Green hydrogen: Europe is still pretty much on its own [GasTransitions]

The report, called Great Expectations, written by Yong-Liang Por, provides an inventory of all the new hydrogen projects going on in the world and their current status, as well as of national hydrogen policies.

It draws two major conclusions. One, the projects fall far short of the targets, particularly given the likelihood that many will be delayed or not built at all. Two, Europe is far ahead of the rest of the world when it comes to green hydrogen ambitions, with Australia, South Korea and the Middle East following behind. China and the U.S. have no green hydrogen policies and Japan only to a very limited extent.

Industrial policy

IEEFA notes that the EU has a target of 40 GW of electrolysis capacity and 10 Mt of green hydrogen production by 2030, and 60 Mt by 2050. Meeting the 2030 target requires €430 billion in investments. By contrast, South Korea and Japan together aim for 27 Mt of hydrogen production by 2050, less than half the European target.

Under the EU plan, hydrogen is to cover 24% of total energy demand by 2050. South Korea has a target of 20%, China 10%. Heavy transport is expected to constitute the largest proportion of demand, both in South Korea and the EU, followed by heating for buildings. (Figure 1)

The EU plan, however, is the only one with a strong focus on green hydrogen. IEEFA notes that:

- China has ambitious policy plans for hydrogen, with a 2019 hydrogen white paper calling for 2050 targets of hydrogen to account for 10% of China’s total energy (equivalent to 60 million tonnes a year of hydrogen) and the construction of 10,000 hydrogen fuelling stations. However, this plan is primarily based on grey hydrogen, which relies on fossil gas and coal-based feedstocks.

- South Korea’s hydrogen roadmap assumes that blue hydrogen (hydrogen produced from fossil fuels with carbon capture) is to constitute the bulk of hydrogen supply as liquefied green hydrogen is not likely to be cost-competitive before 2030.

- Japan’s hydrogen roadmap has a modest target of developing commercial-scale supply chains by 2030 to supply Japan with 300,000 tonnes a year of hydrogen and reduce the cost of hydrogen to JPY30/NM3 (USD3/kg). This plan is focused on a broad reduction in the process costs and incorporates blue and green hydrogen.

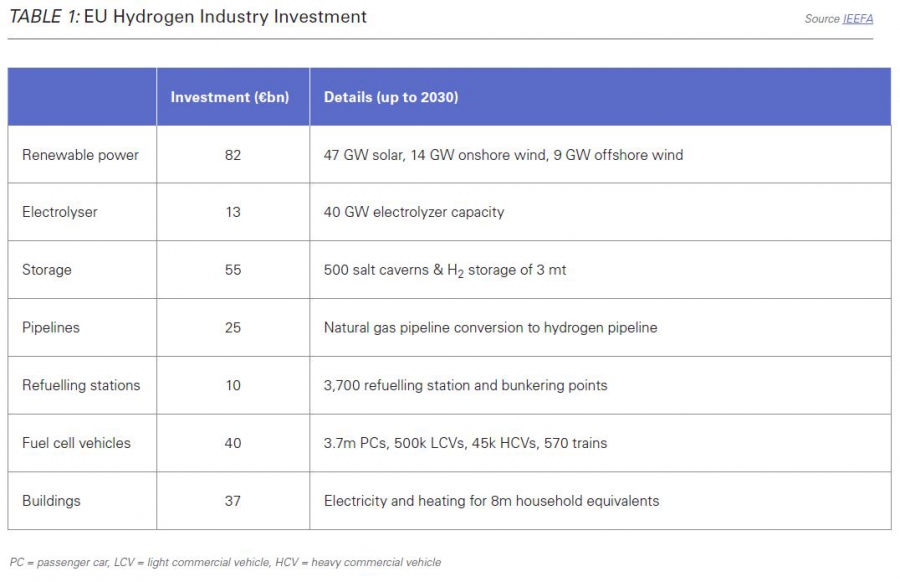

The EU is also the only region in the world that views green hydrogen in terms of a major industrial policy aiming to “ensure a future” for a broad range of European industrial manufacturers, with investment going into renewable power generation, electrolysers, storage, pipelines, fuel cell vehicles and buildings (Table 1).

The buildout of the new hydrogen economy in Europe will require a significant expansion of industrial capability, notes IEEFA:

- Increasing EU electrolyser manufacturing capacity to 25 GW/year from the current capacity of about 1 GW/year

- Raising EU fuel cell manufacturing capacity to the 10-100 GW/year range, from the current very limited position

- Expanding EU manufacturing capacity for a wide range of hydrogen applications such as hydrogen compressors, boilers, drive trains, storage tanks, bunkering facilities, pipelines, sensors, measuring equipment and liquefaction plants.

