[GGP] Poland, Europe and The Coal Conundrum

Over the last decades Poland has dramatically decreased its production and use of coal. However, as impressive as these achievements are, Poland is far from eliminating or drastically curtailing coal in its energy mix. This is predicated upon several types of considerations that include: coal’s legacy, socio-political factors, and energy security concerns. Importantly, these factors are not unique to Poland. And as the world strives to eradicate CO2 emissions, we should see them emerge as increasingly important part of the climate change discourse.

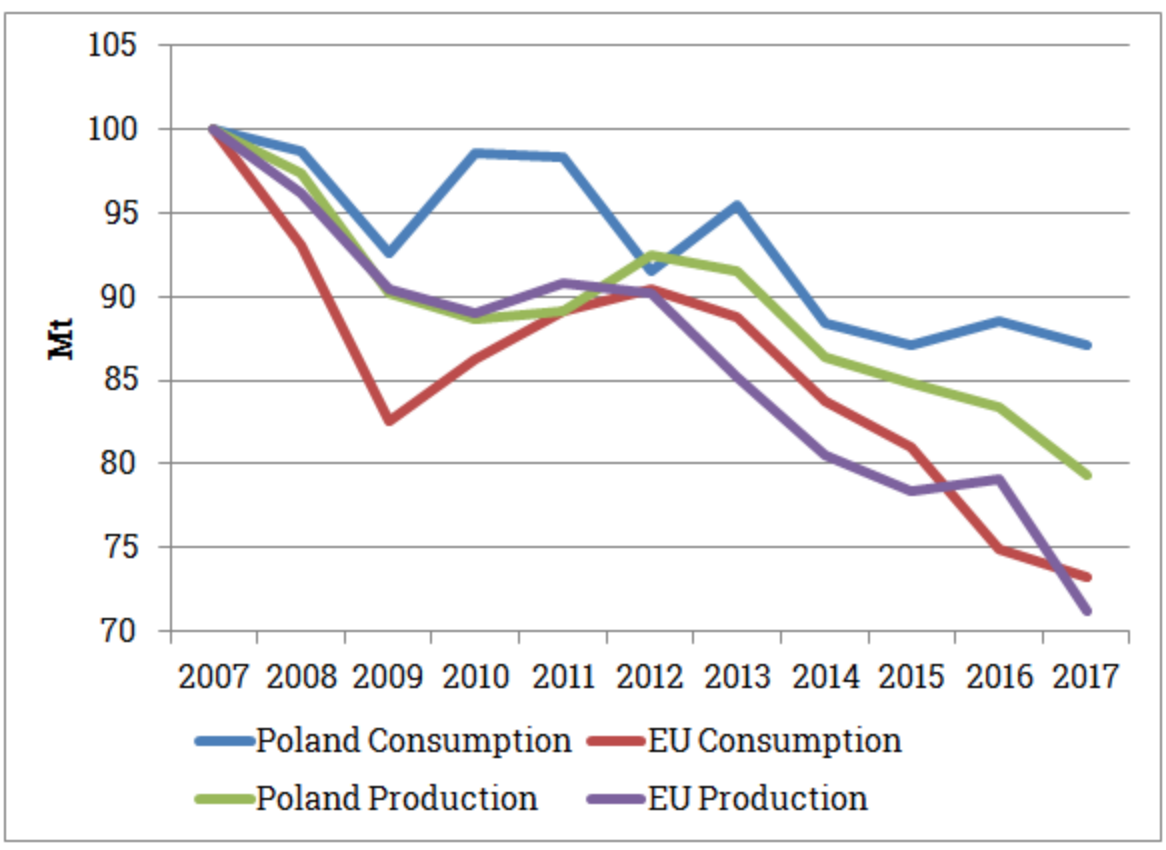

Poland’s coal production has fallen significantly in the recent years (Figure 1). The drop has been most visible in hard coal production, which at 70 million tonnes in 2016 has been a far cry from the 150 million tonnes that the sector supported in 1990 or the record 200 mln tonnes it produced in 1970. The lignite production fared better but still recorded a 13 mln tonnes loss in 2016 over the record 73 million annual production in mid-1980s. Consumption of coal has also waned (Figure 1), with 2017 marking a 100-year low contribution of coal to electricity production.

