[GGP] Turkey is Gassing Up. What Does This Mean for the Regions It Straddles?

Obscured by the shadow of the heated debate raging in Europe over the planned Nord Stream 2 pipeline, natural gas investments capable of transforming European energy access and security in the Black Sea region are underway in Turkey. Aware of the potential importance of these new natural gas corridors, Turkey has positioned itself to become an important player alongside — if not at the expense of — Russia, which has historically been the main natural gas supplier to both Turkey and Europe. But whether this coming diversification of natural gas supply into the Black Sea region will be a decisive win for Turkey or a gain for European energy security remains to be seen. It will depend on the level to which Turkey remains independent of Russian influence and whether Turkey itself follows market rules as it dispenses natural gas flowing from Russia, Azerbaijan, and potentially other Caspian suppliers onward to Europe.

Geology vs. Geography

Turkey’s geology does not support natural gas independence. The country produces only 0.8 percent of the natural gas it consumes. It also lacks suitable natural formations such as salt caverns that could provide large storage capacity and thereby insulate Turkey from either supply disruptions or price hikes. However, what Turkey lacks in geology it makes up for in location, which if well used, gives Turkey the potential to reduce the country’s dependence on any single supplier of natural gas, transform Turkey into a natural gas hub for Europe, and render the country a more significant economic and geopolitical force in both Europe and Asia.

Turkey Plays the Game

Located at the crossroad of natural gas-rich Asia and natural-gas poor Europe, Turkey’s leaders understand the role their country can play in the region. Already laced by natural gas pipelines that deliver fuel from Russia, Iran, and Azerbaijan, Turkey has engaged in new natural gas projects and pipelines, most notably the Turkish Stream and Trans Anatolian Natural Gas Pipeline (TANAP) both of which are currently underway.

Turkey was also an early mover in recognizing the potential of liquefied natural gas. The country’s two existing liquefied natural gas import terminals — the Marmara Ereglisi Terminal and the Aliaga Terminal have been operating since 1994 and 2006, respectively. To take advantage of the rapidly expanding and globalizing liquefied natural gas market, Turkey has also invested in floating liquefaction and regasification units, including world’s largest such facility, called the Challenger that opened in February 2018. Turkey’s investment in these units contributes to the flexibility of supply and provides additional import capacity. It also provides additional storage capacity that the country has not been able to build otherwise.

Bringing in new sources of natural gas from Azerbaijan, Georgia, Turkmenistan, Israel, Cyprus, the United States, Norway, or Qatar reduces Turkey’s dependence on any one supplier — especially vis-à-vis Russia, which had historically dominated gas exports to Turkey.

Yet Turkey is not simply seeking to diversify supply. The capacity of the new country’s infrastructure is higher than Turkey’s current and projected demand. This holds even when one considers Turkey’s growing natural gas demand, which nearly doubled from 27 billion cubic meters in 2005 to the record 53.5 billion cubic meters in 2017. Turkey is also trying to reduce demand growth to further insulate its economy from imported natural gas. Instead it is focusing on coal and wind generation, both of which are available domestically.

