Iran Sanctions Starve Gas Investment

With the US decision to end waivers for Iran’s oil customers, the country's plans to develop the remaining phases of the giant South Pars gas field look uncertain. Last year the field absorbed 90% of Iran’s total upstream investments.

National Iranian Oil Company (NIOC) receives 14.5% of the country’s total oil and gas export revenues. The major agenda for NIOC is South Pars, where Iran has 13.3 trillion m3 in-situ gas.

Iran has spent about $80bn on the field over the last 20 years, and needs a further $30-40bn to both complete that and to prevent pressure fall, expected to occur in 2023.

According to an official document seen by NGW, its cumulative production stood at 1.3 trillion m3 as of end-2018, which is 45% of Qatar’s, which started extraction from its side of the border a decade earlier. It plans to add a third to production by 2023. By that point, gas on the Iranian side is expected to reach dew point and lose productivity by 40%.

Currently, above two-thirds of Iran’s total 232bn m³/yr sale gas production comes from South Pars.

The Iranian parliament’s research centre calculates NIOC's debt at $48.66bn as of March 2018 and the government has to pay off about $15.7bn of debt in the current fiscal year, started March 21.

NIOC’s financial reserves

NIOC expects to have $24.49bn to spend this year, made up of $7.5bn sales (including $4.48bn oil and $0.5bn gas export and the rest from domestic sales), $4.4bn in foreign loans and investments and $5.94bn loans from domestic banks for the next fiscal year. The rest is expected to be allocated from the national development fund (NDF) and other sources.

Curbing oil export revenues would paralyse the country’s upstream projects, including South Pars.

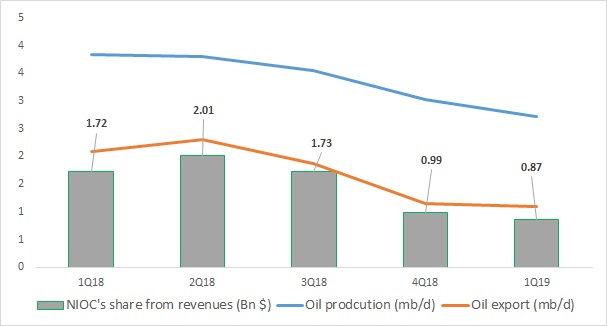

NIOC’s revenues from crude oil export (excluding gas condensate):

Source: NGW, combination of NIOC, OPEC, Kpler

Statistics show that NIOC received $5.6bn from crude oil exports (excluding gas condensate) during last fiscal year. Custom statistics also show a $4.95bn gas condensate export volume for the mentioned period.

The company also exported 10.2bn m³ of gas to Iraq and 7.86bn m³ to Turkey in 2018. Net revenue from gas sales is, according to the government budget, is expected to be $3.4bn, of which 14.5% would be transferred to NIOC.

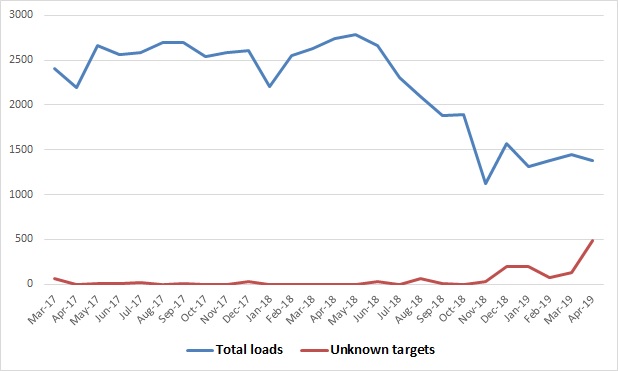

Iran also sells a part of its oil and gas condensate exports secretly. Kpler told NGW that Iran has loaded 1.367 mb/d of oil and gas condensate on average since November 2018, when US gave a six-month waiver to eight Iranian clients, of which the destination of 187,500 b/d is unknown.

Iran’s oil and gas condensate loads:

Source: Kpler

Though Iran will likely continue to sell oil secretly, the volume is not in a quantity that helps NIOC in collecting financial sources.

According to budget law for the current fiscal year, NIOC should invest $8.76bn in oil and gas projects, but there are not even reliable sources for paying off debts.

According to the budget law, Iran has planned 1.54mn b/d of crude oil and gas condensate exports at $54.1/b this year.