Fig.1 - Trends in Coal Production and Consumption in Poland and the EU (2007=100)

Author’s analysis. Data Source: BP Statistical Review of World Energy

Nevertheless, coal still constitutes approximately 50% of Poland’s energy needs and 80 percent of its electricity generation. Also, the drop in coal consumption in particular does not keep up with that registered in the EU (Figure 1). In 2016 Poland accounted for almost 20 percent of total EU solid fuel consumption with each average Pole “consuming” almost triple that of an average European. Going forward, the government predicts that coal will remain at 50-55% of Poland's total energy mix through 2030 if not through 2050, though it hopes to limit the associated CO2 emissions via variety of mechanisms ranging from CO2 sequestration to coal gasification to carbon capture and storage.

So what keeps the coal alive and relatively well in the heart of the European Union increasingly committed to decarbonization and decreasing use of coal, the most polluting of the fossil fuels?

To start: the legacy. Poland’s economic and industrial development has been in many ways predicated upon domestically available and abundant coal. Long life spans typical for coal infrastructure make difficult abandoning the sector at once. And familiarity with technology and specialized work force still encourages investment to restructure or replace some of the Poland’ aging mines and coal power plants. Also, even though employment in the coal sector dropped more than fourfold since early 1990s, the current levels are still high at approximately 100 thousand workers. In addition, the work force is concentrated in the hard coal regions of Silesia, making a quick switch to a different employment structure more problematic.

This concentration of coal- related work force is also highly consequential for Poland’s electoral politics. Of the total of 460 seats in the lower chamber of the Polish parliament 101 seats are elected from hard coal regions in lower Silesia, Opole and Upper Silesia. A highly contested, “swing state” nature of local politics makes it also imperative for any party ahead of local election to appease a large group of coal industry workers that are historically well organized into politically active labor union. As learned by the government of Ewa Kopacz in 2015, they are ready to threaten not only local election results but also the stability of national government. High levels of respect miners enjoy across the nation additionally fortify their position in the political discourse. As a result, all Polish governments - independent of which party is in power - have been and likely will continue to thread carefully when it comes to coal.

But policy considerations with respect to coal go beyond elections to include more substantive policy issues such as energy security. For Poland, coal is the only energy resource that is domestically abundant, relatively cheap and easy to access. In contrast, majority of natural gas - coal’s most serious competitor- is imported. In addition, the imports have been traditionally dominated by Russia, a partner that Poland sees as likely to use its energy dominance for geopolitical goals. And while Poland is making significant strides to diversify its natural gas supplies through LNG imports and new pipelines and interconnectors, those are focused rather on backing out Russian gas than replacing coal. When it comes to other potential coal substitutes, renewable generation in Poland is in its infancy and unlikely to quickly expand in a significant manner given issues of intermittency and costs associated with infrastructure buildup that it necessitates. Costs are also an impediment to the future of nuclear power generation, which as of now has yet to move beyond the decision stage.

At the same time, in the nod to the EU policy of decarbonization, Poland points to set of strategies that could potentially limit CO2 emissions and other pollutants associated with coal mining and coal power and heat generation. These include: 1) use of higher quality, less polluting coal; 2) higher efficiency and lower energy intensity of the country’s economy; 3) coal bed methane extraction; 4) implementation of new less polluting coal power and heat generation technologies; 5) cogeneration than involves use of biomas; 6) and potential coal capture and storage options. The government also hopes that future technological advancement will repurpose coal including via gasification and applications in nuclear power generation.

In the meantime, however, since many of these strategies are still in their infancy, Poland may be opening itself to potential fines if it does not follow up on its EU commitments. This could make the production and consumption of coal more expensive, though it is unclear to what extend potential costs would prevail over considerations mentioned above. On the domestic front, issues related to the ever more bothersome smog associated with coal use will also likely challenge coal’s position. So will the aging infrastructure and need for continuing investment in the sector that is increasingly seen as belonging to the past rather than the future.

In December Poland will be hosting the next Climate Change Conference (COP24) in Katowice, the heart of its coal country. In the minds of the organizers, Katowice is supposed to be a symbol of region transformed from its coal dependent to a paragon of modern industry, innovation, and culture. The conference itself is also supposed to highlight Poland’s successes in the area of CO2 emissions and climate change. But Poland’s choice of Katowice is also likely to underscore the difficulties shared by coal-dependent countries around the world, including world’s top energy consumers like China and India. As tensions related to tariffs and potential trade wars mount around the world, the energy security dimension is especially likely to gain momentum, with domestically available coal becoming more important not only for developmental purposes but also as a “safe” or “safer” energy source.

Anna Mikulska

Anna Mikulska is a senior fellow at the Kleinman Center for Energy Policy and a non-resident fellow with the Center for Energy Studies at Rice University's Baker Institute for Public Policy.

This article was first published by RiEnergia. A version of the original article in Italian is available HERE

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.