Ithaca Buys Rest of UK Stella Area

Aberdeen-based Ithaca Energy, which is wholly-owned by Israel's Delek Group, is buying out its partners in the UK Greater Stella Area (GSA) licences and its floating production vessel, it said August 24. The deal adds over 20mn barrels of oil equivalent (boe) to its proven and probable reserves base.

Ithaca will buy out Dutch Dyas and UK-based international contractor Petrofac from the Greater Stella licences in the central North Sea (see table below) and the FPSO. It said: "The acquisition materially increases the company’s production and reserves base, while simultaneously delivering full control and flexibility over the long term development of the GSA production hub."

The deal is backdated to January 1, so production for this year is forecast to increase by about 50% to 22,000 boe/day, with pro-forma 2018 unit operating costs forecast to reduce to about $18/boe. The transactions are expected to complete around the end of 2018 and are subject to customary regulatory approvals.

In aggregate, the transaction consideration reflects payments associated with the acquisition of the assets of $190mn and a revision and rescheduling of Ithaca’s existing $140mn deferred payments to Petrofac following work on the floating production platform; and its own accrual of associated capital allowances. Ithaca also foresees revenues from third-party use of the platform, such as from the Vorlich field, of which it owns about one third.

Ithaca will pay $130mn up front, net of estimated interim period cashflows of $80mn, plus deferred payments of $120mn between 2020 and 2023. Dependent on the future performance of the Stella and Harrier fields, Petrofac also has the opportunity to earn up to an additional $28mn by 2023. The transaction is to be funded from an increased and extended reserves based loan.

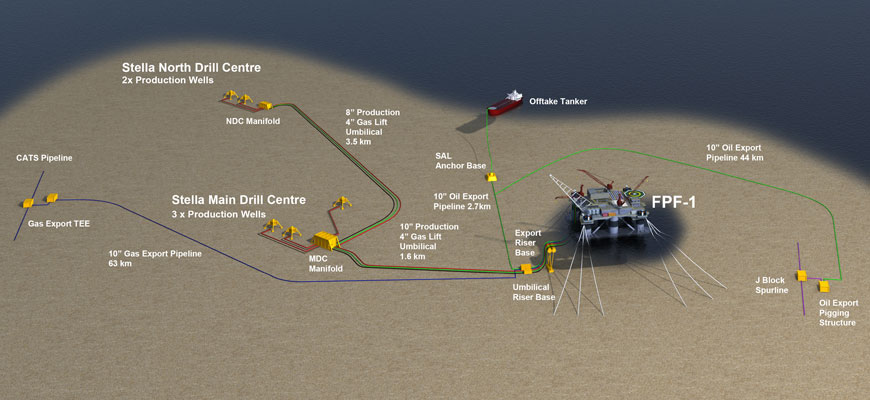

The transaction involves the acquisition of all Dyas’ and Petrofac’s interests in the licences in the table below; and each company’s interests in FPF-1, the company that owns the FPF-1 floating production facility (see banner photo) used on the GSA production hub. In addition, the transaction includes the transfer of Dyas’ interests in the Ithaca-operated (non-producing) Jacky and Athena licences.

The development involves drilling subsea wells tied back to the production unit, with the onward export of oil and gas. To maximise initial oil and condensate production and fill the gas processing facilities, the hub will start-up with five Stella wells. Further wells will then be drilled in the GSA post first hydrocarbons to maintain the gas processing facilities on plateau.

Asset |

Licence |

Dyas Interest |

Petrofac Interest |

Ithaca Interest Post Transactions |

|

FPF-1 Limited |

- |

25.34% |

24.8% |

100% |

|

Stella / Harrier |

P.011 |

25.34% |

20% |

100% |

|

Hurricane |

P.1665 / P.2190 |

25.34% |

20% |

100% |

|

Jacky |

P.1392 |

47.5% |

- |

100% |

|

Athena |

P.1293 |

17.5% |

- |

40% |

Source for table, graphic and banner photo of FPF: Ithaca Energy