GGP: European Energy Outlook: Importance of Supply Diversification

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

This article was written by Emin Akhundzade

INTRODUCTION

European Union (EU) is one of the largest energy consumers in the world, making energy security a topic of a national interest. Since EU cannot produce sufficient energy to cover the domestic demand, it imports almost 53% of total oil and gas consumptions. However, it has a higher dependency on natural gas rather than oil. This is due to the significant decline in indigenous gas production and EU climate change policy, which was envisioned to decrease Green House Gas Emissions by 40% up until 2030.[1]

Natural gas consumption in EU has dramatically increased in last two decades. Even though the consumption decreased slightly between 2008-2014 years, it started to increase as of 2015 and this trend is projected to continue. Especially South Eastern European (SEE) countries is predicted to play significant role in future increment, as natural gas penetration rate is small in these countries in comparision to the rest of Europe. Furthermore, some countries even can not consume natural gas due to the lack of infrastructure. So, natural gas consumption is expected to increase in those countries after the implementation of planned pilepline projects, namely Ionic Adriatic Pipeline and Greece-Bulgaria-Romania interconnector.

Although natural gas consumption is on increasing trend in EU, production on contrary is decreasing, making EU more reliant on the imported gas. Especially, Netherlands and United Kingdom-two major producers of the EU, have been experiencing a sharp decline since early 2000s. Thus, the import dependency of EU is expected to increase to 84% by 2030, which was just 67% in 2016.[2] Thus, we will try to answer the questions that how Europe can provide its energy security in the future, and if the current suppliers will be able to cover the additional natural gas demand of the continient.

In this context, we will investigate the natural gas outlook of Europe by setting forth the current and estimated natural gas consumption and production trends of the continent. Then we will try to explain whether or not the current natural gas suppliers of Europe will be able to cover the additional gas demand. Accordingly, we will analyze natural gas outlooks of Russia, Norway, Nigeria, Algeria and Qatar respectively. Finally, we will mention about the role of the Southern Gas Corridor to the energy security of Europe.

1. Natural Gas Consumption of Europe

Looking at the past two decades, natural gas consumption in Europe has almost doubled. Including the SEE and across the EU member states, the consumption increased from 300 bcm in 1990 to 550 bcm in 2007. There was a slight decrease between 2008-2010 when gas demand reduced to 522 bcm in 2010.[3] The main reason being the global economic crisis, which caused factories to close or reduce production. Even EU’s biggest economies such as Germany, UK, Spain and Italy confronted decline by 10%-20%. However the gas demand started to inrease as of 2015 and is projected to reach to 618 bcm in 2030.[4]

The natural gas consumption is mainly concentrated in the North-West of Europe and Italy, where gas markets have developed earlier. In 2015, the biggest natural gas markets in Europe were Germany, the UK, Italy, France and Netherlands, comprising around 69% of the total gas consumption.[5] Natural gas consumption is less in SEE countries due to the lack of infrastructure, even some of them such as Albania and Montenegro can not use natural gas in their domestic market.

Table 1.Gas Consumption in South East European Countries in 2014

|

Country |

Gas Consumption |

|

|

bcm/year |

|

Albania |

0 |

|

Bosnai& Herzegovina |

0.25 |

|

Bulgaria |

2.9 |

|

Croatia |

2.75 |

|

Macedonia |

0.15 |

|

Greece |

4.2 |

|

Montenegro |

0 |

|

Romania |

12.10 |

|

Serbia |

2.82 |

|

Kosovo |

0 |

|

Total |

25.17 |

Source: Institute of Energy for South East Europe

However, the economies of Southeast Europe is expected to grow at a rate of 2.5% each year, whereas Europe’s overall growth rate is predicted to be 1.5% per annum.[6] This means the economic growth will increase energy consumption, which will trigger natural gas increase in the market. According to Stambolis and Sofianos, the natural gas demand will increase regularly by 1% in SEE up to 2025.[7]

As shown, natural gas consumption is a growing trend in Europe. International Energy Agency predicts that the EU will experience a marginal natural gas growth by 2020. However, this growth level is expected to be even higher from 2020 and 2035 as a result of the fast transformation to the gas fired power generation and economic recovery. BP estimates that China will surpass the EU as the world’s largest energy importing region in 2030; however, the EU will remain the largest net importer of the natural gas. Oil imports will decline by 23% and coal by 49%, but gas imports will rise by 49%, accordingly gas import dependency will rise from the current 67% to 84%.[8] The main reason for the rise in gas import dependency is because the domestic natural gas production will not be able to cover the demand.