Supply outlook

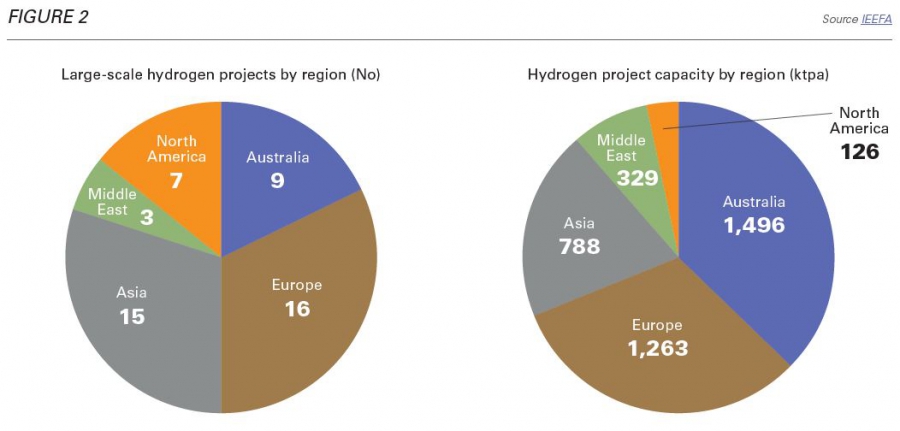

IEEFA managed to compile a database of 50 “viable large-scale hydrogen projects announced so far, primarily in Asia, Europe, Australia.” They estimate these projects to have a total hydrogen production capacity of 4 Mtpa, renewable power capacity of 50 GW, electrolyser capacity of 11 GW and requiring a total investment of US$75bn. (Figure 2)

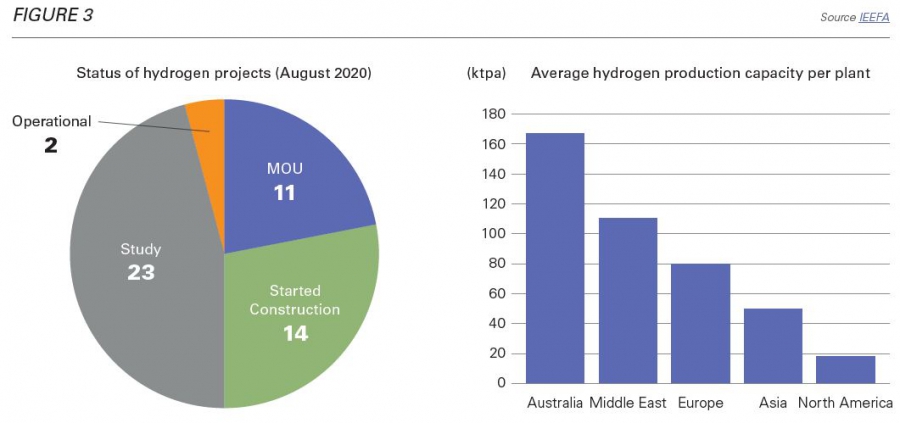

The report notes that “most of these 50 projects are at an early stage, with just 14 having started construction and 34 at a study or memorandum of understanding (MOU) stage. Only two plants are operational in Asia, and they are pilot plants with less than 1,000 tonnes a year of hydrogen production capacity. The biggest projects are being planned for Australia and the Middle East, as economies of scale are required for export-oriented plants.” (Figure 3)

IEEFA notes that there is “serious risk that some of these projects may not be undertaken because of still-unfavourable economics and/or a lack of financing.” As a result, its risk-weighted analysis indicates “that only 2.9 million tonnes a year of hydrogen capacity is likely to materialise by 2030, compared to a theoretical capacity of 4 Mtpa.”

Considering that Europe alone targets 10 Mt of hydrogen production by 2030, the current plans fall far short of what will be needed.

IEEFA draws a number of other conclusions:

- Hydrogen projects in Europeenjoy a strong economic advantage versus imported hydrogen as they are poised to take advantage of falling wind power costs to produce green hydrogen on-site economically and transport it efficiently through the EU’s existing gas pipelines to meet local demand. Key stakeholders in the EU from oil, renewables, gas utilities and ports have formed 10 green hydrogen consortiums so far.

- Australia has the most ambitious hydrogen export plans and is well supported by government agencies. We note, however, that some initial projects are being initiated by new companies that may lack the resources to drive these projects, while the economics of a seaborne hydrogen trade may be unfavourable.

- South Korea is focusing on tapping hydrogen currently being produced at its large-scale petrochemical complexes, where hydrogen is produced as by-product.

- Japan is in the process of trialling green hydrogen imports from Brunei, having built the world’s first liquid hydrogen tanker and is participating in a pilot lignite-to-hydrogen project in Australia.

- China has only minor green hydrogen projects, as it mainly produces hydrogen from coal and petrochemicals and is more focused on building downstream hydrogen infrastructure such as storage, refuelling stations and fuel-cell vehicle fleets in Hebei, Shanghai and Guangdong.

- Saudi Arabia has begun to prepare for its energy transition from fossil fuels with the NEOM project, a pioneering world-scale green ammonia project located by the Red Sea and well suited to transport ammonia to Europe.

The report further contains an overview and assessment of 10 major hydrogen projects, a list of the major producers of electrolysers and an analysis of hydrogen production and transport costs.

_f600x373_1599472625.JPG)