India attempts to revive its upstream [NGW Magazine]

India’s oil and gas demand has been rising at a fast pace in the recent years driven by economic growth, and it is expected to accelerate over the next decade.

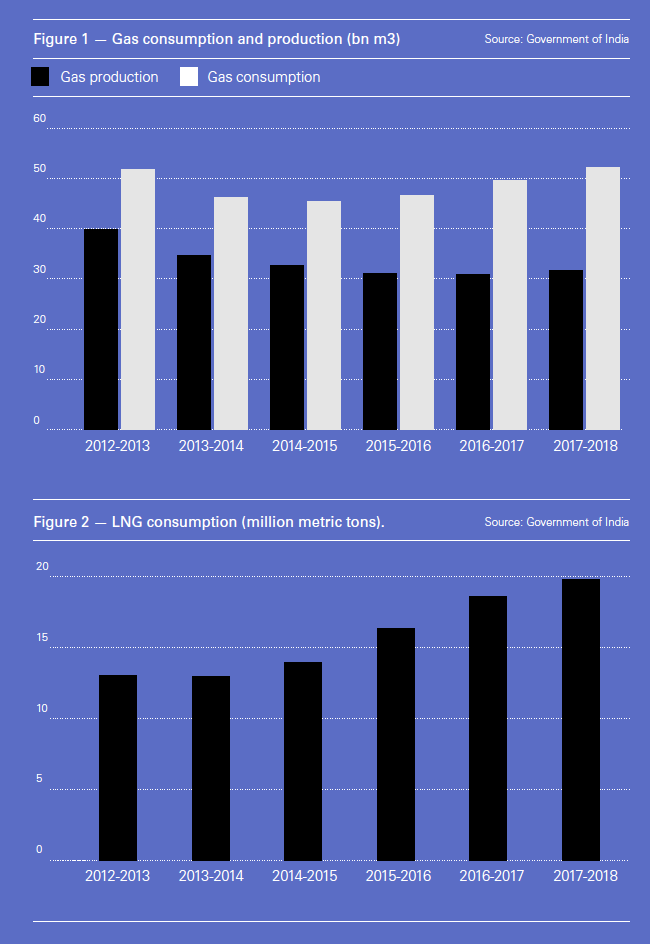

But most of the oil and gas that India uses is imported, as its domestic exploration and production (E&P) sector has woefully underperformed. The country imports four-fifths of the oil and half the gas – all in the form of LNG as India is not connected to any transnational pipeline – that it consumes. India is now one of the biggest importers of oil in the world and the fourth biggest importer of LNG.

However, huge imports have been a cause of concern for the government as they drain the country of its precious foreign exchange. In order to avoid overdependence on imports, various governments over the years have been trying to boost local oil and gas production but have achieved very little owing to factors such as a flawed and complex policy framework; a slow decision-making process; and non-remunerative prices, especially for gas.

The present Narendra Modi-led government has now announced a fresh set of reforms that it says will simplify the decision-making process and boost the local E&P sector. The Indian government mid-February announced the policy framework on reforms in upstream sector with two objectives: to attract new investments to unexplored areas; and to liberalise the policy in producing basins.

“The decision signals a paradigm shift in the core goal of the government, moving from revenue-maximisation to production-maximisation, with the focus on exploration in untapped areas. The need for policy reforms was felt, owing to the stagnant/declining domestic production of oil and gas, the rise in import dependency; and the decline in investments in E&P activities,” commented rating agency, ICRA, on the new policy reforms.

New acreage

Under the new policy, in basins where presently no commercial production is taking place, exploration blocks would be tendered exclusively on the basis of the exploration work programme without any revenue or production sharing for the government. The government has classified these basins in two categories: basins with established commercial production (category one) and basins with known accumulation of hydrocarbons but no commercial production achieved so far (category two).

Only if there is a windfall gain, and annual revenue exceeds $2.5bn, will the government take a share of the additional revenue. The contractor will however pay statutory levies and royalties on output.

The exclusion of revenue or production share with the government in basins where there is no commercial production would increase the potential upside for successful bidders and is expected to incentivise exploration activities in hitherto virgin territories. Accordingly, the policy aims to balance the risk and returns for areas perceived to have higher risk owing to their uncertain prospectivity. The lone bid criteria of exploration work programme is designed to ensure a more thorough exploration of such areas, Icra said.

For unallocated and unexplored areas of producing basins, the bidding will continue to be based on a revenue-sharing basis but with more weight given to the work programme (70% weight to work programme and 30% to the revenue share). A ceiling of 50% on the contestable revenue share at the higher revenue point (HRP) has also been prescribed.