2. Natural Gas Production of Europe

The EU has been experiencing serious production decline in natural gas since early 2000s, which renders it to become more dependent on the imported natural gas. Production is especialy declining within the Netherlands and United Kingdom, two major supply countries of the Union. The Netherlands is the largest natural gas producer among the EU member states. According to the Eurostat data, the country covered by 43.2% of total EU gas production in 2012.[9] However, the production in the country decreased by 61% between 2010-2015 from 70.5 bcm to 43 bcm.[10] Moreover, in January 2014 the government decided to reduce the short term production because of the increase of earthquakes in the province of Groningen.[11] Thus, the production is expected to continue decreasing even more in the future.

The UK is the second largest natural gas producer in the EU, of which natural gas production has been declining since 2000. Although the domestic production of natural gas reached its maximum level in 2000, the UK has transformed from exporter to importer in 2004.[12] The production decreased almost 243% within 10 years, from 96,4 bcm in 2004 to 39.7 bcm in 2015.[13] It is estimated that the country will cover 76% of its total natural gas consumption by imports in 2030.[14]

Norway is the world's third-largest exporter of natural gas after Russia and Qatar and it is second largest supplier of the EU. The future trend in Norwegian production depends on the discovery of new fields, and IEA predicts that the total production will be even less than today in 2030. In addition, smaller gas producers such as Germany, Italy, Denmark, Romania and Poland also confronted production decline. Natural gas production in Germany was 16.7 bcm in 1998, however, it dropped to 7.2 bcm in 2015 and this trend is predicted to continue.[15] IEA estimates that the production decline in the EU will continue in the future and decrease to104 bcm in 2035.[16] That means EU needs additional gas supplies to ensure its energy security.

3. Natural Gas Suppliers of Europe

Europe buys natural gas from different suppliers either via pipeline or LNG. In 2012, around 396.8 bcm of natural gas was imported, and of this almost 246.8 bcm was transported by pipeline. In other words, 86% of natural gas import came through pipelines, while 14% as LNG in 2015.[17] Europe imports natural gas from Russia, Norway and Algeria through pipeline and from Algeria, Qatar, Nigeria, Egypt, and Trinidad & Tobago as LNG. Qatar remained Europe’s leading LNG supplier with 51% share in 2015, followed by Algeria, Nigeria, and the Trinidad&Tobago.[18] As is seen, natural gas comes to Europe from three routes:

- Northern Route: Norway

- Eastern Route: Russia

- Southwest Route: Qatar, Algeria, Nigeria

3.1. Natural Gas Outlook of Russia

According to the US Energy Information Administration, Russia is the largest natural gas holder in the world with 47.8 tcm of reserves, representing the 16.8% of the world total reserves. It is the biggest gas supplier of the EU, which comprised almost 35% of the total gas imports in 2015. The remaining import shares are composed by LNG transportation coming mainly from the other three relevant exporting countries, namely Algeria, Qatar and Nigeria.

Figure 1. EU Natural Gas Imports by Country, 2015

.png)

Source: BP Statistical Review of World Energy 2016

Even though Russia is the largest natural gas holder in the World, it faces instability in the energy sector. The main reason in the energy sector is the requiremet of huge investments in the country. More than 70% of high-pressure gas pipelines in the country were realized before 1985 and the average age of the existing pipelines are 30 years old. In addition, approximately 14% of the pipelines are far beyond their estimated lifespans, causing big losses during transportation and increasing the domestic power consumption. Thus, the country needs to put huge investment into the energy sector. However, Russia had a difficulty of attracting foreign direct investments into the energy sector in recent years. During the last 5 years, the amount of the investment in the energy sector comprised only 60% of the target that was determined in the energy startegy of the country.[19] Given that the budget of the country is highly reliant on oil and gas incomes, the infrastructure investment is also dependent on oil prices. As is known, oil prices declined from around 115 dollars per barrel in June 2014 to 27 dollars per barrel in January 2016.[20] Thus, low oil prices hinders the country from investing in untapped natural gas resources, as well as renovating the outdated pipelines. In addition to the low oil prices, the country was exposed to the enourmous economic sanctions by Western countries due to the 2014 Russia-Ukraine crisis.[21] The country has experienced severe economic problems and cannot attract Western energy companies to the country to put investment into the energy sector.

