Iran’s LNG ambitions in limbo [LNG Condensed]

Iran’s attempts to develop LNG plants and the giant South Pars gas and condensate field have long been hampered both by the restrictions it itself places on foreign investment and international sanctions.

The periodic improvement and deterioration in relations between Tehran and Washington has resulted in the painfully slow and generally stop-start development of gas projects. This contrasts sharply with Qatar’s success in building the world’s biggest LNG industry on the reserves in its half of the North Dome-South Pars field, which it shares with Iran.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

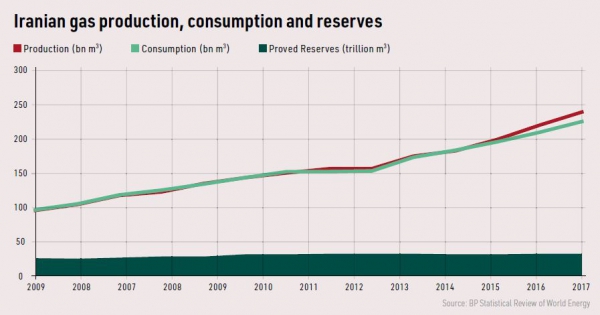

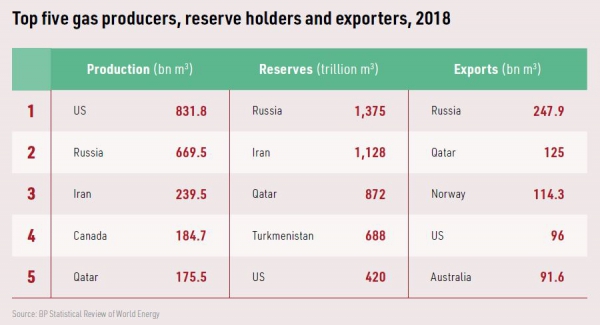

Even allowing for continued growth in subsidised domestic consumption, Iran has huge gas export potential. It is already the third largest gas producer in the world, with output of 240bn m3 in 2018. The country sits on proved reserves of 31.9 trillion m3, almost three times as much as the US, where production is three and a half times higher.

Export constraints

Yet its export capacity remains highly constrained by politics, geography and its lack of domestic LNG technology. In 2018, it piped 7.6bn m3 to Turkey, 0.5bn m3 to Armenia and Azerbaijan combined and 4.1bn m3 to Iraq. Despite longstanding plans, Iran has yet to enter the LNG market.

Political and economic risk figure high for both pipeline and LNG development in Iran and enthusiasm for either option has flip flopped, depending on circumstances at the time.

Iran’s Labour News Agency reported Mohammad Hossein Adeli -- secretary-general of the Gas Exporting Countries Forum for four years until 2018 -- as saying:

“Extending gas pipelines from the southern port of Asalouyeh in the Persian Gulf in Bushehr Province to neighbouring states has always been marred by political issues (sanctions and wars) and, in optimistic terms, may work only for a short term.”

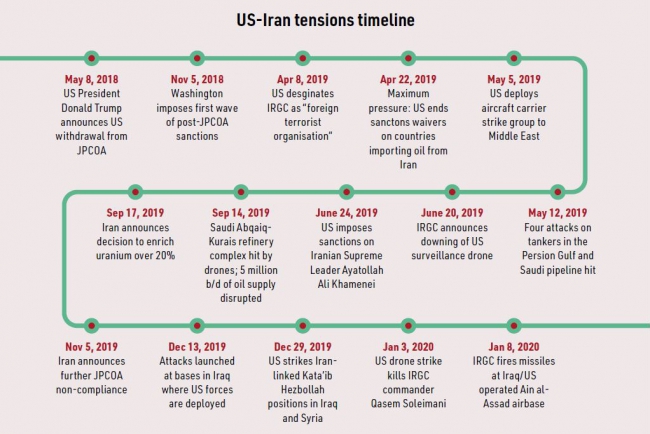

However, the general manager for market research and economic appraisal at the National Iranian Gas Export Company (NIGEC), Mostafa Sharif, has said the country must focus on maximising its piped gas exports rather than LNG. This, he argues, is because of US President Donald Trump’s decision to withdraw from the 2015 Joint Comprehensive Plan of Action (JCPOA) in May 2018 and the re-imposition of US sanctions on November 5 the same year.

Sanctions regime

Under the JCPOA, Iran was to have disposed of its stocks of enriched uranium and massively reduced its enrichment and heavy water production capabilities, in return for the suspension of sanctions.

