India Natural Gas Needs: An Open Question [NGW Magazine]

Based on a target set by India’s government in 2016 to raise the share of gas share in India’s energy mix to 15% by 2022, India needs another 11 LNG import terminals. Not only is the target a more than doubling of today’s 6%; but the overall volume of energy is also going to grow.

The strategy, ‘Gas4India’, aims to make India a gas-based economy, but it was formulated before the rise of renewables and is therefore subject to some revision.

Prime minister Narendra Modi said in April that “India's energy future has four pillars: energy access, energy efficiency, energy sustainability and energy security,” suggesting a big role for gas under most of those heads.

But the kind of energy India wants, and the kind it can afford, are two different things. Population and economic growth mean that India’s energy needs are rising fast, even though electrification is still to reach many rural areas. The International Energy Agency (IEA) forecasts that the country’s energy demand will double by 2040, but where will this come from?

India is now the biggest renewable energy market globally after China and the US, driven by the economics of ever cheaper wind and solar energy.

There is a growing view that India’s entrenched coal industry and coal-based power generation, combined with this rapid growth in renewable power, mean that the future of Indian electricity is likely to be predominantly solar, wind and coal and less natural gas. But powergeneration accounts for only a quarter India’s gas demand.

India’s energy needs

India’s energy needs are governed by targets and guidelines described in the country’s National Energy Policy (NEP), a draft of which was released in July, designed to achieve the following objectives:

- Electricity at affordable prices, including 100% national electrification by 2022, with ‘24x7 power-for-all’;

- Improved security and independence, by decreasing the share of imports in the primary energy supply, such as oil and gas, and by diversifying the energy mix;

- Greater sustainability, by improving resilience towards climate change and reducing air pollution, especially in cities;

- Economic growth.

New Delhi hopes to streamline the country’s energy sector, which at present is fragmented, inefficient and largely controlled by state governments.

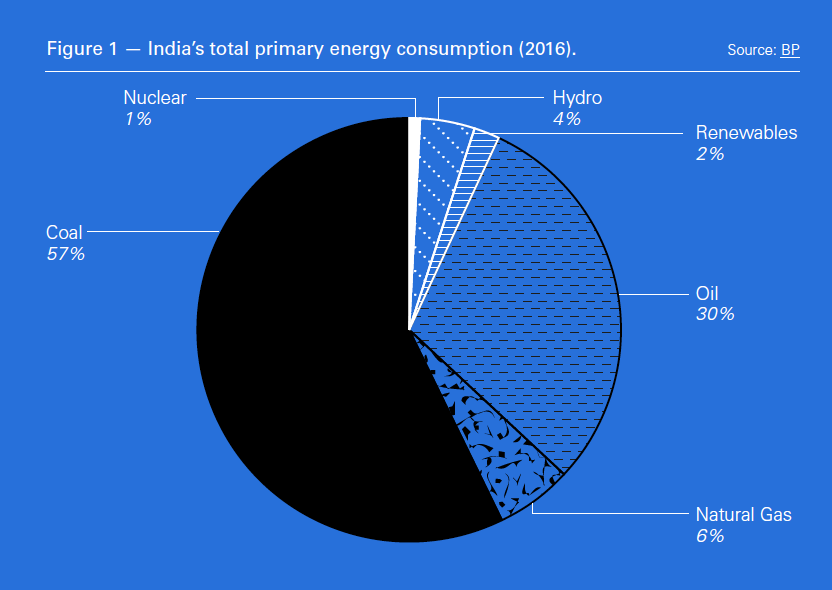

In 2016, about 83% of India’s primary energy supply was met by fossil fuels (Figure 1). A rising proportion of this is imported, although achieving the NEP objectives implies more production at home, including coal and but also renewables. In India energy and economic growth are strongly inter-dependent.

BP’s Energy Outlook 2018 projects that India’s primary energy demand will grow faster than any other major economy, rising by 165% between 2016 and 2040. Coal will contribute most to meeting this demand followed by renewables. As a result, India’s share of global primary energy consumption is expected to grow to 11% by 2040.