Consequently, it is not easy for Russia to catch the export targets it determined in its energy strategy to provide European additional natural gas needs. Moreover, Russia signed two natural gas sales agreement with China; 30 bcm/year and 38bcm/year respectively. Thus, it has to produce 68 bcm/year additional natural gas to stand by its agreements.

3.2. Natural Gas Outlook of Norway

Norway is the second largest natural gas supplier of Europe and the sixth largest in the world. It produced 117,2 bcm of gas in 2015, of which 115 bcm was exported.[22] Norwegian gas is exported to all the major Western European countries and is crucial for the European energy supply security. The country has been exporting gas to the European market since 1977 and it became the third largest producer in Western Europe since 1982, providing 15% of the Western Europe’s production.[23] Thus, the Western European countries, such as Germany, France, Belgium and the UK are the main importers of Norwegian gas, where Norwegian gas comprises between 20% and 40% of the total gas consumption.[24] A well-developed and efficient gas infrastructure and short transportation distances make Norwegian gas attractive to the European market. The country exports LNG to several EU countries such as Spain, the UK as well as Japan in the Far East.

Even though natural gas is an important export item for the country, its export is estimated to decrease as of 2020 due to the decline in domestic production. Production decline is a major problem for the country, as well as for the EU; because the country is a reliable partner and contributes to the global energy security. The IEA admits Norway’s contribution to European energy security and considers its energy resources as admirable and a model for other countries to follow. However, Norway will not be able to meet the additional natural gas demand of Europe in the future unless it discover new natural gas fields.

3.3. Natural Gas Outlook of Nigeria

Nigeria holds the ninth largest natural gas reserves in the world and the first largest in Africa with almost 5.1 tcm of gas.[25] However, the production is not directly proportional with the gas resources, as the country produced 45.15 bcm natural gas in 2015.[26] There are several reasons that the country can not increase its marketable natural gas production.

First of all, the country’s natural gas reserves are mainly concentrated in the Southern Niger Delta area, where is a source of instability.[27] Thus the instability of the country affects the production of natural gas negatively. On the other hand, the production is also mainly affected by the lack of infrastructure. Nigeria's gross natural gas production is flared, as some of Nigeria's oil fields lack the infrastructure required to capture the associated natural gas. Nigeria flared almost 12% of its gross natural gas production in 2015.[28] Furthermore, as natural gas flaring cause environmental pollution, protest between local groups and international oil companies over environmental concerns increase the tension in the country which also negatively effects the production.

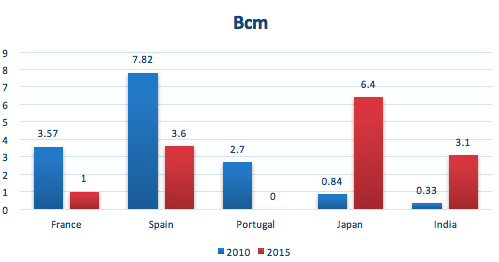

Currently, Nigeria exports most of its natural gas as LNG and only small proportion via West African Gas Pipeline, as the country exported around 26.7 bcm of natural gas in 2015.[29] Nigerian LNG importers have changed significantly within the past few years. Particularly, the country’s LNG exports to Europe have declined 52% within the last 5 years, from 15.81 bcm to 7.6 bcm. Nigeria has increased its LNG exports to Far East, especially to Japan by 6.7 times between 2010 and 2015, subsequent to the Fukushima nuclear disaster.[30]

Graph 1. Nigeria`s LNG Exports to Europe and Far East (2010 and 2015)

Source: BP Statistical Review of World Energy, 2011-2016

As a result, instability and security concerns in Nigeria are major problems in front of the development of the untapped energy resources. Furthermore, outdated infrastructure and poor maintance have also caused in natural gas flairing. Even though the country has huge energy resources, almost 100 million people in Nigeria do not have access to electricity. The electrification rate of the country is estimated at 41%,[31] which means that even the country increases its production in the future, it has to use significant amount for domestic consumption. Moreover, Nigeria is the most populous country in Africa with approximately 175 million people. The United Nations estimates the overall population of Nigeria will reach to almost 440 million by 2050. This ensures increase in the domestic energy consumption. As the natural gas production is low in the country, people in rural areas use wood and biomass for cooking facilities, devastating the atmosphere, polluting the environment and causing a big deforestation. So, the country needs to subsitute its carbon intensive energy consumption with the clean energy, namely natural gas.

