[GGP] LNG Projects Have Stalled. A New Business Model Could Help

Liquefied natural gas (LNG) developers and natural gas producers have depended on third parties to create demand for their product. In recent years, LNG market prices have dropped in response to a surge in supplies and roughly two million tons of LNG contracts are set to expire in the next 10 years. Promising new LNG projects cannot be financed and have stalled.

Developers need to do more to encourage end users – including industrial users and electric generation facilities – to switch from diesel and other liquid fuels to LNG. A new business model could help. We propose a broad collaborative, including natural gas producers, pipeline companies, Engineering, Procurement and Construction (EPC) companies, equipment manufacturers and end users to accelerate market growth.

The International Energy Agency predicts that global oil use will decline as it is replaced by natural gas and renewables. The collaboration we are proposing could accelerate the switch.

A Little Background

Early LNG developments in the 1970s were driven by oil companies that had the misfortune to discover natural gas distant from gas markets. The discovery would have been stranded but for the advent of integrated LNG developments to liquefy, transport and regasify the gas for use in power plants and local distribution. Although LNG was more expensive than oil, utilities in Japan and Europe were prepared to sign long term, take-or-pay contracts because of natural gas’ low emissions and enhanced energy security through the interdependence of buyer and seller and diversification from oil.

U.S. utilities signed similar deals with Sonatrach, the Algerian national oil company, but reneged when domestic production and pipeline companies were deregulated from 1978 through 1985 and advances in 3D seismic technologies opened the Gulf of Mexico shelf as a prolific hydrocarbons resource. A natural gas oversupply “bubble” caused prices to decline below the contractual costs of LNG, and a long arbitration process resulted in settlement agreements.

Regasification plants were built, but essentially no LNG was delivered until the bubble deflated after 2000.

Meanwhile, successful lobbying encouraged new domestic natural gas demand, notably through cogeneration facilities that provided steam to industrial customers and sold surplus electricity into the grid at “avoided cost” that would have been incurred from a new power generator.

It is time to shake the dust off that playbook.

Recent LNG Contracting Evolution

Those early LNG sales contracts were all point-to-point, stressing the interdependence of buyer and seller. Cracks in the global contracting regime began to emerge in 1995 with Atlantic LNG’s waiver of destination restrictions. From its web site: “Atlantic was often described as “The Trinidad Model”, which referred to the unique partnership between four energy majors and the Government of Trinidad and Tobago to form an LNG company. The model was unique too in its objective to target two dedicated primary markets at that time: the US East Coast and Spain, capitalizing on Trinidad and Tobago’s geographic proximity to these markets and therefore competitive delivery costs.” To further that goal, Atlantic successfully lowered the construction cost of its liquefaction plant below previous international LNG projects.

Fifteen years later, the majors led by ExxonMobil doubled the size of single liquefaction trains and the size of the LNG carriers as they invested in massive Qatargas LNG projects commissioned in 1998 through 2011. LNG supplies surged, and the global contracting regime could have come under extreme pressure.

However, on March 11, 2011, a massive earthquake offshore Japan caused a tsunami which killed thousands of people and inundated the Fukushima Diichi nuclear power plant. Failure of back-up systems resulted in a meltdown and release of radiation. In reaction, most nuclear power plants in Japan were shut down and fossil fuel power generation plants had to fill the supply gap; demand for LNG escalated and fortunately major new Qatar LNG plants were able to supply it.

A robust spot market soon emerged to provide incremental LNG supply to Japan beyond that assured under previously executed long term contracts. LNG prices rose to support new LNG plants in Australia to address growing Asian LNG demand.

At the same time global LNG suppliers were realizing premium prices for their spot sales, U.S. natural gas prices were under tremendous downward pressure in the face of the oversupply of unconventional gas. The coupling of these premium LNG prices and the glut of U.S. gas combined to provide the economic incentive for the U.S. to evolve from LNG importer to exporter, adding to LNG capacity being built in Australia and Papua New Guinea (Figure 1).