Trump describes his policy on Iran as one of “maximum pressure” and the US has also introduced sanctions against specific Iranian organisations and individuals. The sanctions apply to US investment in Iran, block access to the US financial system for Iranian companies and, crucially, levy penalties on non-US firms that do business with Iran via their US operations.

Collectively, sanctions have had a huge impact on the Iranian economy in general and Tehran’s LNG ambitions in particular.

Iranian non-compliance

Iranian officials responded by saying that they would no longer abide by the terms of the JCPOA, gradually increasing the seriousness of their non-compliance, until Iran breached restrictions on its production of enriched uranium in July 2019.

The renewal of sanctions was opposed by the European signatories to the JCPOA: the UK, France and Germany. Along with the IAEA, they argued that Iran was generally abiding by the agreement.

London, Paris and Berlin have set up the Instrument in Support of Trade Exchanges (Instex) to allow non-US companies to circumvent the sanctions by avoiding use of the US dollar and they have since been joined by other Western European governments. Yet the vast majority of non-US firms active in the Iranian oil and gas sector have pulled out.

Hormuz brinksmanship

A string of other incidents has heightened tensions between Tehran and the West, although both the US and Iran have pulled back from the brink, when outright war appeared possible.

These include the tit-for-tat seizure of Iranian and British vessels in July 2019, and Washington’s claim that attacks on tankers in the Gulf have been carried out by Iranian forces.

These incidents were followed in September 2019 by the drone and missile attack on Saudi Arabia’s major Abqaiq refinery complex, temporarily knocking out 5 million b/d of Saudi oil production. Although Houthi rebels in Yemen claimed responsibility as part of the Yemeni civil war, the US and Saudi Arabia placed the blame at Tehran’s door.

US-Iranian relations deteriorated further following the killing of the commander of the Revolutionary Guard’s Quds force, Qassem Soleimani, in a targeted US drone strike in January 2020. He was regarded by some as the second most powerful person in Iran, after Supreme leader Ali Khamenei but ahead of President Hassan Rouhani.

Tehran responded to Soleimani’s death with limited retaliation against bases operated jointly by US and Iraqi forces in Iraq. The Iranian government stated that it would no longer abide by the JCPOA restrictions, but would continue to coordinate with the IAEA, suggesting that it has not completely given up on the nuclear deal.

Impact on LNG projects

Iranian officials have conceded that the development of the country’s first LNG project has again stalled because of US sanctions. Iran LNG, which is owned by NIGEC and the National Iranian Oil Company Pension Fund, is due to have two 5.4mn mt/yr trains in Phase 1, rising to four trains in Phase 2. The government said in 2016 that the plant in the Pars Special Economic Zone was already half built.

However, the developers seem to accept that completion is impossible while sanctions remain in place. NIGEC’s Sharif said last year: “This project’s storage capacity has been built and gas intake facilities are available, but the liquefaction facility has not been built due to the sanctions. After the sanctions removal we hope that we can revive the project.”

Sharif said that talks had been held with BP, Shell and Total over investing in this or other LNG projects, but that they had been halted because of the sanctions.

History appears to be repeating itself. Sanctions prevented contractor Linde from working on Iran LNG in 2012. The German firm may require compensation for storing the equipment it built for the plant over the years since then and this could pose another obstacle to development, even if sanctions are eventually lifted.

South Pars

Iran hopes that the South Pars field, which accounts for 60% of Iran’s total natural gas reserves and 10% of global reserves, can eventually supply several LNG plants. A total of 18 phases on South Pars have been commissioned since 2001, but development is underway on only five of them. However, there has been some progress, including on Phase 14, where the Pars Oil and Gas Company announced at the end of December that it had increased output.

Production on South Pars reached 610mn m3/d last year out of domestic output of 840mn m3/d and the government hopes that production on South Pars will reach 1.2bn m3/d when all development phases come on stream, with the bulk of the extra production allocated to exports.

In 2017, a consortium of Total (50.1%), China National Petroleum Corporation (CNPC) (30%) and Iran’s own Petropars (19.9%) signed an agreement to develop Phase 11. The project is designed to supply the domestic market from 2021 in the first instance, with exports at a later date, although it has not yet been determined whether this would be in the form of LNG or via pipeline.

However, work on the project was suspended in December 2018 after the imposition of US sanctions prompted Total to withdraw from the venture.