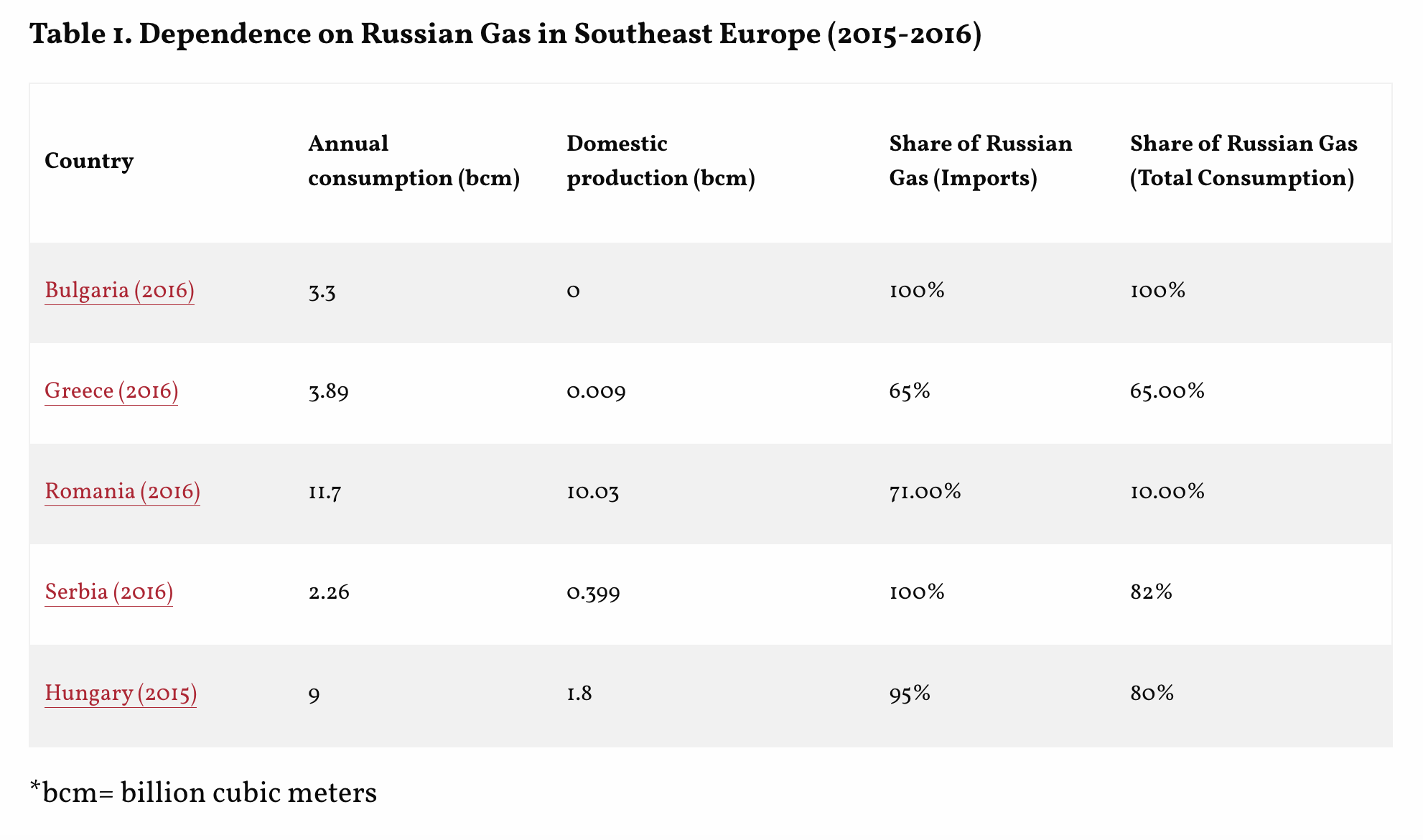

The shift is driven in part by a desire to reduce strong seasonality as well as ensure energy security. But embracing an energy strategy that creates overcapacity also signals an outward focus in Turkey’s view of its future energy role. Awash in natural gas deliveries from highly diversified pool of suppliers, Turkey hopes to dominate the market by becoming a natural gas hub for Europe, particularly Southeast Europe, which is less connected to E.U. natural gas infrastructure and remains heavily dependent on Russia (See Table 1).

If Turkey becomes a hub through which a diverse set of suppliers sends its natural gas to Southeast and Southern Europe, the country stands not only to amass economic benefits that include transit fees and potentially cheaper gas for domestic consumption. It can also use the status of an energy hub to heighten its geopolitical weight in the region, vis-à-vis Russia and the European Union.

The Balancing Act: Between Russia and the European Union

At this point, Russia is the weaker bargaining partner when it comes to natural gas transit via Turkey. Russia has pushed to keep its market share in Europe and diversify its routes of natural gas delivery, particularly to circumvent Ukrainian transit. After the failure of the South Stream project and the current difficulties faced by Nord Stream 2, Turkish Stream has become an important part of this strategy. Even at the height of the two countries’ tensions over Syria, Russia declined to cancel the investment in reaction to Turkey’s downing of a Russian jet in 2015. Russia has also been offering lower prices on Turkey’s domestic consumption. Recently, the countries signed a deal where Russia agreed to retrospectively discount gas delivered to Turkey in 2015 and 2016.

Turkey’s quest to become a natural gas hub could also help repair the country’s complicated relationship with the European Union. As Turkey is unlikely to become an E.U. member, its future status as a gas hub could become an alternative way in which Ankara could be linked to Europe, playing an important role as a trade and energy partner in the Black Sea basin. Considering that the gas that transits through Turkey will be likely delivered to Greece, gas could even play a role in helping to resolve the Cyprus issue.