This is driven by population and GDP growth and lifting people out of poverty. According to World Bank data, India’s GDP grew by a factor of 5 between 2000 and 2016 and it is expected to grow by as much again by 2040. Its population was over 1.3bn in 2016 and it is expected to peak at about 1.8bn.

India uses less than a sixth of the energy Europe uses, per capita. The scope for growth as its economy grows is enormous. This is acknowledged by the International Energy Agency (IEA). It expects India to become the fastest growing energy market in the world by 2040.

In terms of climate targets, Climate Action Tracker (CAT) states that “with the adoption of India’s NEP, the country remains on track to overachieve its ‘2 °C-compatible’ rated Paris Agreement Nationally Determined Contributions (NDC) climate action targets. On present estimates, India could achieve part of its NDC goals – a 40% non-fossil-based power capacity by 2030 – as early as the end of 2018, a full 12 years earlier than targeted.”

This is assisted by the rapid growth in the use of renewables in electricity generation, driven by ever lower prices.

Coal

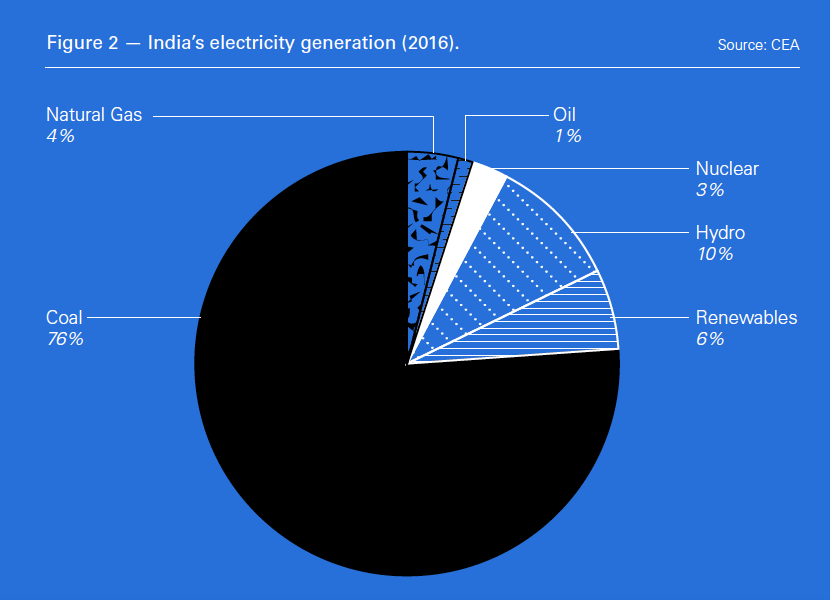

India’s coal sector contributes 57% of its primary energy and 76% of its power (Figure 2), but it is perceived to be inefficient because of the dominance of Coal India Ltd (CIL) whose costs are passed through to the customer.

In order to deal with these demands, the NEP includes provisions to open up the sector and make it more efficient, retiring old, generation capacity.

Renewables

India’s NEP includes the ambitious goals of increasing renewable energy capacity to 175 GW and achieving full electrification by 2022. About a fifth of India’s population has no access to electricity. It recognises that “the government has a vital role to play in the integration and balancing of variable energy, wind and solar.

In addition to the electricity sector, the government also intends to promote renewables in heating industry and homes. It is also pushing for electrification of the transport sector, with a target to source 40% of power requirements from renewables. But beyond 2022 renewable capacity growth will be market-driven.

Prices are tumbling. An auction in September in Gujarat attracted prices below $0.035/kWh. In addition, the huge number of solar power auctions being issued by various agencies across India have forced the ministry for new and renewable energy to propose a schedule for all issuing agencies. The uptake of solar power in India is exceeding all expectations.

By August India’s total grid-connected solar capacity reached 22 GW, with total renewable capacity – solar, wind, biomass and waste to power – reaching 71.5 GW, or almost a fifth of the total. Even though remarkable in terms of progress, this shows how challenging the target of achieving 175 GW renewable energy capacity by 2022 is going to be.

