IEA: Chinese Power Helps Gas Growth - NGW Magazine

This article is featured in NGW Magazine Volume 2, Issue 14

Gas will grow faster than oil and coal over the next five years, helped by low prices, ample supply, and its role in reducing air pollution, according to the International Energy Agency’s Gas 2017 report. The study, previously known as the Gas Medium-Term Gas Market report and published July 13, also forecasts that the recent US shale gas boom "shows no sign of running out of steam."

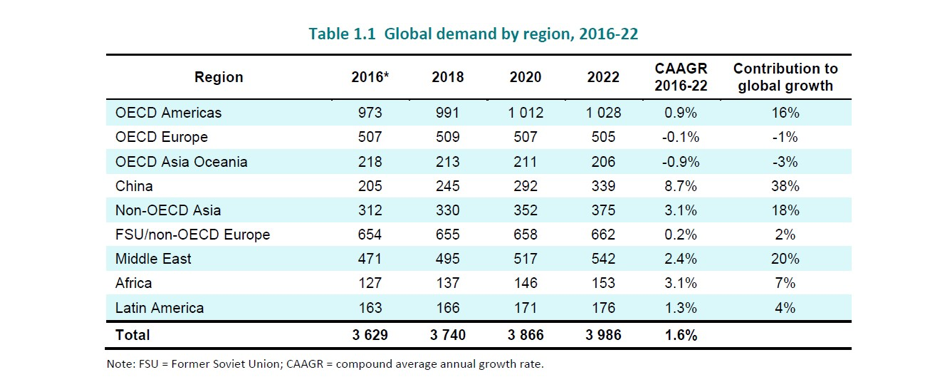

World gas demand will grow at 1.6%/yr on average from 2016-22, a slight upward revision from its similar forecast a year ago of 1.5%/yr, the IEA said. The average annual growth rate during 2010-16 was also 1.5%.

