[GGP] Continued Investment in Gas Infrastructure is not Optional... If Energy Security is Still Important to Us

Stranded Assets

With the Paris Agreement and energy transition plans top-of-mind challenges for many energy policymakers, some have been debating the merit of continued investment in natural gas infrastructure.

They fear the possible risk of “stranded” assets.

Yet, in the most ambitious sustainable development scenario of its latest World Energy Outlook, the International Energy Agency (IEA), the most trusted global authority on energy, assessed it “unlikely that there would be stranding of natural gas assets, including upstream, LNG, and pipelines.”

Yet risk exists, albeit in the exact opposite scenario; that of supply shocks, caused by stalling investments in infrastructure, needed to meet the projected demand for natural gas. This is true for the entire gas value chain – from supply through distribution. On the upstream side, infrastructure investments are needed to ensure that new supply is available, in time to meet the growing demand, especially from markets where natural gas is helping to displace highly polluting fuels like coal. On the midstream and downstream sides, infrastructure capacity must remain in line with peak demand, while providing a critical flexible resource for the increasingly more intermittent energy mixes and volatile demand.

According to the IEA, over $8.5 trillion in natural gas infrastructure investment will be required through 2040 to comply with the increasing demand.

How Much Pipeline Capacity is the Right Amount? Peak Demand vs Average Demand

Conclusions that there is high risk of stranded assets often stem from a common error of using total, or average, demand as a measure of capacity requirements. It has been common, especially in Europe, to point to examples of declining average gas demand, as a reason to stop investing in natural gas delivery infrastructure.

However, total gas demand has little to do with the optimal size and layout of transmission and distribution networks. What matters is peak demand and consumption variability.

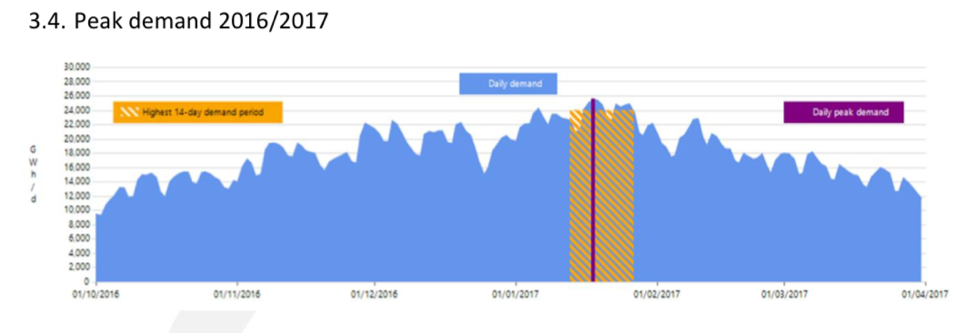

Similar to electricity, natural gas demand fluctuates widely throughout the year. For example, in Europe, during the winter heating months it can be almost twice the annual average consumption, as shown in the chart below.

This means that delivery infrastructure must be designed to accommodate the highest possible consumption volume to deliver reliable supply to consumers on when it is needed. This is particularly important during cold winter snaps, such as Europe has just experienced in February. Thus, infrastructure investments are needed to continue to meet peak demand, as shown below. If those investments do not happen, the system will not be able to deliver enough fuel to heat homes and cook meals during peaks.

Source: European Network of Transmission System Operators for Gas, Winter Review 2016-17.

What Happens When You Don’t Build the Pipelines?

New England in the U.S. also felt the impact of this winter’s record-breaking cold spell, not just via temperature, but also through a jump in its energy bills and emissions. The onset of cold temperatures brought on the highest gas demand in history of the United States.

While New England is close to domestic gas production fields, it lacks pipeline connections to access abundant domestic supply. The result was a steep increase in price of gas and electricity, accompanied by a jump in CO2 emissions, as dirtier fuels were recruited to compensate rising demand.

Gas Storage: The Big Enabler

Storage is a pivotal gas infrastructure, as it enables flexibility, security of supply, price, liquidity, and resilience.

Similar to batteries, natural gas storage reservoirs provide an invaluable flexibility resource - not just for electrical grid operators, but for the entire energy system. The technology here is simple and mature, and allows storage of large quantities of energy cheaply, efficiently, and over long periods of time.

Long-term natural gas storage is typically located in underground formations, such as depleted reservoirs, aquifers, or salt caverns. There are also smaller scale and more modular alternatives, including LNG and above ground tanks, although these are usually more suitable for shorter-term needs.

In the most simplified scenario, energy storage reservoirs would be filled up during off-peak season, when the price of gas is low, and used up to meet peak demand during high price season. However, in liquid markets, like North America, they tend to “cycle” a lot more frequently, supporting arbitrage opportunities.

What Happens When You Don’t Build Storage?

Without adequate storage infrastructure, jurisdictions can run into serious trouble, as has been demonstrated by China this winter - in Beijing, winter demand is more than 10 times higher than in the summer.

