uncertainty. The 22-24% share of renewables in generation targeted for 2030 is not massively higher than the present 15%. But with few new hydroelectric sites available, meeting the target will require more wind and especially solar capacity.

That in turn will depend on the purchase price renewables can achieve. The provision of high feed-in tariffs in July 2012 led to a surge in renewable plant in Japan, with solar PV capacity reaching almost 50 GW by the end of 2017.

But the increase was expensive. In mid-2018, Meti observed that the power purchase costs of reaching the 22-24% target were originally estimated at Yen 3.7-4.0 trillion ($33.4-$36.1 bn). However, it added that the cost was already expected to reach Yen 3.1 trillion in the year starting April 2018, requiring “drastic revisions” to renewable purchase prices. Subsequent reports suggested feed-in tariffs will more than halve in the 2020s.

Changes have already been made, including moves to cut feed-in tariffs on delayed projects and competitively tender large plants. But the auctions held to date have not significantly reduced power purchase prices. There is thus a large question mark over how much new solar and wind capacity will be built and what contribution renewables will make to reducing fossil-fuelled generation in the 2020s and beyond.

Nuclear

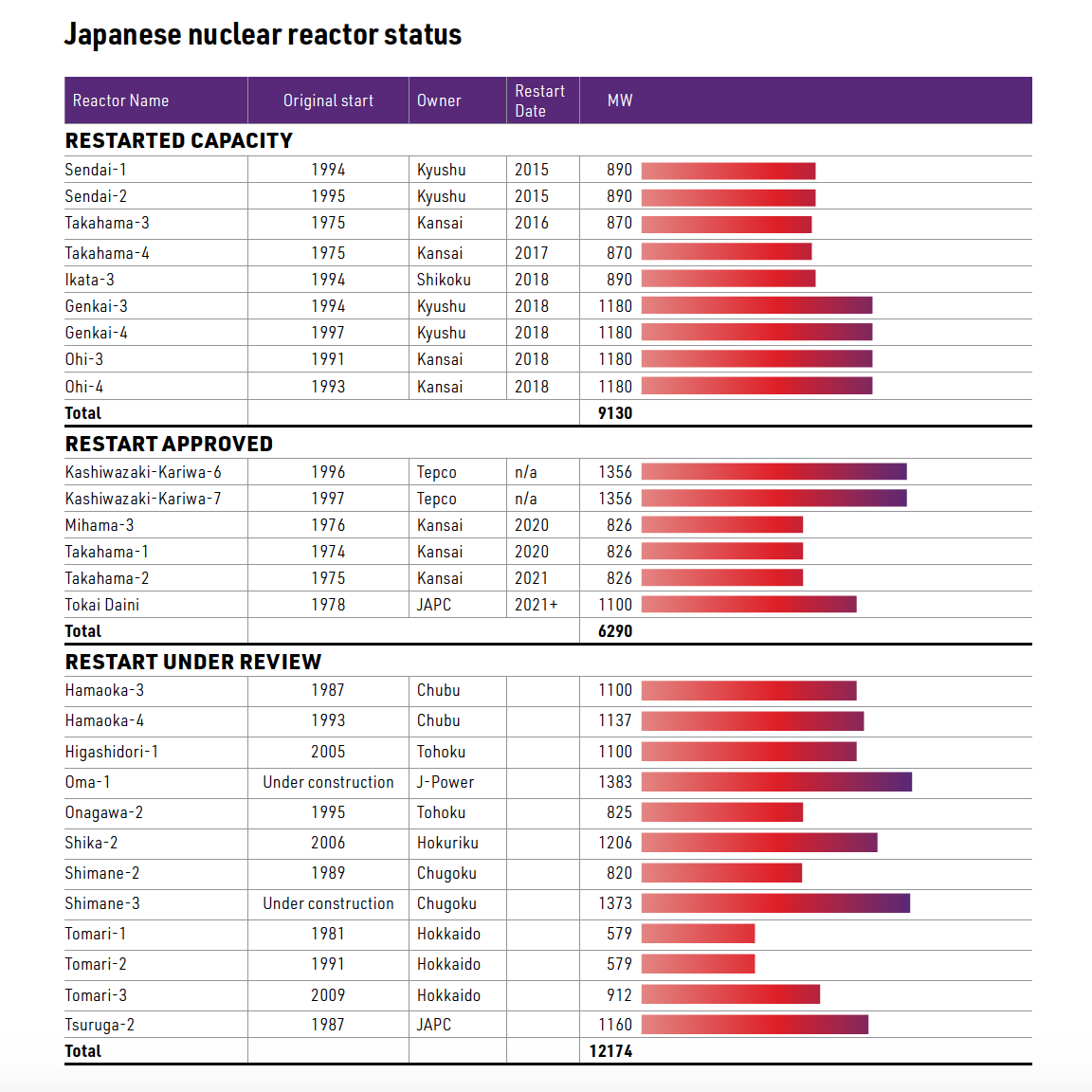

The greatest near-term uncertainty regarding gas-fired generation is the number and timing of nuclear reactor restarts. By the beginning of 2019, nine reactors with 9.13 GW of capacity had restarted operation, five of them in 2018. Six more reactors with 6.29 GW of capacity have secured regulatory approval to restart, while the restart of 12 reactors with 12.2 GW is under regulatory review.

