How to make money with CO2 [GasTransitions]

Carbon capture and storage (CCS) and carbon capture and use (CCU) are important topics for the gas industry, but it is hard to get reliable information on their real potential and challenges. Most information comes either from the CCS industry or from opponents. A recent article written by four partners from McKinsey, Driving CO2 emissions to zero (and beyond) with carbon capture, use, and storage, is a welcome exception.

The article focuses mostly on the potential of carbon capture and use. In particular, it discusses eight business cases under which CO2 could be captured and re-used in various processes:

- enhanced oil recovery

- storing CO2 in concrete

- using CO2 to create jet fuel (with hydrogen)

- direct air capture (DAC)

- bioenergy in combination with CO2-storage

- using CO2 to make superstrong and superlight carbon fibres

- using CO2 as substitute for fossil fuel–based inputs in plastics production

- and using it to make biochar

The authors estimate that CCUS could expand from 50 million tons of CO2 abatement per year (Mtpa) today to at least 500 Mtpa (0.5 gigatons a year, or Gtpa) by 2030 —just over 1 percent of today’s annual global CO2 emissions (41 Gtpa). Such an expansion would only be possible, however, “with a supportive regulatory environment.”

Economic payoff

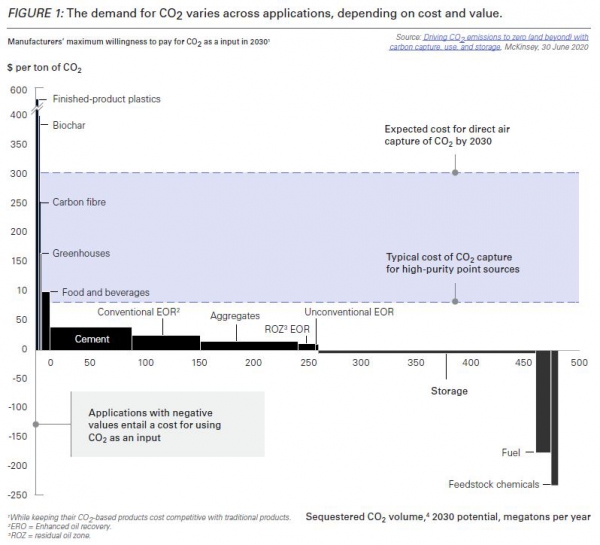

The possible uses of CO2 are at various stages of development. Figure 1 shows in which cases the economic payoff is close and where more incentives would be needed to enable CCUS technologies to scale and reach their full potential.

Enhanced oil recovery (EOR) is unsurprisingly the most profitable business case. EOR accounts for around 90% of all CO2 usage today (mostly in the United States), notes McKinsey, but it obviously does not reduce emissions to zero.

Using CO2 in concrete also presents “a significant decarbonization opportunity”, according to the authors. For example, “precast structural concrete slabs and blocks could potentially be made with new types of cement that, when cured in a CO2-rich environment, produce concrete that is around 25 percent CO2 by weight. There’s a CO2 bonus available here as well: cement used in this curing process has a lower limestone content. That’s significant, since baking limestone (calcination) to make conventional Portland cement releases around 7 percent of all industrial CO2 emissions globally.”

A second process involves “combining the aggregates with cement to make concrete (think cement mixers). Synthetic CO2-absorbing aggregates (combining industrial waste and carbon curing) can be formed to produce this type of concrete, which is 44 percent CO2 by weight. We estimate that by 2030, new concrete formulations could use at least 150 Mtpa of CO2.”

The third potentially most significant use of CO2 concerns the production of jet fuel. McKinsey notes that “CO2 could be used to create virtually any type of fuel. Through a chemical reaction, CO2 captured from industry can be combined with hydrogen to create synthetic gasoline, jet fuel, and diesel. The key would be to produce ample amounts of hydrogen sustainably.”

The aviation industry is particularly keen to develop this business case. McKinsey estimates that this technology could abate roughly 15 Mtpa of CO2 by 2030.

Weak link

Two more general challenges to CCUS, in addition to the financial one, are transportation and storage. According to the authors, CO2 transportation currently is “a weak link in the value chain. In the United States, some 5,000 miles of pipeline transport CO2, compared with 300,000 miles of natural-gas pipelines. Outside the United States, pipelines for moving CO2 are rare.”

The challenges for storage are “primarily nontechnical—a function of economic, legal, and regulatory challenges.” The authors note that “by some estimates, the United States could geologically store 500 years of its current rate of CO2 emissions; globally, the number is around 300 years.” But storing CO2 delivers no financial benefits, so it will only be done if it is incentivized somehow. Moreover, it involves “complex legal issues that must be resolved, such as liability for potential leaks, as well as the jurisdictional complexities associated with underground property ownership and use.”

Nevertheless, the McKinsey partners estimate that by 2030 “storage could account for 200 Mtpa of CO2 abatement—a small but meaningful slice of the full potential for storage.”

|

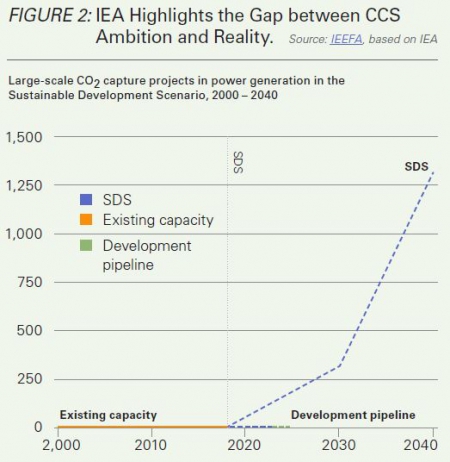

IEEFA: CCS is “prohibitively expensive and offers no financial returns” “There isn’t one example of a CCS project anywhere in the world that offers a financial justification for CCS,” according to a new paper from the Australian branch of the U.S.-based Institute for Energy Economics and Financial Analysis (IEEFA) written by Clark Butler. IEEFA is a climate think tank sceptical of CCS and natural gas use. Butler does not offer any new arguments or facts, he merely stresses the well-known fact that progress on CCS worldwide has been slow (see Figure 2) and CCS is nowhere near delivering on its carbon reduction potential. He notes that despite repeated statements on the importance of CCS by executives from Shell, Total and Equinor, they have put little of their own money into CCS projects. For Butler this implies that the Australian government should not subsidize CCS projects. If the government wants to encourage CCS, he writes, putting a price on carbon would be a much better policy. |