With gas demand surging 15% last year, exceeding projections, the country faced supply shortages, and its infrastructure reached capacity before it could meet all the demand. This could have been avoided with sufficient, strategically located storage capacity, but China is a new market and is just starting to build it out. Currently, China has storage capacity equivalent to 3.3% of its annual demand, whereas world averages is almost 12%, with US at 17%, and some markets as high as 23%.

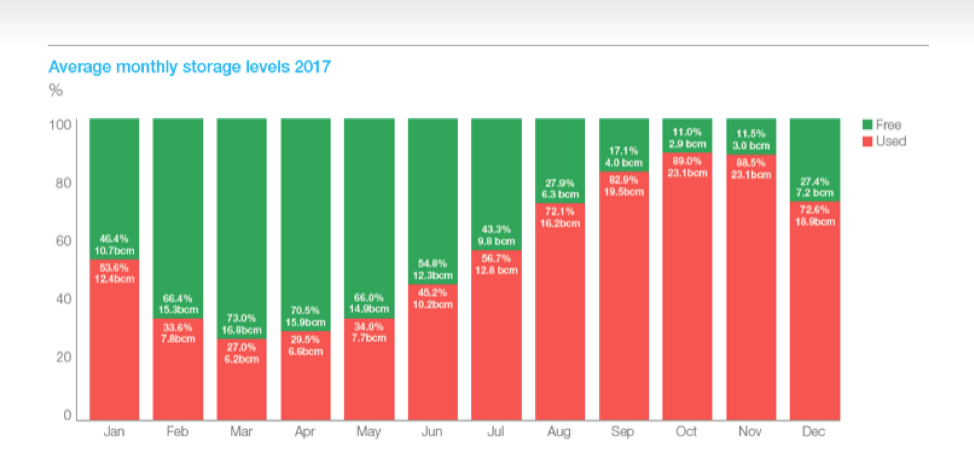

Europe relies on storage heavily for meeting its peak demand and ensuring energy security. In Germany, for instance, more than half of its winter peak demand was met with stored gas this past heating season. The dominant role of storage in Europe’s gas supply can be seen below.

Source: McKinsey

Case in Point: What Happens When You Have a Diversified Clean Energy Mix

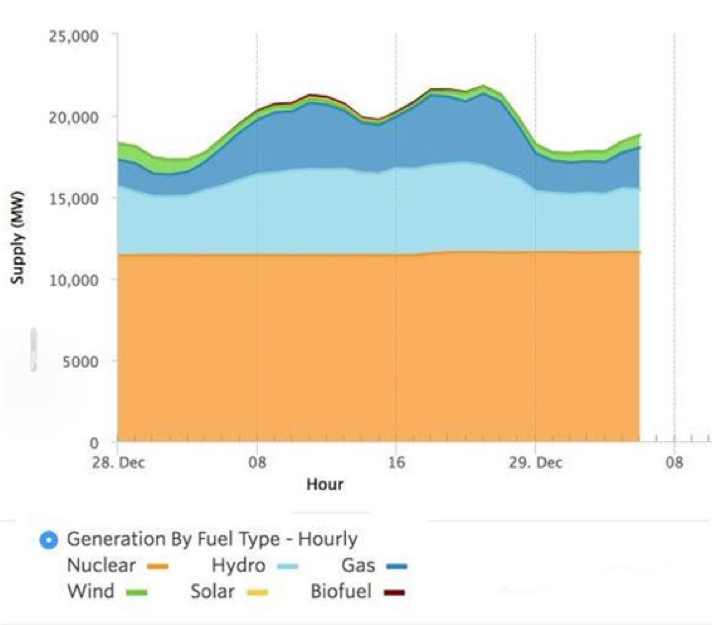

The Canadian province of Ontario is a great example of the reliability and flexibility value that natural gas provides. Ontario enjoys a clean electricity generation mix, with the majority of supply coming from carbon-free sources.

On December 28, Toronto hit a nearly 57-year low temperature record for the date.

Natural gas in Ontario meets nearly 75% of the winter industrial, commercial and residential heating needs. It is also a critical flexible fuel for electrical power generation.

On December 28, as the cold air moved into the province, wind speeds dropped, and wind-generated electricity output fell to a mere 129 MW of an installed capacity of over 4,500.

Natural gas-fired power generation output, on the reverse, went from 1,300 MW in the early morning hours, to 4,500 MW by mid-day, a more than three-fold jump.

Natural gas is a crucial flexibility resource because of its ability to seamlessly balance the increasingly variable grid demand, efficiently heat homes and businesses when the cold strikes, as well as to fuel many other parts of the economy, from industry to transport, and to do so without polluting the air and at low GHG emissions.

Because of its versatility, natural gas is required to continue to seamlessly fuel our communities for the current planning horizon, and continued investments in its infrastructure are imperative, if energy security is still a priority for the policy makers.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.