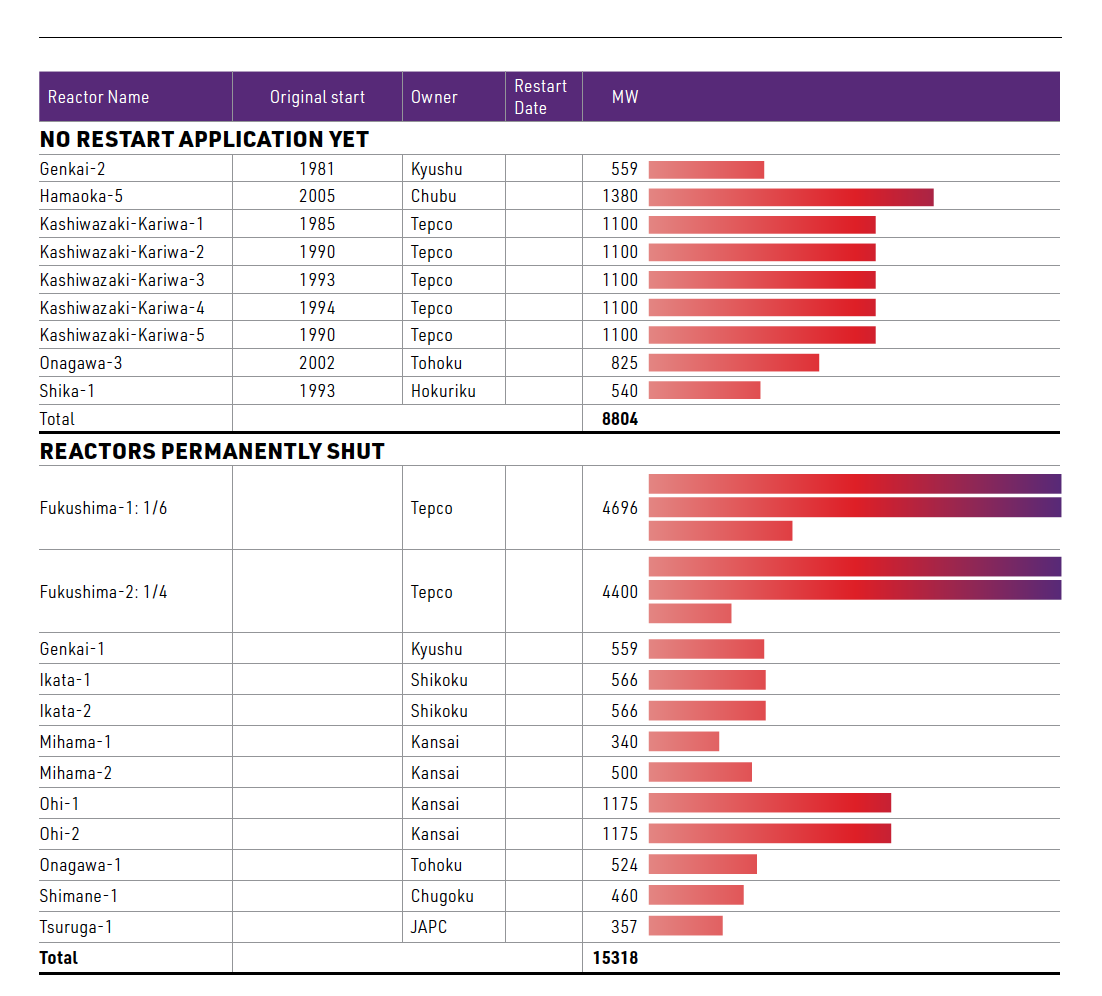

Some 27.6 GW of capacity could thus return to operation, with a further nine reactors with 8.8 GW of capacity yet to apply. The other reactors formerly operating in Japan have been closed. Permanent closures total 15.3 GW of capacity.

To reach the 20-22% nuclear output target for 2030, the 27.6 GW of capacity and some plants yet to apply to restart would have to be operational. However, reactor restarts have proceeded more slowly than envisaged. For instance, in February, Kansai Electric said operation of its three reactors which have been approved to restart would be delayed by up to ten months, to between 2020 and 2021. It is unclear if any approved reactors will restart in 2019.

The issue is not simply one of schedules slipping, but continued opposition to nuclear power and reactor restarts. This was one of the main reasons why half the respondents to a 2018 survey of nuclear sector companies questioned the feasibility of the 20-22% target. The IEEJ seems to share their view, since its reference scenario projects only 13.5% of electricity generation coming from nuclear plants in 2030.

Upside potential

Japan’s LNG requirements in the 2020s and beyond will be determined by a combination of factors. For instance, if the 20-22% nuclear target were met and electricity output grew at the rate projected by IEEJ, gas and coal-fired plants could lose some 70 TWh of generation to nuclear in 2030 -- with each 5-6 TWh lost by gas-fired plants broadly equivalent to 1bn m3 of LNG.