Thus, taking into consideration of all above mentioned reasons, the country will not be able to increase its natural gas exports to Europe, so that to contribute European supply security.

3.4. Natural Gas Outlook of Algeria

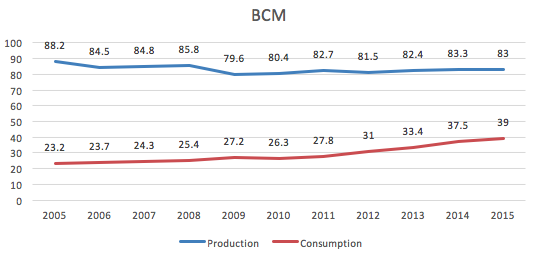

Algeria is the second largest natural gas holder in Africa following Nigeria, with 4.5 tcm of reserves.[32] Even though the country is the leading natural gas producer in Africa, its production was stagnant or on downtrend over the last decade. The production decreased almost 6.5% between 2005 and 2015, from 88.2 bcm to 83 bcm.[33] Even though gross production of the country was around 183,83 bcm in 2015, only 83 bcm of them was marketable, which means that the country can only utilize around 45% of the total production.[34] There are several problems that why Algeria can not utilize its natural gas resources well.

First of all the country has been struggling with the instability due to the terrorist attack to the Amenas gas plant in 2013, which is one of the significant gas plants of the country. The attack caused several causalities and the temporary suspension of the gas production.[35]

Natural gas plays an important role in the total primary energy consumption of the country as natural gas consumption increased almost 68% between 2005 and 2015, from 23.2 bcm to 39 bcm.[36] Algerian Ministry of Energy and Mines estimates that, the consumption will increase to almost 45 bcm by 2020 and 55 bcm by 2030.

Graph 2. Natural Gas Consumption and Production of Nigeria by Years

Source: BP Statistical Review of World Energy 2016

The main reason of increasing in domestic gas consumption is highly usage of natural gas in power generation. According to the IMF, natural gas comprises 98% of the power generation in Algeria.[37] The country allocates big subsidies for the natural gas, that incentives the consumption of the gas. The country plans to compensate the fall in domestic gas production through the development of shale gas resources, however, according to the Middle East Economic Survey, the lack of infrastructure and limited water resources creates big obstacles for the country.[38] Moreover, the Algerian people oppose to the production of shale gas due to its negative environmental affects.

High growth rate of the population also increases the domestic consumption. Currently, the population of Algeria is 35 million, which is predicted to reach to 45 million by 2030.[39]

There is a poor investment environment in the country due to the country’s protectionist policies and the unstable legislative and regulatory environment in the country.[40] The government places massive subsidies on the natural gas prices, complicating the competition environment in the energy market.

Thus, it will be hard for the country to increase the export quantity to the European countries, unless the country increase production and decrease consumption domestically. To achieve it, the country should provide security across the country and remove protectionalist policies, so that it can improve the business environment.

3.5.Natural Gas Outlook of Qatar

Qatar is the largest natural gas producing country in the Middle East and the third largest in the world following United States and Russia. The country produced almost 30% of the total natural gas production of Middle East in 2015.[41] In comparision to Algeria and Nigeria, Qatar is able to utilize significant part of its gross natural gas production, as it was 184.3 bcm in 2015, of which almost 178.5 bcm was marketed production. The country used only 25% of its gas production in the domestic market, while the remaining was exported to abroad.[42]

Taking into account that the production of the country is increasing; can it be a solution for the increasing natural gas import dependency of the Europe? To answer this question, it is necessary to refer to the following factors.