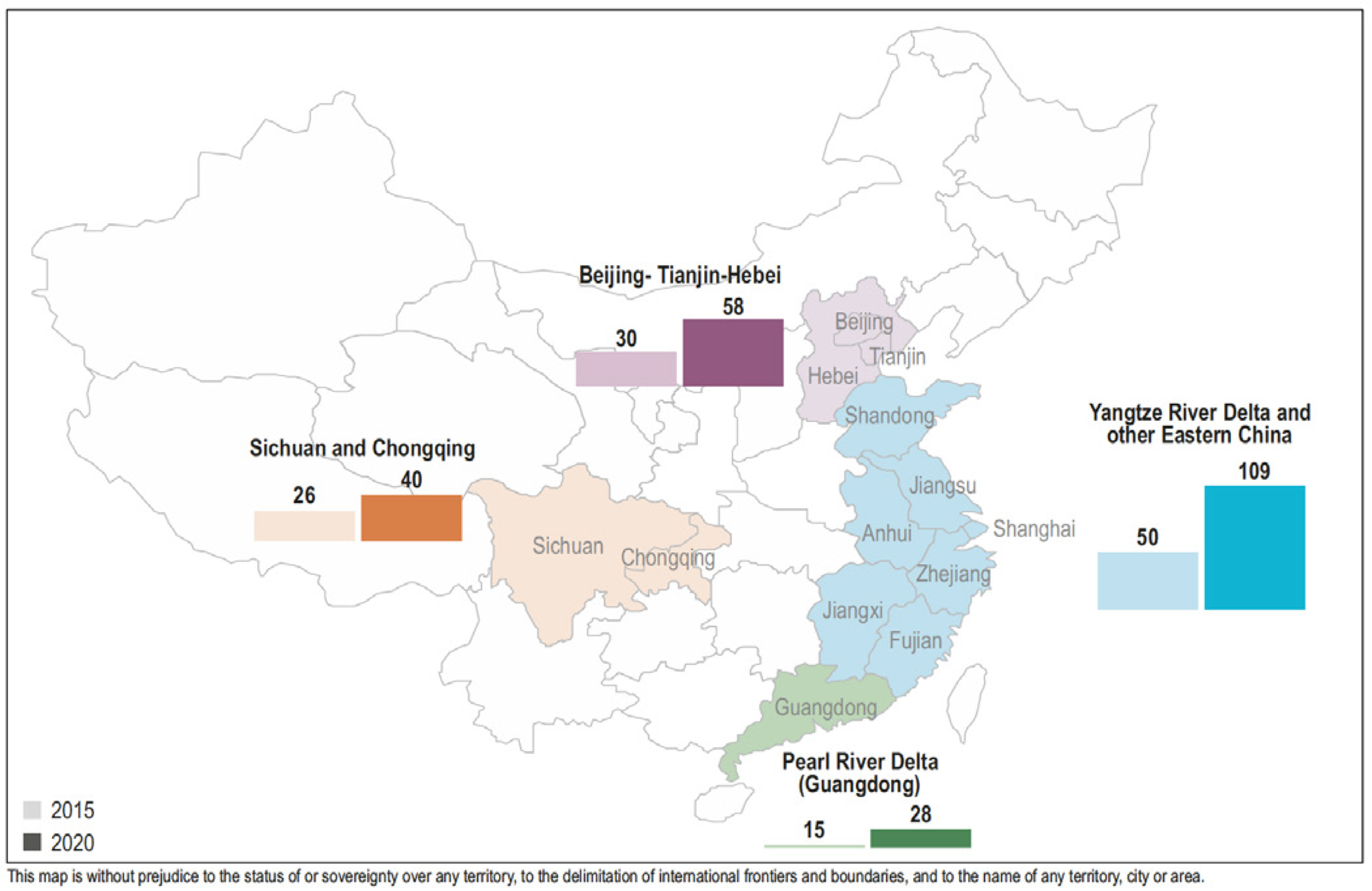

Of that growth of 360bn m3 during 2016-22, 90% will come from developing countries, led by China which alone will account for some 40% of the global demand increase. Moreover, much of the increased demand will be from industries in China, India and the US – for instance in the petrochemical sector – as use of gas in global power generation will grow by only 1%/yr. That’s far lower than the gas in power generation growth rate of 4%/yr seen in 2004-10.

Competition from coal and renewables, but also more efficient gas-fired CCGT units, will limit gas in the sector in 2016-22, although gas for power will see stronger growth in China and the Middle East.

North American overall demand – the US, Mexico and Canada – will surpass 1 trillion m3 by 2022, meaning that one quarter of global gas will be used in North America, as global demand rises from 3.629 trillion m3 in 2016 to 3.986 trillion m3 in 2022, the IEA forecasts.

US shale will fuel global supply

Global gas production is also forecast to rise by 1.6%/yr in 2016-22.

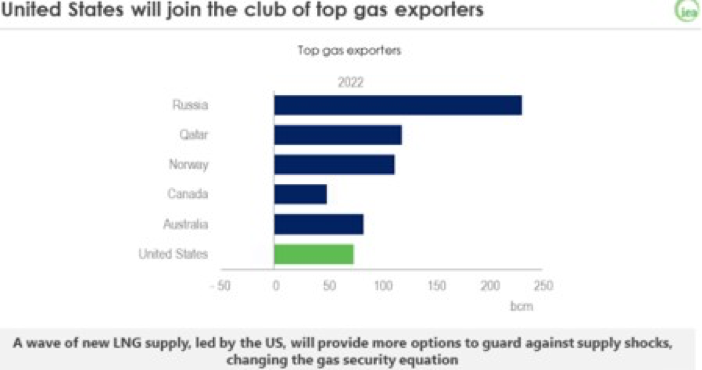

The US alone will account for almost 40% of global output growth over that period, such that in 2022 some 890bn m3, or one-fifth of world gas production, will come from the US. Indeed, US gas output during 2016-22 is estimated to grow at 2.9%/yr, adding around 140bn m3 to global production.

"The US shale revolution shows no sign of running out of steam and its effects are now amplified by a second revolution of rising LNG supplies," said IEA CEO Fatih Birol in a statement. The report moreover foresees that half of that incremental US supply will be liquefied for export.

The Marcellus shale in the northeast US will be able to produce at breakeven prices less than $2/mn Btu, although more pipeline capacity will be needed to sustain production, the IEA’s director of energy markets and security Keisuke Sadamori told a press briefing July 11 ahead of publication.