.png)

Cheniere was first and pioneered a new tolling contracting model to support financing its Sabine Pass natural gas liquefaction complex. Under this model, buyers would acquire U.S. natural gas at spot market prices and make long term take-or-pay commitments to liquefy their gas in Cheniere’s facilities. Buyers took the risk that the delivered cost of LNG would be lower than it would be under a traditional oil-indexed contracting regime.

Unpacking the LNG Value Chain

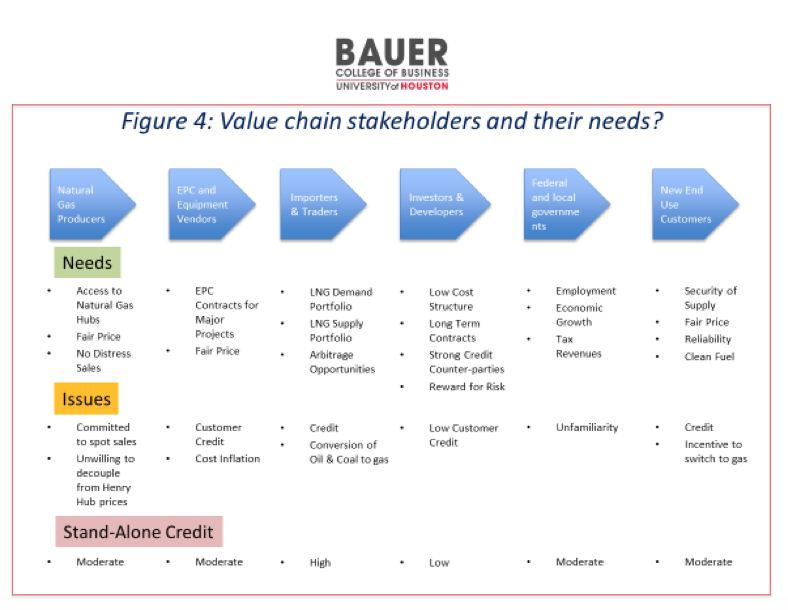

It is helpful to start with an assessment of the LNG value chain and its participants (Figure 4) and then review some initiatives that address the need to finance new projects in a market where buyers are looking for flexible pricing mechanisms and are no longer receptive to long term take-or-pay contracts.

A wide range of countries and companies have a potential interest in successful development of new U.S. LNG projects that contribute to a broader and deeper LNG market, with prices below oil prices and reducing greenhouse gas emissions.

• Natural gas producers would benefit from access to a new market segment of companies and utilities currently dependent on expensive diesel fuel and should be interested in a pricing mechanism linked to diesel prices.

• EPC companies would benefit from the opportunity to provide services and equipment for the switching LNG customer as well as in the liquefaction complex and may be prepared to consider innovative contracting features.

• Importers and traders may be prepared to take on some price risk to catalyze collaboration among disparate partners.

• Investors and developers of independent LNG projects should be willing to consider innovative tolling fee structures to spread price risks among collaboration participants.

• The federal government has expressed its support for LNG exports as helpful to narrowing the trade deficit and achieving “dominance” in global energy. Importing countries should welcome a transition from oil to natural gas as positive for air quality and competitiveness if priced below diesel.

• End users may be willing to invest in switching to LNG as fuel at a price below diesel prices, so long as supplies are secure and reliable.

New Business Models

The traditional model is an integrated supply chain: IOCs and NOCs develop and operate the gas field, negotiate EPC contracts for construction of the liquefaction complex, sign charter parties with shipping companies, and often offer an ownership share to end use buyers. As the initial contracts reach their term, the IOCs have uncontracted volumes that they can recontract or sell in spot markets. Roughly two million tons of LNG contracts will expire in the next 10 years. The IOCs and publicly traded NOCs have strong balance sheets that can support new projects without recourse to project financing. Independent LNG project developers must find different business models.