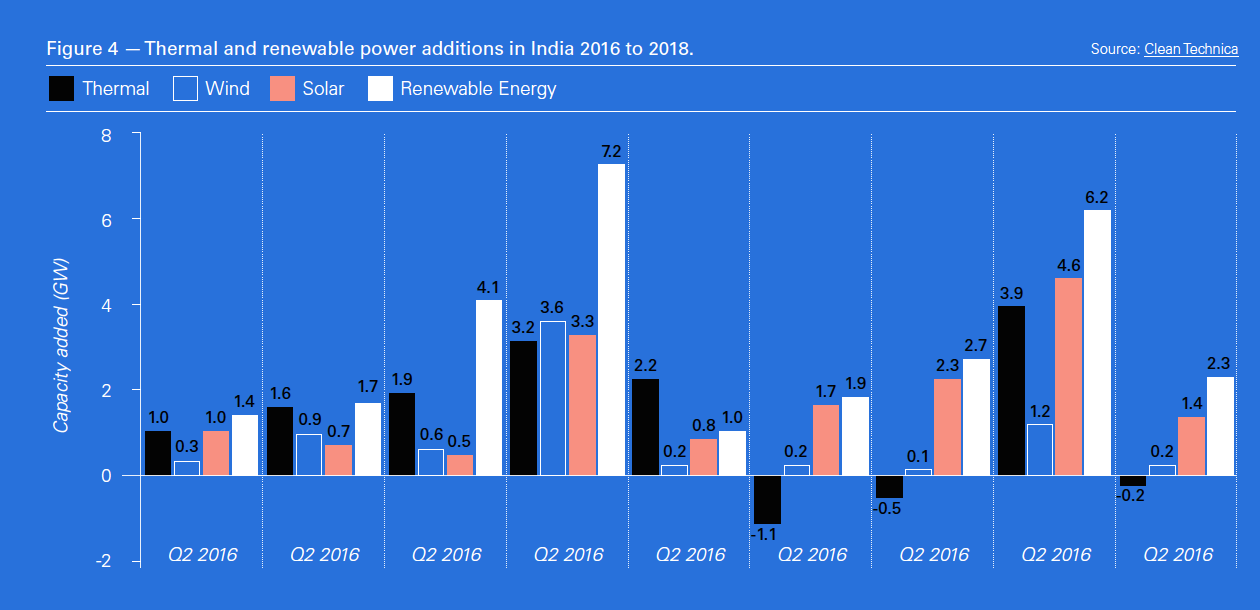

Nevertheless, fast-declining costs are turning solar and wind into the main drivers of growth in India’s power sector (Figure 4). In the 27-month period, the net additions were 28.5 GW renewables and 12.1 GW thermal.

This growth is already affecting the coal sector adversely. And cheap solar is also challenging the use of gas in power generation.

Natural gas

India was the 12th largest gas consumer in the world and the fourth largest LNG importer in 2017, with just under 6% of global LNG trade. According to BP, gas consumption was 54bn m³ in 2017, 6.7% up on 2016. This was the second successive year of rising gas demand, after some years of decline.

There were also a number of other positive developments last year. Domestic gas production was up 4.5% on 2016 and should benefit further from revisions of pricing guidelines and the revamping of upstream policies and regulations through the launch of India’s Open Acreage Licensing Policy (OALP) mid-2017. It offered 55 blocks for exploration in January 2018, and all were awarded in August.

In addition, the government approved mid-September a policy framework to promote enhanced recovery of unconventional hydrocarbons. In the case of gas, “an increase of 3% recovery rate on original in-place volume is envisaged, leading to additional production of 52bn m³ of gas in the next 20 years.”

Increasing awareness of the need to curb air pollution in cities, including the transport sector, should also benefit gas.

In support of the objective to increase energy security and independence, the NEP is giving priority to revitalising domestic oil and gas exploration and production through the adoption of “a more attractive profit-sharing regime.”

