Israel-Lebanon maritime deal raises East Med gas prospects [Gas in Transition]

Israel and Lebanon on October 13 agreed a landmark deal that should bring an end to a decades-long dispute over the demarcation of their shared maritime border, even as the two countries remain technically at war with each other. The agreement should spur gas exploration in the East Mediterranean, strengthening the case for the region as a key source of gas for Europe.

Lebanese president Michel Aoun said that long-running discussions between the two sides had come to a “positive end”, describing the agreement as a “historical achievement.” However he cautioned that it would not lead the way to the normalisation of ties with Israel.

“This indirect agreement responds to Lebanon’s demands and preserves our rights in full,” he said.

The deal comes as Lebanon scrambles to emerge from a three-year financial meltdown that has impoverished its population and seen the Lebanese pound lose over 95% of its value. The hope is that gas exploration will unlock foreign investment and later, potential production can help stabilise the economy and shore up government finances.

“I hope the end of these negotiations will be a promising beginning that lays the foundation for the economic recovery that Lebanon needs,” Aoun said.

Israel has likewise praised the deal.

“All our demands were met, the changes that we asked for were corrected,” Israel’s national security advisor Eyal Hulata and the lead negotiator for Tel Aviv, said. “We protected Israel’s security interest and are on our way to an historic agreement.”

The deal was brokered by Washington, with US energy envoy Amos Hochstein serving as a mediator. Hochstein is due to arrive in Beirut in the week starting October 24, carrying a copy of the maritime agreement with Israel for Lebanon officials to sign, according to Reuters.

Once both sides confirm to the US that the agreement has been approved, Washington will in turn notify them that it has entered into force.

What was agreed

At the heart of the dispute are potentially significant gas resources. The agreed border will run mostly along Line 23, south of the Hof line that was proposed by US envoy Frederic Hof in 2012. Beirut had pushed hard for demarcation along Line 29, but this was seen as unrealistic, as it would mean Lebanon having rights over part of the 1.4-trillion ft3 Karish gas field, where Energean launched gas flow tests earlier this month. The agreement will see Israel maintain full control over the Karish.

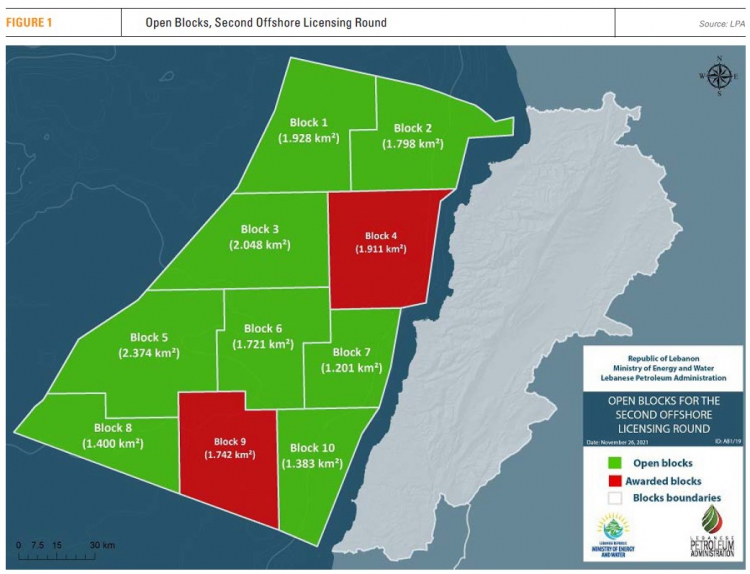

Lebanon, on the other hand, will retain most of the Qana gas prospect, situated in what the country has designated as its Block 9 concession. While little is known about the prospect’s true potential, a best-case scenario places its resources at more than 15 trillion ft3. The maritime deal should pave the way for further seismic surveying of the area.

Block 9 was awarded to France’s TotalEnergies, Italy’s Eni and Russia’s Novatek in 2018, along with Lebanon’s Block 4, although the latter company withdrew earlier this year. While they drilled a well at Block 4 that turned up dry in 2020, they were warned against any operations in Block 9 by Israel.

