How can Australia LNG disruptions impact EU markets?

With 0.1mn tonnes of Australian LNG received in the EU (Netherlands & Spain) in 2022 or 0.1% of its annual production, how can potential strikes in Australia push TTF prices to extreme volatility as seen in August?

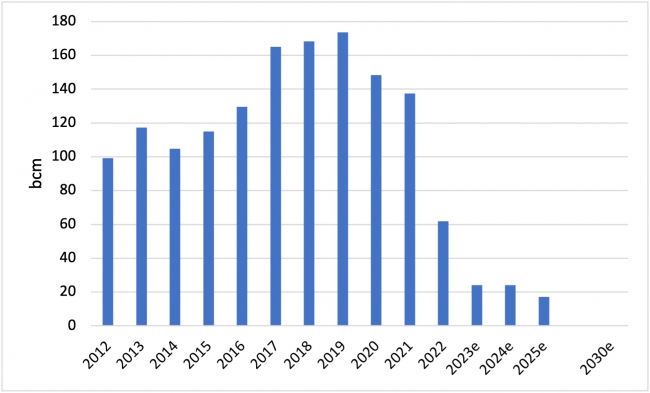

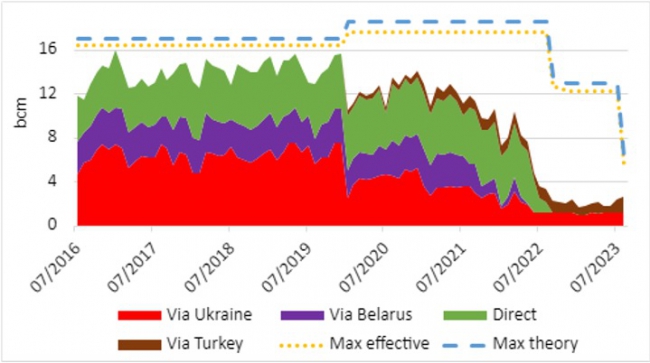

In August we narrowed the expected Gazprom’s exports to Europe range until the end of 2024, with a mean of 24bn m3/yr allowing Gazprom to still sell contracted gas to Austria, Croatia, Greece, Hungary and Slovakia. Those flows correspond closely to the contracts still effective in those five countries and are unlikely to be cut as they help lubricating relations in the least Russian unfriendly EU countries. As the Ukrainian transit contract is ending on December 31, 2024 and unlikely to be renewed, a further minimum drop of 7bn m3/yr from 2024 to 2025, is to be expected. Finally, RepowerEU is targeting to reach zero Russian pipe imports before the end of the current decade.