The first movers for U.S. LNG exports were able to negotiate long term tolling contracts with creditworthy customers, allowing project financing of the liquefaction complexes. These have been difficult to secure in current times of low spot market LNG prices, where the large global commodity traders (e.g., Koch, Vitol, Trafigura) are finding opportunities to develop new LNG customers, using existing infrastructure and managing the credit risk as part of their risk portfolios. With access to long term take-or-pay contracts scarce, new business models are being tried by developers of new LNG projects with mixed results. However, most of these business models assume that increased LNG supplies will create their own market demand if the price is low enough. The problem is that the required price may not guarantee sufficient cash flow to service debt required to finance a new LNG project and higher prices would suppress new demand. Examples of new business models are:

• Supply Chain Integration: Tellurian has devised an integrated LNG supply chain from natural gas resource through end use buyer. They have raised over $400 million from Total SA, Bechtel and public equity and have acquired 11,620 net acres in the Haynesville, taking advantage of low prices for natural gas reserves outside Appalachia. They have completed a FEED study for their subsidiary’s Driftwood LNG project and have signed a fixed price EPC contract with Bechtel. They have announced open seasons for planned pipelines connecting Permian and Haynesville production to its LNG project. They have reserved up to 40% of the equity for potential buyers so they can participate in the full U.S. natural gas supply chain. The complete project cost, excluding LNG tankers and regasification investment is estimated to be over $20 Billion: $7.3 billion for pipelines to supply the LNG plant, $15 Billion to build the liquefaction facility, plus further investments in acquiring natural gas resources.

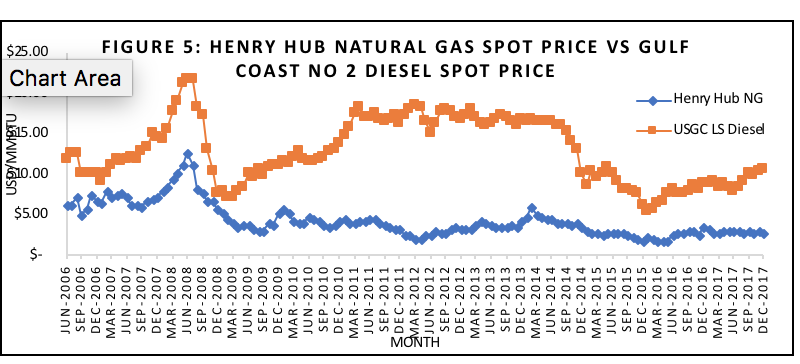

• LNG Demand Creation: AES LNG is a subsidiary of AES Corporation, an international electric power company. They “aim to radically improve the environmental and economic condition of many small liquid petroleum fuel consumers in the Caribbean, Central America and the northern parts of South America by substituting dirty and often expensive fuel oil or diesel with clean-burning natural gas.” Certainly, diesel prices in the Caribbean are set by U.S. Gulf Coast prices, which have historically been significantly above Henry Hub spot natural gas prices (Figure 5). The lowest annual Gulf Coast price spread was $4.96 in 2016, when oil prices were abnormally low. The price spread should most of the time be above $6/MMBtu, sufficient to cover debt finance of the liquefaction and regasification and fuel switching facilities and cover the higher LNG marine transport cost compared to diesel.

AES Dominicana has safely been operating the large-scale LNG receiving facility since its inception in 2003. The facility provides gas to AES Dominicana’s two gas-fired power plants as well as 50 industrial clients, two third-party power plants and 15,000 gas vehicles in the Dominican Republic. As well as serving the domestic market the terminal has capacity to serve the regional market. AES is currently constructing a second LNG receiving terminal in Panama to be completed in mid-2019, the first of its kind in Central America. With slightly larger capacity than AES Andres, the Colón terminal will serve AES Panama’s own 381MW power plant as well as the domestic and regional demand for gas. Both terminals are designed to receive LNG on standard large carriers of 125,000m3 – 175,000m3 and redistribute LNG via re-loading small bulk carriers and ISO containers.

Utilizing AES expertise and in partnership with several infrastructure providers, AES believes it can provide entire value chain solutions including LNG supply, logistics, design, build, commission and start-up of an LNG receiving terminal. AES operates in 15 countries so it could extend its model beyond the Dominican Republic and Panama. The question is whether it can negotiate price and credit terms that can support project financing of fuel switching its current power generation assets and underwrite a new liquefaction plant.