The policy also provides for a shorter exploration period of three years for onshore or shallow water blocks and four years for deep water blocks. To incentivise early production, the government will offer a 10% royalty discount in category one basins, a 20% discount in category two basins and a 30% discount in category three basins. These last are basins with hydrocarbon shows that are considered geologically prospective and will be given if production starts within four years for onshore or shallow water blocks. Shallow water is defined as under 400 metres’ water depth. They have five years to start output in deeper water, but beyond 1,500 metres’ water depth) / ultra deep water blocks (beyond 1500 metres of water depth) from the effective date of contract.

Icra said: “For unallocated/unexplored areas of producing basin the increase in weighting given to the work programme would drive greater and more thorough exploration effort in all parts of the block as typically E&P blocks are several hundreds to thousands of square kilometres,” Icra said.

Providing an upper ceiling on biddable revenue share, besides preventing unviable bids, Icra added, would also ensure higher returns for the operators thereby incentivising higher production. “It is also designed to maximise the work programme as bidders would bid a higher work programme to secure highly prospective blocks thereby leading to a more intensive exploration program,” ICRA said.

According to the policy, contractor will have full marketing and pricing freedom for crude oil and natural gas to be sold at arm’s length basis through transparent and competitive bidding process.

Marketing and pricing reform for natural gas

To incentivise enhanced gas production, marketing and pricing freedom has been granted for those new gas discoveries whose field development plan (FDP) is yet to be approved. Fiscal incentive in the form of reduced royalty rates by 10% is also provided on additional gas production from domestic fields over and above normal production under ‘business as usual’ scenario.

In a bid to fight chronic air pollution in urban clusters, the Indian government is promoting the use of cleaner fuels such as natural gas. At present, gas has about 6-7% share in overall energy mix. The government wants to lift this share to 15% in a decade. Increasing domestic production will be very important if the government wants to achieve this target as expensive LNG will not suffice.

The domestic pricing of gas has remained below the cost of production for several fields for many years which, coupled with lack of pipeline connectivity, has disincentivised development of natural gas fields. Domestic gas prices have been pegged to the prices prevailing at international hubs through a complex formula, in the absence of a price discovery mechanism owing to the lack of a gas trading hub.

“As the international hubs are located in gas abundant areas the domestic gas prices have been low. Providing marketing and pricing freedom to gas producers would go a long way in increasing the production of gas by incentivising development of gas discoveries,” Icra said.

Production enhancement

To enhance production from existing nomination fields of state-owned national oil companies (NOCs), ONGC and OIL, enhanced production profile will be prepared by both companies. For production enhancement, bringing new technology, and capital, these NOCs will be allowed to induct private sector partners. The government also decided to give 66 fields of these NOCs to private operators for increasing the production. The state-owned companies will get a share in the increased production apart from getting what was being produced by them.

Ease of doing business

Slow-moving bureaucracy and lack of co-ordination between the various government departments have slowed down decision making in India, which has adversely impacted investments in various sectors, including E&P. With the new policy, the government is looking to promote the ‘ease of doing business’.

The new policy says that measures will be initiated to promote the ‘ease of doing business’ with the creation of a co-ordination mechanism and the simplification of the upstream regulator’s approval process, as well as an alternative dispute resolution mechanism, among others.

The government will set up the co-ordination mechanism under a cabinet secretary to expedite inter-ministerial approvals and clearances. It will simplify the approval processes using more online technology, such as a web-based window system with standard operating procedures.

The simplification of the upstream regulator’s approvals process and the dispute settlement process are still the two most contentious issues facing the Indian upstream sector. Through the new policy, the government will also strengthen the upstream regulator, including delegating powers for effective contract management and expediting approvals. Also, to avoid arbitration, the government will establish an alternative dispute resolution mechanism in the form of a committee of experts.

A hopeful government

With the new policy framework, the government has tried to give a booster shot to the struggling Indian E&P sector. It expects enhanced exploration activities, giving greater weight to exploration work programmes and with simpler and cheaper fiscal and contractual terms. It hopes that by extending the fiscal incentives and freeing producers to set prices will result in early monetisation of discoveries and marketing.

More functional freedom has been provided to NOCs for collaboration and private sector while approval processes have been streamlined with focus on ‘ease of doing business’.

The policy framework aims to make the fiscal and approval regimes more attractive for both FDI [foreign direct investment] and domestic investments, thereby incentivising E&P investments and higher production. Overall, Icra believes the reform measures will improve the credit ratings for the sector, as they should lead to improved profitability for incumbents and make exploration more attractive for new entrants too, Icra said.