In terms of natural gas this will be achieved through:

- Giving market price for gas to upstream producers and introducing a policy framework to boost oil and gas production;

- Declaring LNG terminals as ‘common carriers’ with tariffs regulated by the regulator;

- Rolling out a gas pipeline grid across the country

- Developing a policy for conversion of depleted oil and gas fields into gas storage reservoirs

- Eliminating import duty on LNG, to level the playing field with respect to crude oil, and equalisation of taxes and subsidies – at present subsidies distort the energy market in India

- Promoting a gas-based economy by encouraging the use of gas across demand sectors.

The latter would be good for gas, but high LNG prices in comparison with coal may limit what may be achieved, at least in the power sector. This is perhaps one of the reasons why BP expects only a modest increase in gas demand from 6% of total primary energy in 2016 to 7% by 2040. In real terms, though, this corresponds to an increase from 52bn m³ in 2016 to 145bn m³ in 2040.

In contrast to coal, out of 145bn m³ gas to be consumed in 2040, BP expects only 52 bn m³ to be produced domestically, with the rest to be imported, putting pressure on the country’s economy and security of supplies concerns.

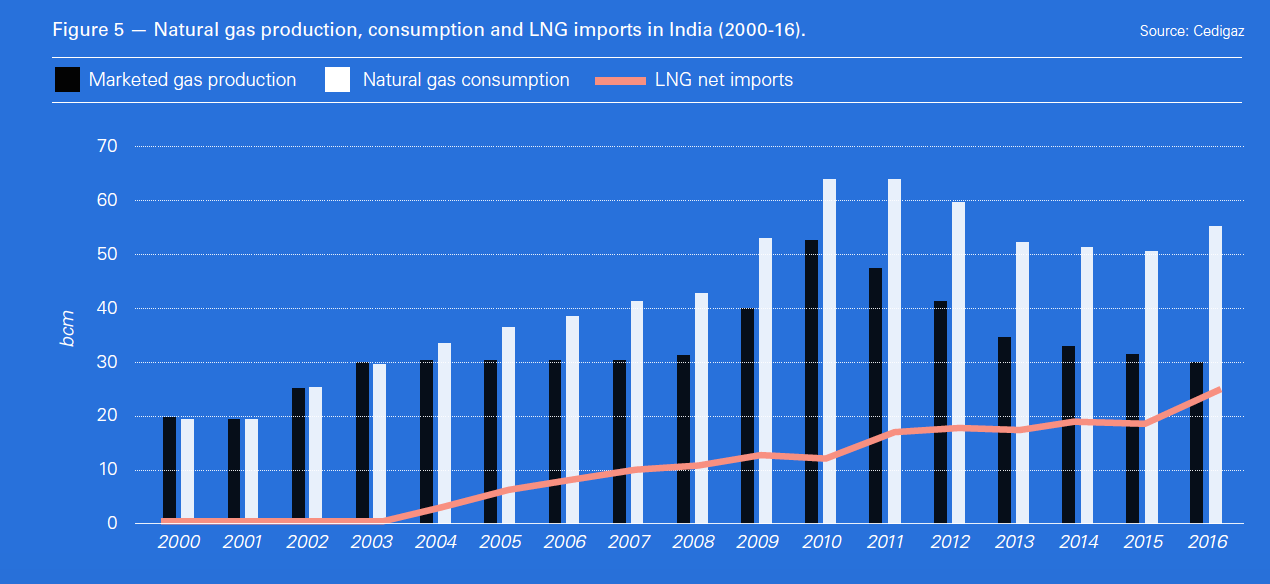

The widening gap between gas consumption and domestic gas production is clear from Figure 5. The difference is met by imported LNG. In response to operators' demands for the adoption of market-based gas-pricing, India is now planning to establish a gas trading hub. But this is facing challenges owing to concerns over third-party access and competition, as well as infrastructure limitations, and it is expected to be a slow process.