Independently of AES, Crowley Maritime through its subsidiary Carib Energy since 2013 has been supplying LNG to Coca-Cola Puerto Rico Bottlers in specially designed vessels, providing technical solutions include customized regasification systems; design services; mechanical, electrical and site/civil engineering; commissioning; storage and supply management; consultation and training; bunkering; providing a lower cost energy source, utilizing the cold from regasification to chill its products and even capturing CO2 exhaust gases to provide the fizz for its sparkling drinks.

• U.S. Midstream Growth: Dominion Energy, Sempra and KMI saw LNG plants as a natural extension of their midstream pipeline businesses, but shareholders have been less enthusiastic:

o Dominion Energy, a large electricity and natural gas company has shipped its first cargo from its Cove Point LNG plant with natural gas supplied by Shell and has 20-year sales contracts with Japanese and Indian buyers.

o Kinder Morgan in 2015 bought out Shell’s interest in Elba Island LNG but Shell remained committed to supply natural gas and purchase all the plant’s LNG production; KMI then in 2017 sold 49% of its Elba Island LNG project to a private equity firm EIG as a “strategic step towards achieving our stated goals of strengthening our balance sheet and positioning the company for long-term value creation” according to Steve Kean, KMI President and CEO.

o Sempra LNG & Midstream (SLM) is a subsidiary of Sempra Energy, whose main businesses are Southern California Gas; San Diego Gas & Electric; Oncor Electric Delivery and Sempra South American Utilities. SLM is a partner in Cameron LNG in Hackberry, LA with Engie, Mitsubishi, Mitsui and Japanese shipping company MYK Line. The project is under construction, with expected completion in 2019 though the capacity is not yet fully contracted.

Midstream companies are generally unwilling to take commodity price risk and seek a tolling agreement for liquefying the natural gas with a counterparty that has strong credit, leaving the buyer to take any price risk. U.S. midstream companies are quite uncomfortable with any deviation from the contracting model inherited from gas pipeline developments.

AES and Crowley Maritime are making a useful contribution by enabling fuel switching in end-user facilities, but so far on a small scale with a business model that currently depends on low spot LNG prices. Engie, however, with a footprint in 70 countries, may have more upside potential, especially since its acquisition by Total. Total and other majors have the balance sheets and capabilities that would allow them to encourage and aggregate small LNG customers into a material demand segment.

Tellurian is taking most of the commodity price risk in its newly acquired production subsidiary. Tellurian recognizes that the variable costs of natural gas production are quite low, where the capital costs are small relative to the cost of liquefaction. By buying producing acreage in the Haynesville, they can absorb periods of low end-user prices through a reduced return on investment in its production subsidiary and hopefully can compensate investors with superior returns during an up-cycle. They can also modulate their own returns on investment in liquefaction during the price cycle.

However, the Tellurian approach would not be necessary if large natural gas producers (e.g., EOG Resources, Apache and others with assets in the Permian and Haynesville plays) come to recognize that they are likely to achieve better netbacks to their wellheads by negotiating long term contracts with LNG developers including price formulae that incent international substitution of oil by natural gas.