Firstly, the gas consumption of the country is increasing rapidly, as natural gas is the most widely used fuel in the country. Unless the country can diversify its total primary energy consumption, it will be hard for the country to increase its export amount more in the future. On the other hand, after the Fukushima disaster, the country started to export its natural gas resources to the Asian Pacific region rather than the Europe.[43] Moreover, China and India are two growing energy markets that attract attention of the country. As a result, significant proportion of the country’s natural gas production were transported to Japan, South Korea, India and China.

Graph 3.Qatar’s Natural Gas Exports in Europe and Far East (2010, 2015)

.png)

Source: BP Statistical Review of World Energy 2011 and 2016

As is seen from the Graph 3, the Qatar`s gas export to Belgium, France and Spain decreased almost 53.2%, 600% and 91% respectively between 2010-2015. However, the country increased its exports to South Korea, Japan and China by 61%, 99% and 404% respectively at the same period. Thus, above datas illustrate that Qatar’s exports to Europe will continue decreasing or at least remain stable, indicating that the country will not be able to contribute growing import dependency of the Europe, unless the prices in Europe and Asia Pacific come to the same level.

4. Southern Gas Corridor: New Energy Corridor for Europe

Southern Gas Corridor (SGC) project was envisioned to transport natural gas from the Caspian, the Middle East and Central Asia regions to the European market. The project has strategic importance for the EU, which was included to the list of Project of Common Interest (PCI) on October 15, 2013.[44] Therefore, EU committed to reinforce energy cooperation with the Caspian region in order to achieve the diversification of sources and suppliers. Thus, what is the importance of SGC project for Europe, and how it can contribute to the energy supply security of the continient?

Although the SGC will end in Italy, it will be able to reach almost every part of the Europe by interconnectors, given the fact that TAP will connect to the Italian natural gas gridSnam Rete Gas,[45] from there it will be able to reach almost all European destinations. In this context, by using swaps and reverse flows, SGC can reach to the Central European largest energy hub of Baumgarten in Austuria[46] from Italy by Trans Austuria Gas pipeline.[47] Furthermore, TAP can transport natural gas to Germany and France through Switzerland by using reverse flow via the Transitgas pipeline, which will be commissioned by 2018.[48] In addition, the SGC will carry gas to the UK-one of the biggest natural gas trading hubs of Europe. In this context, Italian natural gas operator Snam Rete Gas and the Belgium operator Fluxys made an agreement to promote physical reverse capabilities between Italy and UK by integrating the gas markets of Italy, Switzerland, Germany, the Netherlands and Belgium.[49] Thus, the SGC will reach to northen European markets where demand is estimated to increase.

SGC will supply gas to Bulgaria and Romania through Greece-Bulgaria-Romania interconnector. Given the fact that there is an existing pipeline between Romania and Hungary,[50] Hungary can also import natural gas through the SGC. Moreover, the Caspian gas also will flow to the Balkans through the Ionic Adriatic Pipeline.[51] As is seen, SGC will be able to transport natural gas to almost every part of the Europe by interconnectors and the reverse flows.

Taking into account that there is a lack of domestic natural gas market in several SEE countries like Albania, Kosovo and Montenegro,[52] SGC can faciliate the development of the natural gas markets of these countries by constructing networks, and interconnectors among themselves.

Given the fact that some European countries such as Switzerland, Slovenia, Slovakia, Czech Republic, Macedonia, Kosovo, Serbia and Hungary are landlocked[53] and therefore cannot buy LNG to ensure their supply diversification, they can only buy natural gas through pipelines. In this case, by bringing new volumes of natural gas from new sources, SGC will be able to contribute to the supply security of these countries.

One of the significant prioritets of the EU energy strategy is providing supply and route diversification in order to lessen its vulnerability against supply distruptions. Taking into consideration that Bulgaria, Czech Republic, Estonia, Latvia and Lithuania are entirely reliant on Russian gas in their gas imports and the dependency is almost 80% to 100% in SEE countries, these countries should be ready for the possibility of future supply interruptions.[54] However, in the event of future disruptions, SGC can provide natural gas to these countries by activating its reverse flow capacity.

