Guyana’s new oil industry will also spur gas development [Gas in Transition]

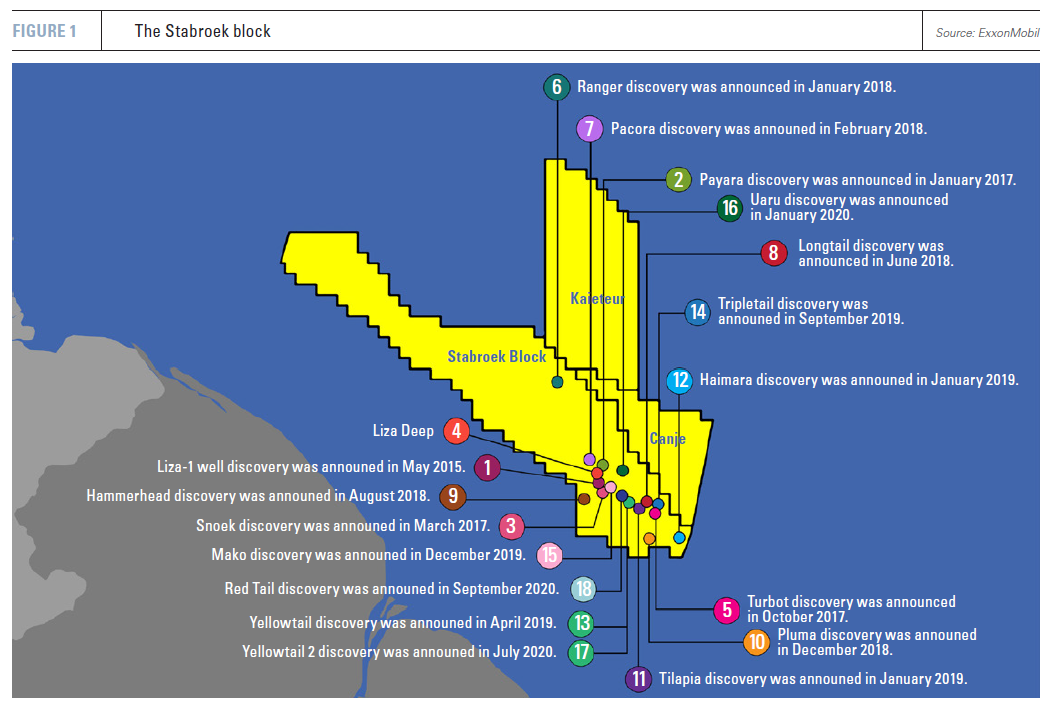

Guyana is a newcomer to the roster of the world’s crude producers, as it brought its first oilfield on stream in December 2019. That field – Liza-1, a section of the Stabroek offshore block – is currently yielding about 120,000 barrels/day.

ExxonMobil, the operator of the block, expects to see output levels rise significantly in the medium term. It has already drawn up plans for launching production at three more sections of Stabroek – Liza-2, Payara and Yellowtail, each of which will yield 220,000 b/d – and aims to select its fifth, sixth and seventh development targets within the next year or so. Altogether, these projects may push the South American country’s oil output up to about 1mn b/d by the end of the decade – even if none of its other offshore blocks turn out to contain commercial reserves of crude.

Virtually all of the oil extracted from Stabroek will be exported, as Guyana does not have any refineries that can process it for domestic consumption. Additionally, fully 52% of it will be exported on behalf of the government, in line with an agreement that ExxonMobil signed with officials in Georgetown in 2016. As a result, if production rises as quickly as expected, Stabroek will generate enough revenue to transform the Guyanese economy.

But the transformation won’t stop there. ExxonMobil’s plans for Stabroek don’t just involve crude oil; they also provide for the development and utilisation of the block’s associated gas resources. More specifically, they are designed to make associated gas from Liza-1 and Liza-2 available for use within Guyana for power generation and other purposes.

Gas to power – and further down the value chain

The US major has spelled out its plans in documents submitted to Guyanese government agencies, including the Environmental Protection Agency (EPA).

Those documents call for associated gas from Liza-1 – and, eventually, gas from Liza-2 as well – to be pumped from production sites to shore. The gas will be transferred from the floating production, storage and off-loading (FPSO) vessels stationed at the fields to shore via subsea pipeline. This 12-inch (304.8-mm) pipe will handle initial volumes of 50mn ft3 (1.42mn m3)/day, but throughput is slated to rise to 120-130mn ft 3(3.4-3.7mn m3)/d after Liza-2 comes online.