Speaking after the deal’s announcement, Hochstein said he hoped that TotalEnergies and Eni would begin preparing for gas exploration at the site within weeks. The Israel government has also struck a separate agreement with the Block 9 consortium that will see royalties from the concession shared.

In the event that cross-border deposits are found in the future, the two countries have agreed to have the US mediate a solution.

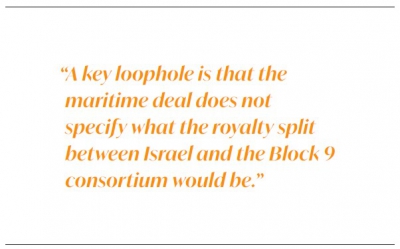

A key loophole, however, is that the maritime deal does not specify what the royalty split between Israel and the Block 9 consortium would be. Instead, it simply states that “Israel shall work with the Block 9 operator in good faith to ensure that this agreement is resolved in a timely fashion.” Those negotiations could take considerable time, preventing the prospect’s development. Cyprus and Israel, for instance, have been stuck in talks for several years over how to distribute profits from the Aphrodite-Yishai reservoir.

Hunting for investors

Both Lebanon and Israel are counting on the maritime agreement to entice more investors to explore their offshore zones, although in Lebanon’s case, this still might prove difficult.

In June, the Lebanese Petroleum Administration (LPA) pushed back the deadline for its second bid round from June 15 until December 15, seemingly to give time for the maritime agreement to be reached. The original deadline for this round was January 31, 2020, but this was delayed until April 30, and then June 1 of that year, in response to the COVID-19 pandemic and falling oil and gas prices. The deadline was then extended once more to the end of 2021, and then the contest was completely relaunched in December that year, possibly because no bids were received.

The round is offering rights to blocks 1, 2, 3, 5, 6, 7, 8,and 10 – Lebanon’s exclusive economic zone is divided into 10 concession areas. While the maritime breakthrough should help matters, the country’s political turmoil and severe economic woes likely pose a far greater deterrent to offshore investors at this time.

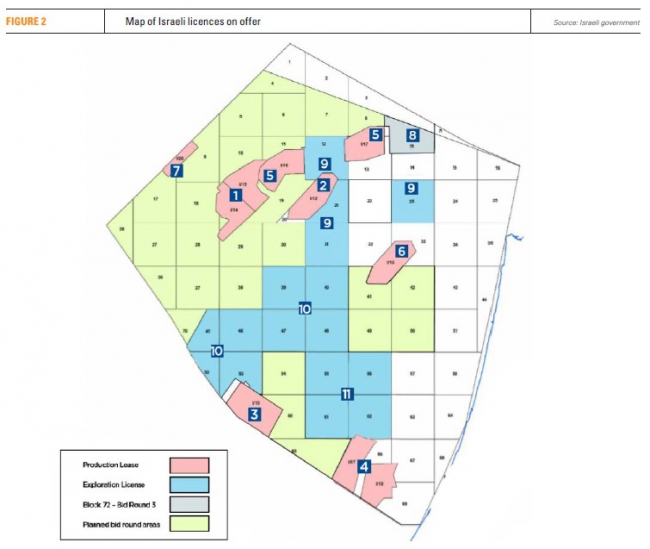

Israel, meanwhile, announced plans in July to launch a fourth offshore licensing round, without disclosing a time frame – possibly because of uncertainty regarding the maritime negotiations. Investors are expected to be invited to bid for “around” 25 blocks that have been mapped but not delineated or grouped yet, Israel’s ministry said. Each one will span an area of up to 1,600 km2 and contain “approximately” four concessions.

The announcement of the new licensing round marks a significant policy reversal, as only six months earlier the same ministry had announced a ban on new licensing for oil and suspended plans for a new gas bidding round. It said at the time that the move would

The change in direction comes as Europe scrambles to find new sources of gas supply following Moscow’s invasion of Ukraine, as part of its commitment to completely phase out Russian gas within a few years. Projects such as the EastMed pipeline to bring this East Mediterranean gas to European shores have seen a revival in interest this year, although a lot will depend on EU support, which is not assured given the block’s ambitious climate objectives.