Hydrogen Europe looks to North Africa and Ukraine for renewable energy [GasTransitions]

Europe has almost all the ingredients it needs to become the world’s number one green hydrogen producer, note the authors, both renowned advocates of hydrogen: it has great demand for hydrogen, an extensive gas infrastructure, good renewable energy sources, ample hydrogen storage capacity in the form of salt caverns, as well as a “world class electrolyser industry”.

However, to be able to obtain green hydrogen in quantities that will really make a difference, Europe needs to look beyond its borders to its “neighbouring countries”, write Van Wijk and Chatzimarkakis. In particular to Ukraine, North Africa and the Middle East (MENA). These regions can deliver the quantities of renewable energy that Europe needs – partly in the form of hydrogen. The report offers a roadmap to achieve “2 x 40 GW” of electrolysis capacity by 2030 – 40 GW inside Europe and 40 GW outside.

Sahara Desert

The reason the authors look to the MENA region for renewable energy is not hard to fathom. The massive solar resources of the region are well-known. “A fraction (8-10%) of the Sahara Desert’s area could generate the globe’s entire energy demand,” they write. The Sahara also has great wind resources.

Europe has long had an eye on North Africa’s renewable energy resources, but in the past plans to import them were usually focused on building electricity cables. Now there is a growing awareness that transport by pipeline, in the form of hydrogen, would be much more efficient.

“Hydrogen transport costs by pipeline are about 10-20 times cheaper than electricity transport cost by a cable,” notes the report. What is more, pipelines have a much larger transport capacity: “An electricity transport cable has a capacity between 1-2 GW, while a hydrogen pipeline can have a capacity between 15 and 30 GW. Besides, transporting electricity via cables incurs losses, while hydrogen transport by pipelines does not have losses.”

Existing gas infrastructure “can be relatively easily and quickly converted to accommodate hydrogen at modest cost,” write the authors. But even building new hydrogen infrastructure “is 10-20 times cheaper than building the same energy transport capacity with a new electricity infrastructure.”

North Africa is of course already exporting natural gas from Algeria and Libya, with several pipeline connections to Spain and Italy. These pipeline connections have a capacity of more than 60 GW, notes the report. There are also two electricity transport cables, each with a capacity of 0.7 GW, between Morocco and Spain. Morocco and Spain have signed in 2019 a Memorandum of Understanding to realize a third power interconnector of 0.7 GW (Tsagas, 2019), which will be used also to export solar electricity from Morocco to Spain.

Clearly, “the capacity of these electricity inter-connections … is much less than the capacity of the gas interconnections. Therefore for Africa and Europe it would be very interesting to unlock the renewable energy export potential in North Africa, with North African countries converting this electricity to hydrogen and transport the energy via pipelines to Europe.”

The authors calculate that “the realisation of a large new hydrogen pipeline from Egypt, via Greece to Italy, 2,500 km, with 66 GW capacity, consisting of 2 pipelines of 48 inch each, would imply an investment of about € 16.5 billion. With a load factor of 4,500 hours per year, an amount of 300 TWh or 7.6 million tons of hydrogen per year can be transported. The levelized cost for hydrogen transport by such a pipeline is calculated to be 0.005 €/kWh or 0.2 €/kg H2, which is a reasonable fraction of the total cost of delivered hydrogen.”

The African Hydrogen Partnership initiative prepared an overview of existing and planned pipeline infrastructure for gas, oil and chemical products in Africa, notes the report. This indicates what type of hydrogen product could be transported through these pipelines. (Figure 1)