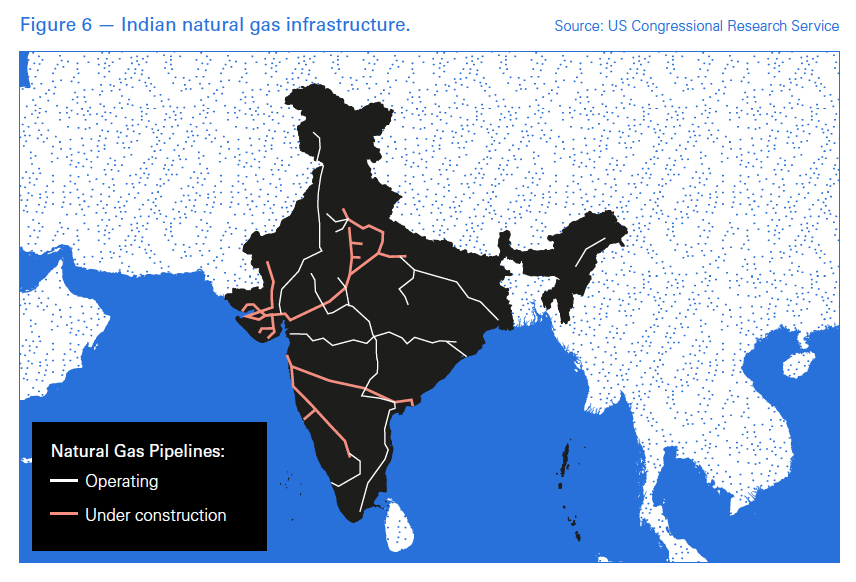

India has four LNG import terminals with capacity limited to 30mn mt/yr, but with only about two-thirds available at any one time. The pipeline network (Figure 6) is also extremely constrained. As a result, expansion of regasification capacity may be frustrated by lack of pipelines to connect terminals to the end users of the gas.

A comparison between India and western Europe puts this in context. With a land area of 3.8mn km² and a population of 1.3bn, India has only 16,000 km of high-pressure gas pipelines. In comparison, western Europe with 2.6mn km² land area and a population of 334mn has over 200,000 km high-pressure gas pipelines. India has a very long way to go. Even if gas import facilities become available soon, with terminals totalling 50mn mt/yr being planned, getting the gas where it is needed will be a challenge.

A news headline September 21 sums up the problem: “Will Ennore LNG terminal go the same way as Kochi terminal?” Even though the Ennore terminal is close to completion, the pipeline to connect to it, to evacuate the gas, is nowhere near being ready. In total, Indian Oil Corporation has to lay 1,385 km of gaslines to connect this terminal to Tamil Nadu, where most the gas is needed, but the necessary infrastructure facilities are not available.

A news headline September 21 sums up the problem: “Will Ennore LNG terminal go the same way as Kochi terminal?” Even though the Ennore terminal is close to completion, the pipeline to connect to it, to evacuate the gas, is nowhere near being ready. In total, Indian Oil Corporation has to lay 1,385 km of gaslines to connect this terminal to Tamil Nadu, where most the gas is needed, but the necessary infrastructure facilities are not available.

And laying the pipelines faces opposition from local people. Similar problems were faced earlier for a pipeline to Tamil Nadu to transport the gas from the Kochi terminal. This is still at a standstill and is being replaced by a pipeline to Karnataka state.

In terms of power generation, over the last few years many gas-fired power plants have been running below capacity, providing only 4% of India’s electricity in 2016 (Figure 2), owing to the price, and also to gas supply inefficiencies associated with government regulated gas allocations.

But in the longer-term gas can play a role in the integration of renewables, especially where air quality is an issue. This was recognized by India’s minister of petroleum and natural gas, Dharmendra Pradhan, who said that "Gas-based power can play a big role in integrating renewables with the grid."