One of the significant objectives of EU energy supply security is providing natural gas at affordable prices. Looking at the cost of the natural gas supplying to the European countries, Lochner and Bothe claims that the cheapest gas supply route to Europe are from Azerbaijan, Algeria, Norway, Oman, Russia and Iran respectively.[55] According to OME, the cheapest natural gas comes to the EU from Algeria, followed by Iraq, Azerbaijan, Iran and Egypt by pipeline through Turkey.[56] Moreover, according to the calculations of Mavrakis the cheapest natural gas through SGC are from Iraq, Azerbaijan, Iran, and Turkmenistan respectively.[57] As is seen, natural gas prices from the Caspian region are the cheapest among the other alternatives. Thus, the SGC will allow EU to access the cheaper natural gas resources.

As Southern Gas Corridor will carry additional and new volumes of natural gas to the European market; it will create a competition environment in the market which will reduce the import prices of the European countries. The amount of price reduction will reliant on the volume of natural gas transported to the Europe through the SGC. According to the calculations of Hasanov, an initial supply of 10 bcm per year will cause $2.4 to $4.81 reduction in natural gas import prices of EU per thousand cubic meters. When the volume reaches to 25 bcm per year, price reduction will increase to $6 to $12 per thousand cubic meters. That means the European countries can save $0.78 to 1.85 billion annually on natural gas import bills by 2020 and $1.34 to $3.24 billion by 2023 and $1.97 to $4.99 billion by 2026 in real terms.[58]

The EU aims to reduce its GHG emissions by 40% till 2030 in the framework of EU Climate Change programme. In this context, it aims to substitute carbon intensive fossil fuels, particularly coal with the environmentally friendly natural gas. However, some countries can not substitute their coal consumption with natural gas due to their high natural gas import prices. For example, coal comprises almost 37% of the Bulgaria’s total primary energy consumption, followed to 22% oil and 13% natural gas. In addition, while coal accounts for around 44% of the total primary energy consumption of Czech Republic, the shares of oil and natural gas are 25% and 18% respectively.[59] Given the fact that SGC will ensure a competition in these countries and therefore pave the way for the reduction in natural gas import prices, they will be able to substitute their coal consumption with natural gas.

CONCLUSION

Natural gas import dependency of Europe is increasing rapidly due to the sharp decline in domestic gas production and increase in the gas consumption. Europe needs to provide additional and alternative gas supplies so that to ensure its energy security. However, the current natural gas suppliers of the Europe will not be able to meet the additional natural gas demand of Europe in the short and mid term.

Russia is the largest natural gas supplier of Europe, confornting instabilities in its energy sector. Because there are huge untapped natural gas resources in the country and the existing infrastructures are old. Therefore, the country needs to invest into untapped natural gas resources and old infarstructures in order to increase the gas production. However, the country has difficulty in putting huge investment due to the low oil prices given the fact that 68% of the country’s budget comprise by oil and gas incomes. In addition, due to the Crimea annexation, Russia was subjected to the western sanctions. So, the country couldnt attract western investors to invest into the energy sector. More importantly, Europe belives that Russia uses natural gas as a political tool against to it. Thus, Europe tries to decrease its dependency to Russia in the long run.

Even though Norway is a best energy partner of the Europe, it also will not be able to meet the additional natural gas demand of Europe in the long run unless it discovers new natural gas fields. The indiginous natural gas production of the country is estimated to decline as of 2020 and become less than current level in 2030.

Internal instability and security concerns are two major problems in front of the development of the untapped natural gas fields of Nigeria. Even though Nigeria is the ninth largest natural gas holder in the world, the country can not utilize its natural gas resources well. There are huge untapped natural gas reserves in the country, and the existing infarstructures are outdated. The country is not able to increase the production due to the presence of the Boko Haram terrorist organization.

Looking at the energy outlook of Algeria, the natural gas consumption is growing rapidly, while the production is declining. On the other hand, the bureaucratic obstacles, ethnic conflicts, and the lack of infarstructure are major problems in front of the development of the energy sector in the country. In addition, Al-Qaida terrorist organization pose huge threat for attracting foreign investors to the energy sector.

Qatar is the largest LNG supplier of Europe. However, after the Fukushima disaster, Qatar’s LNG exports increased to Far East countries, particularly to Japan and South Korea, while decreased to Europe. In addition, China and India-two growing natural gas consumers also started to increase their natural gas imports from Qatar which impacted negatively to the European natural gas import. As is seen, the current natural gas suppliers of Europe will not be able to supply additional natural gas to Europe, even the current supplies are decreasing.