Difficult, but crucial

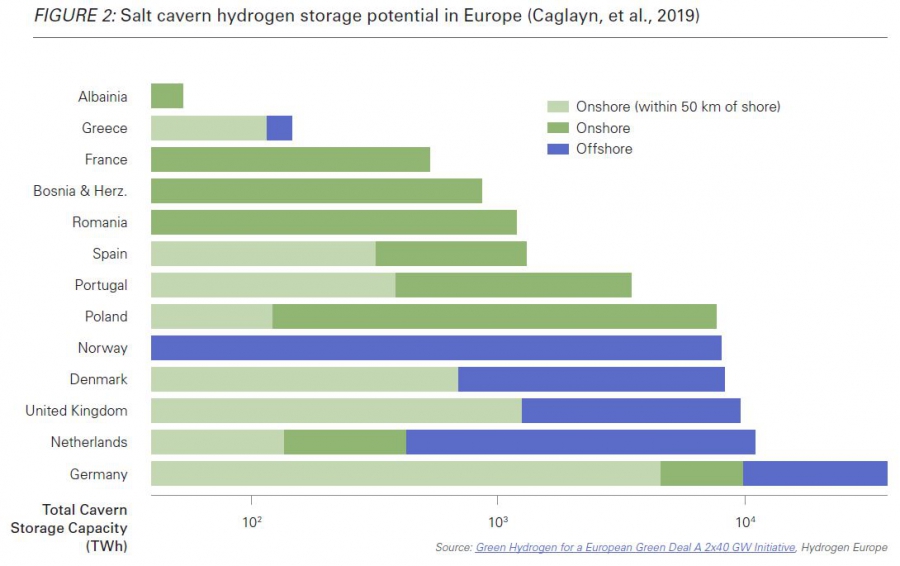

Storage of hydrogen is also much cheaper than storing electricity, write Van Wijk and Chatzimarkakis. “In a typical salt cavern, hydrogen can be stored at a pressure of about 200 bar. The storage capacity is then about 6,000 ton hydrogen or about 240 GWh. The total installation costs, including piping, compressors and gas treatment, are about € 100 million. For comparison, if this amount of energy would be stored in batteries, with costs of 100 €/kWh, the total investment cost would be € 24 billion. Storing energy as hydrogen in salt caverns is therefore at least a factor 100 cheaper than battery storage.”

A recent study shows that there is a very large hydrogen storage potential in salt caverns in Europe. (Figure 2)

Europe also has a number of major producers of electrolysers: McPhy, ThyssenKrupp and NEL are known for their alkaline electrolysers, Hydrogenics, Siemens and ITM Power for their PEM electrolysers. Sunfire produces so-called SOEC electrolysers based on solid oxide electrolyser cells.

Today, worldwide electrolyser capacity is 20-25 GW, according to the report, which is operated mostly for chlorine production. By electrolysis of salt dissolved in water, chlorine is produced from the salt, and hydrogen is produced from water. Globally, a large part of these chlorine electrolysers are produced by European companies, according to the report.

The “difficult but crucial question”, however, according to the authors “is how to transition from a natural gas infrastructure to a hydrogen one in the next decade. Ramping up the hydrogen production capacity to fill a newly built or convert a natural gas pipeline into a hydrogen transport pipeline with a capacity of 15-20 GW takes time. Converting a natural gas transport pipeline into a hydrogen pipeline or building a new dedicated hydrogen pipeline is only fully cost-effective at the end of the period up to 2030.”

The authors suggest several interesting “pathways and solutions for this transition from natural gas to hydrogen”:

- “In parallel to hydrogen produced through electrolysis, stimulate the production of large quantities of carbon neutral hydrogen [i.e. “blue” hydrogen made from natural gas with CCS] to have enough volume to fill a transport pipeline. This makes it possible to convert natural gas pipelines to hydrogen transport pipelines earlier.

- Blend hydrogen with natural gas. Some 2-5% of hydrogen could be blended in the natural gas transport grid without the need to replace or adjust compressors. Above 5%, the hydrogen could be blended in one specific transport pipeline, where the compressors are replaced or adjusted.

- Put a small hydrogen pipe in a natural gas pipeline. Such a pipe in pipe system is most probably cheaper and faster to install. In this way 1-2 GW capacity of hydrogen can be transported over larger distances, e.g. crossing the Mediterranean Sea or at the North Sea, without prohibitively high cost. At the same time, natural gas can still be transported, albeit with lower capacity.

