Iran’s gas woes in focus [Gas in Transition]

Iran, the third-largest gas producer in the world, is experiencing severe natural gas shortages amid rising consumption, rampant inefficiency and flagging production. This, international sanctions and other issues have led its export projects to flounder.

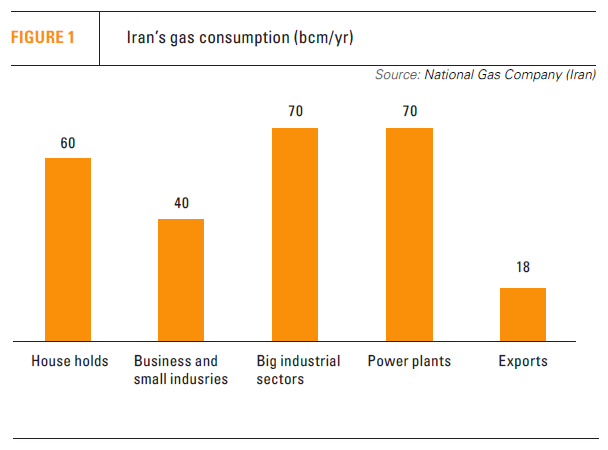

Boasting the second-largest natural gas reserves in the world, Iran consumed around 240bn m3 of gas in 2022, of which 45% was used for commercial and residential purposes, and the rest by power plants, petrochemical companies, general industry and other sectors. Iran also exports 18bn m3/year of gas to Iraq and Turkey. However, rising houshold demand led Iran to suffer a 250mn m3/day supply shortfall last winter, with the shortages affecting all sectors that use the fuel (see figure 1).

The massive offshore South Pars field, which accounts for two-thirds of national production, entered its eleventh phase of development in the summer of 2023. Iranian officials have previously said that this phase would yield 56mn m3/d of gas at full capacity, by transferring and installing one of phase 12’s platforms there. As a result, phase 12’s production capacity has declined.

As such, it is not clear how much the field’s overall production has increased. But according to Iran’s National Gas Company, the field’s overall productivity is set to decline in the coming years, with a 10bn m3/yr decline expected as a result of dropping pressure. Development of the field has been stifled over the years as a result of insufficient investment and a lack of Western technology.

Iran needs to install at least 15 20,000-t platforms, 15 times bigger than those currently based at South Pars and each capable of carrying two giant compressors, to maintain the field’s production capacity.

Iran has revived plans for its first LNG export project, which officials say could be launched in mid- 2025 – though the financing and technological challenges are clear. In the March 2024-March 2025 period, national gas exports are expected to come to 11bn m3/yr.

Waste

Iran ranks second in the world in terms of flaring, burning 18.4bn m3 of associated gas in 2022. It is also second place in terms of methane emissions, with them estimated at 7bn m3 in that year. Around 6% of Iran’s natural gas supply is lost in the transmission and distribution network, affecting volumes provided to homes, businesses and power plants. Iran's gas power plants, which use 70bn m3/yr of gas, meanwhile run at 33% efficiency, versus a 60% world average. This issue is made worse by inefficient industrial procedures, which emphasizes the need for motivating measures to encourage behavioral adjustments.

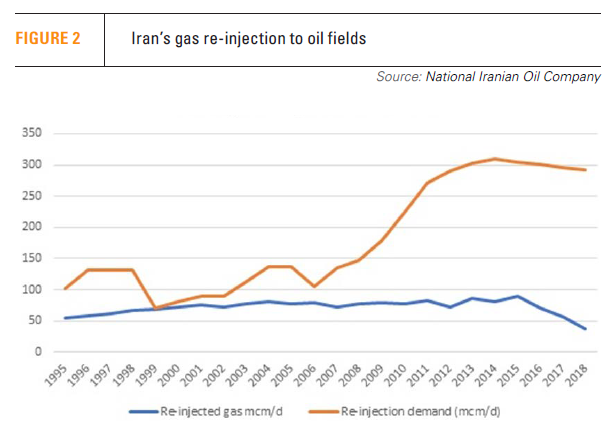

There are also significant amounts of gas needed in the oil sector to prop up output. Ageing oilfields account for four-fifths of the country’s oil production, and the county needs to reinject nearly 300mn m3/d of gas into reservoirs to boost recovery and avoid production falling by 8-10% annually (see figure 2). Only roughly 37mn m3/d was reinjected in 2022, and only 10% of the necessary gas was reinjected in 2023, according to a major reduction reported by the Fars news agency. This represents a major threat to Iran's oil output and necessitates quick response to avoid negative economic effects.