By supplying new volumes of energy from alternative sources and routes, SGC will significantly contribute to the energy supply security of the European countries. In addition, openning up the fourth corridor, SGC will provide supply diversification in Europe, and lessen its dependency on single supplier, which will protect the Europe against to the future supply disruptions.

Emin Akhundzade

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.

[1]European Commission, 2030 Energy Startegy, http://ec.europa.eu/energy/en/topics/energy-strategy/2030-energy-strategy (25.05.2017).

[2] See: https://windeurope.org/newsroom/reneuable/67-percent-how-denmark-and-lithuania-fix-the-gas-leak/

[3] Costis Stambolis,“Europe’s Natural Gas Supply Prospects, The South Corridor and the Role of Greece”, Institute of Energy for South East Europe, January 2012, p.5.

[4] The Oxford Indstitute for Energy Studies, “The Outlook of Natural gas Demand in Europe”, June 2014, p.71

[5] BP, BP Statistical Review of World Energy 2016, p.23

[6] David Jolly, “Economic Growth in Eurozone Appears to be Gaining Momentum”, The New York Times, May 2015, http://www.nytimes.com/2015/05/06/business/international/european-union-economy-forecast.html?_r=0 (25.05.2017).

[7] Stambolis, p.14.

[8] BP, BP Energy Outlook 2035, http://www.bp.com/content/dam/bp/pdf/Energy-economics/Energy-Outlook/Regional_insights_European_Union_2035.pdf (25.05.2017).

[9] European Commission, 2014 Country Reports: Netherlands, https://ec.europa.eu/energy/sites/ener/files/documents/2014_countryreports_netherlands.pdf (15.06.2015), p.225.

[10]BP Statistical Review of World Energy 20156 p.22.

[11] Minister of Economic Affairs of Netherlands, “Gaswinning in Groningen”, Letter to Parliament, 17 January 2014.

[12] EIA, UK Became a Net Importer of Petroleum Products in 2013, 03.07.2014 http://www.eia.gov/todayinenergy/detail.cfm?id=16971 (25.05.2017).

[13] BP Statistical Review of World Energy 2015, p.22.

[14] EIA, United Kingdom: International Data and Analysis, July 2014, p.11.

[15] Statista, Natural Gas Production in Germany from 1998 to 2014,

http://www.statista.com/statistics/265341/natural-gas-production-in-germany-since-1998/ (18.06.2015).

[16]Azzaddine Layachi, “The Geopolitics of Natural Gas”, Harvard University’s Belfer Center and Rice University’s Baker Institute Center for Energy Studies, November 2013, p.10.

[17] BP, BP Statistical Review of World Energy 2016, p.28

[18] Eurogas, Statistical Report 2016, p.7.

[19] Ministry of Energy of the Russian Federation ,p.28.

[20]See: http://www.reuters.com/article/us-global-oil-idUSKCN0UY04U (23.05.2017)

[21]European Union News Room, EU Sanctions Against Russia over Ukraine Crisis, http://europa.eu/newsroom/highlights/special-coverage/eu_sanctions/index_en.htm (23.05.2017).

[22] BP, BP Statistical Review of World Energy 2016, pp 22-28

[23]George W. Hoffman, The European Energy Challenge: East and West, Duke University Press, Durham,1985,p.70.

[24] Norks Petroluem, Export of Oil and Gas, http://www.norskpetroleum.no/en/economy/exports-norwegian-oil-and-gas/ (25.05.2017).

[25] Exploration World, Top 10 Countries by Proved Natural Gas Reserves, 15.09.2014, http://explorationworld.com/top10/127/Top-10-Countries-by-Proved-Natural-Gas-Reserves-and-Their-Production-Rates (25.05.2017).

[26] OPEC Annual Statistical Bulletin 2016, p.103

[27] EIA, Country Analysis Brief: Nigeria, p.13.

[28] OPEC Annual Statistical Bulletin 2016, p.103.

[29] OPEC Annual Statistical Bulletin 2016, p.106.

[30] BP Statistical Review of World Energy 2011,2016 p.28.