Even higher breakeven prices would comfortably allow for added liquefaction and transport costs to reach global markets. IEA Gas 2017’s price assumptions (based on forward curves of May 2017) are that the European gas price hubs NBP and TTF – for which 2018-19 forward curves were a tad above $5.20/mn Btu – should stay roughly at this level through 2022. The IEA’s assumed oil-linked LNG price, more widely used in Asia, would increase towards around $8.50/mn Btu towards 2022.

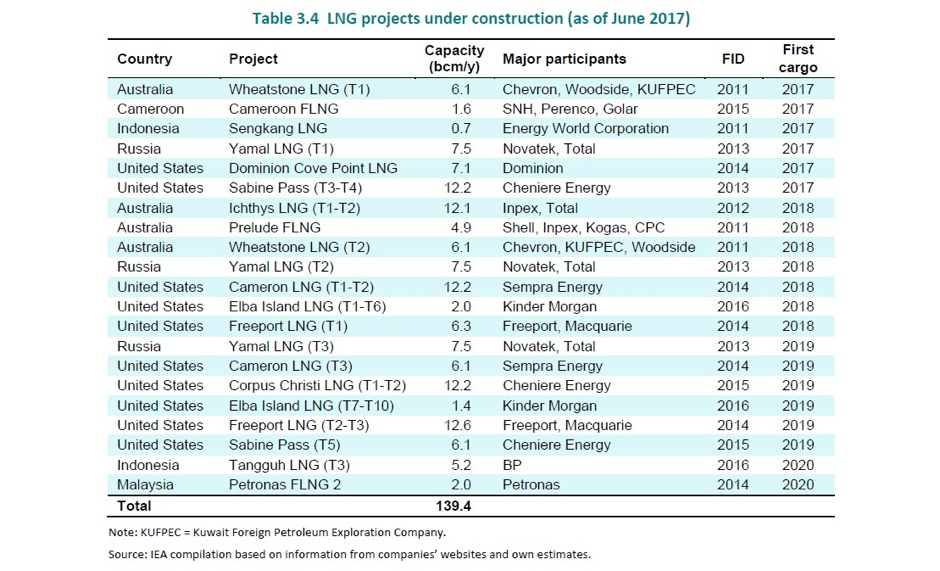

Thus the US will be a strong supplier in world markets, where Russia and Qatar will have to compete for market share, argued Sadamori: “Fifteen new projects with total export capacity of around 140bn m3/yr are now under construction, and Australia and the US account for 75% of them.”

Birol’s statement noted: “The rising number of LNG consuming countries, from 15 in 2005 to 39 this year, shows that LNG attracts many new customers, especially in the emerging world. Whether these countries remain long-term consumers or opportunistic buyers will depend on price competition."

Russia, China and the Middle East will also add to production growth – with China’s forecast production growth a robust 6.6%/yr, adding an extra 65bn m3 between now and 2022. International gas trade reached 1.060 trillion m3 in 2016, the IEA’s report noted.

Pipeline-traded gas has gradually lost market share with the rapid development of global LNG trade, with the IEA forecasting that LNG will account for 38% of all traded gas in 2022, and that the world is on the cusp of a “second wave of LNG expansion.”

It expects global liquefaction (LNG export) capacity to reach 650bn m3/yr by 2022 – an increase of 160bn m3/yr – on the back of additions chiefly in the US (90bn m3/yr) and Australia (30bn m3/yr).

This will strengthen buyers’ hands, as ample LNG availability will “put pressure on traditional ways of pricing and marketing gas.” That will be further accelerated by the expansion of US exports, which are neither destination- nor oil-linked.

The LNG supply glut will continue to discourage new investment. The IEA to date notes just one LNG project took its final investment decision this year (Coral floating LNG offshore Mozambique).

Repercussions of Qatar’s planned LNG expansion

Qatar, Australia and the US will account for nearly 60% of global LNG supply in 2022.

The IEA report though does not include Qatar’s planned 30% expansion to 100mn mt/yr (138bn m3/yr) in its projections, as that expansion would come onstream in 5 to 7 years -- so after 2022.

Sadamori said July 11: “The expansion projects by Qatar, even if they go well, are expected to be completed after the projection period covered by our report – so we have not included any of the quantities.”