That said, it seems more likely gas demand and LNG imports will be higher than projected. If electricity demand grows more strongly than expected, persisting high costs constrain investment in renewables, and environmental opposition results in coal plant closures and fewer reactor restarts, gas demand could rise well above past – and projected -- levels.

If electricity generation grew 0.8%/yr from 2016 to 2030 rather than the projected 0.5%/yr, fuel would be needed for an additional 50 TWh in the latter year. And operation in 2030 of only those reactors with approved restarts could reduce the IEEJ’s projected nuclear output by more than 40 TWh. As a result, the future decline of Japanese LNG demand may not

Download this article and many others by subscribing to LNG Condensed ↓

_f193x247_1552386214.jpg) LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

LNG Condensed brings you independent analysis of the LNG world's rapidly evolving markets.

Covering the length of the LNG value chain and the breadth of this global industry, it will inform, provoke and enrich your decision making. Published monthly, LNG Condensed provides original content on industry developments by the leading editorial team from Natural Gas World.

LNG Condensed is your magazine for the fuel of the future. Sign Up Free below:

Volume 1, Issue 2 - February 2019

> Japan: future uncertainty, but potential upside

> Which ship engine should a new ship owner shoot for?

> Argentina to join LNG production club

> Poland’s 2040 energy plan provides key role for LNG

> LNG Canada — a game changer for Canada’s gas industry

> Conference Report: EGC Vienna

and more!

Sign up now to receive LNG Condensed monthly FREE