[31] African Development Fund, Partial Risk Guarantee in Support of the Power Sector Privatizations of Nigeria, December 2013, http://www.afdb.org/fileadmin/uploads/afdb/Documents/Project-and-Operations/Nigeria_-_Power_Sector_Privatization_Program_-_Appraisal_Report.pdf ( 25.05.2017), p. 8.

[32] OPEC Annual Statistical Bulletin 2016, p.100.

[33] BP Statistical Review of World Energy 2016, p.22.

[34] OPEC Annual Statistical Bulletin 2016, p.102.

[35] Sohbet Karbuz and Castellano Bruno, Assessment of Europe’s Future Gas Import Sources and Routes, OME, July 2013, p.43.

[36] BP Statistical Review of World Energy 2016 p.23.

[37] EIA, Country Analysis Brief: Algeria, p.3.

[38] Carole Nakhle, “ Algeria’s Shale Gas Experiment”, Carnegie Middle East Center, 23.04.2015.

[39] Karbuz, Bruno, p.53.

[40] Marc Lanthemann, “In Europe, The Strategic Importance of the Algerian Natural Gas”, Natural Gas Europe, 23.01.2013, http://www.naturalgaseurope.com/strategic-importance-of-algerian-natural-gas-for-europe (28.05.2017).

[41] BP Statistical Review of World Energy 2016, p.22.

[42] BP Statistical Review of World Energy 2016, pp.22-23.

[43] World Nuclear Association, Fukushima Acccident, http://www.world-nuclear.org/info/Safety-and-Security/Safety-of-Plants/Fukushima-Accident/ (25.05.2017).

[44]European Commission, Commission Delegated Regulation (EU) No 139/2013, Brussels, 14.10.2013, p.18.

[45] Amouk Honore, “The Italian Gas Market: Challenges and Opportunities”, The Oxford Institute for Energy Studies, June 2013, p.49.

[46] Patrick Heather, “Continental European Gas Hubs: Are They Fit For Purpose?”, The Oxford Institute For Energy Studies, June 2012, p.14.

[47] TAG Pipeline System, http://oldarchive.taggmbh.at/control?page_id=1 (25.05.2017)

[48] Snam, The Transit Gas-TENP Will Be Bidirectional As of The Summer of 2018, 30.01.2015i http://www.snam.it/en/Media/energy-morning/20150130_2.html (25.05.2017)

[49] TAP, Southern Gas Corridor, http://www.tap-ag.com/the-pipeline/the-big-picture/southern-gas-corridor (25.05.2017).

[50] Vladimir Socor, “Hungary-Romania Gas Interconnector”, Natural Gas Europe, 16.10.2010, http://www.naturalgaseurope.com/hungaryromania-gas-interconnector-step-regionwide-network (25.08.2015).

[51] Hellenic Shipping News Worldwide, Shah Deniz Targets Italian and Southeastern European Gas Markets through Trans Adriatic Pipeline,26 .06.2013, http://www.hellenicshippingnews.com/d40ea55b-3ab5-4bff-8fd8-4a8a953f3666/ (15.08.2015)

[52] European Commission, SWD(2014) 323 final, Comission Staff Working Document, 16.10.2014, p.2.

[53] Maps of World, Landlocked Coundtries of Europe, http://www.mapsofworld.com/europe/thematic/landlocked-countries.html (25.05.2017).

[54] SWD(2014) 323 final, p.5.

[55] Stefan Lochner, David Bothe, “The Development of Natural Gas Supply Costs to Europe, the United States and Japan in a Globalizing Gas Market- Model-based Analysis Until 2030”, Energy Policy 37, 2009, pp. 1518-1528

[56] Observatoire Mediterraneen de l’Energy (OME), Assessment of Internal and External Gas Supply Options for the EU, Evaluation of the Supply Cost of new Gas Supply Projects to the EU and an Investigation of Related Financial Requirements and Tools, 2001, p.7.

[57] Dimitrios Mavrakis, Georgios Thomaidis, and Ioannis Ntroukas, “An Assessment of Natural Gas Supply Potential of the South Energy Corridor from the Caspian Region to the EU”, Energy Policy 34, 2006 p. 1671-1680.

[58]Mubariz Hasanov, “Economic Benefits of the Southern Gas Corridor”, Caspian Strategy Institute, January 2014, p.6.

[59] BP Statistical Review of World Energy 2015, p.41.