“In terms of the LNG investment environment, if [Qatar’s] projects go through, this will occur in a well-supplied market, so some other projects now being considered might be impacted – as there is some uncertainty in terms of the demand outlook. So, we expect this would have an impact on other projects.”

He declined to say whether Canadian, East African or Russian schemes would be adversely affected, adding: “It depends on the project; it’s hard to say which area would be affected.”

Within a week of the Qatari expansion announcement on July 4, top ExxonMobil, Shell and Total executives were reported by Reuters to have held separate talks in Doha on possible involvement. All three are partners in existing Qatargas export projects. Total CEO Patrick Pouyanne went public on July 11 stating his company’s “willingness to further expand its cooperation in particular with new projects in Qatar,” as Total was about to take over a key operator role at the country’s main oilfield.

Sadamori declined to speculate on how much funding would be needed, and how easily it might be mobilised. But as the IEA energy security chief, he said: “The current difficult situation surrounding Qatar ... may have an impact, which we need to monitor. This is a major concern for IEA member countries, so we have been tasked [by them] to continue monitoring what’s happening there.”

Japan, South Korea and India each of which imported 11-12mn mt from Qatar in 2016. Sadamori is conscious of east Asian requirements for reliable LNG deliveries. As a senior Japanese official, he advised the country’s prime minister on energy aspects of the Fukushima crisis in 2011, before joining the IEA in 2012.

Of the current top two global LNG importers, the report forecasts that Japan’s overall gas demand will decline as nuclear power capacity comes back on line, flat electricity demand and continued deployment of renewables; it assumes that 17.5 GW of nuclear capacity, around one-third of the capacity operating in 2010, will be running by 2022. It also sees the outlook to 2022 for South Korea’s gas demand as relatively weak, with total gas use expected to decrease modestly.

Investment not flowing everywhere

In a foreword to the new report, Birol notes that Asia is not alone in becoming more receptive to gas. Market reforms in Egypt, Brazil and Argentina have the potential to unlock major new domestic resources by bringing in the necessary technologies and capital, he writes, with Mexico particularly vigorous in enabling gas to reduce the share of expensive oil-fired generation in the country’s mix.

In other countries, though, increased domestic demand is not attracting renewed investment. The report forecasts African gas consumption will rise by 3.1%/yr to reach over 150bn m3 by 2022, with Egypt, Algeria and Nigeria the main countries pushing consumption higher.

Yet also at the July 11 press briefing, IEA senior energy analyst Rodrigo Pinto said of Algeria that new fields will come onstream, but only compensate the decline in existing major fields, meaning: “It will be impossible for [state producer] Sonatrach to increase exports through pipeline or as LNG.”

The report though argues that Algeria since 2015 shifted its focus from supplying as LNG (to a glutted market) to supplying more pipeline gas into its traditional southern European market, where it has reasserted its market share – following a sharp decline of its share there in the early 2010s.

As the graphic below shows, given Algeria’s rising consumption at home, the IEA does not expect it to be able to increase gas exports out to 2022, despite a slight rise in production.

.png) Credit: IEA Gas 2017 report

Credit: IEA Gas 2017 report

The IEA’s Pinto continued: “If we look at Nigeria, we have seen a decrease in the use of gas in the power sector of 50% last year because of terrorist attacks and lack of investment in pipelines, and at the same time no-one is investing money in new upstream activities in Nigeria because of the lack of a well-functioning market.”

Asked if a newly-published Nigeria Gas Master Plan might improve investor confidence, Pinto replied: “Oil companies are very careful about putting money into upstream activities. The reforms could have an impact, but it needs more years to see the impact of [any] rising production. For the next five years, we are conservative in terms of the country’s capability to increase gas production.”

Asked by NGW if markets should be sceptical of claims that Nigeria might expand LNG facilities, Pinto noted Nigeria LNG’s existing long-term supply obligations, which was why the IEA expects Nigerian exports to remain at about 25bn m3/yr – “but in terms of any expansion of LNG activities, that is not what we foresee in the coming five years.”

Mark Smedley

Gas 2017 is available from the IEA (at €80 per single pdf, with discounts for multiple orders) via the following link: http://www.iea.org/bookshop/741-Market_Report_Series:_Gas_2017

This article is featured in NGW Magazine Volume 2, Issue 14