Hoegh Lines up Clients for Next FSRUs

Norway-based Hoegh LNG expects to receive bids from six shipyards to build its next floating storage and regasification unit (FSRU) and it sees up to three possible clients willing to charter it when completed in early 2019.

The Bermuda-registered shipowner said August 25 that its profit after tax was $3.5mn, down from $6mn year on year.

Higher 2Q earnings were mainly due to Höegh Gallant being deployed throughout 1H 2016 – it began commercial operations in Egypt in April 2015 – and lower business development costs, in part because it ceased work on developing new floating liquefaction projects in February 2016.

Its FSRU (floating import terminal) project in Colombia is on schedule and due to start commercial operations in 4Q 2016. This will be Hoegh’s sixth FSRU project. Under a contract with local SPEC, Hoegh LNG will be paid 50% of the charter hire from June 2016 until the regas trial starts in the fourth quarter, spread over the first ten years of the contract. The ship to be used, Hoegh Grace, is on a spot charter to trader Trafigura in the meantime.

Hoegh said it tendered in June for a seventh newbuild FSRU and expects to receive bids, based on an early 2019 delivery, from six international shipyards with a view to deciding on them in 2H 2016. It has three possible clients whose expected start-up dates match FSRU-7’s 2019 delivery. Once a contract for this FSRU-7 is secured, Hoegh plans to place an order for its next purpose-built FSRU.

Also August 24 Hoegh announced for the first time that it will convert a ship into an FSRU “in order to capture additional business opportunities with a start-up at the end of 2017 and in 2018.”

Penco LNG FSRU project, previously named Octopus, reached important milestones when all permits were issued by Chilean regulatory authorities in July and August. Scheduled delivery by Hoegh is in 1Q 2018 and is likely to be its eighth FSRU venture, the company said August 25. The project – which includes a 640-MW gas-fired power plant – is 50%-backed by US marketer Cheniere Energy.

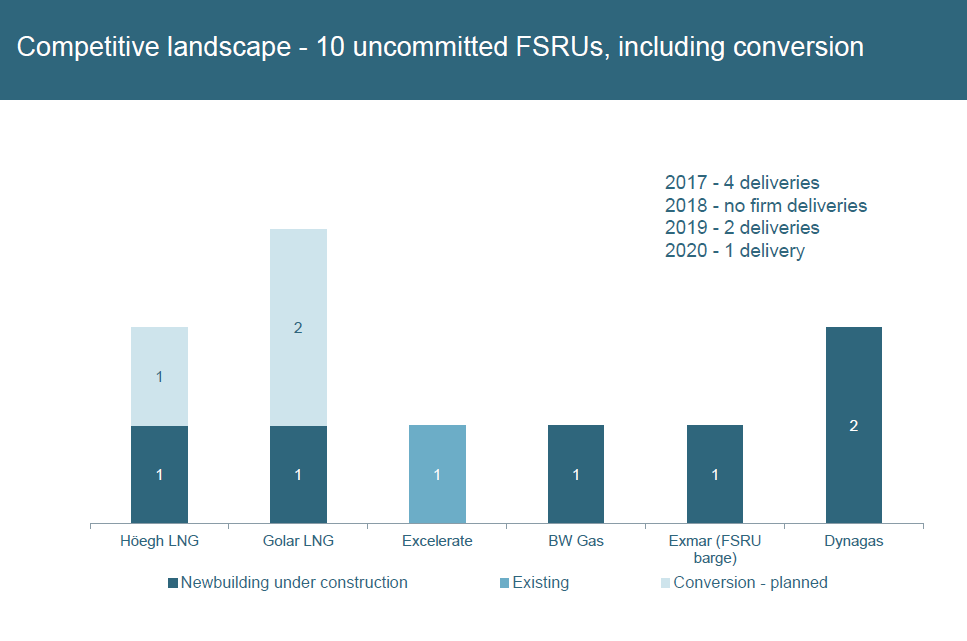

Terminal developers still have a choice of FSRU providers, but shipowners expect demand to rise until 2020 as LNG output grows. (Source: Hoegh LNG)

Only 10% of the 150mn metric tons/yr additional LNG liquefaction capacity due onstream between 2016 and 2020 has so far entered the market, said Hoegh LNG, eyeing continuing growth in the FSRU segment. This bullish outlook, which echoes that of Monaco-registered GasLog last month, contrasts with the currently bearish market for LNG tanker charters – which remains the bread-and-butter activity of all LNG shipowners.

Mark Smedley