- Build green ammonia plants in harbour areas and export the hydrogen by shipping the ammonia. This ammonia, which is a combination of nitrogen and hydrogen, could be used in the fertilizer and chemical industry, it could be cracked back to hydrogen or it could directly be used as a fuel in maritime diesel engines or in converted power plants.

- Build hydrogen liquefaction plants in port areas and export liquid hydrogen in special cryogenic vessels similar to LNG. The liquid hydrogen can be easily re-gasified in the port of arrival and injected into a pipeline system. Or the liquid hydrogen could be sent to fuelling stations in trucks carrying liquid hydrogen (up to 10 times more energy can be transported in liquid hydrogen than at pressurized hydrogen)

- Other solutions: to ship hydrogen, such as Liquid Organic Hydrogen Carriers, combine hydrogen with CO2 to produce methanol, formic acid, kerosene, or another synthetic hydrocarbon.”

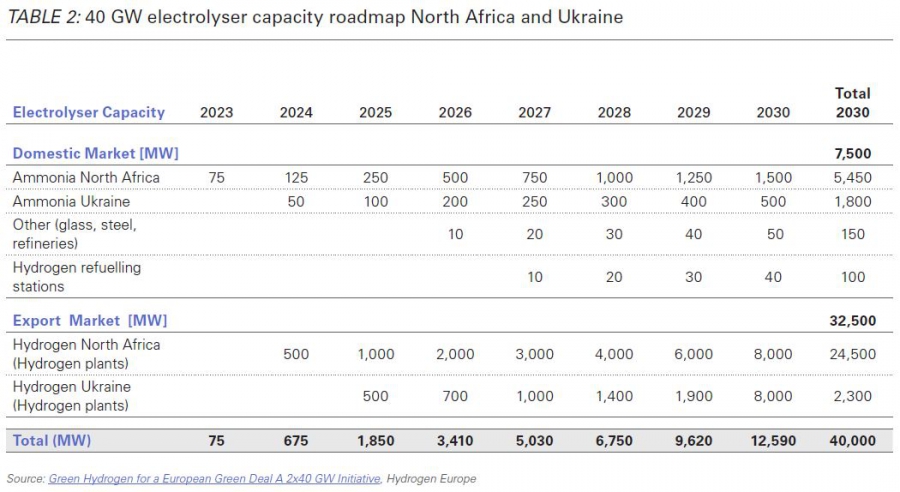

Depending on the choices that are made, the two roadmaps to the 2x40 GW in 2030 could look as follows (see tables 1 and 2):

The European capacity would lead to annual production of 4.4 million tons of hydrogen. This is equal to roughly half of current European production of “grey” hydrogen and represents 25% of European hydrogen demand in 2030 under the “ambitious” scenario laid out in the 2019 report Hydrogen Roadmap Europe from the Fuel Cell Hydrogen Joint Initiative (FCH-JU).

The North African and Ukrainian capacity would result in 3 million tons of ammonia production (in Egypt, Algeria and Morocco) and 1 million tons of ammonia production in Ukraine, plus a total of 3 million tons of hydrogen for export to Europe.

Success of this project would have several benefits, according to the authors.

First, “renewable hydrogen would become cost competitive with fossil (grey) hydrogen. GW-scale electrolysers at wind and solar hydrogen production sites will produce renewable hydrogen cost competitively with low-carbon hydrogen production (1.5-2.0 €/kg) in 2025 and with grey hydrogen (1.0-1.5 €/kg) in 2030.”

Secondly “by realizing 2x40 GW electrolyser capacity, producing green hydrogen, about 82 million ton CO2 emissions per year could be avoided in the EU.” To compare: this is around 10% of total German greenhouse gas emissions.

Three, “The total investments in electrolyser capacity will be 25-30 billion Euro, creating 140,000- 170,000 jobs in manufacturing and maintenance of 2x40 GW electrolysers.” That is to say, mostly jobs in Europe.

_f600x551_1588582507.JPG)

_f900x577_1588582614.JPG)