To give an example, the 650bn barrels of oil reserves in Iran typically yield a 20% recovery rate. The recovery rate was raised to 24% over a 20-year period via gas reinjection and the use of brackish water, indicating recoverable reserves of 156bn barrels. This rate may rise to 27–28% with enough gas reinjection, adding 20bn barrels to extractable reserves estimated to be worth more than $1.5 trillion. Over the last 20 years, Iran has increased well drilling and developed new oilfields in an effort to counteract diminishing oil output.

Iran-Turkmenistan gas swaps

Iran, Turkmenistan, and Azerbaijan signed a trilateral agreement to swap 1.5bn m3/yr of gas in November 2021. To alleviate the shortfall of natural gas, Iran purchases gas from Turkmenistan and transfers an equivalent quantity to Azerbaijan at the border. This agreement improves regional cooperation by fortifying Iran's and Turkmenistan's energy relations. Natural gas exchange is encouraged, and debt problems are settled through the gas swap. Iran exchanged 1.2bn m3 of Turkmenistan's gas with Azerbaijan in the first 10 months of this year. These agreements address the energy demands of participating nations and provide energy security, especially during winter, while also promoting greater regional cooperation in the energy sector.

Through Iran, Turkmenistan and Iraq have signed a vital five-year natural gas exchange deal that calls for the transfer of 9bn m3/yr of natural gas. This action provides a long-term solution to Iraq's energy problems and is a crucial part of Turkmenistan's aim to diversify gas export markets. The deal is in line with Turkmenistan's larger initiatives to increase its gas export possibilities and open up new markets for its significant reserves. With favorable effects on regional gas commerce and energy security, this agreement represents the countries' growing energy cooperation.

Iraq reportedly owes Iran $11bn for gas and electricity imports. Due to payment delays and US sanctions, Iraq has faced challenges in settling this debt. Since last July, the US agreed that Iran can use about $3-4bn of the debt to import non-sanctioned goods from a third country.

Export pipelines

The Iran-Oman natural gas pipeline, an agreement on which was signed in 2013, has seen minimal progress in the past decade. Last April, Oman’s energy minister, Salim Al Aufi , stated that Oman aims to be self-sufficient in gas within the next 10 years, diminishing the need for Iranian gas. Given Oman's reduced demand, Iran's gas shortages, and ongoing sanctions, the operationalisation of the Iran-Oman pipeline appears unlikely. Despite this, there are potential benefits, such as exporting Oman's gas as liquid gas or blue hydrogen and fostering connections with India and the UAE for domestic industries.

There are delays to the $7.5bn Iran-Pakistan gas pipeline project as well. Work on this plan began in 2013. Iran says it has finished its 1,150-km portion, while Pakistan's portion was delayed over the original January 2015 deadline because of obstacles brought on by international sanctions. Pakistan's petroleum minister, Musadik Malik, responded to media reports by saying that Iran is actively working with Pakistan to stop international arbitration. Tehran threatened to fine Islamabad $18bn if its portion was not finished by March 2024. The geopolitical obstacles and ongoing talks between the two countries cast doubt on the project's future.

Iran is Turkey’s second-largest gas supplier after Russia, annually delivering 10bn m3/yr under a 25-year deal. Negotiations are under progress to extend the present contract, which is scheduled to expire in July 2026 or at the end of 2025, despite sporadic setbacks. Turkey has an energy diversification plan which aims to reduce reliance on Iranian gas and increase negotiating leverage in gas transactions.

Iran's gas deliveries to Turkey have encountered difficulties, especially during the winter months when demand is highest. Iran reduced its gas deliveries to Turkey by 70% in January 2023, raising worries about possible shortages in Turkey over the winter. This decline in gas exports is a part of a larger trend as Turkey's gas supply from Iran has been beset by problems with quality, price, and sporadic outages. Turkey has been making efforts to purchase gas at a cheaper cost from other suppliers, such Russia and Azerbaijan, to lessen its reliance on Iranian gas.

Conclusions

A report by the Majlis Research Center highlights important obstacles facing Iran's energy industry, especially the impending natural gas crisis. The research on the country’s natural gas deficit warns of the serious ramifications if left ignored and emphasises how urgent it is that this issue be addressed under President Ibrahim Raisi's government. Iran's natural gas shortages affect many aspects of society, including everyday living and heating requirements, as well as the financial health of many sectors. This might lead to societal instability and provide security issues. To prevent a crisis, quick fixes are required, therefore addressing the present natural gas shortfall is essential for Iran's transition to a more secure and sustainable energy future.