[Premium] GTL Production To Rise into 2020s: EIA

Global gas-to-liquids (GTL) plant production is set to rise significantly into the 2020s, thanks to two new projects already under development, according to the US Energy Information Administration's latest International Energy Outlook 2017 released September 14.

But few or no new GTL projects are starting up, because the fall in oil prices in 2014 has meant putting new investments into synthetic diesel production (from natural gas) is uneconomic, given today’s moderated diesel prices and demand levels. GTL technology firms instead have refocused on smaller GTL projects that use landfill gas as a feedstock.

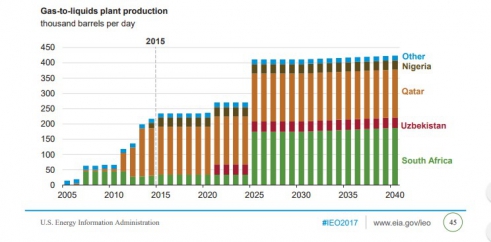

The EIA report’s reference case shows world GTL plant production of about 230,000 barrels/day in 2015 continuing flat out to 2020, then stepping up to about 270,000 b/d in 2021 out to 2024, before reaching some 410,000 b/d from 2025 to 2040.

Two large-scale GTL projects are projected to come online in the EIA’s main reference case – a 37,600 b/d GTL facility in Uzbekistan in 2021 and a conversion of a 160,000 b/d coal-to-liquids to a GTL plant in South Africa in 2025. EIA is conservative in its estimate of when the Uzbek 'Oltin Yol' GTL venture will start up, with industry sources suggesting it might be complete later this decade; the venture in 2013 said it would be producing by 2017.

In a landlocked country such as Uzbekistan, developers can use GTL technology to deliver gas to distant markets by land, although liquefaction is now becoming more realistic as cryogenic tanks improve and gas can be trucked to power plants or industrial estates.

Apart from these two big projects, EIA expects any remaining growth in GTL output to come from small (5,000 b/d or less) facilities.

Existing producing GTL plants include Qatar's Pearl (140,000 b/d) and Oryx (34,000 b/d), plus Nigeria's Escravos GTL (33,000 b/d) plants. Plans by Sasol to develop a 96,000 b/d GTL complex at Lake Charles in Louisiana were shelved in 2015 and are not included in EIA's forecast.

EIA says that GTL development is sensitive to product prices and regulatory factors, and small-scale projects may be used as an alternative to flaring natural gas or to capture emissions from landfills.

Forecast GTL plant production out to 2040 (Graphic credit: US EIA International Energy Outlook 2017)

The EIA report also forecasts that world natural gas demand will increase by 43% from 2015 to 2040 in its reference case, with the non-OECD share of gas consumption rising from 53% to 59% over that period. US and Chinese shale gas, Russian (increasingly in the Arctic/Far East) natural gas, Egypt’s Zohr field, and later on Mozambican and Tanzanian LNG projects will help meet incremental supplies.

That rate of increase is broadly consistent with BP's latest forecast of an average 1.6% annual rise in natural gas consumption between 2015 and 2035, but contrasts with DNV GL's more conservative outlook which sees all fossil fuel demand contrained by significant global energy efficiency gains.

Mark Smedley

There will be more on the EIA study in the upcoming NGW Magazine.