Gulf Coast Express Eases the Permian [NGW Magazine]

The Kinder Morgan-led Gulf Coast Express pipeline entered service on September 25, alleviating some of the natural gas takeaway capacity constraints in the Permian Basin. The pipeline’s start-up is a particularly welcome development for operators given that natural gas is a by-product of drilling for oil in the basin, and regional producers have been struggling, as there is a shortage of infrastructure for handling it. Indeed, the Permian is now estimated to be the largest US shale region by gas output growth despite the fact that drillers are prioritising oil.

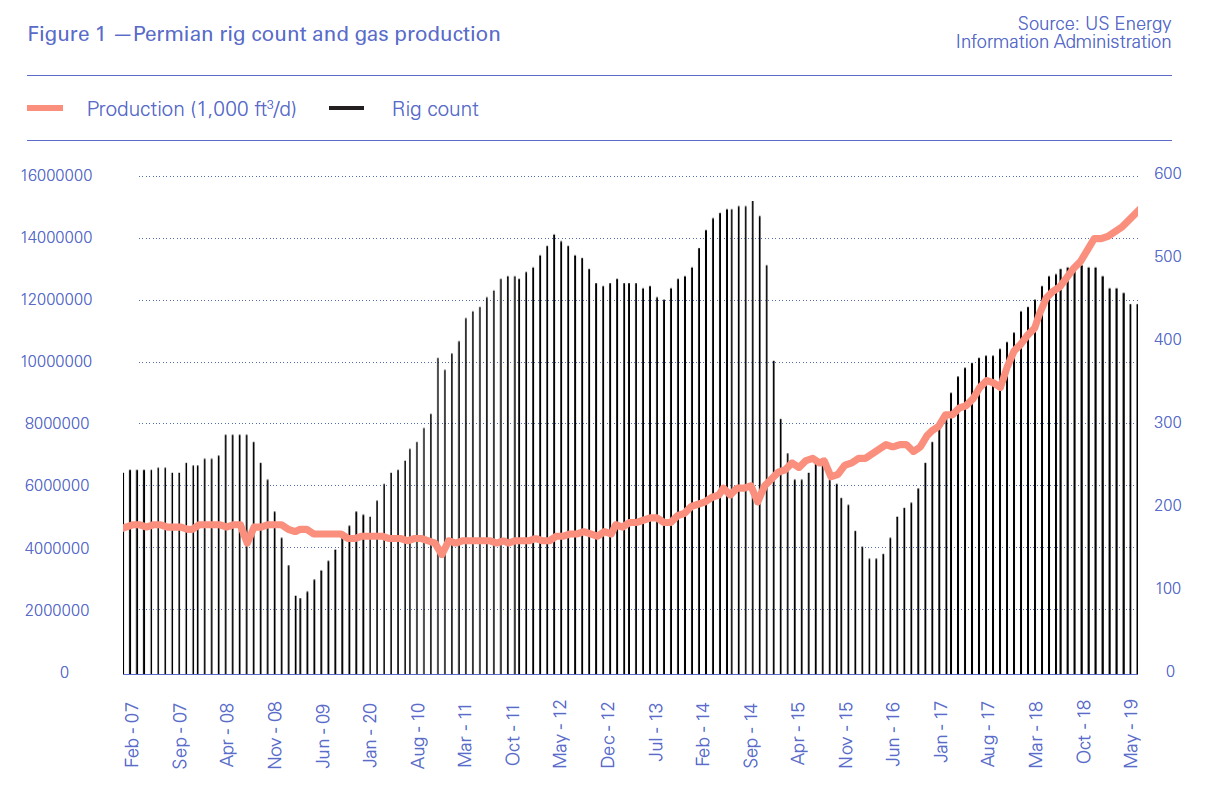

The US Energy Information Administration (EIA) has projected that Permian gas production will hit 15.1bn ft³/day in October, or just over 150bn m/yr. The agency notes, however, that this includes non-shale output from the region, where conventional production still continues. Nonetheless, while this figure is less than half the amount forecast to be produced in the Appalachia region – at 32.8bn ft³/day – it would mark a monthly increase of 229mn ft³/day, compared with a projected 196mn ft³/day in Appalachia. And the growth is being driven by shale drilling in particular.

Takeaway capacity

The $1.75bn Gulf Coast Express pipeline adds 2bn ft³/day of gas takeaway capacity out of the Permian. The pipeline will carry gas from the Waha area of West Texas to the Agua Dulce hub near the Texas Gulf Coast. From there the gas can be sent to LNG terminals along the coast, or across the border to Mexico via connecting pipelines.

“The start-up of Gulf Coast Express was definitely good news for the natural gas industry, and especially producers in the Permian Basin,” a PA Consulting energy expert, Michael Bennett, told NGW. The consultancy estimates Permian dry gas production to be closer to 9bn ft³/day, but even this more modest figure illustrates the need for new gas takeaway capacity.

