Higher investment needed for Bakken Shale to exhibit full recovery

Bakken shale has experienced a constant decline since production peaked in November 2019, according to analysis by GlobalData. The leading data and analytics company notes that a steady rise in capital allocation from leading oil and gas operators and infrastructural improvements would reboot production in this region.

According to GlobalData’s latest report, Bakken Shale in the US, 2021 – Oil and Gas Shale Market Analysis and Outlook to 2025, Bakken Shale accounted for a mere 11% of oil and 2.8% of natural gas production in the US Lower 48 for 2020, which is a drop from 12% for crude oil and 3% for natural gas in 2019

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “Production in the Bakken shale was adversely affected by the COVID-19 outbreak and restrictions on economic activity. Although easing of restrictions and travel bans during H1 2021 have improved demand prospects, production is not expected to reach pre-pandemic levels in the next five years. This is because operators are still being extremely careful in ramping up drilling activities, and most likely we will not see any significant acceleration in hiring new rigs in the near-term.”

.png)

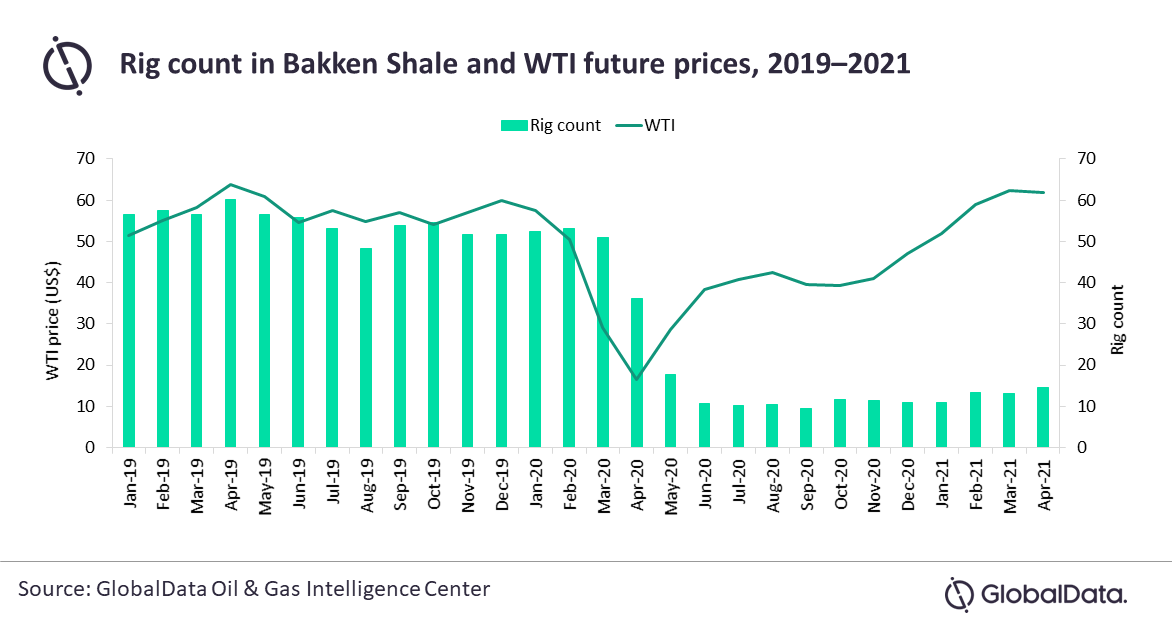

The Bakken averaged 55 drilling rigs in 2019, which then decreased to an average of 24 rigs – a 79% drop in 2020.

Doh continued: “While other basins throughout the US have increased their rig count, the Bakken has lagged with its rig count. Lately, the number of rigs has started to slowly increase, and has reached 16 rigs in June 2021, which is just a six-rig increase compared to the lowest number recorded last year. With West Texas Intermediate (WTI) future prices averaging $62/barrel for the remainder of 2021, GlobalData expects a slight uptick in the rig count but not the level that was observed before the COVID-19 pandemic.”

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.