Gazprom's Europe Yearly Exports

Source: thierrybros.com

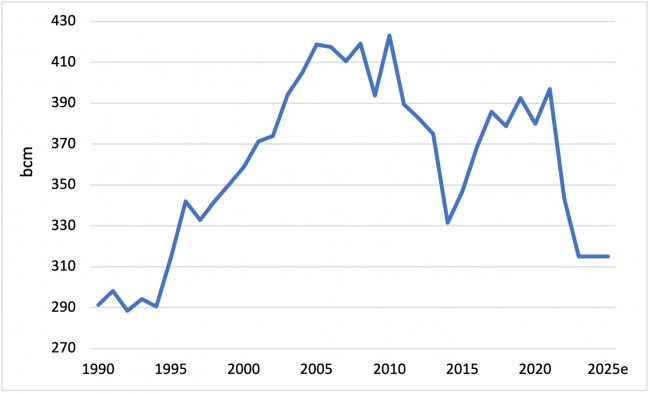

The effective drop in gas demand in 2022 vs 2021 was a whopping 13.5%. The demand reduction continued in 2023 both with a warm winter and new massive drop in gas for power generation, that represents 25% of total gas demand. For the first 7 months of 2023, EU net electricity generation was down 5% or 74.6 TWh. During the same period, wind, hydro and solar increased respectively by 6% (or 14 TWh), 10% (or 10.8 TWh) and 14% (or 14.8 TWh). All other generations were turned down: gas with -18% (or -46.1 TWh) and coal and other fossil fuels (lignite, oil) with -25% (or 63.4 TWh). For 5 first months of 2023 versus 2022, EU gas demand is down by 12% due both by a warm winter (-18% in Jan 2023 versus Jan 2022) and the electricity switch away from gas. We expect a the drop to continue in the coming months but more likely at the level witnessed in May (-6%). With the drop in gas demand witnessed in 2022 (-13.5%) and expected in 2023e (-8%), EU gas demand should bottom at 315bn m3/yr in 2023e-2025e (or -21% versus 397bn m3 in 2021) - a level not seen since 1995.

EU Gas Demand

Source: EI Statistical Review, thierrybros.com

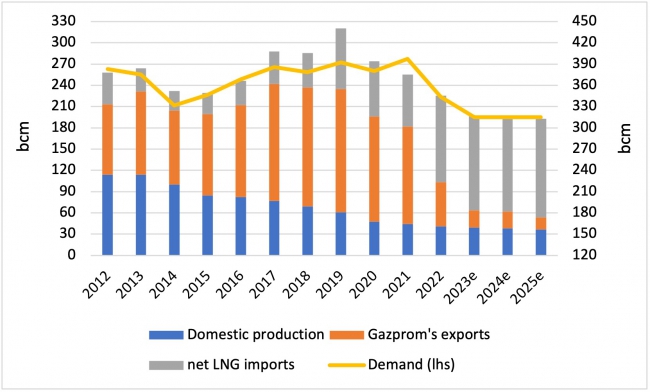

But this exceptional demand reduction doesn’t change the fact that EU will continue to need more LNG in the coming years due to lower Russian pipe imports. The EU should pass the 100mn t/yr LNG import mark before 2025e!

The EU has become not only a firm demand LNG centre but a premium market

EU simplified gas supply-demand balance

Source: EI Statistical Review for historical data, thierrybros.com

Not even taking into account the continuous decline in EU gas production (CAGR of -7.2% pa in 2012-2022 mostly due to Groningen closure), LNG net imports should continue to grow from records to records in the next few years. This is already visible in 2023 where, for the 7 first months, the growth has been 6.4% y-o-y while LNG production grew only by 2.7%. The EU accounted last year for 23% of global LNG but is accounting for 54% of the growth in 2023. Any hiccups in supply in the next 3 years, like potential strikes, would impact the EU that cannot further massively reduce its gas demand. Hence why markets are worried…

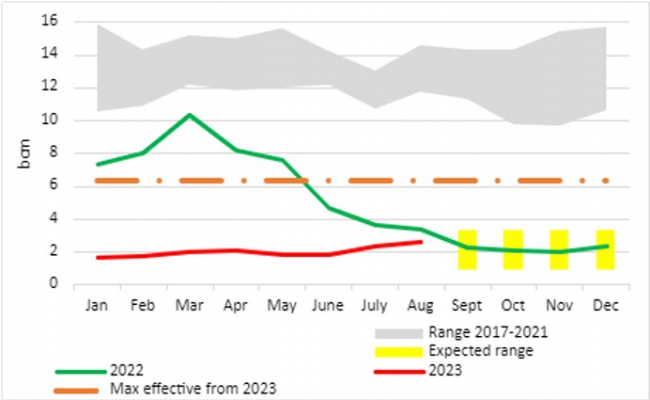

After more than a year war in Ukraine it looks unlikely that Poland would ever allow any transit of Russian gas; it is now time to reduce the theoretical maximum capacity Gazprom can use to push gas into the EU taking into account this hypothesis.

Gazprom's Europe Monthly Exports

Source: Gazprom, GTSOU, Entsog, thierrybros.com

With 2.6bn m3 exported in August 2023 vs 3.4bn m3 exported in August 2022, the drop yr/yr 23% but up 8% versus July 2023 thanks to an increase use of TurkStream.