Gulf Coast Express is already fully subscribed under long-term contracts, and is anticipated to fill up relatively quickly, leaving the basin’s producers waiting for more gas pipeline capacity to enter service. Indeed, several other pipelines of roughly the same capacity as Gulf Coast Express are already under development. Kinder Morgan is also involved in one of these projects, partnering with EagleClaw Midstream Ventures and Altus Midstream on the Permian Highway pipeline, which is due to enter service in late 2020. The other major Permian gas pipeline project to have reached a final investment decision (FID) is Whistler, which is being developed by MPLX, WhiteWater Midstream and a joint venture between Stonepeak Infrastructure Partners and West Texas Gas. It is expected to come online in 2021.

Pipeline operators are also considering proceeding with a number of additional Permian gas pipelines – again with capacities of roughly 2bn ft³/day. Once again, Kinder Morgan is among these, with the company’s CEO, Steven Kean, saying in July that the company was in the process of researching the exact route for the proposed Permian Pass project. At least four other pipeline proposals are being weighed up and, while the coming months may provide clarity on which will move forward, they would still take some time to be built.

In the shorter term, Bennett said PA Consulting anticipates at least three 2bn ft³/day pipelines entering service over the next two years or so, in addition to Gulf Coast Express. “That should allow production to continue to grow,” he said. “We’re looking for Permian production to reach 13bn ft³/day by 2022, and that’s slightly over a doubling since 2017.” As previously with the Permian, this growth will be driven by drilling for oil rather than for natural gas, with additional gas takeaway capacity removing one of the hurdles for producers.

In the longer term, others have called for even more capacity to be built, with LNG developer Tellurian’s chairman, Charif Souki, saying recently that at least four more pipelines would be needed in addition to those already under construction. Driftwood LNG is predicated on Permian gas, although Utica/ Marcellus and Haynesville are also candidates. He reminded the Oil & Money conference in London October 8 of the rapid change in pipeline use in Louisiana, thanks to shale gas production and liquefaction projects taking up capacity. And he said that while its Driftwood LNG project would take five years to build, a pipeline would take a year or a year and a half.

Relieving pressure

The gas pipeline capacity additions will relieve some of the downward pressure on natural gas prices in the Permian. This wll be welcomed after prices at the Waha hub traded in negative territory earlier this year, as producers had to pay for their gas output to be taken away.

Some operators responded to this by curtailing output, with Apache Corp temporarily halting production at its gas-rich Alpine High project in the Permian. The company is one of the shippers on Gulf Coast Express and has already started using the pipeline.

Pioneer Natural Resources is another producer to benefit from the start-up of Gulf Coast Express. Pioneer’s CEO, Scott Sheffield, said on the company’s second-quarter earnings call that the pipeline would allow the company to move about 300mn ft³/day to the Gulf Coast, pricing it on a Ship Channel index. “And at that point, virtually all of our gas will be sold outside of the Permian Basin,” Sheffield said.

When Kinder Morgan started filling Gulf Coast Express in August, gas prices at the Waha hub rose to their highest since March, with the differential between Waha and the Henry Hub benchmark narrowing to its lowest since January.

Notwithstanding that, PA Consulting still expects Waha to trade at a discount to Henry Hub over the next few years. “We still see $0.50 or $0.40 [per million British thermal units] discounts as the norm, especially when you get out into 2023 or so,” Bennett said. “There’s just so much supply, and because the supply is so affordable and economic due to its associated nature, producers can still crank out production while still receiving discounts to Henry Hub.”

Constraints remain

Producers hoping that Gulf Coast Express – and the expectation of additional new pipeline capacity – will help to reduce flaring of excess gas in the Permian Basin may also be somewhat disappointed. Flaring in the region has reached record highs this year and with both oil and gas output set to grow further still, takeaway capacity will remain insufficient to cater for all of the gas being produced.

“I think the new pipelines will help, but we wouldn’t expect flaring to decrease dramatically anytime soon,” Bennett said. “There are still processing constraints and gathering constraints, and the lead time on the rest of the pipelines is still two or three years out,” he noted.

Permian producers may also need to be cautious in their expectations on the demand side. As well as being used as a petrochemical feedstock, Permian Basin gas is expected to flow to liquefaction terminals on the Gulf Coast and to Mexico. However, uncertainty around demand from both these regions has heightened over the past year.

Mexico’s president Andres Manuel Lopez Obrador appears intent to slow – if not reverse – aspects of the country’s energy liberalisation that was started by the previous government. Meanwhile, the world is facing a glut of LNG that has led to softer prices and less certainty over the fate of proposed new export projects in the US. “I think the risk profile has certainly been elevated recently,” Bennett said.

Despite the increased risk, however, Permian producers will keep seeking outlets for their associated production. And while Gulf Coast Express – and other pipelines in the future – may not address all of the challenges, they will undoubtedly help the basin’s drillers.