Outlining the far-reaching nature of the sanctions for non-US multinationals, in a statement, the French firm said:

“Total has always been clear that it cannot afford to be exposed to any secondary sanction, which might include the loss of financing in dollars by US banks for its worldwide operations (US banks are involved in more than 90% of Total’s financing operations), the loss of its US shareholders (US shareholders represent more than 30% of Total’s shareholding) or the inability to continue its US operations (US assets represent more than $10bn of capital employed).”

Total said that it had invested less than €40mn ($47.2mn) in the project at the time of its withdrawal. CNPC was supposed to take Total’s 50.1% stake, but Tehran announced in October 2019 that the Chinese company too had formally withdrawn from the venture.

CNPC’s decision seemed to prompt government officials into action and a string of announcements were made promising action.

In October, Iran’s minister of petroleum Bijan Zangeneh said: “The fate of the South Pars Phase 11 has been determined and Petropars will continue developing the project alone and by the end of this year the first jacket will be installed in the phase for a platform with 500mn ft3/d of gas production capacity.” Zanganeh said that Petropars had been acquiring pressure boosting expertise from its two partners.

Given that foreign expertise and technology were thought necessary to develop Phase 11 in the first place, there seem only two explanations for Zangeneh’s statement. Either the government feels that Total and CNPC have already done enough to allow Petropars to complete the project, or he was talking up the likelihood of completion to put a brave face on a difficult situation.

Small trains

However, Zangeneh also announced plans for the development of a string of small LNG trains, possibly using South Korean technology.

State media reported him saying: “We are planning to enter the LNG industry tapping into domestic capabilities and with the help of Iranian companies. We have a plan to build an LNG park by constructing mini LNG [plants] that will have a capacity of 3mn mt/yr … which will be reached with small units.”

He added: “We also had discussions with MAPNA Group, a knowledge-based company that could enter into the construction of LNG plants, and the company is going to conduct a review and report the results to the oil ministry.”

MAPNA is an Iranian company working in construction and thermal power plant development.

He clarified that Iranian firms – smaller companies in the first instance – would invest in the project, but that they may not actually build the trains, while the government would provide some support, presumably financial.

The reference to smaller Iranian companies is a new departure. Aside from foreign companies, large, state-owned firms dominate the development of oil and gas projects in Iran.

Talin Mansourian, the director of investment and business at the National Iranian Oil Company (NIOC), also said in October that Iran would seek to monetise its gas reserves through the development of smaller LNG projects. She said that the 3mn mt/yr scheme would comprise six 500,000 mt/yr trains.

The government is looking to small-scale LNG in frustration at its repeated failure to oversee the development of large LNG schemes, but also because of the emergence of small-scale LNG as a viable option. It is more easily scalable, so extra capacity can be added incrementally, allowing all output from a particular train to be sold to a single customer. Not needing to tie up a string of customers can speed up development.

McKinsey Global Institute calculates that small-scale LNG can be 15% cheaper than large-scale and further savings should be possible as the technology matures. However, securing or developing small-scale modular LNG technology, as opposed to that designed for traditional, large-scale projects, is also likely to prove a challenge for Iran while US sanctions remain in force.

Finding friends

Russia’s Gazprom has signed memoranda of understanding with NIOC to support the development of LNG projects in Iran, but there seems to be no more incentive for the Russian firm to take a lead role now than in the past.

Similarly, Tehran has courted Chinese development of gas field and LNG projects, but CNPC’s withdrawal from South Pars Phase 11 suggests that few foreign companies are prepared to risk US sanctions.

Tehran does not appear to have given up on the JCPOA entirely, but relations with the European powers have deteriorated in part due to the latter’s unwillingness or inability to effectively circumvent US sanctions and maintain the agreement in the face of the US withdrawal.

As a result, Iran’s ability to exploit its LNG potential rests on improving its relations with Washington, seeing sanctions lifted and the inflow of foreign investment and technology resumed.

Yet Tehran’s religious establishment has built its reputation on refusing to give in to US pressure, while Trump is just as steadfast in his opposition to a more conciliatory approach. Both attitudes give Iran’s political moderates little scope for compromise and leave LNG development as far off as ever.

Tehran may be banking on Trump failing to gain re-election, but even if that is the result of the US presidential elections in November, there is little love for the Iranian regime across the broader US political establishment.

CHOOSE YOUR SUBSCRIPTION TO NATURAL GAS WORLD

FOR THOSE WHO WANT TO GO BEYOND THE HEADLINES FOR THE FULL STORY.

NGW Premium for $20.00 per month or $198.00 per year for a single user. Gain full access to accurate, essential and reliable information about the natural gas world.

_f600x507_1583231626.JPG)