Proposed Collaborative

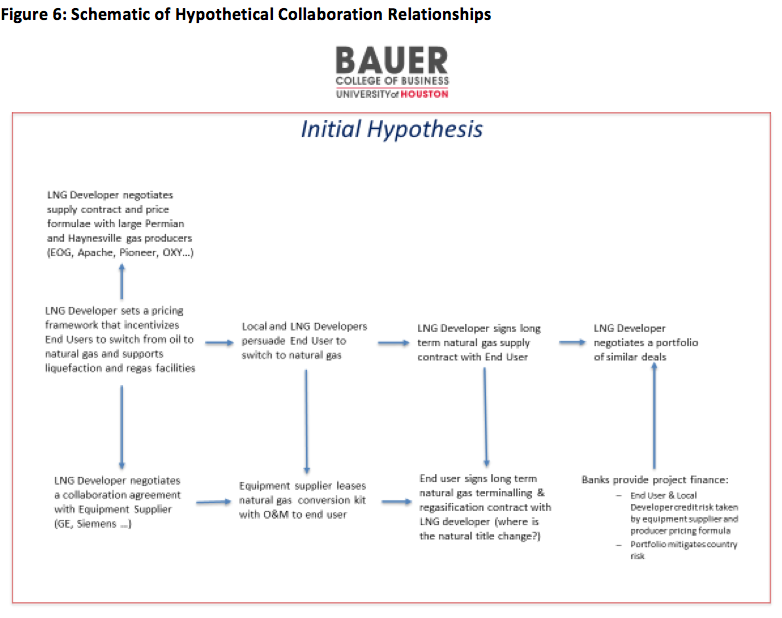

With a plentiful supply, barriers to continued growth in demand and reluctance by traditional buyers to commit to long-term contracts required to finance needed infrastructure, new projects will be stranded. We propose a new model (Figure 6) that may be difficult to negotiate but would spread the risk among entities which in aggregate should have sufficient credit to support project finance.

In our view, natural gas producers are the primary medium-term beneficiaries of expanding the global LNG market by encouraging fuel switching from diesel to natural gas. By securing new markets on long-term contracts, producers will eliminate the need to sell at sometimes distressed spot prices and will strengthen the overall market by increasing global demand. End users should also reap strong benefits of improved air quality, lower carbon emissions and lower costs.

• Natural gas producers should be prepared to commit a proportion of their production to long-term reserve-backed contracts with emerging LNG markets at prices related to the oil products that are being substituted.

• End users and their stakeholders should benefit from lower costs and improved air quality by switching from diesel fuel to regasified LNG.

• Providers of equipment needed to switch from oil to LNG should be prepared to lease the equipment and provide ongoing maintenance at fair prices, rather than trying to sell the units at prices that the end user would find difficult to finance.

• A shipping agreement for small used LNG tankers should be negotiable at favorable rates.

• A liquefaction agreement could be negotiated with “ceiling and floor” features that allows the developer low returns on investment when netback prices to the producer are below Henry Hub spot rates but delivers superior returns when netback prices are above spot prices.

• The “fixed price” construction agreement with the EPC contractor could also provide upside when netback prices are favorable.

• By repeating the same model to various end users in various countries, country risk can be reduced.

This arrangement should spur expanded LNG demand from end users who might not otherwise switch from oil and aggregate credit strength to allow project financing and FID (Final Investment Decision) of the fuel switching and liquefaction construction projects.

The primary economic driver is the current and expected future gap between oil and natural gas prices. Google has recently compiled a database of power plants, listing nearly 3,000 globally (other than China) that rely primarily on oil as fuel.

The natural targets for switching to LNG may be in South and Central America (Figure 5) where there are close to 100 oil-fired power plants greater than 80 MW in capacity. The IEA estimates worldwide oil use for power generation in 2016 at 275 million tons of oil equivalent (over 5 million barrels per day) so the potential market is large.

Perhaps over time, LNG penetration may happen organically, but it is important to recognize the high inertia for change. The schematic we propose will be difficult to negotiate, but the alternative absent a catalyst to overcome inertia is a bust period of low LNG capacity growth as good project ideas are stranded, coupled with depressed U.S. natural gas prices as export demand plateaus. LNG supplies will then fail to meet demand growth ultimately leading to a commodity boom with higher LNG (but not domestic natural gas) prices leading to stifled global LNG demand growth and frustrating low cost domestic natural gas producers.

It’s an appropriate time to look for innovative ways to accelerate creditworthy LNG demand growth in the medium term. Our hope is that this article will stimulate some productive conversations.

Chris Ross is an Executive Professor of Finance at the C.T. Bauer College of Business and the University of Houston, where he teaches classes on strategies in the oil and gas industry. He also leads research classes investigating how different energy industry segments are creating value for shareholders. Ross holds a Bachelor of Science in Chemistry from King’s College at the University of London and a PMD from Harvard Business School.

Justin Varghese is a Spring 2018 Professional MBA graduate from C.T. Bauer College of Business at the University of Houston. He currently works as a project manager for Siemens and specializes in solutions for the oil and gas industry. He holds a Bachelor of Science in Industrial and Systems Engineering from Texas A&M University in College Station.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.