The link will terminate at a state-owned onshore facility near Wales, on the west bank of the Demerara River. This facility will process the gas, separating it into natural gas liquids (NGLs) and dry gas. In turn, Guyana’s government will sell the NGLs (including butane, pentane and propane) and use some of the dry gas to generate electricity at a 250 MW thermal power plant (TPP) it plans to build nearby.

The pipeline and processing plant are due to be completed in 2024, with the TPP to follow soon afterward. ExxonMobil has estimated the cost of building the first two facilities at about $900mn, but Guyana’s vice president Bharrat Jagdeo said in April that the price tag might be as low as $600-700mn.

Initially, the processing plant may only turn out enough dry gas to supply the power station. Eventually, though, it will make larger volumes available to other facilities.

Alistair Routledge, the president of ExxonMobil Guyana, indicated in late June that some of this gas might be delivered to manufacturers and other domestic consumers. He did not name any potential customers, but he told OilNOW.gy that the pipeline project would support “future expansion, either for power or for smaller-scale industries.”

Guyana is not looking to duplicate the experience of Trinidad and Tobago – which is probably wise, given that five of the petrochemical plants at PLIE have been shut down or idled within the last few years. However, it does want to extract as much value as possible from its associated gas production – and in ways that are not just lucrative but “a little bit more eco-friendly,” as Jagdeo said in April.Meanwhile, Guyana’s government is eyeing proposals that would add another link to the gas value chain. Specifically, it is considering plans for the establishment of a gas-driven business hub similar to the Point Lisas Industrial Estate (PLIE) in nearby Trinidad and Tobago. PLIE is the epicentre of the country’s heavy industrial sector. It is home to several large facilities that use gas either as feedstock or as a source of fuel, including multiple petrochemical and chemical plants, a fertiliser plant, a steel mill, two TPPs and a water desalination plant.

Environment, electricity, economy

It remains to be seen exactly how “eco-friendly” this industrial hub might be, as planning for the project is still at a relatively early stage. However, gas development should generate some environmental benefits for Guyana through its link to the power-generating sector.

At present, most of the country’s electricity supply comes from diesel-fired generators. However, ExxonMobil’s project aims to make gas, which burns more cleanly and generates lower levels of greenhouse gas (GHG) emissions, a key fuel for electricity generation. As such, the launch of the 250 MW TPP will make Guyana’s energy sector less carbon-intensive overall.

It may not reduce the sector’s total emissions in the short term, since the new power station is likely to supplement existing diesel generators and not replace them entirely. However, if additional gas-fired TPPs are built – and if these projects are paired with investments in the country’s grid infrastructure, which routinely experiences transmission losses of 30-40% – then supply conditions may improve enough to justify retiring the generators and investing in renewable energy. (Guyana has substantial hydropower and solar potential.)

In any event, Guyana is hoping that gas-fired electricity will give a boost to the economy as well as the environment. Its main avenue for achieving this aim will be a reduction in electricity costs.

As president Irfaan Ali noted in May, Guyanese consumers currently pay about $0.30/kWh for power. This is a relatively high rate, he said, but the gas-to-power plan may cause it to sink to $0.14-0.15/kWh – or even as little as $0.03/kWh, provided that the government uses oil revenues to establish a subsidy programme. In turn, the lower rates will help the country reduce its bill for fuel imports by about $150-160mn/year, while also reducing the financial strain on business and residential consumers, he commented.

Cheap electricity could also help attract foreign investment by reducing the cost of manufacturing, according to natural resources minister Vickram Bharrat. He pointed out in April of this year that Trinidad and Tobago currently had a comparative advantage over Guyana, as it was charging customers about $0.12/ kWh for electricity. “As it is now, if a company wants to come to the Caribbean or to South America to do, let’s say, canned cherries, when they look at the electricity cost in Guyana and ... compare it with Trinidad or Suriname, those countries are way cheaper,” he told OilNOW.gy in an interview.

Lower power costs could also give domestic investors an incentive to launch new manufacturing and industrial projects, Bharrat asserted. “[Some] companies will tell you, ‘We don’t go into value-added products because the profit margin is small, because the electricity is expensive.’ But when electricity becomes cheap, then companies will want to invest in value-added [products],” he said.

Looking ahead

Thus far, all of the benefits envisioned are hypothetical.

The pipeline, gas-processing plant, TPP and other facilities are still on the drawing board and not slated to begin operation for another three years. The Guyanese government has yet to issue the necessary permits and approvals, and ExxonMobil has yet to finish the necessary studies and preparatory work. The US major will also have to find a permanent solution for problems with the flash gas compressor unit on the Liza Destiny FPSO, which it is using to develop Liza-1. (Technical difficulties have led the company to suspend production several times over the last year and a half.)

Nevertheless, Guyana’s gas development scheme is both ambitious and impressive. If it proceeds as planned, the country will be transformed.