Split of Gazprom's Europe Monthly Exports

Source: Gazprom, GTSOU, Entsog, thierrybros.com

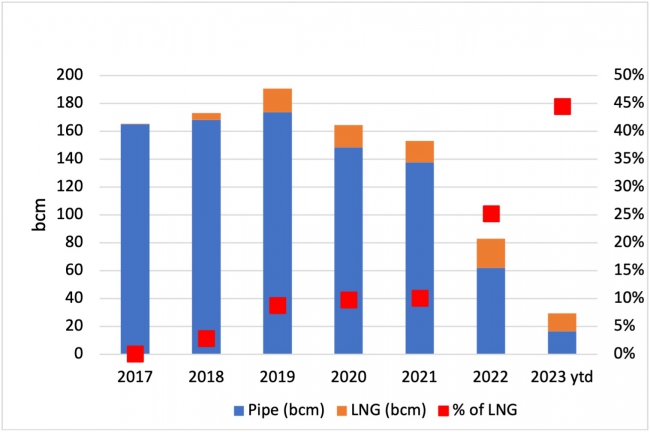

Contrary to EU Commission narrative, EU has not massively reduced its Russian gas dependency. Gazprom’s reduced its exports that used to represent 40% of EU demand in 2019 to 7% now but the market is using Russian LNG to mitigate this. With Russian LNG accounting for 45 % of total Russian gas supply, the EU is still 15% dependent on Russia. As Russia is the fourth largest LNG exporter, it could inflict more pain on EU by weaponising LNG going forward instead of pipe gas used in 2021 and 2022.

Russia's Gas Europe Exports

Source: thierrybros.com

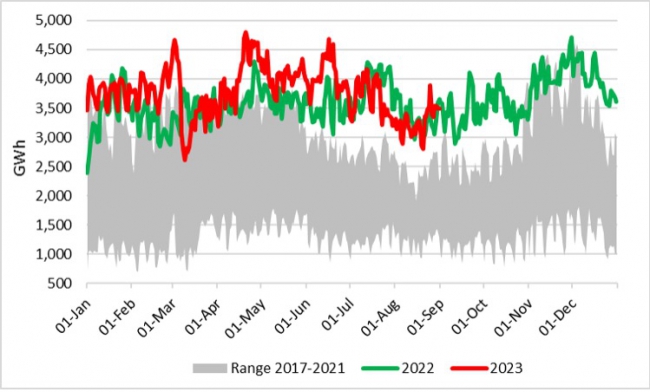

April send-out were at an all time high with a maximum daily recorded on April 20. In August send-out was, for the second time in 2023, down versus last year (-3%).

EU (excl. Malta) LNG send-out

Source: GIE, thierrybros.com

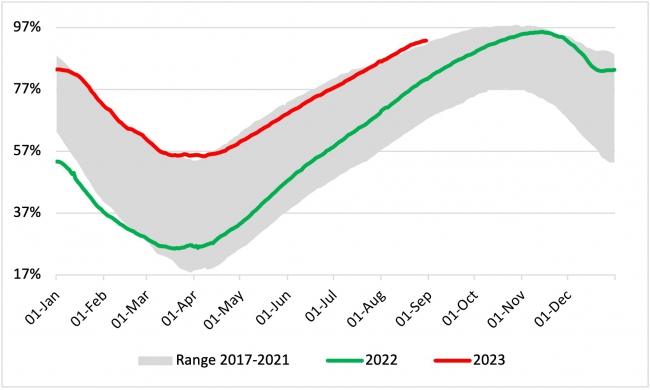

EU Storage

Source: GIE, thierrybros.com

Since July 28, the EU storage level is now back above historical range. On August 16, storage reached the 90% minimum target set by EU Commission ahead of any winter. With 93% full at the end of August, the market needs to find new capacity (Ukraine) to store the gas ahead of winter.

Dr. Thierry Bros

Energy Expert & Professor

September 4, 2023