Approaching the Rapprochement

But the extent to which Turkey’s quest to become an energy hub succeeds — and the extent to which it benefits Turkey and the European Union — depends on multiple factors. First, the future of relations between Ankara and Moscow is unclear. Russia is well known to use natural gas as a way to play carrot-and-stick politics. And cheap Russian gas can become a problem if it cannot be replaced at a short notice and comparable price by gas from other suppliers.

Second, if the Russian-Turkish reconciliation goes too well and the countries coordinate their geopolitical goals, Southeast Europe could become exposed to even stronger geopolitical pressure, especially if the region is unable to take advantage of natural gas supplies in addition to Turkish transit. This is particularly a concern if Southeast European countries are not able to push forward with their own network and diversification projects that currently include the Greece-Bulgaria and Greece-Italy interconnectors, the liquefied natural gas terminal in Krrk, Croatia, or the Northern Gate, a new pipeline that would bring additional supplies of natural gas from Norway. In the context of ongoing Turkish-Russian rapprochement, a Southeastern Europe that is dependent on Turkish gas may be no better off than it is today, dependent on Russian gas.

Third, Turkey’s geography is not enough to guarantee that its energy hub dreams become reality. It is not yet guaranteed that Turkey will have sufficient supplies, in large part because the magnitude of flows of gas via TANAP is not yet clear. This includes the concern about above-the-ground factors that could disturb natural gas delivery, including security issues regarding gas transfer from Iran or Turkmenistan, or related to the Nagorno-Karabakh conflict between Armenia and Azerbaijan. Some uncertainty also surrounds TAP, the planned European pipeline that would haul gas supplies delivered to Turkey via TANAP further into Europe. As recently as June 6 the Italian government has declared that it would revisit whether the pipeline should be allowed to pass the country’s territory. And though today the Italian government is back to supporting the pipeline, the local Italian opposition is raising concerns about its timely completion. Even when it comes to Russian supplies, there are limitations on the prospective supply that could transit Turkey. At this point only two instead of the initially planned four strings of Turkish Stream are being built.

Additionally, a major prerequisite for an energy hub is a liberalized market that allows for free trading of gas. It is encouraging that Turkish Energy Stock Exchange Istanbul (EPIAS) has begun testing an online natural gas trading system. All things considered, however, Turkey still lacks a market sufficiently liberalized to support a well functioning hub. While Turkey has enacted laws aimed at supporting its natural gas market, state-owned BOTAS continues to dominate the Turkish market.

Gassing Up

Turkey is doing all the right things to position itself as an important player that could influence both Asian suppliers of natural gas and European customers. At least for the time being, this influence includes the largest and most powerful of natural gas suppliers to Europe — Russia. Turkey is succeeding because it is engaging multiple suppliers that can provide relatively cheap natural gas, limiting use of natural gas domestically so that it is has more to export, and building flexible supply options and storage facilities.

Through these policies, Turkey is becoming an important European energy security player. In particular, gas deliveries through TANAP will help to diversify the gas market in the Southeast Europe, which has been dependent on Russian gas. But the close association that Turkey has forged with Russia could create risks, too, if Turkey tries to use gas as a political tool against Europe. For this reason, Europe should retain its focus on building market connectivity in its Southern and Southeast regions — with Turkey, and beyond.

Anna Mikulska, Ph.D., is a nonresident fellow in energy studies at the Baker Institute’s Center for Energy Studies and a fellow at the Foreign Policy Research Institute. Her research focuses on the geopolitics of natural gas within the EU, former Soviet Bloc and Russia. Mikulska is also a senior fellow at University of Pennsylvania’s Kleinman Center for Energy Policy, where she teaches graduate-level seminars on energy policy and geopolitics of energy. Follow her on Twitter: @anna_b_mikulska

Marcin Sienkiewicz, Ph.D., is a researcher at the Institute of International Studies of the University of Wrocław. He also teaches graduate level seminars on the construction and exploitation of gas pipeline systems at the Wroclaw University of Science and Technology. Between 2008 and 2010 he served as an expert on energy and national security at the Polish National Security Bureau and the Chancellery of the President of the Republic of Poland.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.