How the war is choking energy demand

The constant, 24/7 images of the war serve as a window for us all to witness the tragic devastation being wreaked upon Ukraine and its people. It’s clear the economic fall-out from Ukraine will be felt much more widely: in Russia, reeling from sanctions; across a global economy still recovering from the Covid-19 crisis; and in energy markets where commodity prices have hit the roof. Our chief economist, Peter Martin, shares his thoughts on the deteriorating outlook for the global economy while our team of analysts give their latest views on how it’s affecting oil, gas and coal demand.

First, Ukraine’s economic plight is stark. The exodus of 4.7 million people, more than 10% of the population; the destruction of buildings, infrastructure and capital stock; and disruption of agricultural activity could wipe 35% off GDP in 2022. Some observers have gone as far as suggesting a 50% contraction.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Ukraine’s global GDP per capita ranking is likely to fall six places in 2022 to 143rd, below Bangladesh, and it will be decades of investment and rebuilding for the economy to regain its pre-war heights.

Second, the collateral damage to Russia’s economy will also be very significant, and perhaps as long-lasting if it remains isolated from much of the world by sanctions. Energy is Russia’s crutch, with exports of oil, gas and coal exempt from most sanctions. Our data, including waterborne vessel tracking, show that with a pivot to Asia for crude, in particular, overall export volumes have been largely unscathed so far.

Crude, diesel, gas and coal contributed 60% of Russia’s export revenues before the invasion. Even with heavily discounted prices for spot sales of crude and coal, their importance to the economy can only have increased since the invasion. Separately, the government’s tax receipts from its domestic oil and gas industry were 50% higher in March 2022 year-on-year.

But the toll on the domestic economy will be heavy. The cumulative effect of financial sanctions has disrupted trade and rendered the imports the economy depends on inaccessible. The withdrawal of international companies has left Russian employees redundant and domestic supply chains without customers. Inflation, running at 9.2% year-on-year in February, is eating into consumers’ buying power. We reckon the Russian economy could decline by as much as 15% in 2022.

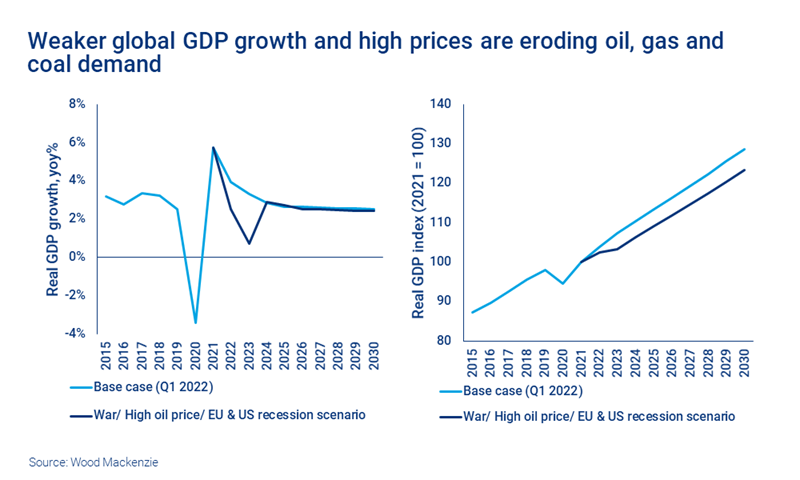

Third, the invasion of Ukraine increases the risk that the global economy will have a hard landing in 2022/23. Before the war, we anticipated the post-Covid recovery would underpin another strong year of economic growth after last year’s stellar 5.5% growth in global GDP.

Our January forecast for global GDP growth of 3.9% in 2022 looks increasingly unlikely. The inflationary effect from rising commodity prices was already dampening economic growth before the invasion. The latest Covid-19 lockdowns in China, now entering their second month, add to the headwinds.

The UK’s meagre 0.1% GDP growth in February over January – before the war ramped up commodity prices – may be an early indicator of what’s to come when more countries report Q1 GDP growth in a few weeks’ time.

Our downside scenario suggests global GDP growth could slow to just 2.4% in 2022 and 0.7% in 2023. Among the key assumptions are large spillover effects from the Russia/Ukraine war and an energy price shock causing recessions in the EU and US.

Fourth, we have lowered our demand forecasts for oil, gas and coal to reflect the changing outlook.

Oil

In its April outlook, our Macro oils team expects oil demand to grow at 3.6 million b/d in 2022 (still the second-biggest annual jump ever) and 2.2 million b/d in 2023. However, annual demand for 2022 has been trimmed by 0.8% and for 2023 by nearly 1% – mainly due to Covid-related lockdowns in several major cities in China and the weaker outlook for Russia’s economy and its oil demand due to sanctions. The impact of higher prices in some countries is a secondary factor.

Gas/LNG

The impact of high and volatile prices is leading to much bigger reductions for gas and LNG. Last week, we cut forecast gas demand in Europe by 4% for 2022 and 5% for 2023 compared with July 2021 (the outlook before the winter rise in gas prices). These reductions were split roughly evenly between the non-power and power sectors. But with gas-fired power plants seriously out-of-the-money, loss of gas demand could be double our current projections.

Asian LNG imports are down 10% in Q1 2022 year-on-year (Chinese, Japanese and Indian imports down 11%, 14% and 25%, respectively). With high LNG spot prices anticipated to persist into the mid-2020s, we have revised down near-term growth and now expect full-year Asian LNG demand to come in at around 270 mmtpa, flat versus 2021, and down 4.5% on our prior forecasts of 283 mmtpa. As global LNG prices moderate next year, we expect demand to rise to 280 mmtpa in 2023.

Coal

In our 1 April outlook, we reduced forecast global coal trade volumes by 1.5% for 2022 and 2.5% in 2023 compared to July 2021. The relative benefit to thermal coal demand from high gas prices into the power and non-power sectors has been offset in some price-sensitive Asian markets by big increases in coal prices.

Simon Flowers is the chairman and chief analyst of Wood Mackenzie.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.