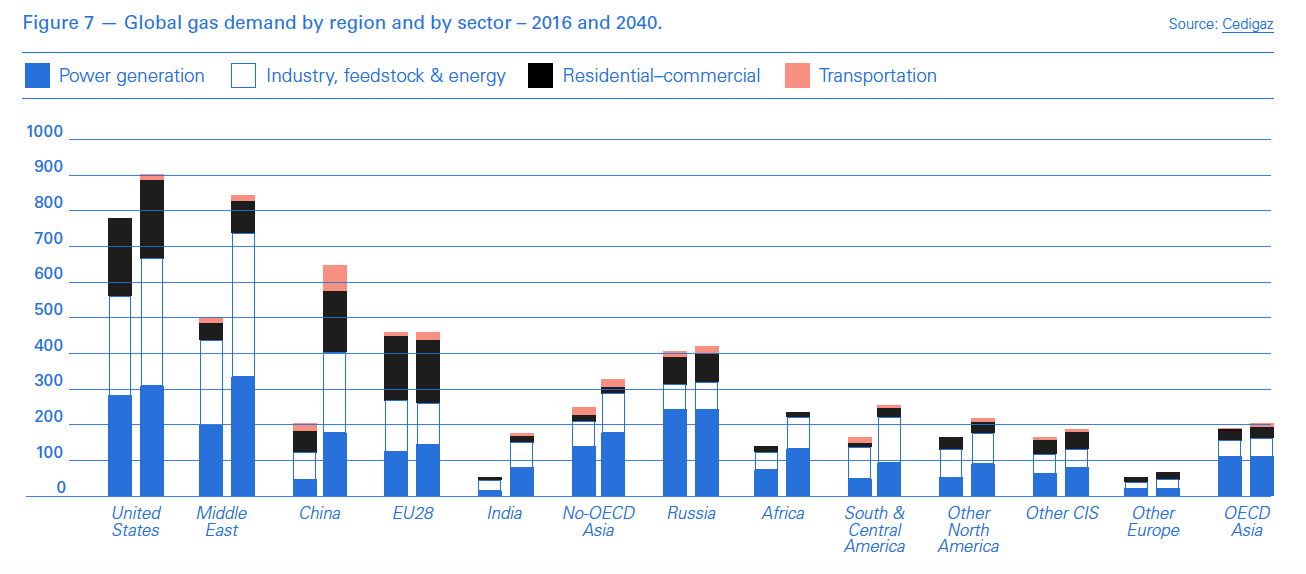

And power is not the key sector, accounting for a quarter of all gas use. Gas plays a much bigger role in the fertiliser, city gas distribution, industrial, transport and petrochemicals sectors. So even if gas use in the power sector is squeezed between cheap renewables and coal, overall, gas demand in India should go up, underpinned by industrial activity and India’s drive to expand city gas distribution and gas demand in the transport sector.

However, political rhetoric in support of gas needs to be matched by the policies and massive investment needed to overcome challenges, raise domestic gas production and expand gas infrastructure to the required levels.

In terms of global positioning, even though India’s gas demand is expected to grow, it will still remain 12th among the top players (Figure 7).

Nevertheless the price of imported LNG will be a factor in its future uptake. Globally, but especially in Asia, 2017 saw a resurgence in gas sales due to abundant and low price supplies. Clearly, if natural gas is to gain a longer-term foothold in emerging markets, the cost gap to competing fuels, including solar, wind and coal, must be kept as low as possible.

With strong oil prices, the Asian spot price for winter delivery was around the same price on an energy basis as Dated Brent crude oil, both as assessed by Platts.

In addition to cost, a key factor in India’s energy policy and planning is security of supplies. Not only it is expensive – and becoming more so as the rupee weakens – but LNG increases dependency on other countries.

It is estimated that plants totaling about 34 GW capacity are struggling, often because they cannot sell their power: they have been left behind by the relentless advance of cheaper renewables and also more efficient plants using clean coal.

International oil companies are also asking for ramping up of domestic reforms, especially the unbundling of India's state-owned gas marketing and pipeline transportation businesses, to improve market access and competition.

These are important challenges that need to be overcome if the government’s ambitious plan to raise the gas share of India’s energy mix to 15% by 2022 is to be realised.